FFMC Registration from RBI: A Complete Guide on the Process

Shivani Jain | Updated: Jan 18, 2021 | Category: FFMC, RBI Advisory

Any company or an individual who wants to carry out forex activities, such as trading or exchange needs to first obtain FFMC Registration from RBI. Further, a Full Fledged Money Changer is governed by section 10 of FEMA 1999 and the yearly guidelines and directions issued by RBI. Also, the other name for these entities is Authorised Money Changers.

In this blog, we will discuss the concept and process to obtain FFMC Registration from RBI.

Table of Contents

Concept of FFMC Registration from RBI

The term Full Fledged Money Changer License or FFMC Registration from RBI means a permit that is necessary to obtain for starting an AMC or Authorised Money Changer business in India. However, to avail of this license, one needs to adhere with the directions issued by RBI in the Master Circular, together with the provisions of section 10 of FEMA 1999.

Concept of Authorised Money Changer

According to the provisions mentioned under section of Foreign Exchange Management Act 1999, a full fledged money changer means an individual or a company that operates in the activities and affairs concerning the foreign exchange. Moreover, the term “Authorised Money Changer” or “AMC” comprises of off-shore Banking Units as well.

Besides this, an AMC is eligible to buy and sell forex, currencies, and coin from the travelers visiting India in against of certain approved securities, such as Traveler’s Cheque, Conversion of Coins, and Currency Notes.

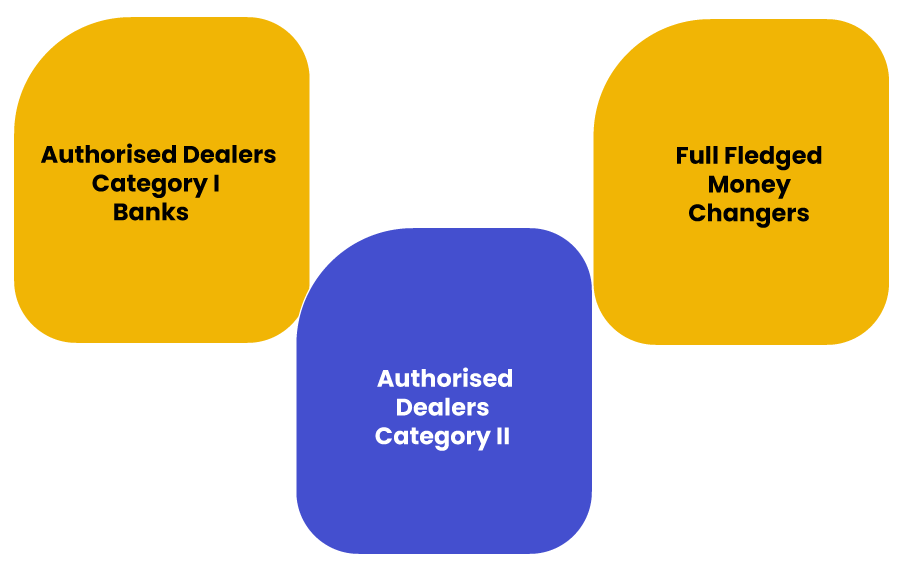

Types of FFMC Registration from RBI

The different type of FFMC Registration form RBI are as follows:

- Authorised Dealers Category I Banks;

- Authorised Dealers Category II

- Full Fledged Money Changers

Conditions to Obtain FFMC Registration from RBI

The conditions to obtain FFMC Registration from RBI are as follows:

- The applicant must have public or private limited company registered under the Companies Act 2013[1];

- It needs to have at least Rs 25 crores as NOF (Net Owned Funds) to manage a single branch;

- A minimum of Rs 50 crores is required as NOF (Net Owned Funds) to manage multiple branches in India;

- The object clause in the company’s Memorandum of Association must declare the intention to operate as Money Changer in India;

- The business entity must not have any pending civil or criminal case its directors before the Department of Revenue Intelligence;

- After acquiring FFMC Registration from RBI, the said business entity needs to start its business operation within six months from the date of registration;

Permitted Activities for FFMC Registration from RBI

The permitted activities for FFMC Registration from RBI are as follows:

- An FFMC License Holder needs to carry out activities, such as Currency Notes, Travelers Cheque, and Conversion of Foreign Currency;

- Every FFMC License holder needs to acquire a Franchise Agreement to carry out the Activities termed as Restricted by RBI;

- An FFMC License Holder can freely operate in the Conversion of Foreign Currencies, Traveler’s Cheque, with both Indian Residents and NRIs;

- An FFMC License Holder can freely operate in the Indian Currency against the International Debit or Credit Card;

- An entity having FFMC Registration from RBI can sell foreign currencies and coins against different forex prepaid cards, personal visits, and business transactions;

When can FFMC Registration from RBI be Revoked?

