Public Limited Company Registration - An Overview

A Public Limited Company or a PLC is the best business structure for those entrepreneurs who are planning big like opening an IT infrastructure, setting up of a manufacturing plant, etc. Nowadays, people mostly choose the option of a Private Limited Company over a Public Limited Company. However, it shall be pertinent to take into consideration that if in case an individual is seriously planning something big and wants to raise capital from the public by issuing them shares in return. Then, in that case, he or she must go for the option of incorporating a Public Limited Company.

A Public Limited Company enjoys all the rights and privileges of a corporate entity together with the feature of Limited Liability. Further, some of the prominent and renowned examples of a Public Limited Company are the TATA Steel Limited, Reliance Communications Limited, etc.

What is a Public Limited Company?

A Public Limited Company is registered as per provisions prescribed under the Companies Act, 2013. The member of a Public Limited Company enjoys the feature of Limited Liability. Moreover, this business structure is allowed to raise capital from the Public by issuing shares in return.

Further, a minimum of three directors and seven members are required for the public limited company registration. The definition of a PLC is also provided under section 2(71) of the Companies Act, 2013.

According to Companies (Amendment) Act, 2015, no minimum amount is required for the registration of a Public Limited Company.

Further, the rules and regulations of a Public Limited company are more rigid and strict in comparison to Private Limited Company. Still, it is considered as a better form of doing business than a Private Company. The reason for the same is that this business structure not only provides the benefits of a Private Company but also has features like easy transferability of shares and ownership, etc.

A subsidiary company for the purpose of a Public Limited Company Registration shall also be deemed to be a public company, even if the subsidiary company remains listed as a private company in its Articles.

