Cancellation or Surrender of NBFC Registration: A Complete Guide

Shivani Jain | Updated: Jan 07, 2021 | Category: NBFC

In India, NBFC or Non Banking Financial Company works at a crucial position as it not only offer loans and assistance to weaker sections but provides sound financial growth to the economy as well. Therefore, the only body having that have the authority to regulate and administer the working of NBFC in India is RBI (Reserve Bank of India). However, over the period of time, there has been a significant decrease in the number of NBFCs in India. The reason behind the same is either the cancellation or surrender of NBFC Registration.

In this blog we will discuss the concept of cancellation or surrender of NBFC Registration, together with its effects.

Table of Contents

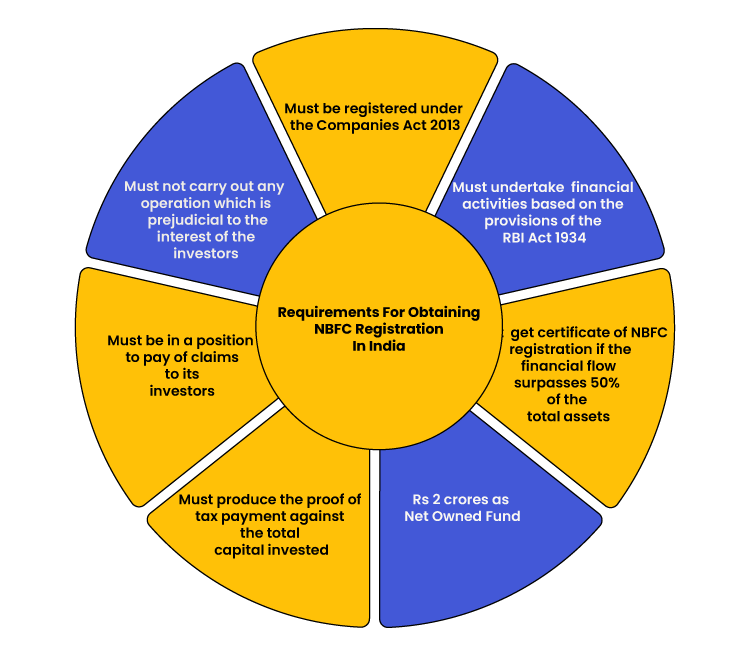

Requirements For Obtaining NBFC Registration In India

The key requirements for obtaining NBFC Registration in India are as follows:

- The company needs to be registered under the provisions of the Companies Act 2013;

- The company needs to undertake financial activities based on the provisions of the RBI Act 1934[1];

- Every business entity needs to get its certificate of NBFC registration in India if the financial flow of the business surpasses the limit of 50 percent of the total assets;

- An amount of Rs 2 crores is needed as NOF (Net Owned Fund) by the company;

- The Applicant Company needs to produce the proof of tax payment against the total capital invested in the NBFC;

- An NBFC must be in a position to pay of claims to its both present and future investors in full;

- It cannot carry out any operation which is prejudicial to the interest of the investors;

Can A Company Surrender of NBFC Registration?

Yes, a company or a business entity can surrender of NBFC Registration to the RBI in the situations as follows:

- On a Suo Motu basis;

- Faces Liquidity Crunch;

- Suffers NPA (Non-Performing Assets) Stress;

List Of Companies That Have Surrendered NBFC Registration

The companies that have surrendered their NBFC License to the Apex Bank are as follows:

- Reliance Net;

- NischayaFinvest Private Limited;

- Penrose MercantilesPrivate Ltd;

- Manohar Finance India Ltd;

- Chandelier Tracon Pvt Ltd;

- Sanghi Hire Purchase Ltd;

- M/s K & P Capital Services Private Ltd;

- M/s BFIL Finance Pvt Ltd;

- M/s Unique Pharmaceutical Laboratories Private Ltd;

- M/s RoopaSona Leasing Private Limited;

- M/s RBS Financial Services (India) Private Limited;

- M/s Sturdy Sales Private Limited;

- M/s Summit Inport Services Limited;

- M/s Paragon Securities Pvt. Ltd;

- M/s N. S. Hire Purchase Private Limited;

- M/s HRG Finance & Investment Consultants Private Limited;

- M/s Rajat Capital Market Private Limited;

- M/s Aashna Investments Private Limited;

- ShapoorjiPallonji Limited;

- Natwest Investments;

When Can RBI Cancel NBFC Registration?

