Overview of Conversion of Private Limited to Public Limited Company

In the Indian Corporate Sector, a Private company enjoys every benefit which is available to a Public Company. However, when it plans to expand its business operation, it cannot issue debentures and shares to the public to raise capital. Therefore, the Conversion of Private Limited to Public Limited opens new opportunities, mainly in the form of market reach and fundraising.

The provisions of conversions are covered under the Companies Act, 2013 and Companies (Incorporation) Amendment Rules, 2020.

Concept of Private Limited Company

A Private Limited Company is a privately owned business entity. The liability of members under this business format is limited to the extent of shares held by them.

As per the Companies Act, 2013, a private company needs a minimum o f two and a maximum of 200 members. It requires a minimum of two and a maximum of fifteen directors to run its business operations. A foreign national is also eligible to become director of a Private Limited Company.

After the introduction of the Companies (Amendment) Act, 2015, the requirement to have Rs 1, 00,000 as minimum paid-up capital for private limited companies has been removed.

Concept of Public Limited Company

A Public Limited Company is a joint-stock company regulated by the provisions of the Companies Act, 2013. This business format has the benefit of limited liability and can issue shares to the public.

A minimum of seven members are required to start a Public Limited Company. However, there is no upper limit for the maximum number of members.

After incorporation, a public company needs to add either “public limited company” or “PLC” as a suffix in its name.

