A Complete Guide on the Conversion of NBFC into a Bank

Karan Singh | Updated: Apr 09, 2021 | Category: NBFC

Various firms in India are directed by different provisions. If a specific company is formed as a public or Private Limited Company and the primary objective of the company is to carry out monetary and banking services, then the company is recognized as NBFC (Non-Banking Financial Company).

The main governing authority for the conversion of NBFC into a Bank is the Reserve Bank of India (RBI). Banks are categorized under the Banking Regulation Act, 1949. But, a Non-Banking Financial Company is certified by the MCA (Ministry of Corporate Affairs) provisions and the RBI. Also in India, NBFC Registration is regulated by the Reserve Bank of India or RBI. Without the registration certificate, no one is allowed for operating such financial activities. When a Non-Banking Financial Company is converted into a bank, there would be lesser costing deposits, but once an NBFC converted into a Bank, there would be more funding. So to understand the procedure for the conversion of NBFC into a Bank, it is essential to know the meaning of the terms Bank and NBFC.

Table of Contents

What is an NBFC?

As per the RBI (Reserve Bank of India), a Non-Banking Financial Company is a company which is formed under the different provisions of the Companies Act, 2013[1]. A Non-Banking Financial Company (NBFC) can carry out various activities such as advances, loans, credits, acquisition of securities or bonds or shares or debentures or stocks issued by the Local Authority or Government of India. But, there are some activities that are not permitted to be carried out by a Non-Banking Financial Company. According to the meaning of the Reserve Bank of India (RBI), under Section 45 (1) (c), a banking entity or institute which carries out the business of a financial company would be assumed as a Non-Banking Financial Company (NBFC).

What is a Bank?

The importance of bank is represented under Section 5 of the Banking Regulation Act, 1949. Any company which is formed or established for the objective of lending or execute any form of investments in the form of money, money deposits, and repayable when asked by the public or its on-demand. A company that carries out all such activities is known as a Banking Company.

What are the Advantages of Conversion of NBFC into a Bank?

Following are some advantages of Conversion of NBFC into a Bank:

- More Reputation: A Non-Banking Financial Company converted into a bank would protect more reputation from the general public. All the different types of digital products can be promoted directly to the customer utilizing this procedure. Moreover, there can be direct marketing of products to customers who come and use the bank’s services.

- Accepting of Deposits: Extra amount of low-cost deposits can be accepted by a Bank when compared to that of a Non-Banking Financial Company. Bank services are for all different types of customers and not just only a particular group of customers. So, the low cost and interest-bearing deposits would be available to all types of customers.

- High Amount of Liquidity: When a Non-Banking Financial Company is converted into a bank, there would be high amounts of liquid funds available to customers. More customers would consider financing in the activities which are carried out by a bank. More investment in the company means more liquidity for the bank.

- Insurance Based Services: Once the conversion of NBFC into a Bank has done, then they can carry out other types of activities. Some of the services offered would be insurance-based services. But, the bank has to make sure to take prior permission and mandatory compliance from the IRDAI (Insurance Regulatory and Development Authority) regarding the same.

- Initial Public Offering: After the conversion of NBFC into a Bank, the bank can begin the procedure for an initial public offering. The bank must comply with the necessities of the SEBI (LODR) Regulations for carrying out this procedure. Reaching out to the general public as a bank is quicker when compared to that of a Non-Banking Financial Company.

- Company can Draw Cheques: A Non-Banking Financial Company cannot draw DD (Demand Drafts) and cheques. Generally, the customer would go to the bank to credit money in their accounts through the cheques drawn in favour of the payee. Such facilities are not permitted in a Non-Banking Financial Company. Therefore, the conversion of NBFC into a Bank would permit cheques to be drawn.

Eligibility Criteria for Converting NBFC into a Bank

Following is the list of important criteria that should be fulfilled before converting NBFC into a Bank:

- For a newly established bank, the minimum paid-up capital is Rs. 200 crores. The initial capital is increased to Rs. 300 crore within 3 years of the beginning of activities of the business of the bank.

- The total contribution of the promoters must be 40% of the paid-up money of the bank.

- The initial money which is provided for the purposes of liquidity can be taken by some form of private/public placements.

- Initially, the capital has to be Rs. 200 crores and after that, it has to increase up to Rs. 300 crores within 3 years of the beginning of the business. But, the promoters have to collect extra money, which will amount to 40% of the newly generated money.

- The capital will be locked for at least five years from the date of capital receipt by the bank.

- The bank should maintain on a regular basis a minimum Capital Adequacy Ratio (CAR) of 10%.

- The fresh bank would be omitted to open 25% of its semi-urban and rural branches.

- The headquarters of a new bank could be anywhere in India, as the promoters have agreed.

- The newly established bank should be regulated by the provisions of the Banking Regulation Act, 1949, RBI Act, 1934, other related laws and SEBI Regulations on public matters and other strategies regarding the banks listed.