As per section 45 – IA (6), the RBI or Reserve Bank of India can cancel NBFC Registration in the situations as follows:

- If an NBFC or Non Banking Financial Company ceases to carry out the operations specified under the RBI Act;

- In case an NBFC has failed to abide by the conditions and stipulations prescribed in the COR (Certificate of Registration);

- If in case an NBFC has failed to comply with the additional stipulations prescribed by the RBI at the time of issuing COR (Certificate of Registration);

- NBFC fails to satisfy the conditions specified with regard to the affairs and capital of the said company;

- NBFC fails to adhere to the directions issued by the Apex Bank;

- In case an NBFC has failed to maintain the book of accounts and records in accordance with the provisions of the RBI Act;

- If an NBFC has defaulted in submitting the books of accounts for inspection;

- If in case an NBFC has been restricted from accepting deposits based on the order passed by the Bank, and such an order has been in force for not less than 3 months;

NBFCs Whose Registration Have Been Cancelled by RBI

The NBFCs whose license or registration have been cancelled by RBI are as follows:

- Murat Viniyog Private Limited;

- Koneru Investments Private Limited;

- BP Capital Private Limited;

- Marudhar Lease Financing Limited;

- Khevana Investments Limited;

- Star Line Leasings Limited;

- Target Credit and Capital Private Limited;

- Vishwakarma Strips and Investments;

- PurohitFinlease Limited;

- Royal Moga Hire Purchase Private Limited;

- Oak Finalease Private Limited;

- Primus Capital Private Limited;

- Bharat Finance and Industries Limited;

- Signature Finance Private Limited;

- Dee Bee Leasing & Hire Purchase Private Ltd;

- Jindal Finlease Private Limited;

- B L S Investments Pvt Limited;

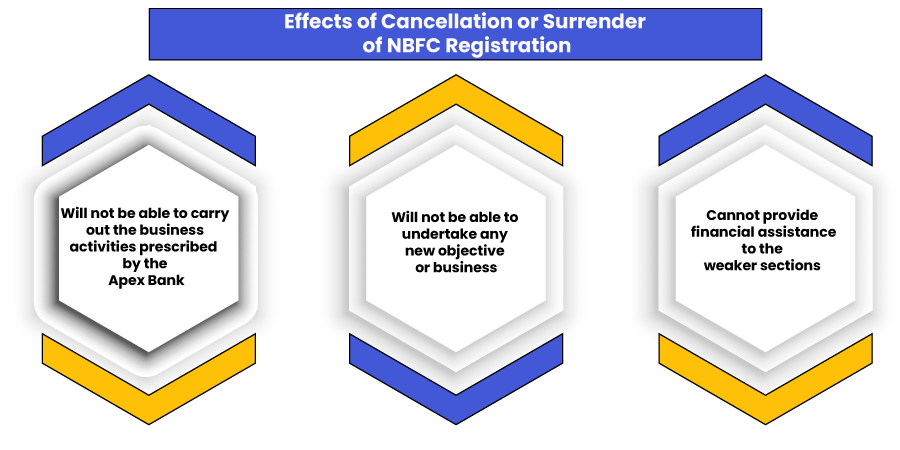

Effects of Cancellation or Surrender of NBFC Registration

The effects of cancellation or surrender of NBFC Registration can be summarised as:

- Will not be able to carry out the business activities prescribed by the Apex Bank;

- Will not be able to undertake any new objective or business;

- Cannot provide financial assistance to the weaker sections;

Conclusion

In a nutshell, Cancellation or Surrender of NBFC Registration, it is crystal clear from the above discussion that an NBFC or Non-Banking Financial Company acts as a backbone in offering finance to the business and weaker sections of the society.

Further, it shall be relevant to state that, at present, the Indian banking sector has been struggling hard with an extraordinary liquidity crunch due to various scams. Therefore, these corrupt and unethical effects have forced the Reserve Bank of India (RBI) and the Indian government to implement special measures in order to support the NBFCs and housing finance companies operating in India.

Also, Read: A Complete Overview of Regulations for NBFCs