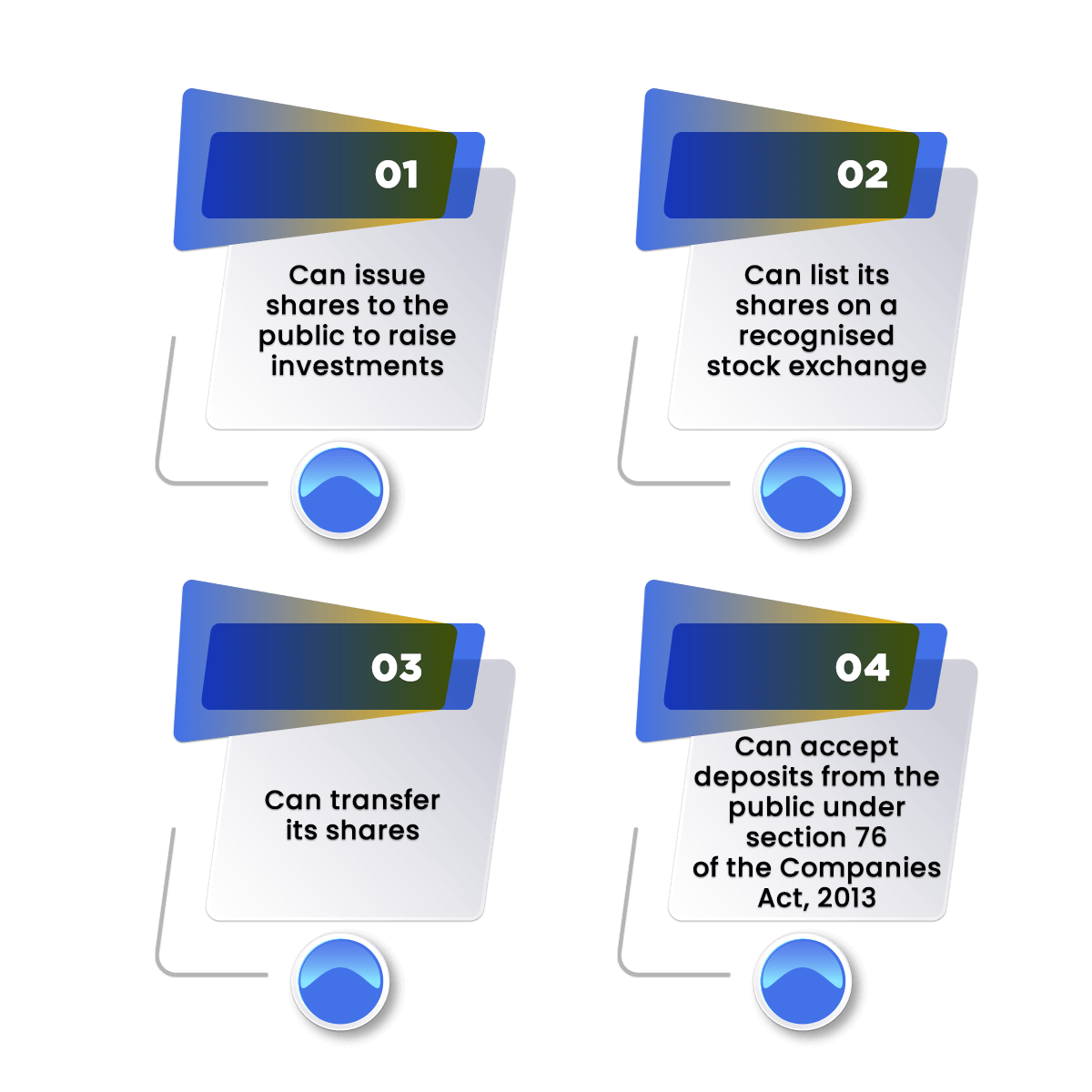

Benefits of Conversion of Private Limited to Public Limited

In India, the benefits of conversion of Private Limited to Public Limited are as follows:

- A Public Company can issue shares to the public to raise investments;

- A Public Company can list its shares on a recognised stock exchange. It means that more people will get information about its functions, thereby increasing brand recognition.

- A Public limited company can transfer its shares in comparison to a private limited company. It means that a shareholder is not bound to be with the company forever and can easily sell shares for a profit.

- A Public Company can accept deposits from the public under section 76 of the Companies Act, 2013.