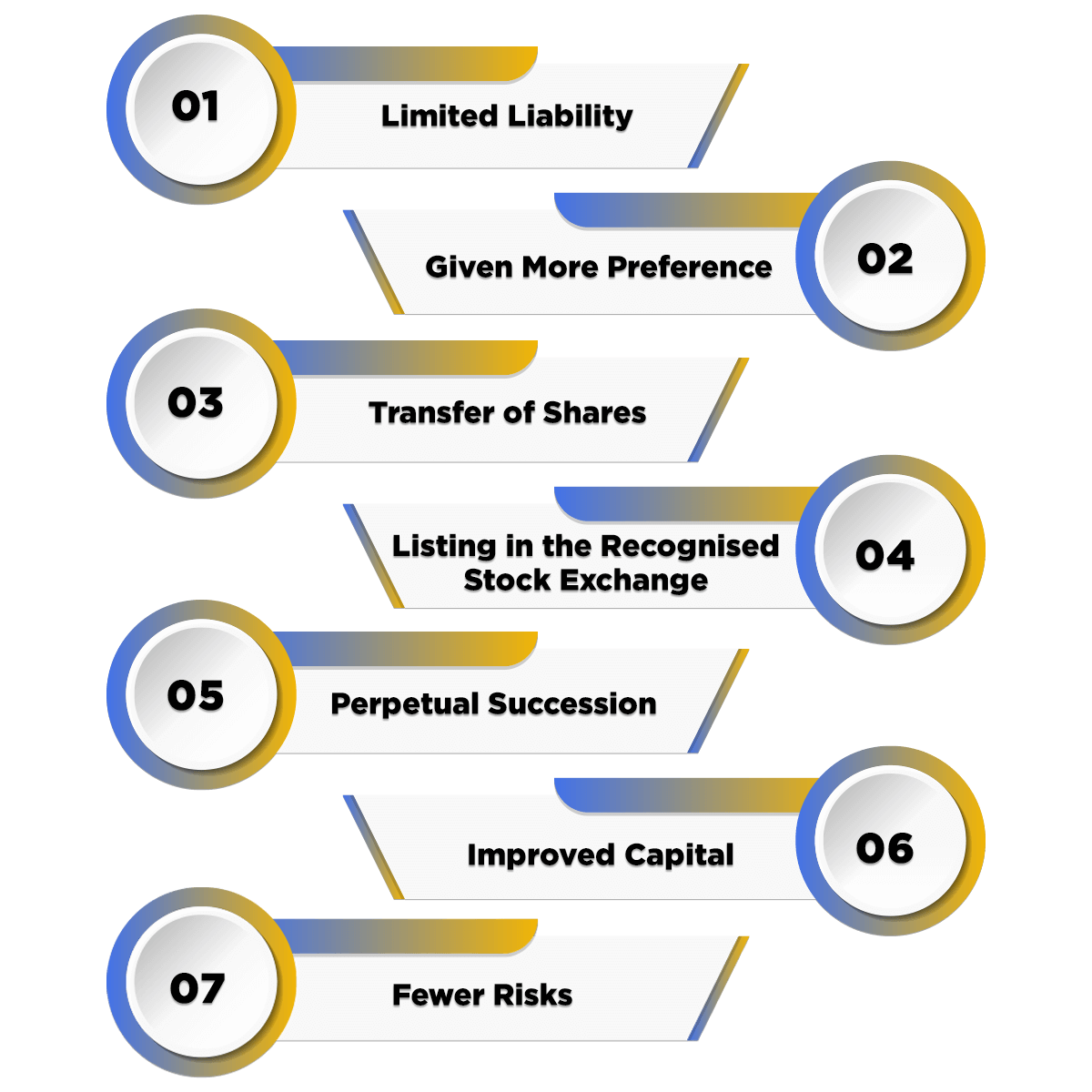

Benefits of Public Limited Company Registration

The benefits of a Public Limited Company Registration are mentioned below:

- Limited Liability

The liability of the members is limited to the extent of the amount remaining unpaid on shares.

- Given More Preference

Banks gives more preference to a Public Limited Company when it comes to offering loans in comparison to any other business structure.

- Transfer of Shares

Shareholders are allowed to transfer or sell their shares with ease.

- Listing in the Recognised Stock Exchange

By following compliance, a public limited company can easily list its shares on a Recognised Stock Exchange.

- Perpetual Succession

The existence of a Public Limited Company will not be affected by the death, retirement, insolvency, and insanity of any member, due to the feature of Perpetual Succession.

- Improved Capital

As the general public is invited by way of prospectus to buy or subscribe to the company’s shares. Hence, subscribing to shares by the general public leads to improved capital of a Public company.

- Fewer Risks

As a Public Limited Company is allowed to sell its shares to the public. These leads to a reduction in the scope of unsystematic risks of the market.

