An Overview of GST Registration

GST (Goods & Services Tax) was introduced by the Government of India to regulate prices throughout the country and remove all state or central Govt. imposed indirect taxes on goods and services by initiating GST Registration in India. As per the new GST regulation, businesses whose turnover exceeds Rs 40 lakhs (20 Lakhs for North East and hill states for sales of goods) are required to get their GST as a normal taxable person. Also, there has been no alterations in the threshold limits for service providers. Persons providing services must register if their aggregate turnover exceeds Rs. 20 lakhs (for the normal category) and Rs. 10 lakhs (for special category states).

Apart from the other turnover bracket, there are certain cases where GST is mandatory for individuals or entities engaging themselves in the supply of goods or services across the State to get new GST registration online. One can apply for online GST Registration either as a normal taxpayer or under a GST composition scheme.

As we glare to the name, the name itself depicts that the GST will be applicable on both the goods and services following a dual system of GST, keeping the work of both the Central and the State Government independently. The GST Council is headed by the Union Finance Minister and will also include various State Finance Ministers.

Different Types of GST in India

Following are the different types of GST in India:

- CGST: CGST or Central Goods & Services Tax is the tax imposed on the Intra State supplies of goods/products and services by the Central Government of India. When the place of the buyer & seller is in the same State, it is known as an intra-state supply of goods & services. Here, a seller has to collect both SGST & CGST, in which CGST remains with the Central Government while the State Government collects the SGST.

- SGST: SGST or State Goods & Services Tax is the tax imposed on the supplies of goods & services by the State Government.

- IGST: IGST or Integrated Goods & Services Tax is governed under the IGST Act, where the seller has to collect IGST from the buyer & the tax collected will be divided between the State & Central Governments.

- Union Territory GST: This tax is imposed when any products & services are used in the Union Territories of India & the Government of Union Territory collects the revenue.

Advantages of GST Registration

Following are some advantages of GST Registration in India:

- After GST, tax evasion is minimised to a great extent;

- Under GST Regime, small businesses under turnover of Rs. 20 lakhs to 75 lakhs can benefit as it gives an option to lower taxes by using the Composition Scheme. This was introduced to lessen the tax & compliance burden on many small businesses.

- Compliance is less under GST;

- Previously, in the VAT system, any business with a turnover of more than Rs. 5 lakhs was liable to pay VAT in India. Moreover, service tax was exempted for service providers with a turnover of less than Rs. 10 lakhs. Under GST Regime, said threshold has been increased to Rs. 20 lakhs, which exempts a lot of service providers & small traders.

- Reduction in costs of goods and services;

- GST has combined varioindirect taxes under one umbrella & integrated the Indian Market.

Who can Apply for GST Registration in India?

- Every entity that is registered under a previous law of taxation i.e., VAT, Excise, Service Tax etc., needs to apply for GST Registration;

- Casual taxable person;

- Any business entity whose aggregator turnover in a financial year is more than Rs. 40 lakhs (Rs. 20 lakhs for the special category in GST);

- Agents of a supplier;

- Any supplier or entity dealing in inter-state supply of goods;

- Non-resident taxable person;

- An individual who supplies via an e-commerce aggregator;

- Person supplying online information & database access/retrieval services from an outside India to an individual in India, other than a registered taxable person or individual;

- Input service distributor.

Documents Required for GST Registration

Documents for Online GST Registration vary with the type of businesses in India. Following are some vital documents that are required at the time of online GST registration in India:

- For a Partnership Firm:

- PAN Card of all partners including authorised signatory & managing Partner;

- Aadhar Card of the authorised signatory;

- In the case of LLP, Board Resolution or Registration Certificate of LLP;

- Details of the bank account;

- Photographs of all the partners & authorised signatories in JPEG format and the maximum size of the photo should be 100 KB;

- Copy of Partnership Deed;

- Address proof partners such as Voters ID, Driving License, Aadhar Card, etc.;

- Address proof of principal place of business;

- Appointment proof of authorised signatory.

- For a Private or Public Limited Company:

- PAN Card of the company;

- Certificate of Incorporation;

- Memorandum of Association (MoA) and Articles of Association (AoA) of the company;

- Id proof & address proof of all directors & Authorised Signatory of the company;

- Passport size photo of the directors & authorised signatory;

- Details of bank account opening;

- Passport size photograph of the authorised signatory & directors of the company;

- Address proof of the business place.

