Startup India Scheme – Registration & Benefits

Japsanjam Kaur Wadhera | Updated: Jan 30, 2021 | Category: Business

A startup is a business which is newly established small business started by one or more entrepreneurs to offer new products or services that are not being provided elsewhere in the same way. The startup is differentiated from the others on the basis of innovation, modernisation and strangeness. Startup India scheme is very popular in India. It is promoted to give recognition to the stratups. This article will discuss about the Startup India Scheme and its registration and benefits.

Table of Contents

Startup India Scheme

The Startup India scheme is the initiative brought by the government of India to build a strong business growth and generate employment opportunities and wealth creation. This scheme has initiated many programs for building a strong ecosystem and helping India to transform into a country of job creators instead of job seekers. The Startup India Scheme is managed by the Department for Promotion of Industry and Internal Trade (DPIIT). The aim of this scheme is to empower the growth of the startup through innovation.

What do you understand by the term Startup?

A startup is an entity which is founded by one or group of individuals to offer those products and services in the market which are different and unique from the others. Through the notification issued by the Department for Promotion of Industry and Internal Trade (DPIIT) on February 19, 2019, provided the definition of a startup. Any of the companies which fall into the list of a category will be called “Startup” and be eligible to be recognized by the DPIIT to get the benefits from the govt of India.

- Age of the Company- the Incorporation date should not exceed 10 years.

- Type of Company- the company should be registered as a Partnership firm or a limited liability partnership or incorporated as a private limited company.

- Original entity- the entity must be formed originally by the promoters and should not have been formed by splitting up or building and forming again an existing business.

- Annual Turnover- the company should not exceed Rs. 100 crore for any of the financial years since the day of its incorporation.

- Innovative and able to change business scale- the company must plan for the improvement and development of the products and services and should have a scalable business model with much potential for the creation of employment and wealth.

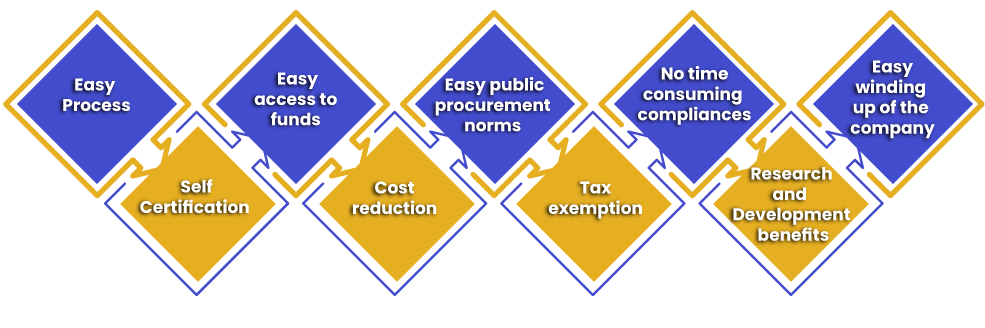

Benefits of Startup India Scheme

Easy Process

A mobile app and a website have been launched by the government of India for easy registration for all the startups. Any business can set up a startup by filling a simple form on the website and by uploading all the required documents. The entire registration process is completely online.

Self Certification

The Startups under the scheme are allowed to self certify their compliance under 6 labour laws and 3 environmental laws. Such certification is allowed for a period of 5 years from the date of the incorporation of the entity.

Easy access to funds

The government has set up 10,000 crore rupees fund to provide it as venture capital to the startups. The guarantee is also given by the government to the lenders to encourage the banks and other financial institutions for providing with the venture capital.

Cost reduction

A list of facilitators of trademarks and patents is provided by the government. It provides high-quality intellectual property right services including the fast examination of patents at the lower fees. The startup has to bear all the statutory fees and the government will bear all the facilitator fees. Therefore, the startup enjoys the 80% reduction in the cost of filing patents. Rendering 50% rebate on the trademark filing when compared with other companies.

Easy public procurement norms

The Startups can apply for government tenders. They are exempted from the criteria of “prior experience/turnover” which is applicable for other companies answering to the government tenders.

Tax exemption

The Startups are exempted from income tax for 3 years provided that they get certification the Inter-Ministerial Board (IMB).

No time consuming compliances

The people who are investing their capital gains in the venture funds which are set up by the government shall get exempted from capital gains. This allows the startups to attract more and more investors.

Research and Development benefits

The startup India research and advocates innovation between those who project themselves as entrepreneur in the near future. The government is committed in establishing seven new research parks for the research and development of the products.

Easy winding up of the company

Startups which are also known as fast track firms can be winded up within 90 days (3 months) as against the 180 days for the other companies. Further, an appointment for insolvency professional shall be done for liquidating the assets and paying to the creditors. This shall be done within 6 months of filing an application to be allowed for such an exit.

Startup India Registration

Firstly, is it necessary for a business to incorporate as a Partnership Firm or Private Limited Company or Limited Liability Partnership. All the procedures for registration of any business is required to be followed like obtaining incorporation certificate/partnership registration, PAN Card and other required compliances.

The startup India registration can be done on the website by following the simple process: –

- The applicant is required to click on the “Register” and fill all the details necessary in the registration form. An OTP shall be sent to the registered email address of the applicant, submitting on which a profile will be created.

- The applicant shall be given an option to select the profile type. The profile goes under moderation for 24 to 48 hours for startups and post which the applicant is able to get all the benefits.

- For those startups having a profile on the Startup India website are considered as registered startups on the portal. And such startups can apply for acceleration, mentorship/ incubator programmes and other availabilities on the website along with getting access to resources like learning and developing a program, state policies for startups, government schemes and pro- Bono services.

- Once the profile is created, the startups get recognition from the Department for Promotion of Industry and Internal Trade (DPIIT) which helps them to avail many benefits.

- The Recognition Application Detail page shall be opened and by clicking on view details under the registration detail section the applicant is required to fill startup recognition form and click on submit.

- On applying the applicant shall get a recognition number for his startup and the certificate of recognition will be issued once the documents are examined, which is usually done in 2 days on submitting the details online.

- The startups are required to apply at[1] to avail benefits under the Startup India Scheme.

Documents required to be uploaded for Startup Registration

- Certificate of the Incorporation of the startup.

- Details of all the directors.

- Proof of concept like a website link, video, in case of validation a scaling stage startup, early traction etc.

- PAN number.

- Details of Trademark and Patent.

Conclusion

The setting up of startups is highly encouraged by the government and there are many benefits that are enjoyed by them. Startup India Scheme and its registration and benefits are discussed above in the article and this scheme is an initiative of the government of India to build and grow the strong startup business which in turn would help in the growth of the economy and generate large employment opportunities in India.

Also, Read: Annual Compliance for an Unlisted Company in F.Y. 2020-2021