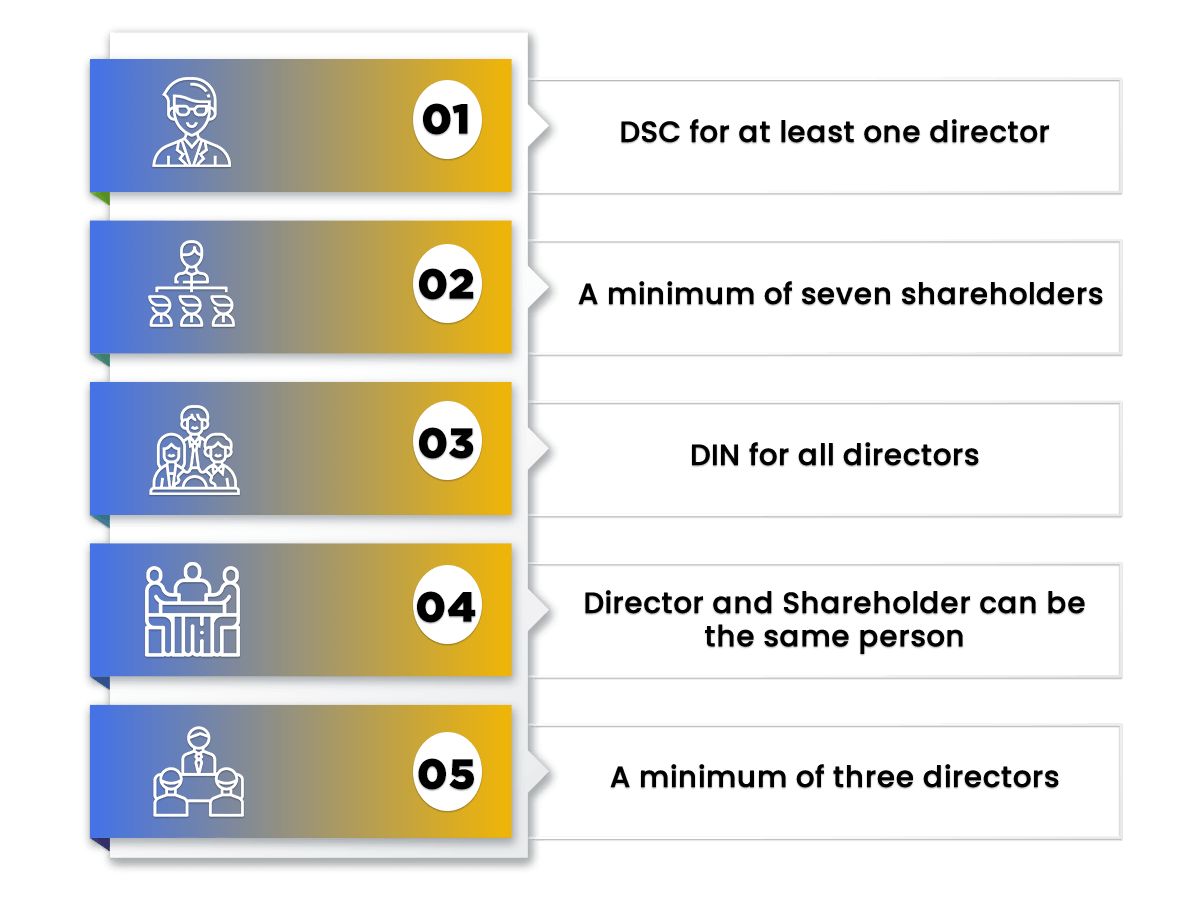

Minimum Requirements for Conversion of Private Company to Public Company

The minimum requirements for conversion of private company to public company are as follows:

- DSC (Digital Signature Certificate) for at least one director;

- A minimum of seven shareholders;

- DIN (Director Identification Number) for all directors;

- Director and Shareholder can be the same person;

- A minimum of three directors.

Documents Required for Conversion of Private Company to Public Company

The documents required for conversion of Private Company to Public Company can be summarised as:

- PAN Card details of the Shareholders and Directors;

- A copy of Passport of the Foreign Nationals;

- A copy of Voter ID/ Driving License/ Passport of Shareholders and Directors;

- Address Proof in the form of Telephone Bill/ Electricity Bill of Shareholders and Directors;

- Latest Passport-sized photograph of Shareholders and Directors;

- Utility Bill in the form of Electricity Bill/ Telephone Bill/ Water Bill of the registered office;

- No-Objection Certificate from the owner of the premise used as Registered office;

- Rent Agreement or Lease Deed of the registered office;

- In the case of Foreign National, all the documents of the director(s) must be duly notarised;

- A copy of the Company’s Incorporation Certificate;

- A copy of the company’s MOA (Memorandum of Association) and AOA (Articles of Association);

- Copies of the latest audited Financial Statements;

- A copy of the ITR (Income Tax Return) filed by the company.