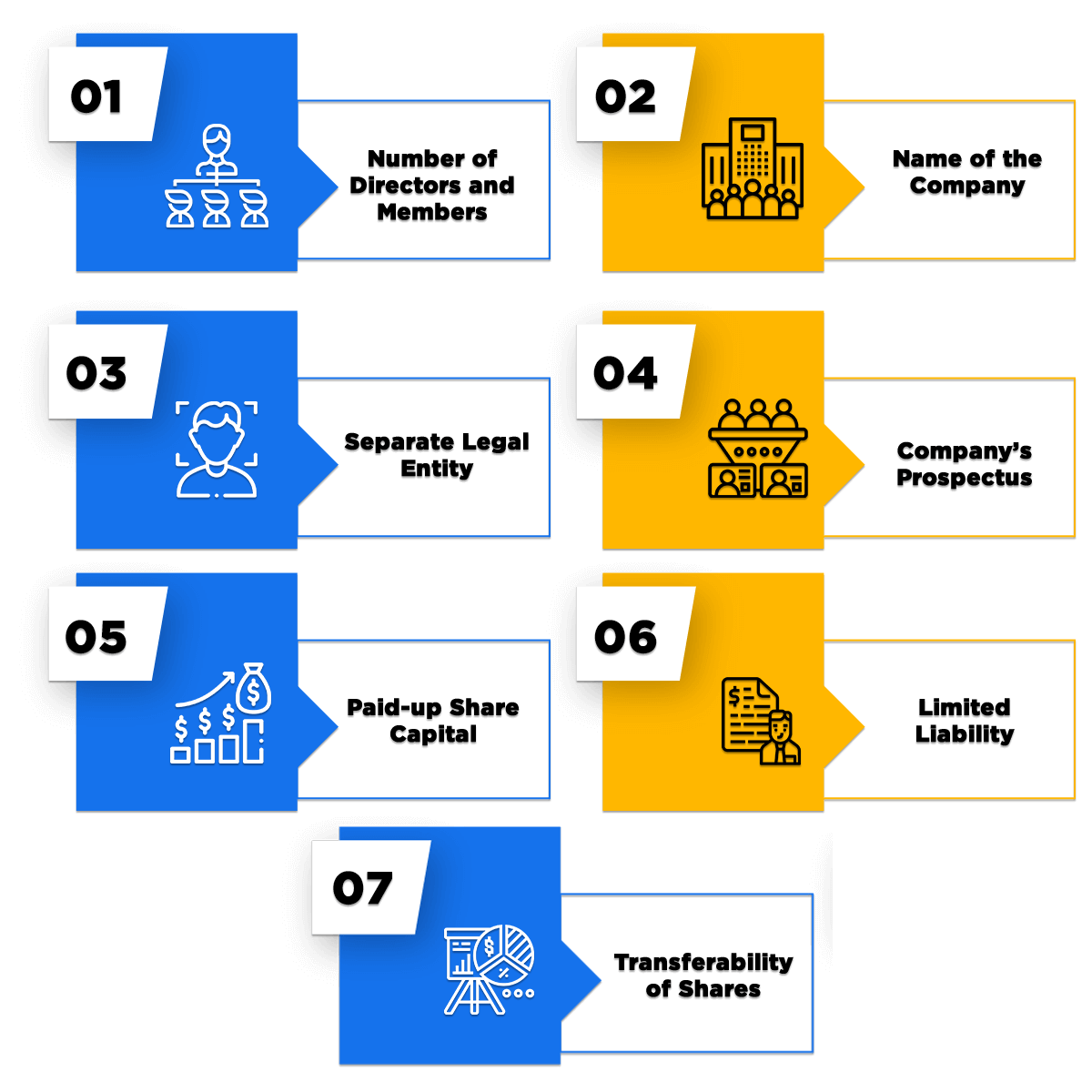

Basic Features of Public Limited Company Registration

The basic features of a Public Limited Company has been explained below:

- Number of Directors and Members

A Minimum of three Directors and seven Members are required for the incorporation of a Public Limited Company.

- Name of the Company

A Public Limited Company is obligated to add a “Limited” word as a suffix at the end of their name. Further, it is represented as an Identity of a Public Limited Company.

- Separate Legal Entity

A Public Limited Company enjoys the status of a Separate Legal Entity. This means the existence of a company is different and distinct from its members.

- Company’s Prospectus

Issuance of Prospectus is considered mandatory in the case of Public Limited Companies. The prospectus also acts as a comprehensive note with regard to the work and affairs of the company. Further, the primary aim of issuing the prospectus to the general public is to raise capital. However, a Private Limited Companies has to fulfil no such compliance as it is not permitted to raise capital from the general public.

- Paid-up Share Capital

As per the requirements of the Companies Act, 2013, no minimum amount is required for obtaining Public Limited Company Registration.

- Limited Liability

All the members of a Public Limited Company enjoys the feature of Limited Liability. This means that the liability of a member is limited to the extent of the amount remaining unpaid on the shares subscribed.

- Transferability of Shares

In the case of a PLC, the members are allowed to transfer the ownership of shares they are holding.

Prerequisites to obtain a Public Ltd Company Registration

The requirement that needs to be adhered for the registration of Public Limited Company is listed below:

- Incorporation of a Public Company requires a minimum of seven shareholders.

- Incorporation of a Public Company requires a minimum of three directors.

- Digital Signature Certificate (DSC) is required for at least one of the directors for signing documents electronically and digitally.

