An Overview of Private Limited Company Registration

In India, establishing a Private Limited Company is one of the most popular ways to commence a business. Private Limited Company Registration is done under the Companies Act, 2013 and governed by the Ministry of Corporate Affairs (MCA). A Private Limited Company provides limited liability and legal protection to its shareholders. It's a corporate structure that provides a business with a separate legal identity from its owners. The Private Limited Company doesn't have any relationship with the public; they are not allowed to ask for any collateral from any public or public sectors. In this type of Company, individuals are not liable to transfer shares, which protects takeovers of Private Limited Companies from big enterprises.

The Private Limited Company Registration procedure is essential as it provides legitimacy to your business structure. If you want to go for Private Limited Company Registration in India, you can entirely rely on Swarit Advisors. Swarit Advisors will help you provide all the relevant information regarding Private Limited Company Registration.

Benefits of Private Limited Company Registration in India

A Private Limited Company is one of the most common forms of legal entity to carry on business intending to make a profit and enjoy the benefits of an incorporated entity. Following are some benefits of getting Private Limited Company Registration in India:

- Better Credibility: Due to their accountability towards the authorities, a Private Limited is more credible among its customers and contributes to creating a more extensive customer base.

- Separate Legal Entity: A Private Limited Company (Pvt. Ltd.) is a separate legal entity that possesses all the rights to sue or be sued. A company is a legal entity and a juristic person established under the Act. A juristic individual is an individual who is not a natural person. Therefore a company has vast legal capacity and can own property & also incur debts. The Directors or Shareholders of a company have zero liability to the creditors of a company for such debts. Therefore, a Private Limited Company is a legal entity separate from its members (Shareholders or Directors).

- Raising Capital: Even though Private Limited Company Registration comes with compliance requirements, it is desired by entrepreneurs as it helps them raise funds via equity, expand and at the same time limits their liability.

- Perpetual Existence: A Private Limited Company in India has a lifelong existence. Being a separate legal entity, the Company is unaffected by the death or other departure of any member but continues to exist regardless of the changes in membership. This benefit is one of the most vital characteristics of a company.

- Borrowing Capacity: A company enjoys better opportunities for borrowing funds. It can issue debentures, secured & unsecured deposits, and accept deposits from the public. Even banking & financial institutions prefer to provide substantial financial help to a company rather than Partnership Firms or Proprietary.

- Easy Transferability of Shares: Shares of a Private Limited Company are transferable by a shareholder to any other person. The transfer of shares is easy compared to the transfer of an interest in a business run as a Proprietary concern or a Partnership. Filing & signing a share transfer form and handing over the buyer of the shares along with a share certificate can easily transfer shares.

Checklist for Registering a Private Limited Company in India

- Unique & Meaningful Name: The name shouldn't match any of the existing entities & shall not contain any offensive words harmful to the interest of the society at large. Also, the name of the Company should necessarily align with the objects of the Company and must contain the word "Private Limited";

- Minimum Capital: There is no minimum capital requirement for a company. All the shareholders or members of the Company shall contribute it in the proportion of the shares held by them;

- Minimum Directors: A Private Limited Company must have a minimum of two Directors & maximum of 15 and at least one Director of the Company must be a resident of India.

- Minimum Shareholders: a Minimum of 2 shareholders are required and a maximum of 200 shareholders are required as per the Companies Act, 2013.

- Registered Office: The registered office of a company doesn't require any commercial space; even a rented home can be a registered office.

Documents Required for Private Limited Company Registration

Following are some vital documents required for Private Limited Company Registration:

- Documents to be submitted by the Directors and Shareholders (Indian Nationals) of the Company:

- PAN Card;

- Government Identity Proof such as Aadhar Card, Voter ID or Driving License;

- Latest Bank Statement;

- Latest Utility Bills such as electricity bills, mobile bills, or gas bills;

- Latest passport size photographs;

- An affidavit on a stamp paper is to be given by all the

- Signature of the Company's Director on a blank document.

- Documents to be submitted by the Directors and Shareholders (NRIs) of the Company:

- Passport;

- Identity Proof: It can be a Driving License, Residence Card, Bank Statement, etc.

- Latest Bank Statement;

- Latest utility bills (not older than 2 months);

- Passport size photographs;

- Specimen Signature.