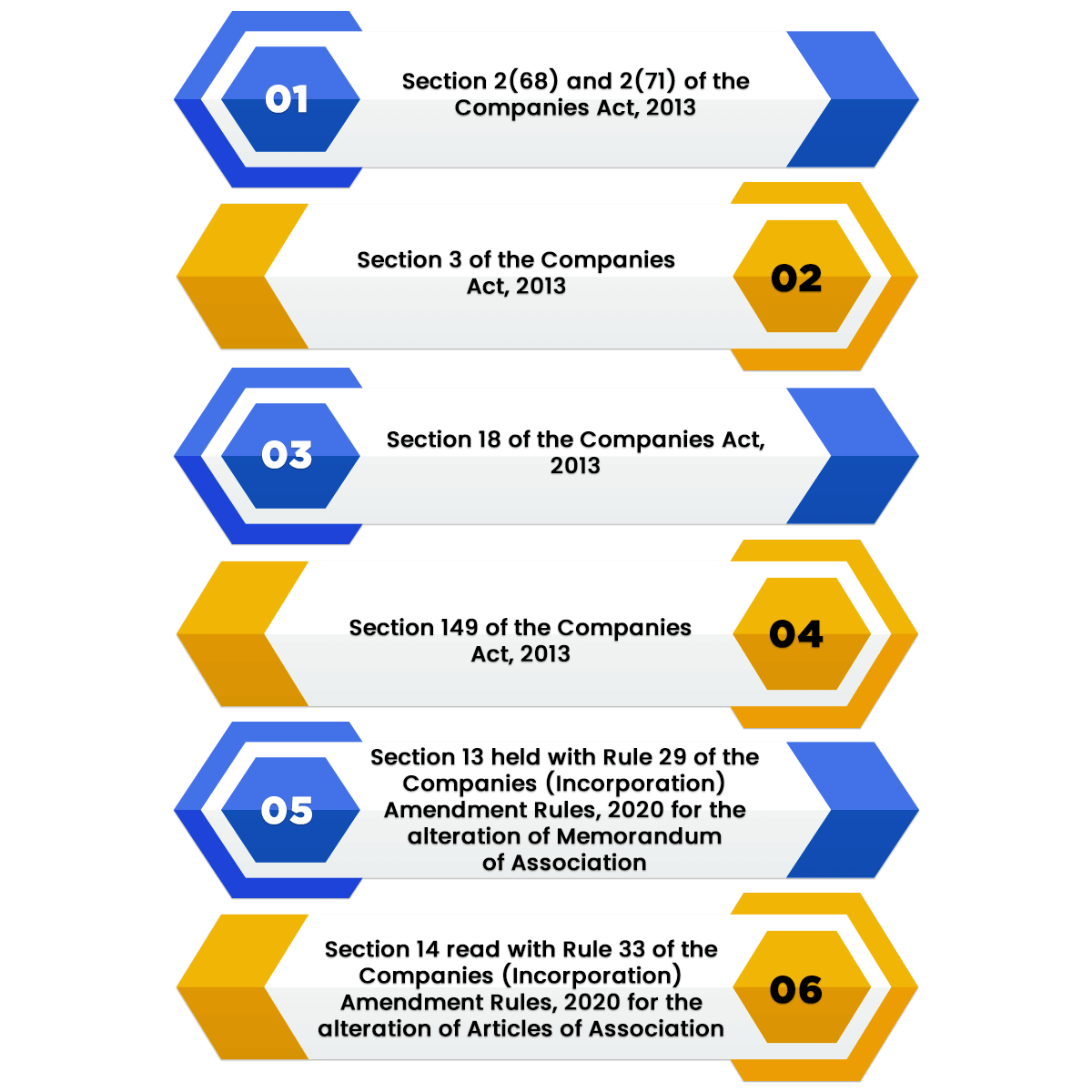

Regulatory Framework for Conversion of Private Company to Public Company

In India, the legal provisions governing the process of conversion are as follows:

- Section 2(68) and 2(71) of the Companies Act, 2013;

- Section 3 of the Companies Act, 2013;

- Section 18 of the Companies Act, 2013;

- Section 149 of the Companies Act, 2013;

- Section 13 held with Rule 29 of the Companies (Incorporation) Amendment Rules, 2020 for the alteration of Memorandum of Association;

- Section 14 read with Rule 33 of the Companies (Incorporation) Amendment Rules, 2020 for the alteration of Articles of Association;