The situations under which FFMC Registration from RBI can be revoked are as follows:

- For the Interest and Benefit of the General Public;

- If the License Holder fails to adhere to the rules prescribed;

Documents Required for FFMC Registration from RBI

The documents required for FFMC Registration from RBI are as follows:

- Certificate of Commencement (COC);

- Certificate of Incorporation (COI);

- A copy of Memorandum of Association (MOA);

- A copy of Articles of Association (AOA);

- Latest Audited Financial Statements and Balance Sheet;

- A copy of certificate received from the Statutory Auditor regarding the Total Net Owned Fund;

- Profit and Loss Account for the last 3 financial years;

- Confidential Report from Bank in a Sealed Cover;

- Details in respect of Nature of Activities carried out;

- A copy of the Board Resolution passed;

- Details in respect of Associated Companies operating in the Financial Sector;

- A copy of Declaration regarding Policy Framework on the matter as follows:

- KYC (Know Your Customer);

- CFT (Combating the Financing of Terrorism Customer Data);

- AML (Anti Money Laundering)

- A copy of Declaration issued by the Department of Revenue Intelligence (DRI) concerning that it has never conducted any investigation against the directors of the company;

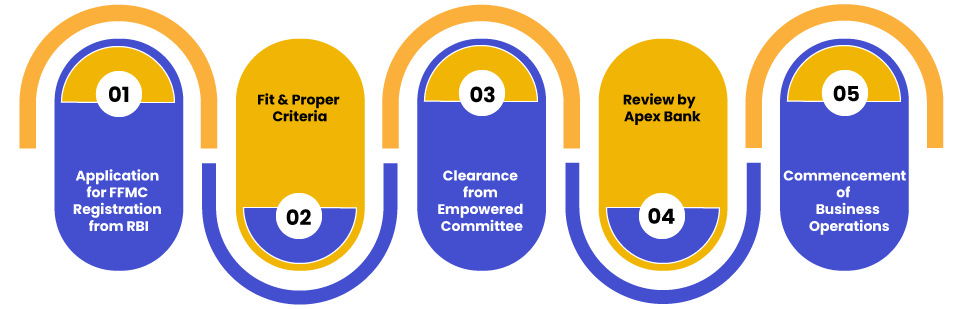

Process to Obtain FFMC Registration from RBI

The steps involved in the process to obtain FFMC Registration from RBI are as follows:

Application for FFMC Registration from RBI

In the first step, the directors of the applicant company require to file an application in the Annexure-II at the Regional Office of the Apex Bank. The directors must file the said application with the documents specified by RBI.

Fit & Proper Criteria

Further, in the next step, the company needs to clear the Fit and Proper Criteria. As per this criteria, the directors of the applicant company must not have any pending criminal or civil against them with the Department of Revenue Intelligence.

If in case the company does not qualify the Fit and Proper criteria, then, in that case, it will not obtain FFMC Registration form RBI.

Further, for meeting the Fit and Proper Criteria, the Board of Directors (BOD) requires to undergo the Due Diligence Process, as the same helps in determining Integrity, Expertise, Track Record, and Qualifications of the person being appointed as Director.

Also, the additional conditions that an applicant needs to satisfy are as follows:

- Must not be more than 70 years in age;

- Must not be the Member of Legislative Assembly or Council;

- Must not be the Member of Parliament;

- Must not have any Previous Criminal Record;

- Must not have any sort of Sanctions from the Regulatory Authorities;

- Must not have any past history of Fraudulent Practices;

Clearance from Empowered Committee

It shall be relevant to note that the application for obtaining FFMC Registration from RBI proceeds further only if the “Empowered Committee” gives its clearance after all the verification.

Review by Apex Bank

Further, the RBI will review the application and documents submitted, and after that, it will decide whether the said company meets the fit and proper criteria or not. If the RBI gives a positive opinion, then, in that case, the company will get its money changer license within the period of 2 to 3 months.

Commencement of Business Operations

Once the company has received FFMC Registration from RBI, it needs to commence its business operation within 6 months time. Moreover, the company requires to submit the duplicate copy of the licenses as follows with the RBI:

- Possession Certificate;

- Lease Deed;

- Shop and Establishment License;

Post FFMC Registration Requirements

The post FFMC Registration requirements are as follows:

- The company needs to adhere to all the guidelines issued by RBI;

- It needs to display the copy of the FFMC License at every place of business;

- To carry out foreign trade activities in a smooth manner, the company must implement the mechanism of Concurrent Audit;

- It must furnish its Annual Audited Balance Sheets at the Regional Office of the RBI;

Conclusion

In a nutshell, if in case a company wishes to carry out the activities concerning forex in India, it needs to obtain FFMC Registration from RBI for the same. However, it shall be considerate to note that the process and documentation for the same is a tough, intricate, and back breaking task as the same involves a lot of compliance and procedures.

Also, the Reserve Bank of India has become stringent regarding the grant of license these days. The reason behind the same is that these companies directly deals with the money of the general public. As a result, every company must consult with RBI and FEMA experts prior to undertaking the process of FFMC Registration from RBI to have knowledge concerning various post registration compliances that an FFMC License Holder needs to fulfill.

At Swarit Advisors, we have a team of experts who have diverse knowledge in the field of RBI and FEMA and are always there to cater to all your doubts and queries.

Also, Read: Cancellation of FFMC License: Reasons for Cancellation of License