- All the directors of a Proposed Company are required to obtain DIN (Director Identification Number) mandatorily.

- An application consisting of the company’s main Object Clause is to be made. Further, the object clause talks in detail about what all the company will pursue after its incorporation.

- Submission of the application to ROC (Registrar of Companies) along with the required documents like MOA, AOA.

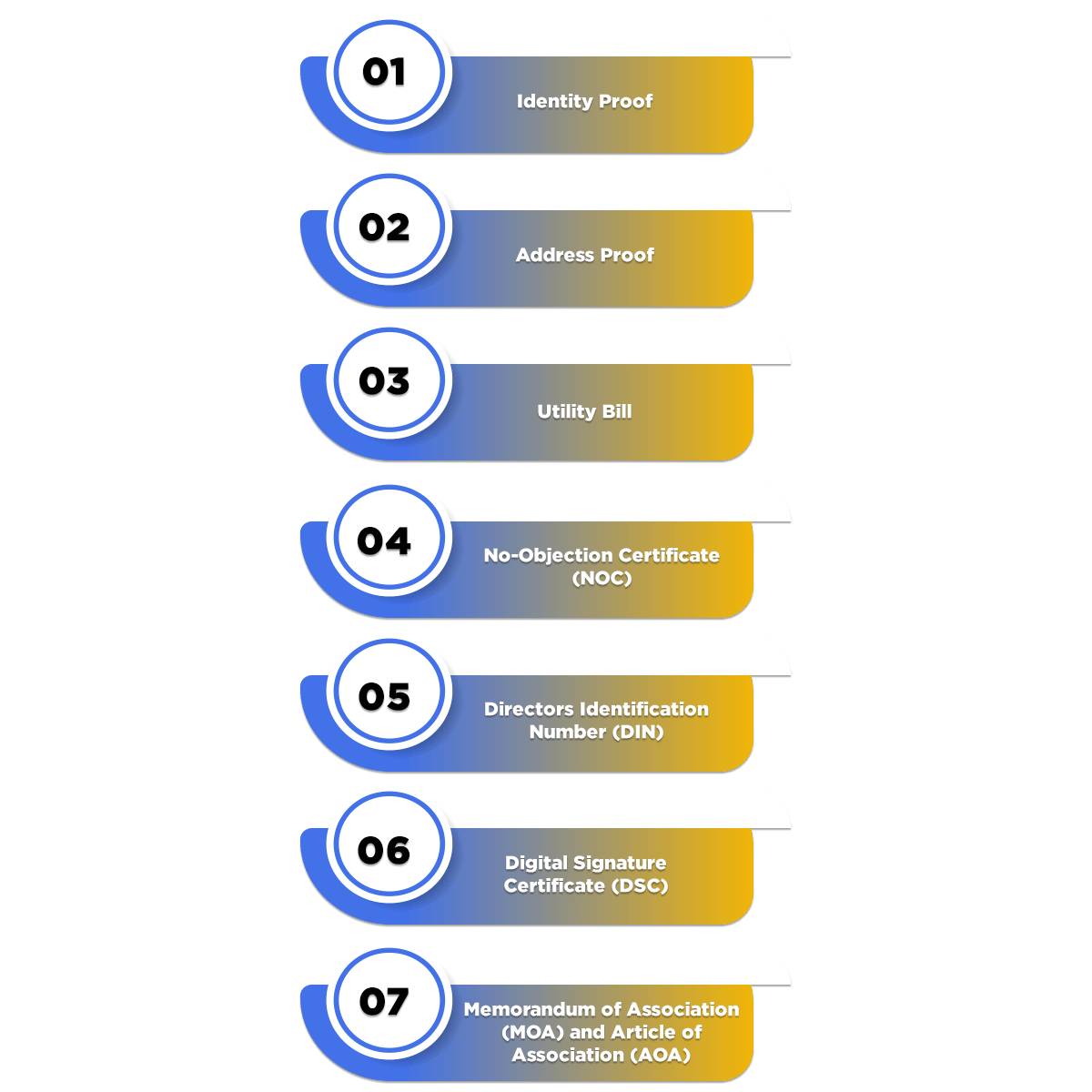

Documents Required for Public Limited Company Registration

For obtaining registration of Public Limited Company the following documents must be provided:

- Identity Proof in the form of PAN Card, Aadhaar card, Voter ID, Driving License of all the directors and shareholders.

