How to Register a Proprietorship Company in India?

Japsanjam Kaur Wadhera | Updated: Dec 12, 2020 | Category: Sole Proprietorship

A Sole Proprietorship is the easiest form of entity to start up a business in India as it is not governed by any specific laws. It is owned by a single person and the compliance under it is minimal and easy to fulfil. It has no separate legal entity from its owner. So when it comes to how to register a Sole proprietorship company in India, there are certain documents that are required for registering a proprietorship company.

This article will provide you with the information regarding the documents that are required and the benefits that a proprietorship company has in India.

Table of Contents

What is a Sole Proprietorship Company?

A sole proprietorship is a one person company where a single person owns, manages and controls the operations of the business. Since no government registration is required, it is easy to form a sole proprietorship company. It does not require any government regulatory paperwork or compliance and nor does any fees is required for the start-up of this type of company.

It does not require a minimum capital investment and the proprietor has his full control and ownership over the sole proprietorship company. The sole proprietor gets the advantage of tax benefits and double taxation of the firm is prevented. The returns and taxes are to be paid only in the name of the sole proprietor and no separate income tax is required to be paid by the firm.

What are the requirements for starting up of Sole Proprietorship Business in India?

There are only two basic requirements for starting up a sole proprietorship business in India: –

- Choosing a business name.

- Selection of a location for a place of business.

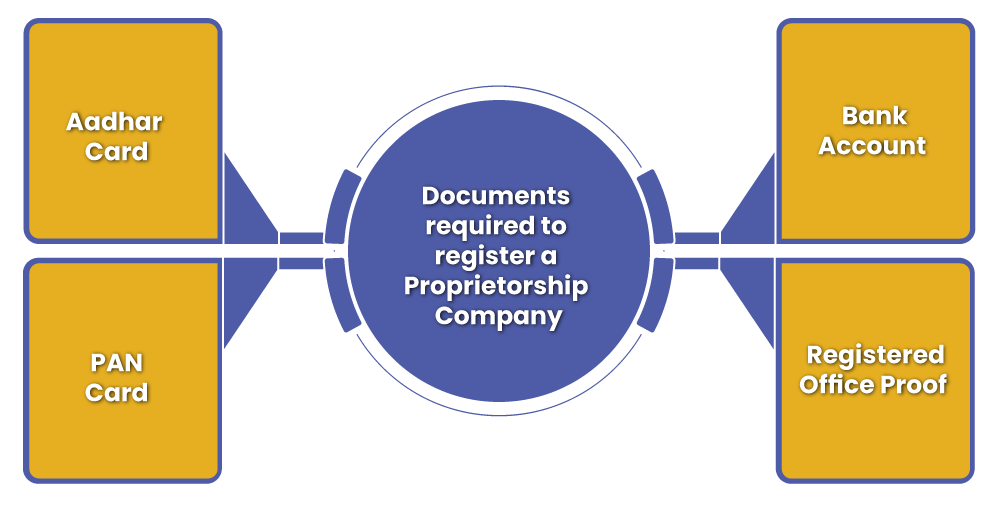

Documents required to register a Proprietorship Company

1. Aadhar Card

To apply for the registration of Proprietorship Company, Aadhar card number is necessary. The income tax return can be filed if the PAN Card is linked with the Aadhar Card.

2. PAN Card

The income tax return cannot be filed in the absence of a PAN Card. And a PAN Card is required at the time of proprietorship company registration to file Income Tax Returns. Along with it, it is also necessary to get a GST registration number also.

3. Bank Account

The applicant for the registration of a proprietorship company must also submit the bank account number which is linked with the office transactions. He can also submit his personal account number if he does not have a separate bank account for the business.

4. Registered Office Proof

The applicant is required to provide a certified office proof for registration. If the property is rented then a rent agreement and a NOC from the landlord is required to be submitted. And if the property is Self-owned property then the electricity bill or any other address proof is required to be submitted.

Sole Proprietorship Company Registrations Required

A proprietor of a sole proprietorship company is required to obtain few registrations to operate his business function smoothly.

1. Registering as SME

The proprietor can get itself registered as a Small and Medium Enterprise (SME) under the MSME Act. It is not mandatory to register as an SME but it provides benefits to the applicant at the time of taking a loan for his business. And the government has initiated various schemes for SME’s in which the loan can be provided at concessional rate of interest. Such an application can be filed electronically.

2. Shop and Establishment Act Licence

Even though this license is not mandatory at all the places but it is needed to be obtained according to the local laws. The Municipal Party issues this license on the basis of the number of employees.

3. GST Registration

If the annual turnover exceeds 20 lakh then the proprietor must get registered under GST registration. Documents that are required under the GST registration are: –

- Aadhar Card, PAN Card and photograph of the proprietor

- Proof of the business place. If rented then Rent agreement and if the self-owned property then electricity bill.

- Bank statement copy

Benefits of Sole Proprietorship Firm

- Overall control of the owner.

- No minimum capital investment.

- Proprietor solely gets profit.

- Tax assistances avert double taxation.

- The proprietor has to file an only annual tax return and pay tax as an individual.

- No separate tax for the company.

Conclusion

Sole Proprietorship Company is a perfect option for an entrepreneur who wants to start a company of his own without any long process of forming it. However, an entrepreneur needs to register a proprietorship company in India and the process of registering a company has been discussed above. No long registration process is required for the establishment of a proprietorship firm. It provides many advantages if a person wishes to start up a company of his own. A sole proprietorship company has a more straightforward operational functioning because only one person is required to create and manage the company.

Also, Read: How to Choose the Correct Form of Entity for Your Startup?