Due Date Compliance Calendar for March 2021: A Complete Guide

Shivani Jain | Updated: Mar 04, 2021 | Category: News

Adhering to the compliances proposed by the Central Government is a compulsory prerequisite for every taxpayer and person qualified. In this learning blog, we will cover the due date compliance calendar for March 2021, concerning the following:

- Income Tax Return Filing;

- GST Return Filing;

- Employee State Insurance Act 1948;

- Employees Provident Fund Act 1952;

Table of Contents

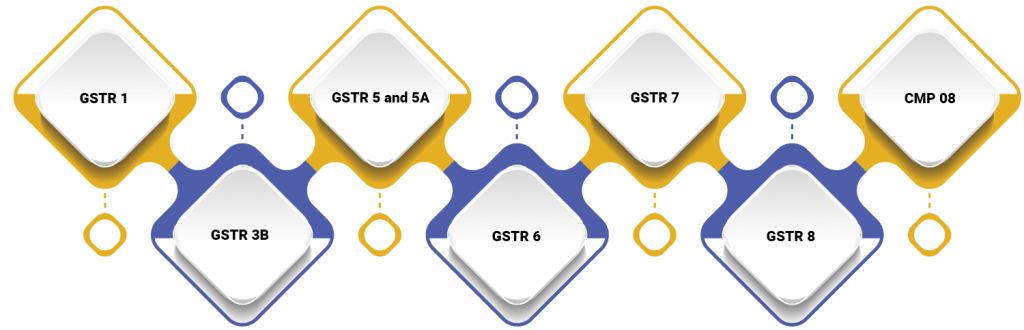

Due Date Compliance Calendar for GST Act

The due date compliance calendar for the GST Act can be summarised as:

GSTR 1

All the taxpayers who are having an aggregate annual turnover of more than Rs 1.5 Crores or have opted to file Monthly Return need to file GSTR 1 for the month of February by 11.03.2021.

GSTR 3B

All the taxpayers who are having an annual business turnover of more than 5 Crores need to furnish form GSTR 3B by 20.03.2021 for the month of February 2021.

GSTR 5 and 5A

All the Non Resident Taxpayers and the ODIAR services providers need to file form GSTR 5 and 5A by 20.03.2021 for the month of February 2021.

GSTR 6

All the Input Service Distributors (ISDs) need to file form GSTR 6 by 13.03.2021 for the month of February 2021.

GSTR 7

All the taxpayers or individuals who is allowed to deduct TDS or Tax deducted at source under the provisions of the GST Act need to file form GSTR 7 by 10.03.2021 for the month of February 2021.

GSTR 8

All the E-commerce Operators who are allowed to deduct TCS (Tax Collected at Source under the GST Act, need to file form GSTR 8 by 10.03.2021 for the month of February 2021.

CMP 08

The Due date for opting for the composition scheme for the financial year 2021 to 2022 is 31.02.2021. The same can be opted by filing Form CMP 08.

Also, Read: Due Date Compliance Calendar for February 2021: A Complete Guide

Due Date Compliance Calendar for Income Tax Act

The due date compliance calendar for the Income Tax Act can be summarised as:

| Sr. No | Particulars | Due Date |

| 1 | For all the individual and corporate taxpayers: The last date for depositing the fourth installment of the advance tax (if in case liable to pay any) for the financial year 2020 to 2021. | On or before the 15th March |

| 2 | For all the taxpayers who have opted or chosen the Presumptive Taxation Scheme under the provisions of section 44AD and 44ADA: The last date for depositing the fourth installment of the advance tax (if in case liable to pay any) for the financial year 2020 to 2021. | On or before the 15th March |

| 3 | The last date for filing the belated or revised return for the financial year 2019 to 2020. | 31.03.2021 |

| 4 | The last date of linking PAN (Permanent Account Number) with Aadhaar Number | 31.03.2021 |

| 5 | The extended last date of filing the quarterly statement of TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) deposited for quarter 1 and quarter 2 for the financial year 2020 to 2021. | 31.03.2021 |

| 6 | The last date of making payment under the provisions of the Vivad Se Vishwas Tak Scheme without any additional levy. | 31.03.2021 |

| 7 | The due date for passing an order or the issuance of notice by the regulatory authorities and several compliances under the provisions of the Benami Law and various direct taxes. | 31.03.2021 |

Due Date Compliance Calendar for ESIC and EPF Act

The due date compliance calendar for the ESIC and EPF Act can be summarised as:

| Sr. No | Particulars | Due Dates |

| 1 | The due date for filing ECR for the month of February 2021 | 15.03.2021 |

| 2 | The due date for making ESIC Payment for the month of February 2021 | 15.03.2021 |

Due Date Compliance Calendar for Miscellaneous Laws

The due date compliance calendar for Miscellaneous Laws can be summarised as:

| Sr. No | Particulars | Due Dates |

| 1 | The RBI (Reserve Bank of India) on Friday had extended the deadline for furnishing applications for setting up a PAN India umbrella entity for making retail payments. | 31.03.2021 |

| 2 | Declaration for Excise Duty | 15.03.2021 |

| 3 | Declaration concerning Indirect Taxes on the goods imported, for the tax period of February 2021 | 25.03.2021 |

Conclusion

In a nutshell, the said Due Date Compliance Calendar is for March 2021, and we have tried to include all the compliances pertinent with regard to taxpayers or an individual or entity qualified.

Also, Read: Customs (Import of Goods at Concessional Rate of Duty) Amendment Rules 2021 Notified by CBIC