Benefits of LLP over Private Limited Company

Dashmeet Kaur | Updated: Feb 21, 2020 | Category: Limited Liability Partnership

The selection of a business structure is a tough choice to make since the success or failure solely depends upon it. The emerging entrepreneurs often get bewildered to find the right company’s foundation for their venture. Usually, the common ground of confusion lies upon whether to form LLP or go ahead with a Private Limited Company. If you also have the same dilemma, then this write-up will resolve your situation by enlisting the benefits of LLP over Private Limited Company.

Table of Contents

A synopsis of Limited Liability Partnership

A Limited Liability Partnership or LLP is a newly formed corporate structure that merges both the essentials of Partnership and Limited Liability. In simple terms, LLP enables the flexibility of Partnership along with the advantages of Limited Liability like a cherry on the cake. Here are some prominent features of the Limited Liability Partnership Company:

- LLP has a separate legal entity from its members;

- Minimum two partners are required for a Limited Liability Partnership while there is no such constraint on the maximum limit;

- No need for the minimum capital contribution;

- The LLP Agreement regulates all the duties and rights of LLP’s members & partners;

- A partner is not liable for another partner’s negligence or misconduct;

- Every LLP must maintain Annual Accounts, but the accounts shall only be audited, if the contribution exceeds INR 25 Lakh or the turnover exceeds INR 40 Lakh.

Fundamental benefits of LLP over Private Limited Company

LLP gives a competitive edge to the entrepreneurs in the following ways:

- No limit on the business owners– To start a Limited Liability Partnership Company (LLP), requires at least 2 members whereas there is no restriction on the maximum number of members, unlike a Private Company that cannot have more than 200 members.

- Zero minimum Paid-up Capital– A notable benefit of LLP is that no partners need to contribute a particular share of minimum capital. On the other hand, the minimum Paid-Up capital in Private Limited Company is INR 1Lakh.

- Lower Incorporation cost– The registration cost of LLP is much less compared to a Private Limited Company Registration. The minimum statutory fee for a Private Limited Company is INR 6000 whereas it is INR 1500 for LLP that extends to a maximum cost of INR 7000.

- Less Compliance burden- A Private Limited Company is required to comply with about 8 to10 compliances per annum. In contrast, a Limited Liability Partnership has to file only an Annual Return and a Statement of Accounts & Solvency.

- Tax exemptions– In terms of taxation, LLP is as privileged as a Partnership firm. It is only liable for Income Tax payment without any implications of Dividend Distribution Tax or Corporation Tax.

- No compulsion on Account Audit- Regardless of the Share Capital, every Public or Private Limited Company has to get his account audited. Nevertheless, LLP is required to get the audit done under two conditions:

- If the contribution exceeds INR 25Lakhs;

- If the Annual Turnover exceeds INR 40Lakhs.

Differences between Limited Liability Partnership and Private Limited Company

The table given below highlights the benefits of choosing LLP over a Private Company:

|

Basis of Differences |

Limited Liability Partnership |

Private Limited Company |

|

Maximum No. of Members |

None |

200 |

|

Annual Meetings |

No Requirement |

Conduct Annual Board or General Meetings |

|

Taxation |

Not compulsory to pay Dividend Distribution Tax |

Must Pay Dividend Distribution Tax |

|

Account Audit Requirement |

Only if Paid-Up capital exceeds INR 25Lakh or Annual Turnover is more than INR 40Lakh |

Mandatory |

|

Registration Cost |

Less |

More |

How to convert a Private Limited Company into LLP?

Now that you have perceived the advantages of LLP, you must be eager to establish LLP or convert your Private Limited Company into LLP. Follow the simple steps given below for the conversion process:

- Obtain DIN (Director Identification Number) – The first step is to acquire DIN for the Directors who do not possess it already.

- Summons Board Meeting- It is required to call a meeting of the Board of Directors and pass Resolution for the conversion of Private Limited Company into LLP. Further, the Directors will file all the necessary Forms with Ministry of Corporate Affairs.

- Application of Name availability- Now the Company needs to apply for name reservation of LLP and attain a name approval Certificate from ROC.

- File Incorporation Form with the required documents- It’s time to file the E-Form FiLLiP with ROC and affix these documents:

- Address proof of the Registered LLP Office

- Subscription sheets

- Consent to act as the designated Partners

- ID and Residential proofs of both the designated Partners

- Filing of Conversion Form- Therefore, File E-Form 18 to convert your Private Company into a Limited Liability Partnership.

- Issuance of Certificate of Incorporation- Once the Company complies to all the legal requisites with MCA, ROC shall issue a COI for the conversion of LLP.

- Draft LLP Agreement- It is essential to prepare a Limited Liability Partnership Agreement which must include:

- Name of the LLP

- Name of Partners and Designated Partners

- Form of Contribution

- Profit-Sharing Ratio

- Rights & Duties of all the Partners

- Proposed Business

- Rules for governing LLP

- File LLP E-Form-3- Follow the instructions prescribed on the official MCA website before filing E-Form-3. It provides all the information about LLP Agreement between the partners. The Form should be filed within 30 days from the date of conversion of the Private Limited Company to LLP.

- Intimate to ROC about conversion- After obtaining the COI of LLP, file E-Form-14 to ROC in 15 days of the date of conversion.

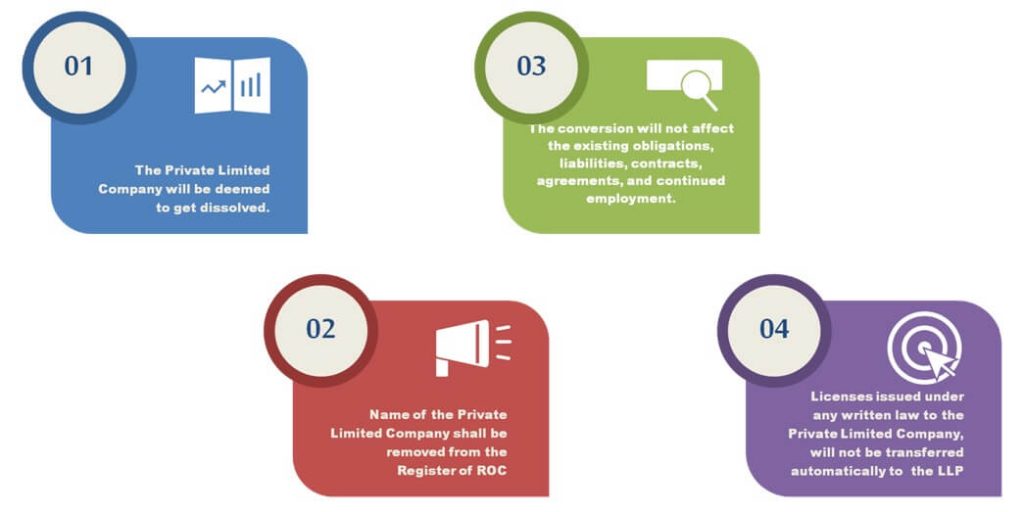

Impact of Company’s Conversion into an LLP

Conclusion

One can yield countless benefits by incorporating LLP or by converting a Company into a Limited Liability Partnership. It is an appropriate fit for all types of the organization from small scale firms to the Multi-national Companies. If you want to avail the advantages of Limited Liability and minimal compliances, look no further than the corporate structure of LLP.

Swarit Advisors can ease the process of Company conversion into LLP and help you provide the Certificate of Incorporation within 20 to 25 working days.

Also, Read our Article: Procedure and Requirements relating to LLP Registered Office change