- Address Proof of all the directors and shareholders of the said company.

- Utility bill in the form of telephone, water, gas, or electricity bill of the said registered office. This will act as a residential proof for the place being used as Registered Office. However, it must not be older than two months.

- A No-Objection Certificate (NOC) from the actual landlord of the place being used as Registered Office.

- Directors Identification Number (DIN) of all the directors.

- Get Digital Signature Certificate (DSC) of the directors.

- Memorandum of Association (MOA) and Article of Association (AOA).

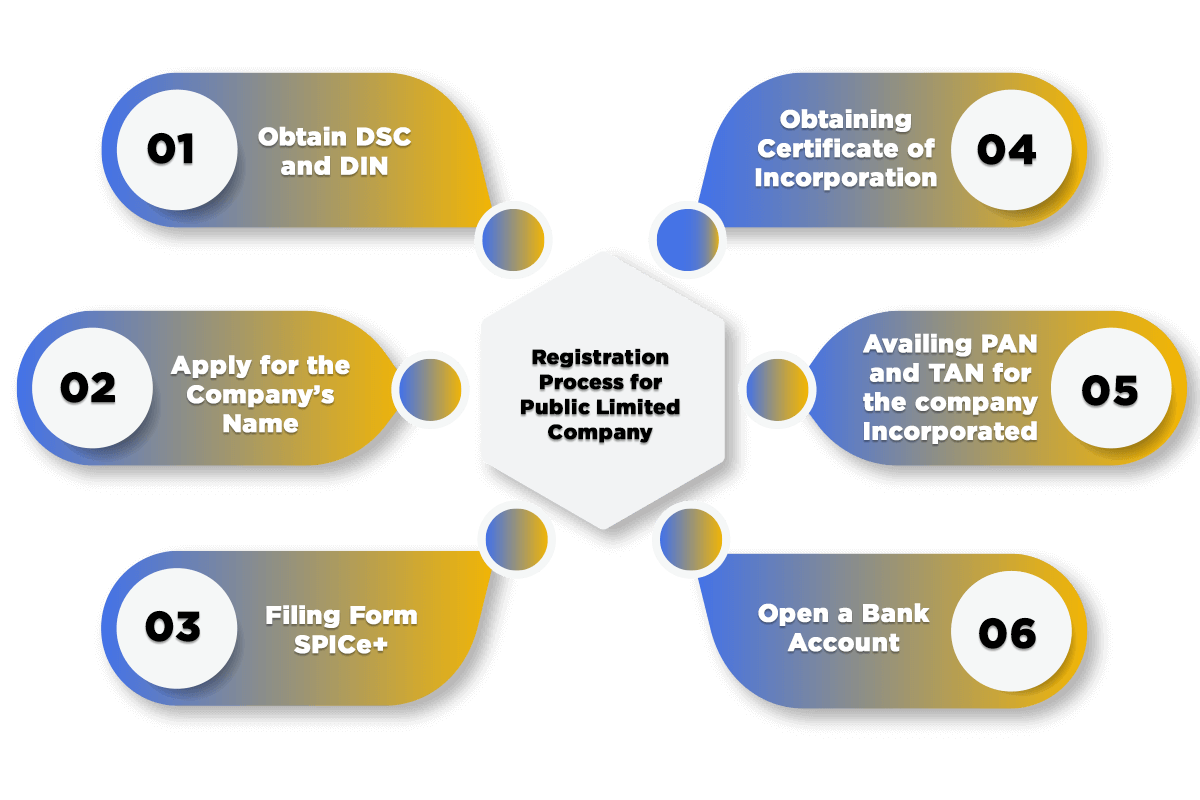

Procedure for Public Limited Company Registration

The steps involved in the process of incorporating a Public Limited Company is listed below:

- Obtain DSC and DIN

The first and foremost step is to obtain DSC (Digital Signature Certificate) for at least one director. The same is required for signing a document digitally and electronically. It is a mandatory document and is issued by the certifying authority.

