An Overview of Nidhi Company Registration

Nowadays, Nidhi Company has evolved as a popular lending mechanism for obtaining secured loans. It’s a type of lending company and it is formed to borrow and lend money to its members. These companies are most predominant in the Southern Parts of India. Further, Section 406 of the Companies Act, 2013, deals with the process of Nidhi Company Registration. No license is required from the RBI (Reserve Bank of India) to register a Nidhi Company in India. Therefore, forming a Nidhi Company is easy and Nidhi Companies in India are registered as Public Companies and must have Nidhi Limited at the end of their name.

Furthermore, the primary reason behind incorporating this business structure is to encourage and motivate its members to save so that they can smoothly satisfy their financial needs arising from time to time. Hence, this Company is based on the principle of Mutual Benefits. Also, remember that the Nidhi Companies fall under the purview of the RBI, as the function of Nidhi Companies is similar to NBFCs.

Advantages of Nidhi Company Registration in India

Following are the advantages of Nidhi Company Registration in India:

- No External Involvement in the Company’s Management;

- Easy to lend money to or raise capital or borrowings from group members;

- Easy to manage;

- Low capital requirement;

- Relaxation in the number of compliances;

- Cost-efficient Registration;

- Many privileges and exemptions are provided under the provisions of the Companies Act, 2013;

- The Minimal involvement of RBI;

- Secured investment with a lower rate of interest;

- Low level of risk;

- Better savings option;

- Fulfilling the financial requirements of the lower and middle-income groups;

- Easy access to public funds;

- Limited liability.

Pre-Registration Requirements for Nidhi Company

The Pre-requirements for Incorporating a Nidhi Company are as follows:

- A minimum of 7 members are required;

- A minimum of 3 directors are required

- No preference shares are allowed to issue;

- The minimum capital requirement is Rs. 5 lakhs;

- The Company's name must include "Nidhi Limited” at the end;

Documents Required for Nidhi Company Registration

Following are some vital documents required for Nidhi Company Registration in India:

- Latest passport-sized photographs;

- NOC (No Objection Certificate) (signed by the owner or landlord);

- DIN (Director Identification Number) & DSC (Digital Signature Certificate) of directors;

- MoA (memorandum of Association) and AoA (Articles of Association) is required;

- PAN Card;

- For Address Proof:

- Driving License;

- Latest Ban Statement;

- Residence Card;

- Or any other Government-issued ID having a valid address.

- Residential Proof:

- Telephone bill;

- Electricity bill;

- Bank Statement;

- Mobile Bill.

- A passport is also mandatory for the companies whose director is a Foreign National and this document is not mandatory for Indian directors of Nidhi Companies;

- Registered Office proof for Nidhi Company Registration.

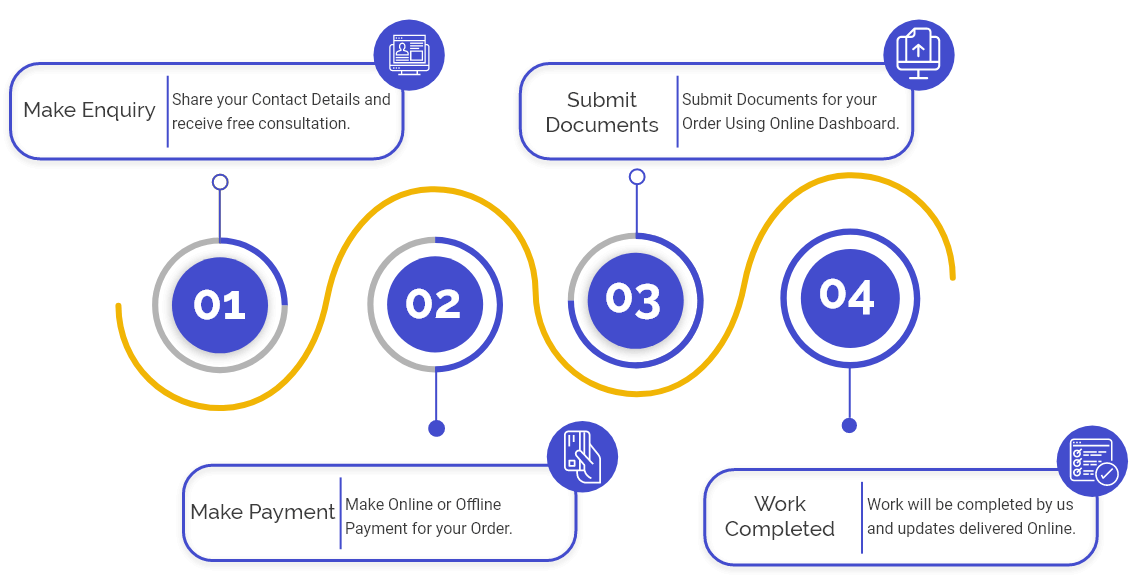

Procedure for Nidhi Company Registration

The steps involved in the procedure for obtaining Nidhi Company registration are as follows:

Step 1: Obtain DSC and DIN

The First and foremost step for all the Directors is to obtain a DIN (Director Identification Number) and DSC (Digital Signature Certificate).

