An Overview of Shop and Establishment License

Nowadays, in India, most businesses, such as the shops, restaurants, cafes, eateries, etc., are regulated and governed by the Shop and Establishment Act provisions and hence, are mandatorily required to obtain Shop and Establishment License. However, it shall be pertinent to take into consideration that State regulates it and the rules & regulations vary from one State to another. Further, this Act aims at providing proper and adequate working conditions to the labourers employed and also taking care of their wages, holidays, and many essential rights.

A Shop Establishment Certificate is required when an entity or a business starts employing people as full-time employees, casual workers, contract-based, etc., to regulate and administer the working conditions and also to ensure that their rights are protected. Moreover, it is also known as the Shop License informally. Hence, the phrase "Shop and Establishment License" refers to a Certificate or License issued to the business, professions, and trade registered under the provisions of the Shop and Establishment Act. Further, it is noteworthy to note that all the rules and regulations of this Act are governed and administered by the Department of Labour.

Furthermore, this Department not only regulates the commercial establishments but also keeps an eye on the working of the charitable trusts, educational institutions, societies, and other premises like the insurance companies, banking, stock exchanges, share brokerages, etc.

Objectives of the Shop and Establishment Act

The following listed are the objectives of the Shop and Establishment Act:

- The main aim of the Shop and Establishment Act is to protect the rights and provide benefits to employees working in organized sectosr such as hotels, establishments, and restaurants along with the unorganized sectors.

- Additionally, the Shop and Establishment License aims at regulating and administering the day-to-day employees' treatment and also sets better standards for employment.

Benefits of Shop and Establishment License

The benefits of the Shop and Establishment License are mentioned below:

- It provides legal acknowledgement to the particular shop or establishment.

- It acts as an essential Registration for further registrations.

- This License acts as business proof. Hence, it helps in obtaining additional registrations in India.

- Further, shops cannot open a bank account without a Shop and Establishment License. Hence a Shop and Establishment License is mandatory for opening a bank account in the name of a shop or establishment.

- Shop License helps in raising investments by way of Venture Capitals or Loans for the proposed business establishment.

Who can apply for Shop and Establishment License in India?

- Wholesalers or the Retailers’ shops and establishments.

- Service Centres.

- Store-rooms, Warehouses, and Godowns.

- Also, any other working places.

- Hotels,

- Restaurants and Eateries.

- Theatres, Amusement Parks, Entertainment, etc.

Documents Required for Shop and Establishment License

The vital documents needed for obtaining Shop and Establishment License are as follows:

- Identity proof such as Aadhar Card, PAN Card, Driving License, Voter ID.

- Employer’s latest passport-sized photograph.

- Photo of the Establishment or Shop along with the employer.

- Copy of Rent Agreement, in the case of the rented premise or property.

- Any utility bill of the working premises such as electricity bills, water bills, mobile bills, etc. However, the said utility bills should not be 2 months older.

Other vital documents required as per the concerned business/establishment:

- In the case of a Trust, a list of the number of Trustees.

- MoA (Memorandum of Association).

- For a Co-operative Society, a list of a number of Members and Chairman is required.

- Partnership deed with all the crucial information regarding the firm's name, name & signature of all the partners, along with the share % of each partner.

- A copy of the permission issued by RBI (Reserve Bank of India).

- A copy of the COI (Certificate of Incorporation) issued under the Companies Act, 2013.

- A Resolution regarding the commencement of the society's business.

- RTO Transportation Permit.