Further, all the directors of the proposed company are mandatorily required to obtain DIN (Director Identification Number). However, the process of obtaining DIN has now been simplified by the MCA as directors can now apply DIN by just filing the SPICe form.

- Apply for Company’s Name

In the second step, the members of the company are required to check name availability by visiting the MCA (Ministry of Corporate Affairs) official website. After visiting the MCA portal, the next step is to select the MCA services and then check for the name availability. However, it shall be taken into consideration that the name proposed must not be the name already taken or registered.

- Filing Form SPICe+

Once the name proposed has been approved, the applicant is now eligible to file the SPICe+ form for availing the Certificate of Incorporation. Further, along with the form, the applicant is required to file all the documents needed, such as MOA and AOA.

Furthermore, these two documents contain all the details regarding the mission, vision, objectives, aims, business activities, and the roles and duties of directors and shareholders together with the definition of a proposed company.

- Obtaining Certificate of Incorporation

Once all the applications and documents submitted have been received and verified by the authorities, the company would then receive its Certificate of Incorporation, which will include its CIN (Corporate Identification Number) and the Date of Incorporation.

- Availing PAN and TAN for the company Incorporated

Once the company has obtained its Certificate of Incorporation (COI), the members and the directors of the company can now apply for the PAN (Permanent Account Number) and TAN (Tax Deduction Account Number) in the name of the company by filing an application to the MCA (Ministry of Corporate Affairs).

- Open a Bank Account

With the help of PAN card details and the Certificate of Incorporation (COI), the members of the said company can now easily open a bank account in the company’s name.

Difference between Public Ltd Company and Pvt Ltd Company

|

Point of Difference |

Public Limited Company |

Private Limited Company |

|

Minimum members |

A minimum of seven members are required to incorporate a Public Limited Company |

A minimum of two members are needed to incorporate a Private Limited Company |

|

Minimum directors |

A minimum of three directors are required to incorporate a Public Limited Company |

A minimum of two directors are required to incorporate a Private Limited Company |

|

Maximum members |

Unlimited |

A maximum of two-hundred members are required to incorporate a Private Limited Company |

|

Minimum capital |

No, minimum amount is required as the Minimum Capital |

No, minimum amount is required as the Minimum Capital |

|

Invitation to Public |

Yes |

No |

|

Issue of Prospectus |

Yes |

No |

|

The Quorum at Annual General Meeting |

Five members |

Two members |

|

Certificate for the Commencement of Business |

Yes |

No |

|

Suffix used at the end of name |

Limited |

Private limited |

|

Managerial Remuneration |

No restriction |

Cannot exceed more than 11% of the Net Profits |

|

Statutory meeting (mandatory) |

Yes, conducting a Statutory Meeting is compulsory for a Public Limited Company |

No, conducting a Statutory Meeting is not compulsory for a Public Limited Company |

Public Limited Company Registration FAQ

A minimum of 3 Directors and 7 shareholders are needed to incorporate a Public Limited Company in India.

Any person who is 18 years or above in age is eligible to become Director in a Public Limited Company. Further, any NRI (Non-Resident of India) or foreign national can become a director of a Public Limited Company.

No, there is no need for anyone to be present at our office in person as the process for obtaining Public Limited Company Registration is 100% online. You just need to mail us your documents, and the rest will be handled by our team.

Yes, an NRI or a Foreign National is eligible to become Director of a Public Limited Company.

No, there is no need for you to hire a full-time CA (Charted Accountant) or CS (Company Secretary) as our team will provide you an Annual Compliance Package as well, by which you will get the right and timely advice.

Usually, a period of 15 business days is required by our experts for registering a Public Limited Company in India.