Step 2: Apply for a Name Approval

Now, in the second step, the shareholders or the Directors are required to apply for a name approval by suggesting three names to the MCA (Ministry of Corporate Affairs). Further, out of all the names suggested, the MCA will choose one name for the said Company. Furthermore, it shall be considered that all the names suggested must be unique and not similar to an already existing company's name. Moreover, according to rule 8 of the Companies Act, 2013, the approved name will remain valid only for 20 days.

Step 3: Drafting of MOA and AOA

After completing the name approval process, the directors need to submit the Application for Registration in the form INC- 32, together with the Articles of Association (AOA) and Memorandum of Association (MOA), respectively. Further, it is significant to consider that the documents must state the objective behind incorporating a Nidhi Company.

Step 4: Certificate of Incorporation

Usually, it takes about 15-25 days to get the Certification of Incorporation of a Nidhi Company. Further, this certificate acts as a piece of evidence or proof that the said Company has been incorporated. Furthermore, this certificate also mentions the Company's CIN (Company Identification Number).

Step 5: Opening a Bank Account and Applying for TAN and PAN

In last, the directors need to apply for PAN (Permanent Account Number) and TAN (Tax Deduction Account Number). Further, shareholders or the company members are also required to get a bank account opened just by submitting the Certificate of Incorporation and the copies of MoA, AoA, and the allotted PAN details to the bank.

Post-Registration Requirements for Nidhi Company

The Post requirements for Nidhi Company within 120 days of incorporation are as follows:

- A minimum of 200 members are required;

- A minimum paid-up capital of Rs. 10 lakhs;

- NOF (Net Owned Funs) to maintain Rs. 20 lakhs or more;

- Filing of NDH-4 Application Form (by Public Companies) within 120days of incorporation;

- The ratio between NOFs and Deposits cannot be more than 1:20 for any companies to register for Nidhi Company and a ratio more than this is not accepted for a Nidhi Company Registration;

- A company which wants to get Nidhi Company Registration must have a minimum of 10% unencumbered term deposits of the outstanding deposits. Term deposits of more than 10% are acceptable, but less than 10% are not considered for the Registration.

Compliances for Nidhi Company Registration

|

Form |

Compliance |

Due Date |

|

Form NDH-1 |

(Return of Statutory Compliance) – These forms contain all the information regarding deposits, reserves, members, loans, etc., for full financial years. E-Form GNL-2 for the submission of the documents with the Registrar |

Within the 90 days from the closure of the Financial Year, along with fees. |

|

Form NDH-2 |

This Form is for the extension of time and this Form is filed if: · The Company fails to add at least 200 members within 120 days of incorporation. · Failure to maintain the NOF to deposit ratio of 1:20.

|

This Form must be filed with the Regional Director within 90 days from the closure of the financial year, along with the prescribed fees. |

|

Form NDH-3 |

This Form is used for Half-yearly returns and it should be filed with the Registrar of Companies. |

This Form should be filed within 30 days from the conclusion of the half-year. |

|

Form NDH-4 |

This Application is for the declaration as Nidhi Company |

For a New Nidhi Company: Within the duration of 60 days post expiration of 1 year from the date of incorporation. For Existing Nidhi Company: Within a time of 120 days from the commencement dates as per the Rules 2022. |

|

NDH-5 |

This Form is the format of advertisement to be given while closing branch. |

A Nidhi Company in India shall not close any branch unless it: · Publishes an advertisement in vernacular language in the place where it conducts business at least 30 days prior to such closure. · A copy of such advertisement or notice informing such closure of the branch on the notice board of Nidhi for a period of at least 30 days from the date on which the ad was published under clauses (a) & (c) gives an intimation to the Registrar within 30 days of such closure. |

|

AOC-4 |

Filing of Financial Statements |

Within 30 days from the date of the Company's AGM. |

|

MGT-7 |

Annual return along with a list of all the members serving the Company |

Within 60 days of the AGM. |

|

ITR-6 |

Income Tax Return |

By 30th September |

Event-Based Compliances of a Nidhi Company

Following are some critical Event-Based Compliances of a Nidhi Company that should be followed when there is any change in the Nidhi Company's structure which are non-periodical:

- Any change in the Company's name;

- Removal of Director or Resignation/Appointment of a Director;

- Transfer of Share;

- Appointment of the KMP (Key Managerial Personnel);

- Increased the authorised capital of the Company;

- Removal of Auditor or Resignation/Appointment of an Auditor;

- Any changes in the Company's objective;

- Change in Registered Office Address;

- Any other changes that are event-based.