- Registered Office Proof:

- In case the office is owned by the Director or Shareholder of the Company, the latest electricity bill, gas bill, or mobile bill in the name of the Director or Shareholder is required;

- Also, a Sale Deed is required in the case of owned property;

- In the case of rented premises or offices, a No Objection Certificate from the property owner is required and notarised Rental Agreement in English is also required.

Looking for a free company registration guide?

Download our free pdf for company registration

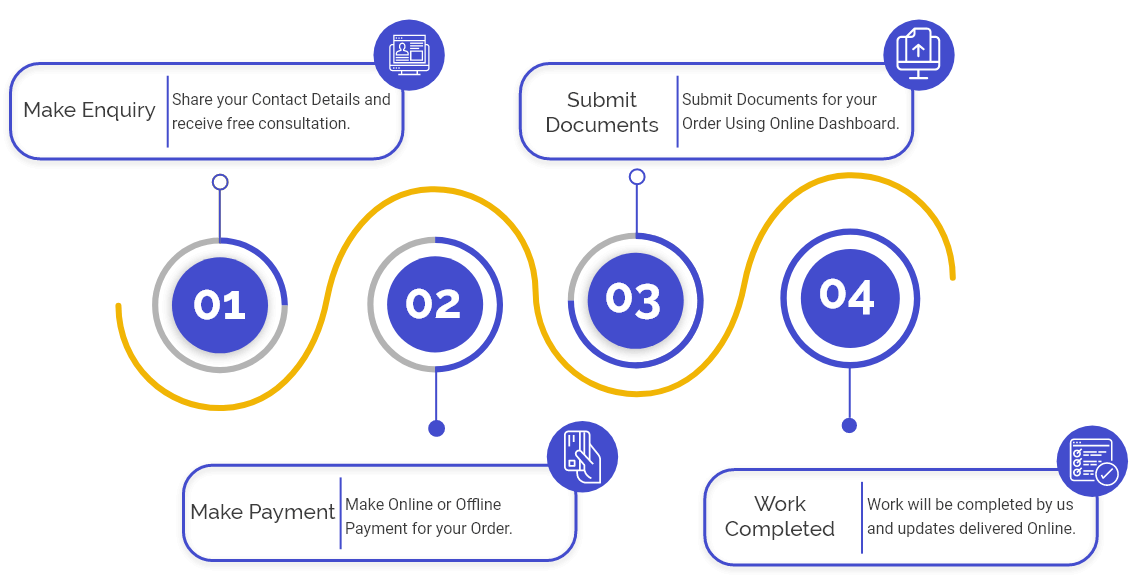

Download PDFProcedure for Private Limited Company Registration in India

Following is the step by step procedure for Private Limited Company Registration in India:

Step 1: Obtain DSC: Before setting up a Private Limited Company in India, Digital Signatures are required to obtain first. As you already know, the registration process is entirely online and online forms require a Digital Signature. That's why Digital Signature Certificate (DSC) is required. You can get your DSC online in just a few days from Swarit Advisors.

Step 2: Filing SPICe+ Form: With this form, the company's directors get DINs (Direction Identification Number) who don’t have a DIN. Under this filing process through SPICe+, a minimum of 3 directors can apply for DIN. In case the applicant wants to register Company with more than 3 directors and more than 3 person does not have DIN, then the applicant has to register a Company with 3 Directors and must appoint new directors later on after incorporation.

The applicant can also use this form for Name approval by filing Part A and B of the SPICe+ Form together. Part-A of the SPICe+ Form allows for name reservation with 2 proposed names and one re-submission while reserving Unique Names for the Companies. The applicant can apply for the proposed name along with the application for Private Limited Company Registration.

Part-B of the SPICe+ Form enables applying for Private Limited Company Registration. Similar to the earlier SPICe Form, SPICe+ Form also enables combined application for Registration and Name Approval of the Company. That means Part-A and Part B of this form can be submitted together.

Part - B of the new SPICe+ Form serves the following purposes:

- Incorporation of a new company;

- Application for EPFO and ESIC Registration;

- Reservation of a new company name;

- Application for DIN;

- Application for PAN & TAN;

- Opening of a Bank Account for the Company and so on;

Step 3: e-MoA and e-AoA: e-MoA stands for Electronic Memorandum of Association and e-AOA stands for Electronic Articles of Association. These two e-forms have been introduced to simplify the process of Private Limited Company Registration in India. These two forms can be filed online at the official website of MCA as a linked form with SPICe+ and these forms must be digitally signed by subscribers to the AoA and MoA.

