How to Obtain Digital Signature Certificate in India?

Shivani Jain | Updated: Nov 17, 2020 | Category: Compliance

The term “Digital Signature Certificate or DSC” denotes as one of the main requirements for incorporating a company, whether a Private Limited Company or Public Limited Company in India. Further, the same is required by Designated Partners of an LLP as well. In this blog, we will discuss the concept and process to obtain Digital Signature Certificate in India.

Table of Contents

Concept of Digital Signature Certificate

A Digital Signature Certificate means a secured digital key that comprises of details of the holding person holding, such as the name, pin code, email, country, date of issuance, and the name of the regulatory authority that has granted DSC.

Further, a DSC is able to reduce cost, save time, avoid the scope of fraud during e-filing or statutory filing of documents.

Also, a DSC validates the identity of the director or designated partner, signing the document and assists in maintaining Data Integrity.

Moreover, it shall be relevant to note that there is no need for the signatory to be physically present for signing the document and the clients are being assured of the scope of the document as the chances of forgery gets reduced.

Different Classes of Digital Signature Certificate

In India, a Digital Signature Certificate is a physical equivalent digital certificate that allows the user to perform several functions as follows:

- Digitally signing a Document.

- Access to Confidential Information on the Internet.

- Acts a Prove for Business Transaction.

Further, the different classes of Digital Signature Certificate based on applicability and data protection are as follows:

Class 1 Certificate

The term “Class 1 Certificate” denotes a certificate that purposes to serve both individuals and private subscribers. This type of certificate will declare that the information and details covered within the application are not similar to the details available on the consumer database.

Also, it provides a basic level of surety to the user regarding his/her information and is applicable only in those areas where the threat to data is low.

Class 2 Certificate

A class 2 certificate is usually utilised by business personnel and private individuals. Further, in terms of functionality, a class 2 certificate serves the same purpose that of a class 1 certificate.

Class 3 Certificate

In general terms, a Class 3 certificate is meant to benefit the bigger organizations and have a larger scope of applicability.

Also, this certificate intends to work for online trading platforms as well, and it shall be granted to the person only on his/her personal appearance prior to the issuance authorities. Moreover, a Class 3 Certificate is generally used in situations where the threat to data is significantly higher.

Benefits of Digital Signature Certificate

The benefits of a Digital Signature Certificate are as follows:

Authenticity of Documents

Digitally signed documents give confidence to the receiver to be assured of the signer’s authenticity. They can take action on the basis of such documents without getting worried about the documents being forged.

Integrity of Data

Documents that are signed digitally cannot be altered or edited after signing, which makes the data safe and secure.

Reduced Cost and Time

Digitally signing a document is quicker and faster than physically signing a document and then scanning the same to send via e-mail. That means the same saves time and cost of printing and scanning documents.

Also, Read: Process of GST Registration in India

How does a Digital Signature Certificate work?

The working of a Digital Signature Certificate can be summarised as:

- It is an e-document that is used to validate the identity of an individual.

- It needs digital language to authorize content.

- The document is properly encrypted and secured.

- The receiver needs to have proper key access to operate the document.

- One can send the encrypted file to anyone by providing him/her the key access.

- After that, a DSC validates the identity of an e-document or file.

Certifying Authorities of Digital Signature Certificate

The authorities certifying Digital Signature Certificate in India are as follows:

- IDRBT Certifying Authority[1]

- E-Mudra

- Code Solutions

- Safescrypt[2]

- Tata Consultancy Service

- National Informatics Center

How to Obtain Digital Signature Certificate in India?

One can obtain Digital Signature Certificate in India by directly approaching the Certifying Authority or applying online through third-party service providers, such as SwaritAdvsiors. Further, the process of obtaining DSC requires both the original documents and their self-attested copies. Also, the applicant for DSC needs to undergo the process of eKYC authentication.

Documents Required to Obtain Digital Signature Certificate in India

The documents required to obtain Digital Signature Certificate in India are as follows:

- DSC Application Form

- Identity Proof for the Applicant

- Address Proof for the Applicant

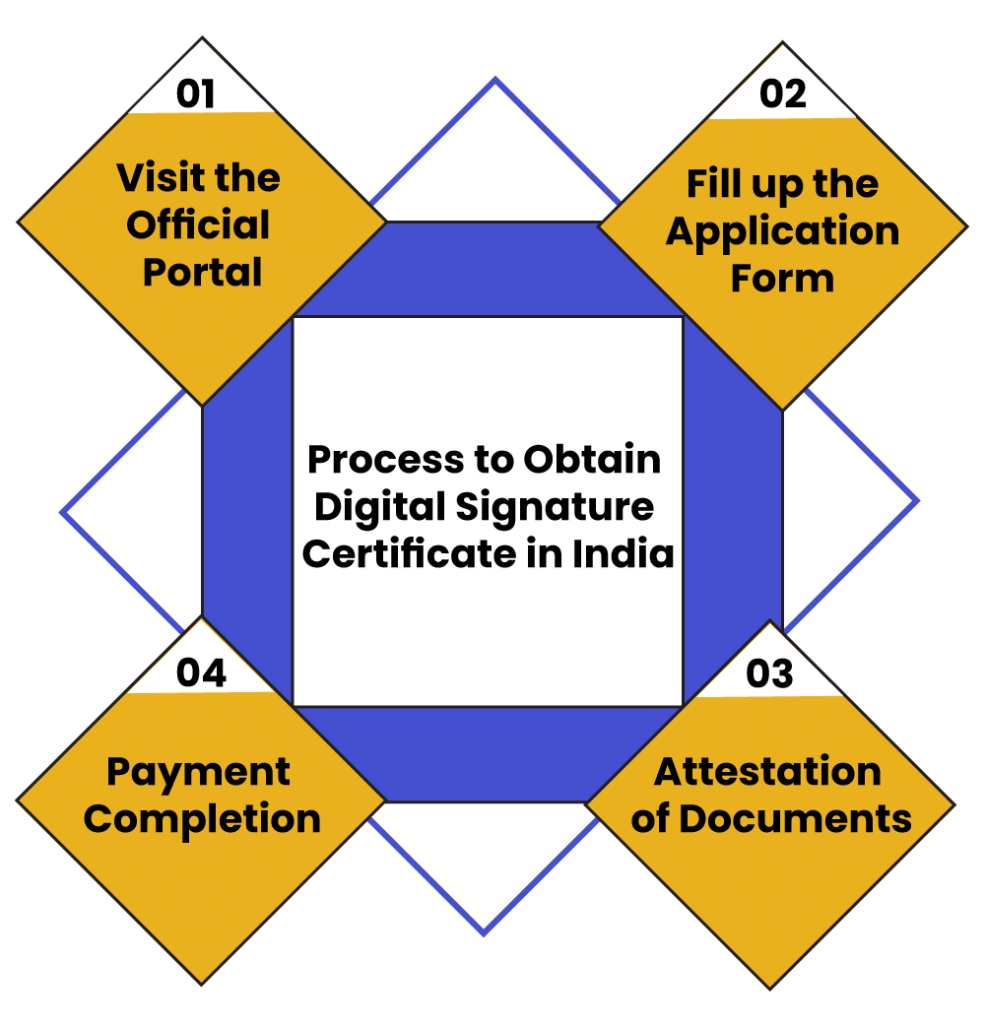

Process to Obtain Digital Signature Certificate in India

The steps involved in the process to obtain Digital Signature Certificate in India are as follows:

Visit the Official Portal

In the first step, the applicant requires to choose any of the above mentioned six certifying authorities. After that, select the type of business entity for which he/she requires DSC or Digital Signature Certificate.

However, it shall be relevant to state that once the applicant gets access on the portal of the Issuance Authority, then he/she will be guided towards the “Digital Certification Services” section.

Also, if in case, the applicant wants to acquire DSC for an organisation, then a “new tab” with the “DSC application form” will appear. The applicant needs to download and fill the same.

Fill up the Application Form

In the next step, the applicant needs to provide the details as follows:

- Name of the Applicant

- Contact Details

- Validity of Digital Signature Certificate

- Type of Digital Signature Certificate

- Specific Class of Digital Signature Certificate

- Residential Address of the Applicant

- ID Proof in the form of Voter Id, Aadhar Card, etc.

- Address Proof of the applicant in the form of Utility Bills.

- Goods and Service Tax Registration Number.

Once the applicant has filed in all the required details, he/she then needs to attach his/her latest photo and specify the signature in the declaration column.

Also, the applicant needs to enclose the information concerning the attestation officer and payment details in this step.

Attestation of Documents

In this step, the applicant requires to get all the documents, identity proofs, and address proofs attest by the attesting officer. After that, scan all the attested documents and upload them with the form.

Payment Completion

In the last step, the applicant needs to make the payment concerning the Digital Signature Certificate, in favour of the local registration officer, in the form of a cheque or demand draft.

Further, the details of the issuance authority, to whom the applicant needs to submit the form will vary zone-wise.

Also, after the completion of the registration procedure, the applicant needs to be posted. Together with the documents as follows:

- Attested copy of the Address Proof.

- Attested copy of the Identity Proof.

- Demand Draft or Cheque.

Validity of DSC in India

In general, a DSC or Digital Signature Certificate has the validity of 1 to 2 years. That means an applicant can apply for the renewal of DSC after its expiry.

Further, the process of Digital Signature Certificate Renewal is somehow the same as that of a regular DSC Registration.

Also, the applicant can either go to the issuance authority with the required documents or can take advantage of the online portal for doing the same.

Conclusion

In a nutshell, a Digital Signature Certificate or DSC is capable of offering personalized protection to the individuals who are willing to prevent fraudulent doings, address online tasks, such as accessing membership based portals, ITR Filing, or furnishing e-tender documents.

Also, a DSC provides end-to-end protection to emails and transaction-related tasks and can assist in establishing SSL/TLS encrypted secured sessions whenever required.

In case of any other doubt or dilemma, reach out to Swarit Advisors.

Also, Read: Private Limited Company Registration Procedure in India