Checklist & Documents Required for Trust Registration in India

Dashmeet Kaur | Updated: May 11, 2020 | Category: Trust Registration

The greater thing in life is not what you have but what you can offer to the society. In the metropolitan sphere, everyone is busy watering their dreams and is least concerned with social welfare. It is essential to make the world a better place by igniting the feeling of harmony, humankind, and charity. One such way of contributing to the needs of underprivileged is by establishing a non-profit organization. In India, an NPO can either be registered as Trust, Section 8 Company, and Societies. This write-up will provide a completed checklist & documents required for Trust Registration.

Table of Contents

What is Trust Registration in India?

Trust has ancient roots in the form of Dharamshalas, trees plantation, constructing water tanks, educational and medical institutions, etc. However, in the new era, the concept of Trust has been more apparent for many reasons.

Trust refers to the transfer of a trustor’s property to another person (trustee) for the benefit of a third person (beneficiary). The Trusts is divided into two categories:

- Public Trust: The beneficiaries of this Trust is public at large. Further, the Public Trust is subdivided into Public Religious Trust and Public Charitable Trust.

- Private Trust: The beneficiaries of a Private Trust include families or individuals. Further, it is subdivided into the following:

- Private Trusts whose beneficiaries and requisite shares can be determined;

- Private Trusts whose beneficiaries and requisite shares cannot be determined.

The Indian Trust Act[1] governs Trust Registration. It a financial vehicle wherein a property is transferred to a Trust for the lawful purpose. Usually, Trusts are made for religious purposes; but, there is no such restriction, and even sports academies get registered as Trusts.

Trusts can be formed by a company, Hindu undivided family, association of individuals, and people that meet the eligibility criteria. Once every condition is fulfilled, one can prepare documents required for Trust Registration.

Requisites for Trust Registration

A Trust Deed lays out the terms and conditions in the transfer of property from the owner to the trustee. Bailment can also be considered as Trust, but in bailment, there is no transfer of an interest in the property, and it is only a transfer of possession without ownership.

Precisely a Trust is a transfer of property by a trustor to be held by a trustee for carrying out some object for the benefit of others. There are some set guidelines to register a Trust which are as follows:

- Any law should not forbid an objective of a Trust.

- The activities undertaken by a Trust must not breach the provisions of law.

- A trustee must conduct fair practices, and no fraudulent activities should be pursued.

- The purpose of a Trust should not directly or indirectly injure any person or property of the trustor.

- Also, the formation of a Trust should not be such as regarded immoral by court or opposed to the public’s interest.

Things to consider before registering a Trust

Before you proceed to prepare all the documents required for Trust Registration, ensure to have the below checklist in hand:

- Name and Address of the Trust

- Objects of the Trust which primarily should be religious or charitable

- A settler of the Trust

- At least two trustees of the Trust

- Trust Deed

For the property of a Trust movable or immovable, a small amount of cash or cheque is given to save on the stamp duty. You need to prepare a Trust Deed on stamp paper of the stipulated value. In Delhi, it costs around 8% of the property’s value, while the rate varies from one state to another.

Documents Required for Trust Registration

Documentation plays a vital part in registering a Trust; here is an extensive list of documents which one should have for Trust Registration:

- Identity proof such as Voter ID, Driving License, Adhaar Card, Passport of minimum of two members.

- Two photographs of which one must be of passport size

- Copy of the ID proof of the settlor

- Copy of the ID proof of each of the two witnesses and their photographs

- Proof of registered address such an electricity or water bill

Documents for Trust Deed registration with the Registrar under the Indian Trusts Act, 1882

- Schedule (application for registration along with Court Fee INR 100 affixed to it)

- Trust Deed on stamp paper of the requisite value

- Consent Letter signed by all the trustees

- Affidavit/Declaration signed by the settlor (it is to be handed over on the day of the Hearing, with INR 10/- court stamp fee

- One passport size photo & ID proof copy of the three settlor

- One passport size photograph & ID proof copy of each of the two witnesses

- Electricity, Utility bill of the registered address

- No Objection Certificate (NOC) from the property’s owner (trustor) that is proposed as the Registered Address for the Trust

- Signature of the three settlers on each page of the Trust Deed

During registration, two witnesses and the three settlors must be personally present. Also, they should carry their original identity proofs.

Three types of individuals are involved in the creation of a Trust:

- The trustor of the Trust is the person who declares or repossess the confidence;

- Trustee who accepts the confidence;

- Beneficiary is the person for whose benefit the confidence is accepted or who will get the benefits. Usually, the Beneficiary or it is public at large.

A Trust is created when a trustor transfers property to a trustee for the benefit of one or more beneficiaries. A settlor and a trustee play distinctive roles wherein the former is at a more authoritative position. A settlor can reserve several important powers in regards to the Trust. The trustee is obligated to manage the Trust as per the state law until the termination of the Trust.

Procedure for Trust Registration

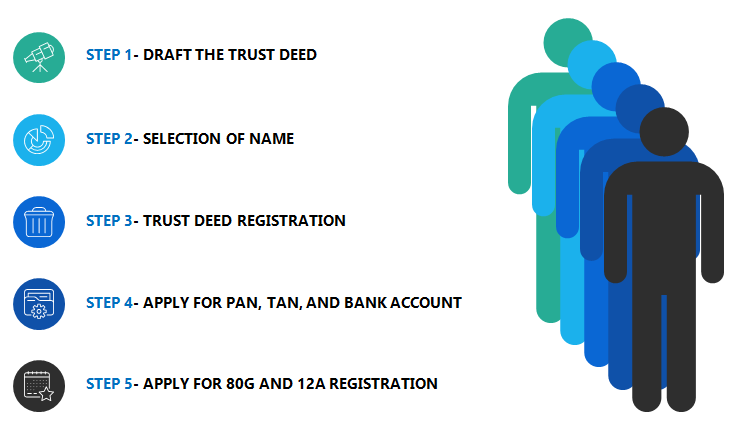

Following are some simple step that you need to take for Trust Registration in India:

Draft the Trust Deed

The first step is to prepare the Trust Deed, though it is non-mandatory but lawfully enforceable. A Deed must include these details:

- Name and address of the Trustor (the person who is setting up the Trust)

- Names and addresses of the Trustees

- Minimum and maximum number of trustees

- Address of the registered office of the Trust

- Objectives of the Trust

- Rules and Regulations of the Trust

- Parties involved in the Trust

- Fix tenure of trustee from a minimum one year to maximum five years

Selection of Name

The next step is to select a unique name of your Trust. Ensure that the name does not violate or infringe an existing trademark or name. You need to provide a minimum of 3 names on a preferential basis

Trust Deed Registration

Now apply to register your prepared deed before the Registrar of the trusts having jurisdiction. The Trust Deed should be submitted with the photocopy to the Registrar and shall have the signatures of the settlor on all the pages.

Apply for PAN, TAN, and Bank Account

After registration, the last step is to apply for the allotment of PAN & TAN. After that, open a bank A/c in which all the donations shall be deposited.

Apply for 80G and 12A Registration

Although it is not mandatory to get 80G and 12A registration, but once registered, one can avail numerous benefits & exemption under the Income Tax Act.

Conclusion

Trust is a significant legal body to cater to the needs of society. If you also intend to serve the social cause, then register a Trust. The procedure of Trust incorporation may seem simple, but the preparation of documents required for Trust Registration can be a daunting task.

So it is prudent to take guidance from a legal expert like Swarit Advisors. Our expert will not only help in drafting the needed documents but also assist in the formation of Trust Deed.

Also, Read: Process of NGO Registration in India