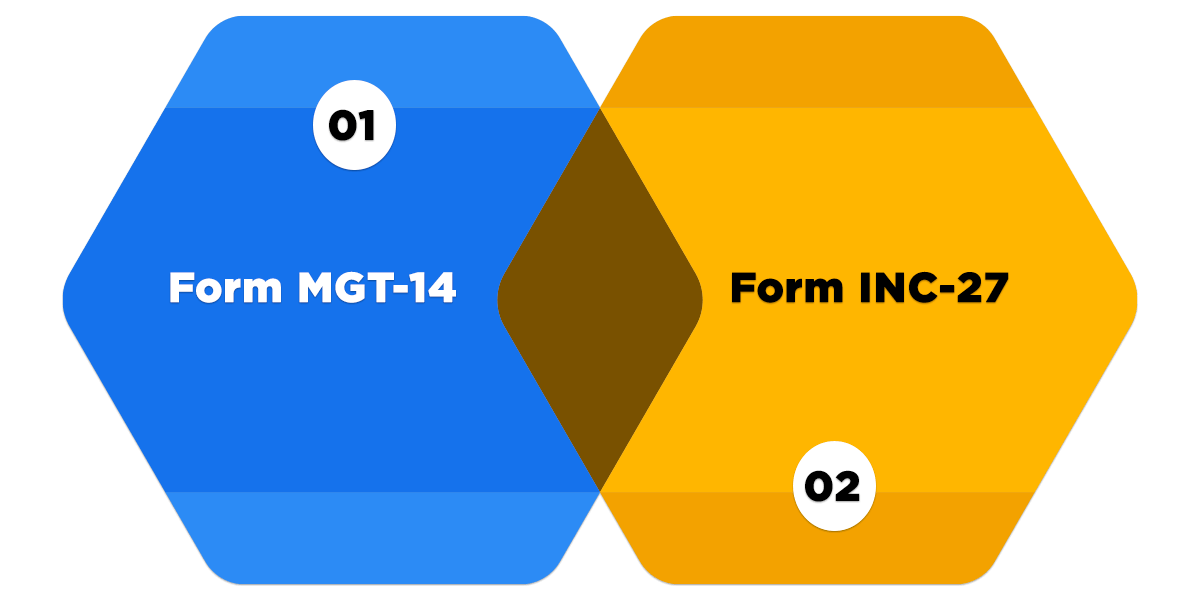

Forms for the Process of Conversion of Private Company to Public Company

In India, the forms required for the process of conversion of Private Company to Public Company can be summarised as:

|

S.no |

Form No |

Filing Time |

Attachments |

|

1 |

Form MGT-14 |

Within Thirty Days of passing Special Resolution. |

|

|

2 |

Form INC-27 |

Within Fifteen Days of passing Special Resolution. |

|

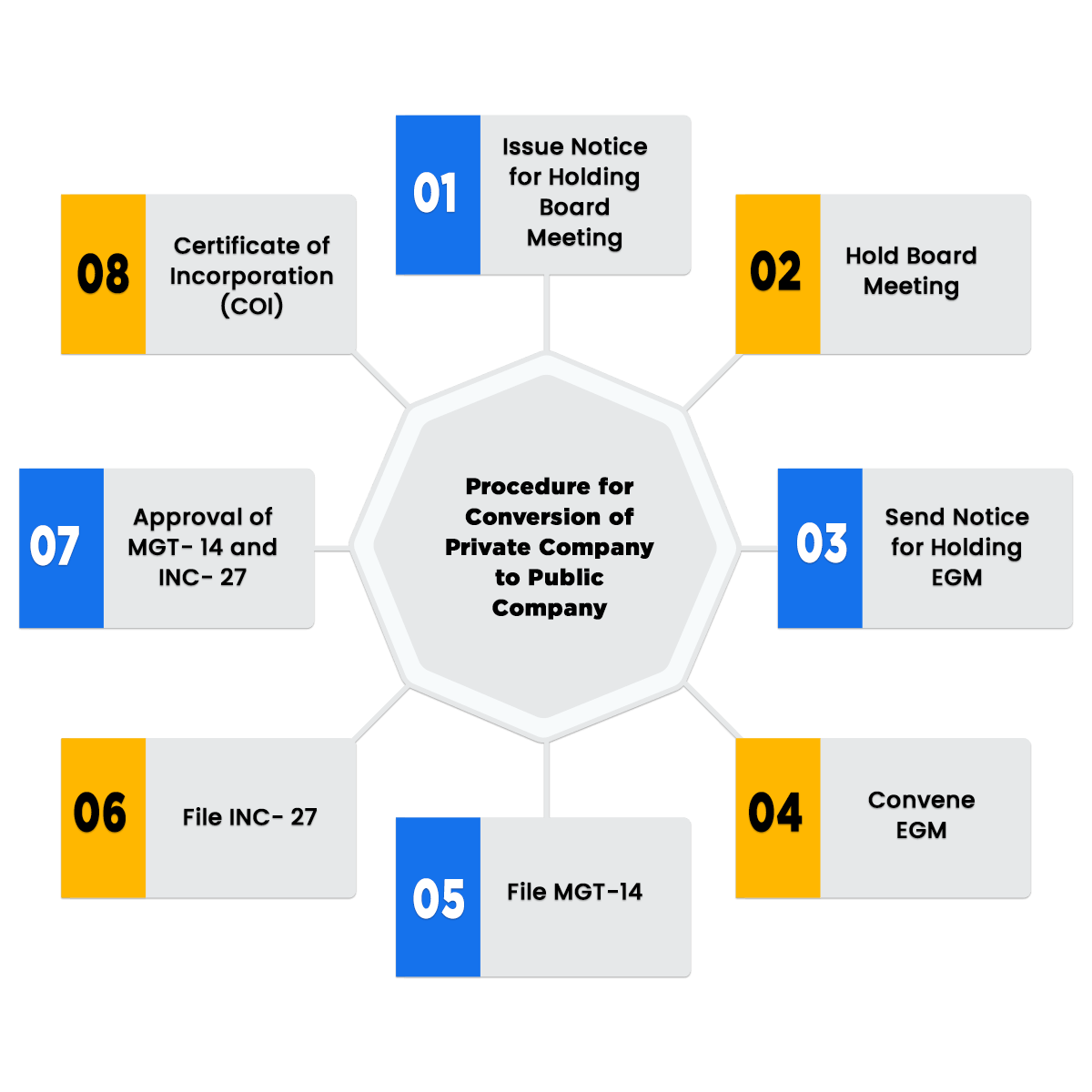

Procedure for Conversion of Private Company to Public Company

The steps involved in the procedure of conversion of Private Company to Public Company are as follows:

- Issue Notice for Holding Board Meeting

The directors of a Private Limited Company need to send a notice for holding BM (Board Meeting). The notice must be sent at least seven days before the date of BM. It must also contain the proposed agenda of the meeting. The items included the proposed agenda are as follows:

- To Pass Board Resolution for Conversion;

- Fix time, date, place, and day of the Extraordinary General Meeting (EGM);

- Approval of the notice for calling EGM together with the Explanatory Statements

- Hold Board Meeting

In the BM, the directors of the company must approve the following items:

- To approve the Conversion of Private Company to Public Company;

- Finalise the list of Creditors;

- Approve the draft of MOA (Memorandum of Association);

- Approve the draft of AOA (Article of Association);

- Fix time, date, and venue for holding EGM (Extraordinary General Meeting)

- Send Notice for Holding EGM

The directors need to send a notice for the EGM at least twenty-one days before the date of the EGM.

- Convene EGM

A Special Resolution (SR) for authorising the conversion of private company to public company should be passed in the EGM. Shareholders also need to approve the draft of the new AOA and MOA in the meeting.

- File MGT-14

After passing the SR, Directors need to file form MGT- 14 with the Registrar of Companies (ROC) within thirty days from the date of the EGM.

- File INC- 27

Directors also need to file INC- 27 with the ROC within fifteen days from the date of EGM.

- Approval of MGT- 14 and INC- 27

The Registrar of Company (ROC) needs to approve the form filed if he/she is satisfied that the Private Company fulfills all the requirements.

- Certificate of Incorporation (COI)

ROC will issue a COI after the approval of MGT- 14 and INC- 27.

