IRDAI Mandates Communication of Basic Information to Policyholders

Shivani Jain | Updated: Mar 06, 2021 | Category: IRDA Advisory, News

The IRDAI (Insurance Regulatory Development Authority of India), by way of the Notification No IRDAI/ HLT/ REG/ CIR/ 038/ 03/ 2021, issued on 01.03.2021, has notified that it is mandatory for all the General and Health Insurers to do the communication of basic information to policyholders.

Further, it shall be noted that by way of this notification, IRDAI has drawn attention towards Rule 12 of IRDAI (Protection of Policyholders Interest) Regulations 2017, which deals with the providing of minimum information concerning the health insurance policy to the policyholder. Furthermore, every insurance company needs to adhere to these instructions by 01.06.2021.

In this learning blog, we will cover the concept of IRDAI, together with the provisions concerning the communication of basic information to Policyholders.

Table of Contents

Concept of IRDAI

The IRDAI or Insurance Regulatory and Development Authority of India means an authority that works as the regulator of the insurance sector and monitors the working and operations of the General and Life Insurance Companies.

Further, the main objective of IRDAI is to safeguard the interest of policyholders and to supervise the insurance sector.

Also, it shall be noted that IRDAI is responsible for ensuring fairness, financial soundness, and transparency in the insurance sector as well.

Also, Read: IRDAI Notifies the Insurance Ombudsman (Amendment) Rules 2021

Why has IRDAI mandated the Communication of Basic Information to Policyholders?

Based on the provisions of Rule 12 of IRDAI (Protection of Policyholders) Regulations 2017, every insurance company must provide minimum information concerning the health insurance policy to the policyholder.

Further, to ensure the smooth flow of relevant information, it is obligatory for every insurance company to periodically notify the policyholders regarding the key details of the health insurance coverage issued to them.

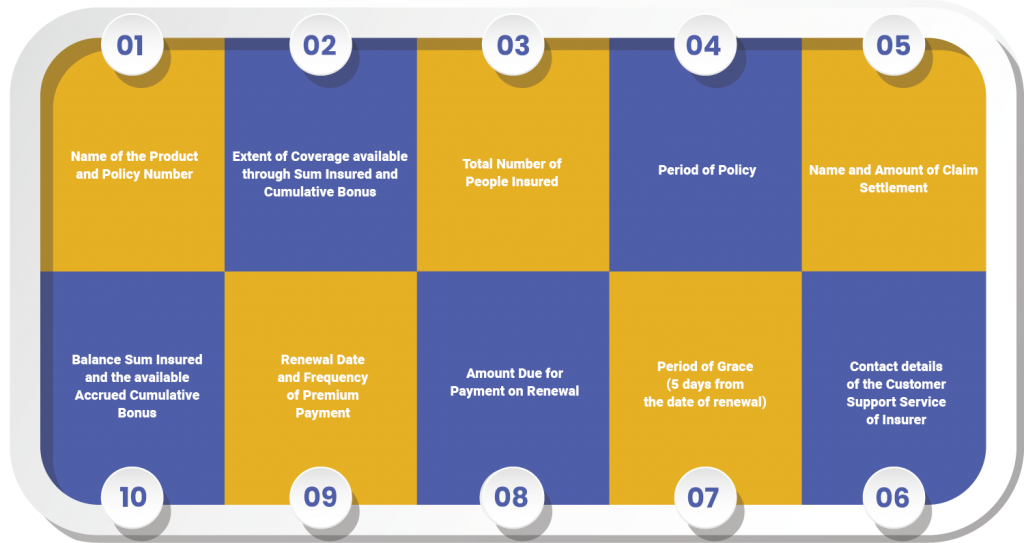

- All the General and Health Insurers need to communicate the information as follows:

- Name of the Product and Policy Number;

- The Extent of Coverage available through Sum Insured and Cumulative Bonus;

- Total Number of People Insured;

- Period of Policy;

- Name and Amount of Claim Settlement;

- Balance Sum Insured and the available Accrued Cumulative Bonus;

- Renewal Date and Frequency of Premium Payment;

- Amount Due for Payment on Renewal;

- Period of Grace (5 days from the date of renewal);

- Contact details of the Customer Support Service of Insurer;

- The insurance company need to communicate the information mentioned above twice a year, i.e., on half yearly basis. It shall be noted that in the case of Renewal, such communication must be made one month before expiry. However, in the case of multiyear policy, such information can be shared within six months from the date of issuance;

- Further, in the case of event settlement, the insurance company needs to communicate the information concerning sum assured and available cumulative bonus to the policyholders within a period of 15 days form the claim settlement;

- Also, it shall be noted that an insurance company can use any of the modes available for making communication and needs to refrain from using long, complex, unintelligible, and unnecessary information.

Who are all exempted from the Communication of Basic Information to Policyholders?

All the companies except the following are exempted from the communication of basic information to policyholders:

- Export Credit Guarantee Corporation of India;

- Agriculture Insurance Company;

Conclusion

In a nutshell, to infuse transparency, fairness, and financial soundness in the insurance sector, IRDAI has made the communication of basic information mandatory for every General and Life Insurance Company. However, it shall be noted that the provisions of this circular will not apply to the Agriculture Insurance Company (AIC) and Export Credit Guarantee Corporation of India (ECGC).

Also, Read: What Role Does IRDA Play in the Development of Insurance Sector?