MCA’s latest update: Conversion of Public Company into Private Company

Khushboo Priya | Updated: Mar 12, 2019 | Category: Conversion of Company

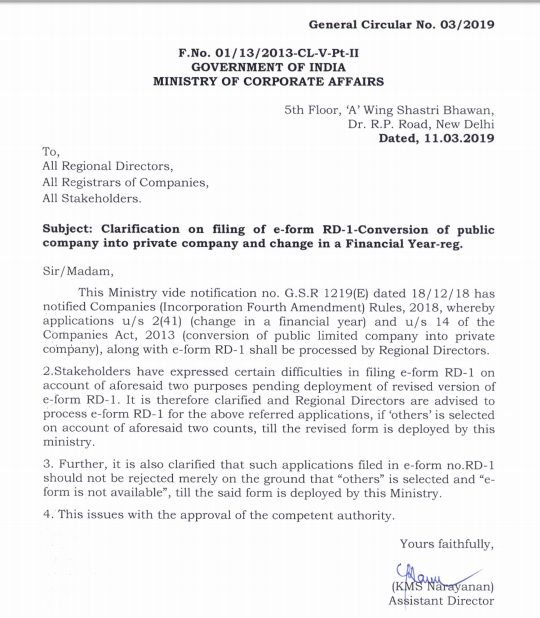

While filing e-form RD-1, for Conversion of Public Company into Private Company and change in a financial year, stakeholders faced certain difficulties. Hence, the stakeholders escalated the matter to the Ministry of Corporate Affairs (MCA) [1] . As a result, MCA came up with the specified solution and issued a notification on 11th March 2019.

Table of Contents

Key Highlights of filing e-form RD-1

According to the latest Circular No. 03/2019, the Ministry of Corporate Affairs (MCA) have made certain clarifications regarding the filing of e-form RD-1 for Conversion of Public Company into Private Company and change in a financial year. The clarifications are as follows:

- Until the MCA deploys the revised form RD-1, the MCA has clarified and advised all the Regional Directors to process e-Form RD-1 for applications u/s 2(41) and u/s 14 of the Companies Act, 2013, if the applicant selects the option ‘others’ on account of aforesaid applications.

- Furthermore, MCA also clarifies that applications filed in e-form no. RD-1 must not be rejected merely on the condition that “others” is selected and “e-from is not available”. Again, this will be in practice until the Ministry of Corporate Affairs deploys the revised form.

The main intent behind introducing the changes for the filing of e-form RD-1

The primary reasons for introducing the changes in e-form RD-1 are as follows:

- In the Circular No. G.S.R. 1219(E) dated 18/12/18, the MCA notified Companies (Incorporation Fourth Amendment) Rules, 2018 and asked the Regional Directors to process the applications under section 2(41) (change in a financial year) and under section 14 of the Companies Act, 2013 (conversion of public company into private company), along with e-form RD-1.

- Secondly, due to the above notification, filing RD-1 became compulsory for filing both applications u/s 14 and u/s 2(41) of the Companies Act, 2013. But stakeholders had several issues while filing RD-1.

Therefore, to ease the process of filing e-form RD-1 so that the aforesaid applications won’t get hampered due to any reason, the Ministry introduced the required changes.

For the complete notification, you can click here.