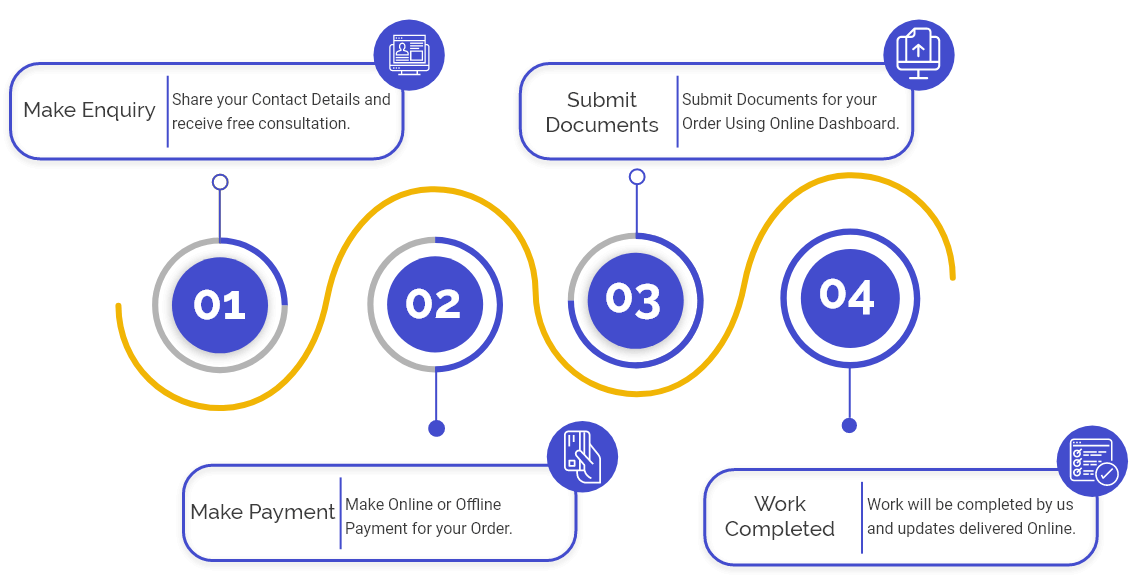

Online Procedure for Shop and Establishment License

The online procedure for obtaining a Shop and Establishment License is discussed below

Step 1: Visit the Official Website: First of all, the applicant needs to visit the official website of the labour department of the respective State where you want to set up a shop or establishment

Step 2: File the Application: Then the applicant need to fill out the application form correctly with details regarding your business and details differ depending on the State & type of company.

Step 3: Upload Documents: After completing the form successfully, upload the vital documents online. In some states, physical submission of documents & a printout of the application form is required.

Step 4: Fee Payment: The fee depends on the type of License and company. Many states have an online payment option.

Step 5: Inspection: The labour department verifies your application and if they believe an inspection of your business premises is required to verify the particular you filled & documents attached, an inspector might be appointed to carry out an inspection and in the majority of cases, inspection is not required.

Step 6: Approval & Issuance of License: Once all the above steps are completed, the authorities will issue a valid Shop and Establishment License (the License is valid for 1 year with renewal every year).

Note: However, the process of getting registration might take around 15 to 20 working days in the major cities in India. However, the same may vary from one State to another.

Key Points to be considered while obtaining a Shop and Establishment License

The things that must be taken into consideration while applying for the Shop and Establishment Registration are as follows:

- The Inspector appointed can visit the registered premises for verification.

- The business owner is required to display the Shop and Establishment Registration certificate at a place easily accessible on the premises.

- The License issued must be timely renewed prior to its expiry date.

- If in case the Owner wants to close his establishment, then he needs to notify the Inspector in writing about the closure within 15 days of the closing.

- Despite the Shop and Establishment License, the Owner of the proposed business is also required to obtain prior approval from the respective state Department of Labour for the commencement of the business activities in that State.

What are the Key Aspects Governed by the Shop and Establishment Act?

There are various provisions prescribed by the Shop and Establishment Act, which regulate the key or critical aspects concerning the working of establishments and shops in India.

The key aspects that are regulated by the Shop and Establishment Act are:

- Maximum Working Hours for the labours and employees.

- Permissible time durations for having meals and rest.

- Regulating Laws to forbid child labour in factories.

- Women Employment.

- The number of compulsory weekly holidays offered to the employees.

- Close or off days of the said establishments and shops.

- Opening and closing time of the establishments or shops.

- Wages are given to employees for the Holidays.

- Accidents Coverage Policies.

- Preventive Measures against Fire.

- Proper Lighting and Ventilation for workers.

- Clean, hygienic, and sterile premises for the workers.

- Conditions, provisions and timing for the payment calculation.

- Regulations regarding payment deductions.