- The suggested bank should maintain an arm’s length relationship with the promoter business entity and other branches.

- The relationship between the group of promoter business entities and the proposed bank will be like that between two individual and unconnected entities.

- As relevant to other domestic banks, the newly established bank would have to experience a priority sector lending target of 40% of net bank credit.

- The establishment of a mutual fund or a subsidiary will not be allowed by the newly established bank for at least three years from the beginning of the company.

- An industrial firm will not be funded by the newly established bank. However, separate companies that are indirectly or directly connected to huge industrial firms can be permitted to invest in the equity of a newly established private sector bank up to a limit of 10% that would not have managed interest in the bank.

Vital Documents Required for Converting NBFC into a Bank

Following are some vital documents required at the time of conversion of NBFC into a Bank:

- Submit a Certificate of Registration of the Company;

- Submit a copy of MOA (Memorandum of Association) and AOA (Articles of Association);

- Submit auditors report;

- Submit an approval letter from the Reserve Bank of India (RBI);

- Submit any information related to maintaining liquidity;

- Submit KYC (Know Your Customer) documents of member and directors;

- Submit Board Resolution related to the process of conversion;

- Summit any other relevant documentation as required by the RBI.

What is the Process of Conversion of NBFC into a Bank?

Following is the step by step process of conversion of NBFC into a Bank:

- A report associated with the practicality study has to be provided by the company or entity. Once the report is made, it is filed with the applicable regulatory authorities in the right manner. All the applications should have a report related to the feasibility study as provided by the bank. The product types which are provided by the bank, the technology used by the bank and other services offered by the bank should also be mentioned in the report.

- After filing the report, the Non-Banking Financial Company has to provide relevant details regarding the members, directors, and other management executives who are indulged in managing the procedures of the bank. If there is some type of foreign involvement here, then all the details related to the same should be provided.

- All the details linked with this have to be provided to the Reserve Bank of India. For the conversion of NBFC into a Bank, the Reserve Bank of India would take all the aspects which affect the procedure of conversion. All applications should be sent to an advisory committee which is established by the bank. This committee would examine the applications on a case to consider the necessities for the conversion of NBFC into a bank. After inspecting the application form, the advisory committee would make a decision concerning the approval or refusal.

- In case the application for the conversion of NBFC into a bank id permitted, then the bank has to immediately begin the activities of the business within a specified time. These operations are carried out to comply with the necessities of the significant law. If operations are not started within the given time of 1 year, then the approval would become invalid.

- After getting approval, if the application for the conversion has some extra necessities or alteration, then the RBI (Reserve Bank of India) would consider the same and grant consent. But, the Reserve Bank of India would offer some situations that have to be followed by the bank. If the conditions are not obeyed, then the status of approval would be cancelled by the RBI.

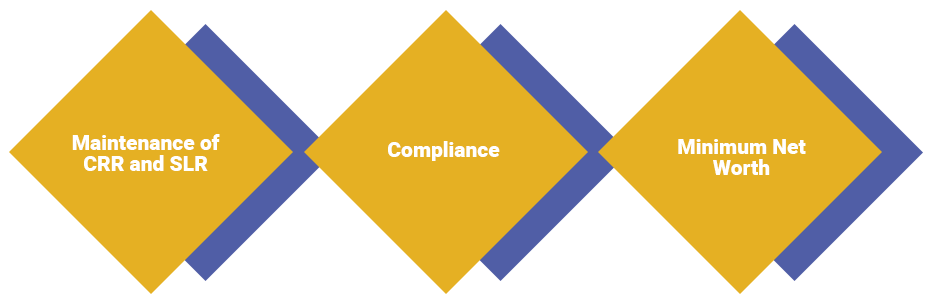

Necessities for Post Compliance for the Conversion of NBFC into a Bank

Following are some post compliance necessities for the conversion:

- Maintenance of CRR and SLR: Once the conversion procedure is completed, the bank has to make sure that the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) is maintained as per the necessities associated with the Reserve Bank of India.

- Compliance: The bank has to frequently observe any updates delivered by the RBI and other relevant authorities, affecting their business.

- Minimum Net Worth: Primarily, the bank must have a net worth of Rs. 200 crores for the beginning of banking activities. But, after 3 years of the beginning of this must increase more than Rs. 300 crores. Such necessities related to net-worth increase to Rs. 500 crores over time.

Conclusion

For the conversion, there should be consideration of a long-term plan. This depends on the business model of NBFCs. Non-Banking Financial Companies are currently not of a scale of discourage present banks. The impact shall be low, despite the threat of growing competition. NBFCs will also enjoy some decline the benefits of regulating in an unregulated field with focused disclosures. But, the services extracted by NBFCs may also be given by Banks.

Read our Article:A Complete Guide on the Roles of Reserve Bank in Acquisition of Control in NBFC