A Digital Signature Certificate or DSC is a signature certificate issued by the Certifying Authority. It is used to sign the documents and forms electronically and digitally.

DIN or the Director Identification Number is a unique identification number issued by the Ministry of Corporate Affairs to every director. It is a mandatory requirement for an individual to become the director of a company. Only one DIN is allotted to one director, and it has lifetime validity.

Every Public Limited Company needs to hold at least one Board Meeting in every 3 months. Moreover, it needs to hold an Annual General Meeting (AGM) at least once a year.

The term PLC is an acronym form for the “Public Limited Company”.

The basic difference between both is that a public company needs a minimum of 7 shareholders and 3 directors. In contrast, a Private Company needs a minimum of 2 directors and shareholders each.

A Public Limited Company can raise its share capital either by selling the shares to the already existing member or by offering new shares to the public, i.e., Initial Public Offer.

The shareholders or the members of a Public Limited Company are considered as Owners of the Company.

All the Directors appointed in a company have the controlling power regarding the management and affairs of that company.

One of the significant disadvantages of a Public Limited Company is that both directors and the manager hired to run a company may have different goals for those of the company shareholders.

The benefits of a Public Limited Company include Limited Liability, Separate Legal Entity, Freedom to Transfer Shares, Perpetual Succession, Increased Share Capital, Increased Borrowing Capacity, Fewer Risks and Compliances, and the Better Growth Opportunities.

The modes of dissolving or winding up a Public Limited Company are Voluntary Liquidation and Winding Up by the Tribunal.

AOA stands for the Article of Association. It is a document that defines the by-laws, rules, and regulations, along with the Internal Constitution of the said company.

MOA is the acronym form for the Memorandum of Association. It is a document that showcases the mission, vision, objectives of the company.

The basic features of a Public Limited Company are Separate Legal Entity, Limited Liability, Perpetual Succession, Separate Property, Transferability of Shares, Common Seal, and Capacity to Sue and being sued.

No, Shareholders and Directors are two people with different and distinct roles within a Public Limited Company. In laymen terms, a shareholder owns the business, whereas a director runs it.

Yes, the process for registration of a Public Limited Company is 100% online. Therefore, neither you are required to be physically present at our office nor at the office Ministry of Corporate Affairs.

A Public Limited Company is qualified to issue Ordinary Shares, Cumulative Preference Shares, Preferences Shares, Bearer Shares, and Redeemable Shares.

Reliance Communications Limited and TATA Steel Limited are some of the prominent and renowned examples of a Public Limited company.

The registration of a Public Limited Company is valid for lifetime.

Around 8 to 10 business working days are needed by our experts to incorporate a Public Limited Company in India.

Yes, an individual can register a Public Limited Company at his Residential Address. That means having a registered office is not mandatory for the incorporation of a Public Limited Company.

Our Experts will mail an all-inclusive invoice with no extra hidden charge.

The Sources for raising funds are Personal Investment, Business Incubators, Bank Loans, Venture Capitals, Government grants, and subsidies.

The three significant similarities between a Public Limited Company and Private Limited Company are Perpetual Succession, Limited Liability, and No Minimum Capital Requirement.

An Individual can convert a Private Limited Company to Public Limited Company by filing E-form INC 27 with the registrar within 15 days from the passing of resolutions, together with the prescribed fees.

According to the provisions of the Companies Act 2013, the name of a company must be unique, new, not offensive, and relevant to the business objectives.

A CIN or Corporate Identification Number is a unique 21- digit identification number issued to the company by the Registrar of Companies.

The companies that are registered in India include “PLC” or “Public Limited Company” as a suffix after the company’s name. In contrast, “INC” denotes the company registered in the USA.

Yes, you can change your registered office anytime after incorporation.

Swarit Advisors is the best to obtain on-time registration of Public Limited Company.

As per the Companies (Amendment) 2015, there is no Minimum Capital Requirement for a Public Limited Company in India.

A shareholder can indemnify the company for the losses incurred, only to the extent of the amount invested by him/her.