Co-lending Model Between NBFCs and Banks- Key Characteristics

Karan Singh | Updated: May 08, 2021 | Category: NBFC

The RBI passed a notification on the co-lending model, which has to be integrated between NBFCs (Non-Banking Financial Companies) and Banks. This notification was passed by RBI/2020-21/63. FIDD.CO.Plan.BC.No.8/04.09.01/2020-21 on 5th November 2020. The primary purpose of this notification is to raise the association between NBFCs and banks when it comes to lending areas in the priority sector. By this notification, the government strategy to create an efficient harmonisation of loans in some sectors. This notification is concerning the co-origination of loans introduced by different NBFCs and Banks in the priority sector.

The Co-lending model is an unbreakable agreement between the contract parties. The agreement terms have to be settled in advance before going into the contract.

Following are some institutions where this model would apply:

- NBFCs or Non-Banking Financial Companies;

- Banks;

- HFCs or Housing Finance Companies;

- All Scheduled Commercial Banks.

Table of Contents

What are the Primary Objectives of the Co-Lending Model?

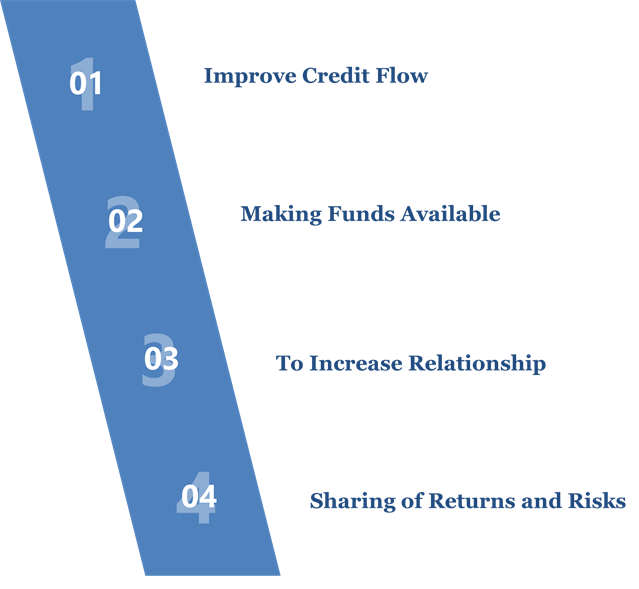

Following are the primary objectives of the Co-Lending Model:

- Improve Credit Flow: Indian is a vast country, and the chief proportion of the population in India represents the rural and underserved sector. To attain the flow of faultless credit, the government articulated this proposal to aid the rural parts of the society.

- Making Funds Available: Generally, the rural parts find it challenging to afford loans offered by tremendous public sector happenings and financial institutions. Therefore, banks have collaborated with Non-Banking Financial Companies to serve the rural area. Non-Banking Financial Companies chiefly serve the rural area; hence by this collaboration, banks would also get to this sector.

- To Increase Relationship: To increase the relationship between NBFCs and Banks, the government introduced the co-lending model scheme. By this scheme, different purposes and goals of Non-Banking Financial Companies and Banks can be harmonised and attained. The government has introduced several plans to increase the relationship or alliance between Non-Banking Financial Companies and Fintech Companies. By this scheme, the chances of collaboration will rise when it comes to lending.

- Sharing of Returns and Risks: Collaboration between NBFCs and Banks would not only mean the development of lending plans and improvement of technology; however, it would consist of sharing the different forms of returns and risks between the NBFCs and Banks.

Characteristics of the Co-Lending Model

The Reserve Bank of India introduced a co-lending scheme to increase lending terms between Non-Banking Financial Companies and Banks. Following are some characteristics of the co-lending model:

- Systems: The Non-Banking Financial Company (NBFC) and Banks have to ensure that there are efficient systems in place to execute measures on Due Diligence and Anti-Money Laundering.

- Master Agreement: Usually, the type of agreement or contract entered between the NBFC and bank would be a master agreement. This would efficiently have the properties of master agreement services. According to the agreement, banks have to take a fraction of their share of the original loans, which increase as a result of initiation from the Non-Banking Financial Company. The total loans share taken should be recorded in their books. However, such loans are subjected to refusal if they don’t obey the necessities of due diligence.

