Key Changes Made in Alternative Investment Funds (Amendment) Regulations 2021

Shivani Jain | Updated: Jan 25, 2021 | Category: News

Recently, the Securities Exchange Board of India (SEBI), by way of a notification, dated 08.01.2021, has declared about the amendments made in the SEBI (Alternative Investment Funds) Regulations 2012. Further, the powers concerning amendments are provided under section 11, 12, and 30 of the SEBI Act 1992. Also, the said amended regulations will be known as SEBI (Alternative Investment Funds) (Amendment) Regulations 2021.

Moreover, it needs to be taken under due consideration that these regulations came into force after that last amendment made, i.e., SEBI (Alternative Investment Funds) (Amendment) Regulations 2020, on 19.10.2020.

Further, the said rules will come into force from the date of publication in the official gazette. In this blog, we will discuss the concept of Alternative Investment Fund, together with the key changes made in SEBI (Alternative Investment Funds) (Amendment) Regulations 2021.

Table of Contents

Concept of Alternative Investment Fund

The term AIF or Alternative Investment Fund denotes a fund incorporated or established in India. It is primarily a privately pooled investment vehicle which gathers funds from the well-known and sophisticated investors, both Indian and Foreign. Further, the funds collected are used in accordance with the stipulations of the defined investment policy, i.e., for the benefit of its investors.

However, it shall be relevant to state that an AIF or Alternative Investment Fund does not comprise of the funds covered under the SEBI (Collective Investment Scheme) Regulations 1999 and SEBI (Mutual Funds) Regulations 1996.

Lastly, the forms in which an AIF can be registered in India are as follows:

- Public or Private Limited Company;

- Body Corporate under the Central or State Legislature Laws;

- Trust;

- Limited Liability Partnership;

Objective of SEBI (Alternative Investment Funds) Regulations 2012

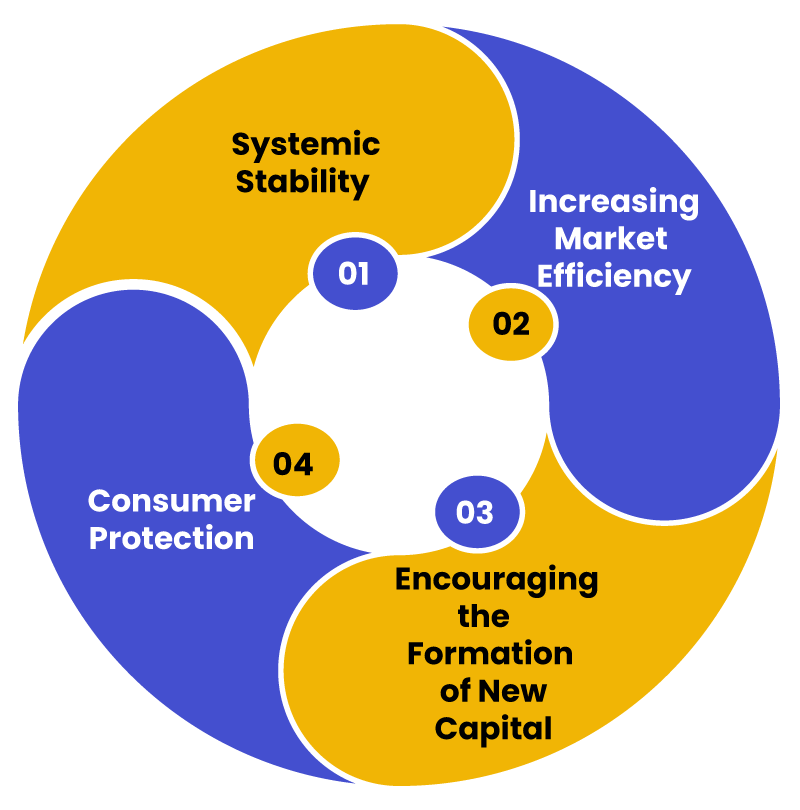

The regulations concerning AIF, i.e., SEBI (Alternative Investment Funds) Regulations 2012 endeavour to extend its ambit on the unregulated funds with an aim to provide the following:

- Systemic Stability;

- Increasing Market Efficiency;

- Encouraging the Formation of New Capital;

- Consumer Protection;

Changes Made in SEBI (Alternative Investment Funds) (Amendment) Regulations 2021

The two main changes made under Regulation 20 by the board in the SEBI (Alternative Investment Funds) (Amendment) Regulations 2021 are as follows:

Substitution of Symbol in Proviso of Sub-rule (6)

In the first change, the SEBI has decided to substitute the symbol “.” with the symbol “:” under clause (iv) of the proviso of sub-regulation (6).

Insertion of Proviso to Sub-rule (6)

Under the next change, the SEBI has decided to insert an extra proviso after clause (iv) of the proviso of sub-regulation (6). The proviso inserted is as follows:

Provided further, that clauses (i) and (ii) shall not be applicable to an Alternative Investment Fund (AIF) in which each an investor other than the Sponsor, Manager, Employees, or Directors of the Alternative Investment Fund(AIF) or the employees or directors of the Manager, has committed to invest not below than Rs 70 crores (or an equivalent amount in any currency other than Indian Rupee) and has furnished a waiver to the AIF (Alternative Investment Fund) in respect of the compliance with the said clauses, in the manner prescribed by the Board.

Conclusion

In a nutshell, the main objective behind the implementation of the SEBI (Alternative Investment Funds) (Amendment) Regulations 2021 was to replace, amend or insert some of the provisions specified under the SEBI (Alternative Investment Funds) Regulations 2012.

Also, it shall be pertinent to state that an AIF (Alternative Investment Fund) does not comprise of the funds covered under the SEBI (Collective Investment Scheme) Regulations 1999 and SEBI (Mutual Funds) Regulations 1996.

Further, in case of any other doubt or complexity, reach out to Swarit Advisors, our proficient and experienced Company and SEBI Law experts will solve out all your queries and will assist in providing the modes relating to the issuance of shares as well.

Also, Read: Companies (Compromises, Arrangements & Amalgamation) Second Amendment Rules 2020: Key Highlights