Companies (Appointment & Qualification of Directors) Fifth Amendment Rules 2020: A Detailed Summary

Shivani Jain | Updated: Dec 29, 2020 | Category: News

Recently, MCA (Ministry of Corporate Affairs), on 18.12.2020 had issued a Notification to inform that the Companies (Appointment and Qualification of Directors) Rules 2014 have been amended to the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules 2020.

Further, such rules have come into force from the date of publishing in the Official Gazette, i.e., 18.12.2020.

In this blog, we will discuss the key points of the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules 2020.

Table of Contents

Summary of Companies (Appointment and Qualification of Directors) Fifth Amendment Rules 2020

The detailed summary of the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules 2020 is as follows:

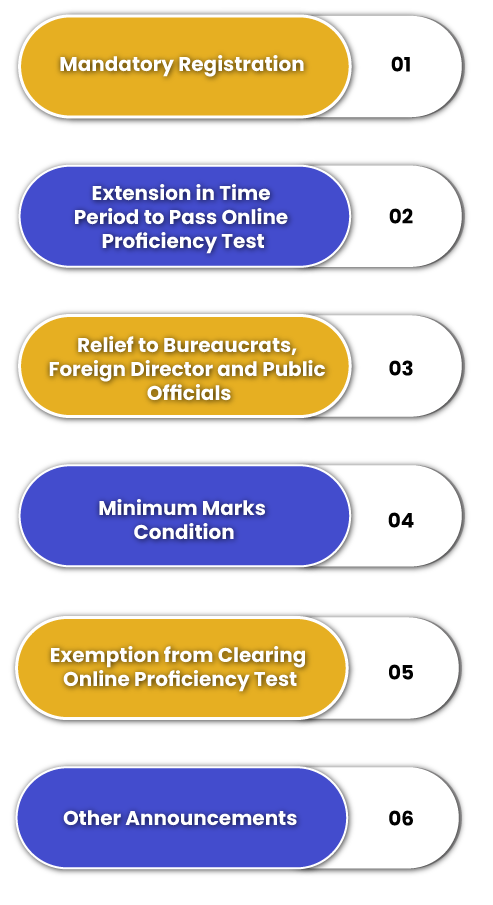

Mandatory Registration

An Independent Director needs to mandatorily get himself/ herself registered in the database on or prior to 31.12.2020.

Extension in Time Period to Pass Online Proficiency Test

Now, the Independent Director requires to complete the Online Proficiency Test within 2 years, starting from the date of inclusion of his/ her name in the database. The said limit is increased in respect of every individual or independent director whose name is included in the official data;

Relief to Bureaucrats, Foreign Director, and Public Officials

With these new amendments, MCA (Ministry of Corporate Affairs) has provided relief to Bureaucrats/Foreign Directors and Public Officials who are also now qualified for an exemption from writing the test. Further, this exemption will enable the Indian companies or entities to retain and attract high caliber public officials as Directors.

Minimum Marks Condition

An individual who has obtained a total score of 50 or more shall be considered to have passed such a test.

Exemption from Clearing Online Proficiency Test

After the introduction of the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules 2020, an individual is not be required to pass or clear the online proficiency self-assessment test if he/she has served for a total tenure of not less than three years, starting from the date of inclusion of his/her name in the data bank. However, the said exemption will apply only if the said individual falls under either of the categories as follows:

- A Director or KMP (Key Managerial Personnel) Is working in one or more of the following types of organizations:

- Listed public Company;

- Unlisted Public Company, which is having a paid-up share capital of Rs 10 crores or more;

- Body Corporate or an entity listed on a Recognised Stock Exchange, which is having nationwide terminals or;

- Body Corporate or an entity which is incorporated outside India and is having a paid-up share capital of the US $2 million or more;

- Statutory Corporation, which is established under an Act of parliament or under any State Legislature carrying out the commercial activities;

- A Director of the Ministry of Corporate Affairs (MCA) or the Ministry of Finance (MOF) or the Ministry of Commerce and Industry (MOCI) or the Ministry of Heavy Industries & Public Enterprises (MOIPF) and who is having prior experience in handling the matters pertaining to the corporate laws or economic laws or securities laws;

- The Chief General Manager (CGM) or above in the Securities and Exchange Board (SEBI) or the Reserve Bank of India (RBI) or the Insurance Regulatory and Development Authority of India (IRDA) or the Pension Fund Regulatory and Development Authority (PFRDA) and who is having a prior experience in handling the matters pertaining to the corporate laws or economic laws or securities laws;

Other Announcements

Lastly, the Ministry of Corporate Affairs declared that for the calculation of the period of 3 years mentioned to in the first proviso, any tenure during which an individual was working as a director or as KMP (Key Managerial Personnel) in two or more companies or statutory corporations or body corporates at the same time will be counted only once.

Conclusion

In a nutshell, the Ministry of Corporate Affairs (MCA[1]) has published the Companies (Appointment & Qualification of Directors) Fifth Amendment Rules 2020 as a reform of the Companies (Appointment & Qualification of Directors) Rules 2014.

Further, the main reason behind the implementation was to provide a sense of relief to the Independent Directors in the form of an extension of the time period for passing an online proficiency test, and only a total of 50% weightage is needed to clear the exam.

Furthermore, the individuals who have served as the designated directors, in the specified organisations of the Central Government, for a time period of not less than 3 years are not needed to appear for this exam. Also, the Foreign Directors, as well as the Bureaucrats/Public officials, are exempted from appearing for the said test as well.

Lastly, in case of any other doubt and complexity, reach out to Swarit Advisors, our expert professionals are ready to cater to all your requirements.