- For a Sole Proprietorship Business:

- PAN Card of the owner;

- Aadhar Card of the owner;

- Owner’s Photographs in JPEG format, maximum size 100KB;

- Details of bank account;

- Address proof.

- For a HUF:

- PAN Card of HUF & the passport size photos of the Karta;

- Identity proof & address proof of the business place;

- Details of the bank account.

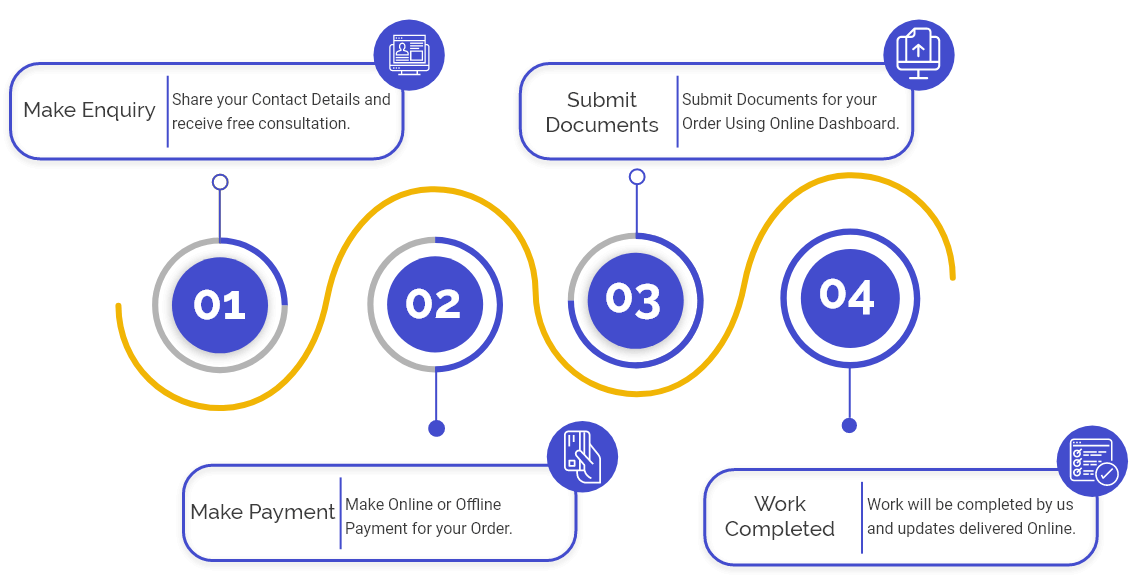

Procedure for Online GST Registration Process

Step 1: The first step is to fill out the online application at the official website of GST and also, the applicant needs to create a username & password in the portal.

Step 2: After creating the login id in the portal, the applicant needs to fill in the details on the website:

- Select taxpayer;

- Select the respective State & district;

- Enter the details of the business (PAN Card & Name);

- Provide the email id & mobile number (that must be active as OTPs will be sent) in the respective boxes.

- Then enter the Captcha shown on the window & click on Proceed.

Step 3: After filling in all the vital details, an OTP will be sent to your email and mobile number.

Step 4: Once all the details have been entered, click on the Proceed button.

Step 5: The applicant will get a Temporary Reference Number (TRN) on the screen. Save the TRN for further process. Remember that TRN is used to open Part-B in GST Registration and to log in to the GST Registration application.

Step 6: After receiving the TRN, the applicant is required to open the GST website again and click on the Register button under the Taxpayers menu.

Step 7: Select TRN and enter the TRN and the captcha code and click on the Proceed button.

Step 8: After that, you will receive an OTP on the registered email id & mobile number and enter the OTP and click on Proceed.

Step 9: A new window will open click on the Edit icon.

Step 10: After clicking the edit icon, a new page will open on your screen where there are various sections and all relevant details are required to be filed along with the necessary documents.

Step 11: Before submitting the application, click on the verification page & check the declaration. Following are the important methods that can be used for submitting the application:

- EVC or Electronic Verification Code;

- By e-Sign method;

- In case the applicant is a company, the application must be submitted by using DSC.

Step 12: Once the process is completed, a message will be shown on the screen and the ARN will be sent on the email id & mobile number registered by the GST applicant.

Step 13: Check the ARN status on the GST website.