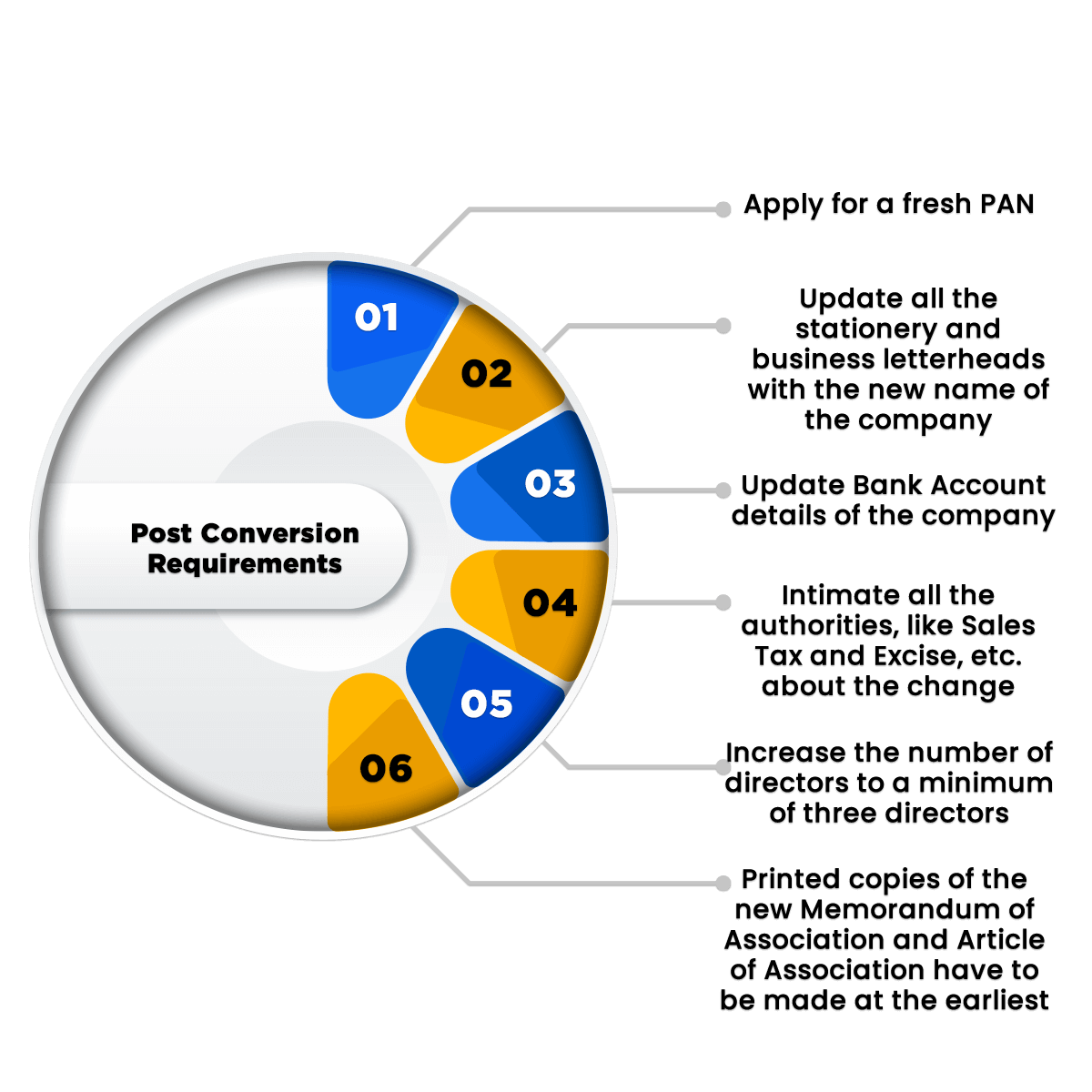

Post Conversion Requirements

The Post Conversion Requirements are as follows:

- Apply for a fresh PAN (Permanent Account Number) Card;

- Update all the stationery and business letterheads with the new name of the company;

- Update Bank Account details of the company;

- Intimate all the authorities, like Sales Tax and Excise, etc. about the change;

- Increase the number of directors to a minimum of three directors;

- Printed copies of the new Memorandum of Association and Article of Association have to be made at the earliest.