Step 4: Apply for PAN & TAN of the Company: Through SPICe+, the applicant can apply for the PAN and TAN of the Company. The Certificate of Incorporation of the Private Limited Company is issued along with the PAN as allotted by the ITD (Income Tax Department) after the approval of the SPICe+ Form.

Points to remember before applying for Private Limited Company Registration

Following are some important points to be kept in mind:

- The name of the Company is the first and foremost thing to be decided as it may take time to get a company registered if the promoters do not come up with a unique and meaningful name;

- Second point to be kept in mind is about the objects which would be carried on in the private limited after its registration. The objects are contained in the memorandum of a Private Limited and are divided into two parts- main objects and other objects;

- Third point of interest is the location of the Company. It is very important to find a suitable registered office of the Private Limited from where all the operations of the Company can be managed. A centralized and well-planned location for the Private Limited may attract more and more customers, thereby adding to the profitability of the business;

- Next comes the authorized share capital with which the Private Limited shall be registered. The authorized capital is the declaration by the shareholders about their contribution to the Company. Before going for the company registration, one should know the complete checklist for Company Registration in India.

- The Private Company may be either limited by shares or may be limited by the liability. Now, we have the provision in the Companies Act, under which a Private Limited can be registered without any capital.

- Then there shall be the finalization of the shareholders and the Company's Board of Directors. The Directors are the faces who run the Company and the shareholders are the promoters who invest in the Private Limited. Both Directors and shareholders can be a similar person.

- The last thing the promoters of a Private Limited shall keep in mind is the shareholding held by each of them. It determines the control of each of the promoters over the income and affairs of the Company.

Post Incorporation Steps by a Pvt Ltd Company

After your Private Limited Company has come into existence, you need to comply with the following to maintain a smooth flow of operations:

- Verification of the Registered Office Address: It shall be done through Form INC 22 and must be filed within 30 days of the incorporation of the Private Limited. The Form INC 22 shall be accompanied by necessary documents mentioned under the Documents for Registered office.

- Company Name Board: A clear and complete Name Board of the Company consisting of details such as CIN, Registered Office Aggress, GSTN, Phone numbers, Email, fax, website address etc., shall be put in English and Hindi or any other vernacular language of the state, where the registered office of the Private Limited is situated. Such name boards shall be put outside every office of the Private Limited.

- Filing of INC 20 A: Within 180 days of Private Limited Company Registration, a declaration, attested by the Director of the Company, shall be filed with ROC that each subscriber to the memorandum has consented to the share value taken by them.

- Appointment of Auditor: Soon after the Private Limited comes into existence, there shall be appointed before the first Annual General Meeting of the Company, the statutory auditor who shall hold office till the sixth AGM until and unless ratified or resignation is served.

Annual Compliances for a Pvt Ltd Company

Every Private Limited Company shall adhere to certain yearly compliances applicable to them from time to time. These can be enumerated as below:

- Board Meetings: There shall be conducted at least two Board meetings, by a Private Limited, in a financial year. Also, it is to be kept in mind that proper minutes of such meetings shall be maintained in the minute book of the Company. The Directors of the Private Limited shall attend the Board meetings.

- Annual General Meeting: Every Private Limited shall conduct an Annual General Meeting of its shareholders once a year to discuss the plan, such as auditor's appointment, declaration of dividend, etc.

- Appointment of Auditor: The first auditors of the Company shall be appointed within 30 days of the incorporation or at the first Annual General Meeting of the Company and soon after the appointment Form ADT 1 shall be furnished to the ROC;

- Directors Disclosure: It shall be made in Form MBP 1 by each Director of the Private Limited before the first Board Meeting of the Company;

- Annual Returns: Form MGT-7 shall be filed in respect of Annual Returns within 60 days of the conclusion of the Annual General Meeting;

- Annual Financial Statements: It shall be filed in Form AOC 4 every year, presenting the statement of Balance year and profit and loss account of the Company for the preceding financial year. The form AOC 4 shall be filed within 30 days of the end of the Annual General Meeting.

- Income Tax Returns

Every Private Limited shall file its Income Tax Return by 30th September of each year for the income earned in the previous financial year.