Voluntary GST Registration

Voluntary GST Registration is for any small business whose turnover is less than Rs. 20 lakhs even though it is not mandatory. Voluntary GST Registration has its own benefits & some of them are:

- Tax Input Credit: Under GST, there is a follow of Input Credit Right from manufacturers of the products till the customers across the country. Iput Credit means a taxpayer, while paying tax on output, can deduct the tax that has already been paid on inputs & pay only the remaining amount. Voluntarily registered businesses can increase their profits & margins.

- Do inter-state selling with zero restrictions: SMEs can increase the scope of their businesses & find prospective customers & explore online platforms.

- Register on e-commerce sites: SMEs can broaden their market by registering via e-commerce websites.

- Have a competitive benefit compared to other businesses.

Penalty in Case of Non-Compliance under GST

- In case of Delay in Filing GSTR:

- The late fee is Rs. 1000/day per Act, i.e., 100 under CGST& 100 under SGST.

- Maximum of Rs. 5,000.

- No late fee in IGST.

- For helping an individual to commit fraud: Penalty up to Rs. 25,000.

- For Not Filing GSTR:

- Penalty 10% of the tax due;

- 10,000, whichever is higher.

- For not issuing invoice:

- 100% of the tax due;

- 10,000, whichever is higher.

- In case of issuing incorrect invoice: Penalty of Rs. 25,000/-.

- For charging GST rate incorrectly:

- Penalty 100% of the tax due;

- 10,000, whichever is higher (if the extra GST collected is not submitted to the Government).

- For committing a fraud:

- 100% of the tax due;

- Imprisonment in case of high-value fraud cases;

- 10,000, whichever is higher.

- Non-Registration under GST:

- 100% of the tax due;

- 10,000, whichever is higher.

GST Returns Filing

A GST Return Filing is an important document that includes details of the income of the taxpayer. It must be filed with the GST Administrative Authority (AA). The document is used by tax authorities to estimate the tax liability of a GST taxpayer. A GST Return Filing form must include the following details:

- Output GST (on sales);

- Sales:

- Input Tax Credit (GST paid on purchases);

Note: For GST Return Filing, you need to have GST compliant & purchase invoices attached.

Indirect Taxes that are Replaced under New GST Registration

After the introduction of GST, all indirect taxes departments were close merged. Hence, the following are the details of the indirect taxes of central and State Government that are replaced after the introduction of GST in India.

- Taxes that are levied and collected by the Central Government

- Service tax

- Central Excise duty

- Additional Duties of Custom ( also known as CVD)

- Special Additional Duty of Custom (SAD) And,

- Taxes that are levied and collected by the State Government

- State VAT

- Central Sales Tax

- Entertainment and Amusement Tax

- Taxes on lotteries, betting, and gambling

Like many other countries such as Canada and Brazil, India will also follow the dual form of GST applied online. At the Intrastate level, where goods and services are sold within the State, CGST (Central Goods and Service Tax) and SGST (State Goods and Service Tax) will be levied on it.

On the other hand, while selling any goods and services in another state i.e. interstate, then IGST will be levied. IGST stands for Interstate Goods and Service Tax. Any goods that are imported come under the IGST and are termed as interstate supply. Not only this, but the imported goods will also attract the basic customs duty. However, Exports and supplies to Special Economic Zone will be considered zero-rated.

Hierarchy of Officers in GST Department

There are 9 classes of officers as per the CGST Act, with 17 officers and a general class, whereas the SGST Act contains 6 classes of officers with a general class.

- As per Model GST Law, Board i.e. the Central Board of Excise and Customs constituted under the Central Boards of Revenue Act, 1963 has the power to appoint officers of CGST (Note: State laws may have similar provisions).

- The Commissioner of SGST under SGST law will have jurisdiction over the whole of the appropriate State. All other officers shall have jurisdiction over the whole of the State or over such areas as the Commissioner may, by notification, specify.

- The powers of the First Appellate Authority have been restricted to those specified under Section 79 of the CGST law. (Note: State laws may have similar provision)

The following is the hierarchy of the officers under the Central Goods and Service Tax act

- Principal Directors General of CGST or Principal Chief Commissioners of CGST or;

- Directors General of CGST, Chief Commissioners of CGST or;

- Principal Additional Directors General of CGST or Principal Commissioners of CGST;

- Additional Directors General of CGST or Commissioners of CGST;

- First Appellate Authority;

- Additional Directors of CGST or Additional Commissioners of CGST;

- Joint Directors of CGST or Joint Commissioners of CGST;

- Deputy Directors of CGST or Deputy Commissioners of CGST;

- Assistant Directors of CGST or Assistant Commissioners of CGST;

- Or such other class of officers as may be appointed for the purposes of this Act.