- Clients: When dealing with clients, the agreement terms will be negotiated by the Non-Banking Financial Companies with clients. Therefore, NBFCs would be the point of contact concerning the agreement terms. Moreover, the agreement should include the duties and responsibilities of NBFCs and banks.

- Warranties and Representations: All agreements which include the terms of the co-lending model will have warranties and representations. Such warranties and representations have to be according to pre-negotiated terms & conditions between the banks and Non-Banking Financial Companies. All Non-Banking Financial Companies under this scheme would be accountable for the share which is recorded in the bank’s books.

- Security: Terms concerning the creation of security in the co-lending model have to be decided between the NBFC and the bank.

- Internal Audit: Any type of loans offered under the co-lending scheme should be as per the external or internal audit guidelines between the NBFC and Banks. Compliance is needed for the same.

- Business Continuity: The provisions concerning the co-lending agreement should not affect the regular business which is conserved between NBFCs and banks with clients. Till the loan repayment, such a scheme should be made operational. Until and unless the scheme is finished, the co-lending scheme should be operational.

- Compliance with Law: Any kind of agreement entered between the banks and NBFCs should obey the necessities of the guidelines concerning the Code of Conduct and Managing Risks in Financial Services Outsourcing. These guidelines were carried out in 2015 vide RBI/2014-15/497DBR.No.BP.BC.76/21.04.158/2014-15.

- Handling of Complaint: There have to be helpful systems in place to handle any type of customer’s complaints. A cell has to be established by the co-lenders as per the model. All customers’ complaints should be handled efficiently in a rapid manner. Non-Banking Financial Companies have to make sure that any complaint made should be resolved within thirty days from the date of the complaint. If the complaint of the customers fails to settle between the co-lenders, the borrowers can appeal their complaints to the banking or the NBFC inspector. The client can also take their complaints to the CEPC or Customer Education and Protection Cell[1] in the Reserve Bank of India.

- Loans Recovery: The scheme of co-lending would have respective arrangements concerning the recovery of the loans from clients. Such terms concerning the recovery have to be jointly agreed upon by the clients.

- Classification of Asset: All the co-lenders should obey the rules concerning the sort of asset. This would also be suitable when parties under this model have to report information to Credit Information Companies.

- Carefulness of Banks: The carefulness relation to taking the loans originated from Non-Banking Financial Companies is based on the independence and the cautiousness of the bank. Sometimes, if the loan is engaged into the books, the transaction would act according to the agreement’s necessities. At the time of the transaction, if there is some kind of loan transfer, then compliance should be maintained regarding the transfer. This should be in respect to the guidelines which were introduced by the Reserve Bank of India (RBI). This would match up with the transactions relating to the Transfer of Assets through Direct Assignment of Cash Flows and underlying Securities issued by RBI/2011-12/540 DBOD. No. BP.BC-103/21.04.177/2011-12, which was introduced in the year 2012. All such transactions would act on the basis of independence. MHP (Minimum Holding Period) would not apply to these transactions.

- Approval: All the co-lending model’s information should be disclosed to clients. Each and every client’s approval should be received for the agreement for the co-lending scheme.

- Promoter Groups: In this co-lending model, banks are not permitted to enter any other co-lending regime, where the Non-Banking Financial Company has directly managed through a promoter group.

Conclusion

The Reserve Bank of India (RBI) introduced a scheme of an arrangement between NBFCs and Banks. Such a scheme is known as the Co-lending model. In this agreement, all the terms should be in compliance with the Terms & Conditions agreed between the parties. Non-Banking Financial Companies should take part in handling clients and improving other relationships. In the agreement mentioned above, the principle concerning data security, KYC, due diligence, and anti-money laundering guidelines have to be followed by the parties. The loan terms concerning the repayment have to be obeyed by the client. Perhaps by this system, the disbursement of the loan process would effectively develop.

Read our article:What are the Key Differences Between Fintech and NBFC?