- Leave Policy.

- Dismissal

- Proper maintenance of records containing employee details.

Note: More information concerning the Shop and Establishment Act can be collected from the relative state government portal.

FAQs of Shop and Establishment License

The documents and records that are mandatory to be maintained under the Shop and Establishment Act include Employment Register, Details of the Fine imposed, Advances Issued, Salary Details, Salary Deduction Details, and Holiday’s awarded.

As per the provisions of the Shop and Establishment Act, the term “Commercial Establishment” denotes commercial sector such as banking, insurance, and trading establishments; hotels, eateries, cafes, and refreshment houses; establishments wherein employees either do office work or provide service; and amusement and entertainment places such as cinema halls, theatres or amusement parks.

Yes, every business registered under the provisions of the Shop and Establishment Act needs to take prior approval from the labour department before commencing its business affairs and operations.

An individual whose business is registered under the provisions of the Shop and Establishment Act needs to submit all the files and information concerning the annual holidays and the number of Employees to the Municipal Corporation Office every year.

Yes, every business, shop, and establishment needs to obtain registration under the Shop and Establishment Act within a period of 30 days from the date of commencement of operations.

The benefits of hiring Swarit Advisors includes 100% in-house services, experienced professionals, free legal consultation during the inquiry, regular updates about the registration on calls and emails.

The primary objective of this act is to provide uniform privileges and benefits for all employees working in different establishments, shops, commercial places, residential hotels, restaurants, theatres, etc.

A Shop and Establishment License remains valid for a period of one year, and the same is eligible to get renewed every year. Further, the rules and regulations regarding the issuance and renewal of licenses vary from one state to another.

No, a factory is not covered under the provisions of the Shop and Establishment Act.

Yes, it is mandatory for almost all the shops and establishments to obtain a shop and establishment license under the respective state shop and establishment act.

Yes, every business and shop irrespective of the number of employees working is required to obtain Shop and Establishment License under the Act.

Yes, it is Mandatory for the shops or Establishment to obtain registration under the Shop and Establishment Act.

Within a period of 30 days from the date of commencement, a shop and establishment is needed to get it registered under the provisions of Shop and Establishment Act.

The term establishment comprises of hotels, restaurants, theatres, and other amusement parks, whereas a factory is a place that has been founded by a company explicitly to manufacture and produce goods sold by that company. Further, an establishment may not necessarily be considered as a factory. However, a factory can be considered as an establishment.

The basic difference as per the provisions of the Shop and Establishment Act is that the term “establishment” comprises of hotels, theatres, restaurants, and other amusement parks. In contrast, a shop is a premise where you can sell goods and offer services to your customers. For example: storerooms, offices, or warehouses.

The penalties imposed for not obtaining a Shop License vary from State to State.

Yes, at Swarit Advisors the processing of the application for the shop and establishment act registration is done online. You only have to provide your personal information, and we ensure that the services are catered to 100% online with speedy online registration and filings.

Starting your business without a Shop and Establishment License is very dangerous and risky as there are chances that regulatory authorities might seal and close your business. Moreover, there are high chances that you will either be levied hefty fines and penalties or even face litigation if found operating without a license.

Yes, a Retail License is the same as Shop and Business License. All three licenses have the same functions and regulatory authorities.

Yes, an individual can open a current bank account with the help of a shop and establishment certificate. Moreover, every bank considered this certificate as valid documentary proof.

The owner of the business or shop needs to file an application to the authorities for the winding up or closure of business.

The shop and establishment license certificate acts as documentary proof for the shop and establishment. Moreover, it assists in opening a Current Bank Account as well.

Yes, Swarit Advisors is an online platform rendering services all over India regardless of wherever you are operating your business. All you require is a proper internet connection on your desktop or mobile, and we are all set to get your registration done.

No, there is no need for you to be physically present at our office to obtain Shop and Establishment License as the entire license process is online based. All you need to submit the necessary documents as required in the portal.

Yes, the registration certificate issued under this act is liable to be renewed.

Yes, the Shop and Establishment License is a State Act, and hence, each state has made its own rules and regulations for the Act.