Furthermore, the hierarchy of officers under the State Goods and Service Tax Act.

- Commissioner of SGST;

- Special Commissioners of SGST;

- Additional Commissioners of SGST;

- Joint Commissioners of SGST;

- Deputy Commissioners of SGST;

- Assistant Commissioners of SGST;

- Or such other class of officers and persons as may be appointed for the purposes of this Act. (List is indicative).

GST Registration FAQs

All businesses that are registered under GST are assigned with a unique Goods and Service Tax Identification Number or GSTIN.

If a business provider operates from more than in one state, then a separate GST is required for each state.

The term “Composition Scheme” denotes a GST scheme that can be opted by the small businesses having an Annual Turnover below Rs 1 crore and Rs 75 lakhs for special states.

All the Service Providers, Inter-state Sellers, E-commerce Sellers, Suppliers of non-taxable goods, and Manufacturers of Notified Goods are outside the domain of the GST Composition Scheme.

Any GST taxpayer whose business turnover is below Rs 1 crore can opt for the Composition Scheme. However, the limit of turnover for North East state has been decided on Rs 75 lakhs.

A reverse charge is a mechanism in which the liability of paying the GST tax is levied on the buyer, and not on the supplier.

When the goods and services are offered or supplied periodically, and the payments are also made on a timely basis, it is called a continuous supply under GST.

The term “Compliance Rating” denotes a rating which is given to all the registered taxpayer on their performance.

The rating is given for implementing and complying with all the provisions of the GST timely and properly.

The one who is supplying Agriculture Produce, NIL rated or exempt supplies, or supply under Reverse Charge are exempt from GST Online Registration.

Yes, a person can anytime get the voluntary registration under GST in accordance with subsection (3) of section 25.

Yes, an individual can cancel his/her GDT Registration when he/she has opted for voluntary cancellation of his/her GST Registration.

In case of default, an officer can decide to cancel the GST Registration of an individual or business.

No, there is no such concept as the Central GST Registration in India. An entity having more than one branch will have to take separate state wise GSTIN for each branch.

A Non-Resident Taxable Person is one who is a foreigner and occasionally wants to affect the taxable supplies from any state in India and for that, he needs a GST Registration.

Yes, there is a need to have DSC in the case of Public Limited Company, Limited Liability Partnership Firm, Private Limited Company, or OPC.

The advantages of the GST Composition Scheme are Reduced Tax Liability, No Need to Maintain Detailed Records, File Single Quarterly Return, Limited Compliances, Small Amount of Tax, and Provides Auxiliary Services up to Rs 5 lakhs.

The disadvantages of the GST Composition Scheme are No ITC, No Composition Tax charged on Invoice, and cannot issue Tax Invoice.

ARN or Application Reference Number is generated automatically after the submission of form and documents on the GST Portal.

HSN Code or Harmonised System of Nomenclature, is an internationally accepted Product Coding System. It is used to maintain Uniformity and Consistency in the Classification of Goods.

One can register for GST by visiting the official GST Portal.

There is no fee involved in the process of GST Registration. However, the process of document and identity verification may require some charge.

Any Goods or Services Provider who is earning an annual turnover above Rs 20 lakhs is required to register their business under the provision of the GST Act.

A Minimum of 3 days are required to acquire GST Number.

The term “Destination-based Tax” denotes the place where the goods or services are used.

The Goods and Services Tax or GST includes all the Indirect Taxes that were levied under the preceding Tax Regime in India.

As per the GST Act, a 28% tax slab, together with NCCD and Compensation Cess, is applicable to the Cigarettes and Smoke-less Tobacco.

In India, GST is proposed in 3 tiers, i.e., CGST, SGST, and IGST.

The GST Council in India has the sole authority to levy and administer GST in India.

Integrated Goods and Service Tax or IGST applies to all the goods and services that are supplied in various states other than the origin state.

The GST Tax Rates are decided mutually by the Central Government and respective State Government.

IGST or Integrated Goods and Service Tax, will apply on Imports.

IGST or Integrated Goods and Service Tax, will apply on Exports.

The GST or Goods and Service Tax Act came into force on 01.07.2017.

Yes, B2B transactions are covered under GST.

The term ITC or Input Tax Credit means the tax paid by the company on purchase to reduce the tax levied on sale.