New Nidhi (Amendment) Rules, 2022 – Major Changes

Following is the list of significant amendments made under the Nidhi (Amendment) Rules, 2022:

- Meaning of a Branch: As per this Rule, a Branch means a place or location other than the registered office of Nidhi Company.

- Deposit Raised by the Nidhi Company: No company shall raise the deposit or give a loan to any of its members if:

- It doesn’t follow the new Nidhi Company Rules, 2022;

- If the Central Government has refused the Application in Form NDH-4.

- Declaration of Nidhi Company for any Public Company: Any public company that wants to register as a Nidhi Company shall apply through the NDH-4 Form within 120 days from the date of Nidhi Company Registration, after fulfilling the following conditions:

- It has not less than 200 members;

- It has NOFs of Rs. 20 lakhs or more.

After checking the Application, the Central Government conveys its decision within 45 days to the Company and if it fails to do so, then it will be considered to be approved. When the Central Government satisfies that the Company meets all the requirements, it will notify it as Nidhi Company/Mutual Benefit Society in the Official Gazette. However, the Company shall start its business only if the Central Government approves its Application.

- Fulfilment of Fit & Proper Person: The Company must attach a declaration regarding the fulfilment of fit & proper person by all of its Promoters & Directors with Form NDH-4. Following are the criteria to determine that any Director or Promoter is a fit & proper person:

- Ethical behaviour, honesty, character, and integrity of the person;

- Not incurring any of the disqualifications such as charge sheet filed against him in any economic offences, any complaint under Section 154 of CrPC has been filed or is pending, Prohibition, restraining or department order has been passed against the persons in any matter regarding the company law, securities law/financial market in force, unsound mind, Director of 5 or more companies or Promoter in 3 or more than 3 Nidhi Companies, and so on.

- Minimum Paid-up Capital: Previously, the minimum paid-up capital was Rs. 5 lakhs, but in the new amendment rules, it has been raised to Rs. 10 lakhs.

- Rules for Existing Nidhi Company: Existing Nidhi Company, on the date of enforcement of New Nidhi (Amendment) Rules, 2022, shall follow all the requirements within a period of 18 months from the date of such enforcement.

- Minimum NOFs: Earlier, the minimum NOFs was Rs. 10 lakhs, but after this new amendment, the requirements of NOFs for Nidhi Company have been changed to Rs. 20 lakhs.

- Transfer of Shares: Any member shall not transfer more than 50% of their shares at the time of the subsistence of such deposit or loan. However, members shall keep the minimum number of shares required.

Restrictions applicable to a Nidhi Company Registration

Nidhi Companies in India are not allowed to engage with the following undertakings:

- Carrying a business of Chit funds, Insurance, Leasing finance, Advertise themselves to invite deposits, Hire-Purchase finances, Lotteries is strictly prohibited;

- Sell, Mortgage or Pledge the assets kept with it as collateral security for a loan,

- Getting into Partnerships in order to carry out lending and borrowing activities,

- Accepting deposits or lending funds to any other person than its shareholders,

- Issuance of preference shares, debentures or any other type of debt instruments,

- Open a current account together with its members (although it is permitted to open a Savings Account),

- Lend to or accept a deposit from a corporate,

- Pay commission, incentive or fee for the mobilisation of deposits,

- Carry out any other business than lending or borrowing from its members,

- Hire a Purchase Financer,

Pay any brokerage amount for granting a loan to its members.

Difference Between Nidhi Company and NBFC

|

Nidhi Company |

NBFC |

|

Nidhi Companies are incorporated to encourage and motivate its members to save so that they can smoothly satisfy their financial needs arising from time to time. |

NBFC is incorporated to provide financial help to small businesses and weaker sections of society. |

|

This Company is not allowed to undertake any other business transaction such as Hire Purchase, Chit Fund, Lending Business etc. |

An NBFC (Non-Banking Financial Company) can perform the activities of Chit Fund, Lending Business, Chit Fund etc., |

|

There is no need for approval from RBI regarding the commencement of business activities in Nidhi Company. |

It requires prior approval from RBI. |

|

A Nidhi Company in India is not eligible to issue debentures to the 3rd parties. |

An NBFC can issue debentures to the 3rd parties. |

|

This Company cannot open a current bank account in its name. |

An NBFC can open a new current bank account in its name. |

|

Nidhi Company requires a minimum of Rs. 20 lakhs of NOF. |

NBFC requires a minimum of Rs. 10 crores of NOF. |

FAQs of Nidhi Company Registration

An average period of 15 business working days is required for setting up of a Nidhi Company.