- GST Returns: To be filed every month.

Other Periodic Compliances: Like a change in directors, increase in capital, etc. shall be done on a date basis.

Frequently Asked Questions

The process of PVT LTD Company registration needs around 8 to 12 business days. If all the details filled are correct and documents submitted are complete, then the time taken for registration can be minimised.

Yes, a Private Company must use the word “Private Limited” as a suffix.

A minimum of two directors and shareholders are needed for the process of private company registration. Moreover, the same individuals can act as Directors as well as Shareholders of the company.

No, an individual must be at least 18 years old to become a director in a Private Limited Company.

There is no need for the promoters to present themselves before the authority, since the process of private ltd company registration is done 100% online.

The documents needed for obtaining Private LTD Company Registration include ID and Address proofs of the Directors; Address proof and Utility Bills of the registered address; and Bank Statements of the company.

The minimum capital of Rs 1,00,000 is required for incorporating a private limited company in India.

Yes, at any point of time, the maximum number of members must not exceed 200. If it exceeds the prescribed number, then the Company must be converted into a Public Limited, and all the provisions governing a public limited are applicable to it.

No, a convicted person is not eligible to become a director or shareholder of the company.

DIN is the acronym for Director Identification Number. It is a unique number allotted by the MCA to every director. Further, a DIN is issued only once by the MCA (Ministry of Corporate Affairs) during the lifetime of the director. Therefore, no Director can ever be allocated two DINs. This also means a person can be a director in more than one companies with the same DIN.

Till the time a private company is in existence, its COI (Certificate of Incorporation) also remains valid. However, the same can get cancelled, or the company can be struck-off by Registrar of Companies in case of non-compliance with the regulations, non-filing of returns, default in updating the true and fair status of the Company or non-compliance by any of its Directors or Shareholders.

No, a Private Limited Company is not eligible to get its shares listed on the Recognised Stock Exchange. However, for listing its shares, a private company needs to convert into a public limited company after satisfying the financial parameters regarding capital, profitability, etc.

The Mandatory Annual Compliances include Filing of Audited Balance Sheet, Profit and Loss Statements, Annual Returns. A private company also needs to appoint a statutory auditor, conduct board meetings and maintain a book of accounts, minute book and company registers.

The process fees involved in company incorporation ranges from Rs 8000 to Rs 20,000. However, there is no uniform costing as fee applicable varies from one state to another.

A Private Company can appoint a minimum of two and a maximum of fifteen directors. However, it can also appoint a maximum of fifteen directors but after passing a special resolution.

No, there must be at least one director who is a resident in India, which the individual must have stayed in India for a total period of not less than one hundred and eighty-two days in the previous calendar year.

AOA refers to Articles of Association which defines the internal constitution, by-laws, rules and regulations of the company. In contrast, MOA stands for Memorandum of Association which represents the mission, vision and business goals of the company in the long run business.

Yes, an individual can use the residential address for Company registration and GST Registration.

No, you do not need to hire a full-time CA or CS as our team of experts can handle all the formalities required for annual compliance on your behalf.

DSC stands for Digital Signature Certificate, which is used by the directors for signing documents digitally. There is a Certifying Authority in India, which can issue DSC to directors.

Obtaining GST Registration is not mandatory for a private limited company until the annual turnover of the company reaches Rs 20 lakhs or Rs 10 lakh rupees in case of the north-eastern state. There are various other conditions relating to GST registration eligibility, and if a business falls under the ambit of any of these parameters, it needs to obtain GST registration in India.

Yes, you can apply for Start-up India Registration on the basis of your Private LTD Company Registration. We can also assist you with the process of registration on the Start-up India portal.

Yes, an individual is eligible to do multiple businesses with just one Private ltd Company Registration. However, to the business owner must mention the details of all the businesses in the MOA (Memorandum of Association) of the company while filing for registration.

If there is no employment contract, the person can become a director in a company even while working in some other country.

Yes, Angel Investors or Venture Capitalist Firms can make a foreign direct investment in a private limited company.

Yes, a Private limited company can easily be converted into a Limited Liability Partnership or One Person Company at any time by filing the appropriate forms together with the prescribed government authority.

The term Limited Liability means that the liability of the partners in a private limited company is limited up to the extent of the contribution made by them.