Difference between Private Company and Public Company

|

Basis for Comparison |

Public Company |

Private Company |

|

Meaning |

Public Limited Company is owned and traded openly on the recognised stock exchange. |

A Private Limited Company is owned and traded privately. |

|

Use of Suffix |

“Limited” needs to be used as a suffix after the name of a public company. (Example- BCD Limited) |

“Private Limited” needs to be used after the name of a Private Company. (Example- BCD Private Limited). |

|

Minimum Members |

Minimum seven members are needed to form a public limited company. |

Minimum two members are needed to form a private limited company. |

|

Maximum Members |

No Maximum Limit |

The maximum limit of the members in a private limited company is 200. |

|

Minimum Directors |

At least three directors are needed in a public limited company. |

At least two directors are needed in a private limited company. |

|

Start of Business |

Certificate of Incorporation (COI) and Commencement of Business (COB) is needed to start the business. |

Only Certification of Incorporation (COI) is needed to start the business. |

|

Public Subscription of Shares |

Public subscription of shares is allowed in public limited companies. |

Public subscription of shares is not allowed in private limited companies. |

|

Quorum at AGM (Annual General Meeting) |

Five members must be present personally at AGM. |

Two members must be present personally at AGM. |

|

Statutory Meeting |

Holding a statutory meeting is compulsory in Public Companies. |

Holding a statutory meeting is optional in Public Companies. |

|

Issue of Prospectus |

It is mandatory to issue a prospectus in Public Company. |

It is not mandatory to issue a Private Company. |

|

Shares Transferability |

Shares can be transferred freely in public limited companies. |

Shares are not allowed to be transferred in private companies. |

|

Managerial Remuneration |

There is no restriction imposed on Managerial Remuneration. |

Managerial Remuneration cannot exceed 11% of the Net Profits. |

|

Disclosure of Financial Report |

A public limited company needs to disclose its financial reports on a quarterly and annual basis. |

There is no such obligation on a private limited company to disclose their financial reports to the normal public. |

|

Funding |

A Public Limited Company can raise funds by issuing IPOs (Initial Public Offer) in the general public. |

A Private Limited Company can only raise funds through Private Investors. |

Frequently Asked Questions

Yes, it is compulsory to change the suffix from “Private Limited” to “Limited”.

No, unlike a Private Limited Company, there is no restriction imposed on the Managerial Remuneration in a Public Limited Company.

Yes, it is mandatory to have at least 3 directors for a Public Limited Company.

The key requirements are DSC for at least one director, minimum 7 shareholders, DIN for all directors, minimum 3 directors, and both Director and Shareholder can be the same person.

Any individual or organization, including foreigners and NRI, is eligible to become a member of a public company.

The benefits of the process of conversion are that the company can issue shares to the public to raise investments, can list its shares on a recognised stock exchange, can transfer shares, and can accept deposits from the public under section 76 of the Companies Act 2013.

No, there is no need to obtain a new GST Registration. However, changes and modifications can be made in the existing records.

The legal provisions involved in the process are Section 2(68) and 2(71) of the Companies Act 2013, Section 3 of the Companies Act 2013, Section 149 of the Companies Act 2013, Section 13 held with Rule 29 of the Companies (Incorporation) Amendment Rules 2020, and Section 14 read with Rule 33 of the Companies (Incorporation) Amendment Rules 2020.

A minimum of 20 to 25 business days are needed for the conversion of a private company to a public company.

The steps involved in the process are Issue Notice for Holding Board Meeting, Hold Board Meeting, Send Notice for Holding EGM, Convene EGM, File MGT-14, File INC- 27, Approval of MGT- 14 and INC- 27, and Certificate of Incorporation.

A Public Company can start running its business affairs after receiving COI (Certification of Incorporation) from the Registrar of Companies (ROC).

Shareholders are the owners of a public company. However, they appoint directors to run the business operations of the company.

The forms required for the process of conversion are Form MGT 14 and Form INC 27.

The post conversion requirements for a Public Company are Apply for a fresh PAN, Update all the stationery and business letterheads, Inform all the Authorities, Increase the number of Directors, ad Print the copies of new MOA and AOA.

No, there is no need to make any other payment. Our team will send you an all-inclusive invoice, with no hidden cost.

As per Companies (Amendment) Act, 2015, the requirement to have Rs 1, 00,000 as minimum paid-up capital for public limited companies has been removed.

No, conversion of one company to another is an online process. There is no need for you to be present at our office as all documents are filed electronically. You just need to send us the scanned copies of all the required documents and forms.