Yes, it is necessary to use the word “Nidhi Limited” in the name of the company. However, the term “Mutual Benefit” can also be used.

A minimum of three directors and seven shareholders are needed for incorporating a Nidhi Company.

No, a minor is not allowed to become director of a Nidhi Company. Only a person who is a minimum of 18 years old can become the Director of a Nidhi Company.

No, there is no need for anyone to visit our office personally, as the process of Nidhi Company Registration is completely online.

The primary documents required for Nidhi Company Registration are ID proofs, Address proofs, latest bank statements, and Address proof of the Registered Office.

No, there is no upper limit prescribed for the maximum number of members. However, it is mandatory for a Nidhi Company must have a minimum of two hundred members by the end of the 1st financial year.

No, a convicted person is not eligible to become a director or shareholder in a Nidhi Company.

A DIN or Director Identification Number is a unique identification number given to every director by the Ministry of Corporate Affairs. It has lifetime validity, and a director can never be allotted with two DINs.

A Certificate of Incorporation has lifetime validity, or till the time the company’s name is not struck off by the ROC (Registrar of Companies).

No, a person who has earlier defaulted in a loan from Nidhi Company cannot borrow again from the Nidhi.

The government fees differ from state to state. Hence, there is no uniform costing. However, the whole process cost ranges from Rs 16000 to Rs 30000.

No, Nidhi Company is not qualified to issue unsecured loans. However, it can issue Secured Loans to its shareholders or members.

No, a Nidhi Company is not allowed to operate outside the state in which it is registered.

No, the profits earned from a Nidhi Company cannot be invested in any other business.

A minimum of 6 months and a maximum of 60 months period is prescribed for fixed deposits in a Nidhi Company.

A minimum of 12 months and a maximum of 60 months period is prescribed for recurring deposits in a Nidhi Company.

The maximum qualifying balance in a savings deposit account at any given time qualifying for interest shall not exceed Rs 1 lakh, and the rate of interest provided on such deposits shall not exceed 2% above the rate of interest payable on the savings bank account by nationalized banks.

No, Nidhi Companies are exempted from the core NBFC provisions of the Reserve Bank of India.

A Nidhi Company is not regulated and governed by the provisions of RBI. Moreover, Nidhi Company Registration requires a much smaller amount of capital than Rs 2 Crore paid-up capital requirement for NBFCs.

The regulations passed by the Ministry of Corporate Affairs and the provision of Nidhi Rules, 2014 act as the regulating authority for Nidhi Company.

A Nidhi Company can accept deposits only from its Registered Members.

No, only an NBFC after the approval from RBI can start Micro Finance Business in India.

No, a Nidhi Company is not allowed to issue Preference shares and Debt Securities.

No, a Nidhi Company cannot purchase securities and shares from any other organisation.

No, a Nidhi Company is not allowed to open a Current Bank Account with its shareholders or members.

No, a Nidhi Company is not allowed to carry out any activity other than Lending and Borrowing.

The primary objective of a Nidhi Company is to carry out the business of accepting deposits and lending money to its registered members. This company must aim to inculcate the habit of thrift and savings amongst its shareholders.

A director of Nidhi Company can hold his/her office for a period of 10 consecutive years. However, he is eligible for re-appointment only after the expiry of 2 years starting from the date of cessation of his term.

A Nidhi Company cannot accept deposits exceeding the limit of twenty times its NOF (Net Owned Funds).

DSC is the acronym for Digital Signature Certificate. This means digitally or electronically signing the documents by an authorized person. Moreover, DSC is used for signing the electronic forms and statements. However, it cannot be used in the case of physical documents.

A Nidhi Company is allowed to open only three branches within a district. However, to open more than three branches, the said company is must seek prior approval of the RD (Regional Director) for every additional branch.

A Director is firstly required to be a member of the said company, and then, he must comply with the requirements prescribed under Section 152(4) of the Companies Act, 2013.

No, a Body Corporate is not allowed to be admitted as the member or shareholder of a Nidhi Company.

A Nidhi company is required to be incorporated under the provisions of Companies Act, 2013, and shall acquire the status of a Public Limited Company.

No, such rules have been prescribed banning a salaried person from becoming a director of a Nidhi Company. However, the employment agreement of the said person may place some restrictions on him or herein doing so.

The term NOF is the acronym form for the Net Owned Funds. Further, NOF or the Net Owned Fund = Aggregate Paid up share capital + Free Reserves – Accumulated losses (Deferred Revenue Expenditure), and Other Intangible Assets appearing in the Last Audited Balance Sheet.