An Overview of Housing Finance Company and NBFC: Its Exemptions & Filing

Karan Singh | Updated: May 20, 2021 | Category: NBFC

In this article, we are going to focus on different provisions concerning NBFC and Housing Finance Company, its filing process, amendments, and exemptions. Companies Act 2013; Section 186 primarily highlights the entity’s right to make investment, security, and loan. So, to know the ambit of Section 186 of the Companies Act, 2013, we have first to understand the term “Investment.”

Table of Contents

Meaning of Investment Concerning the NBFC and Housing Finance Company

Under Section 186(1) of the Act, the following will be measured as an investment with a few irregularities:

- The purchase or subscription of shares;

- The purchase or subscription of warrants;

- The purchase or subscription of indistinguishable debt securities or debenture bonds.

Exceptions:

- The expenditure of advances or loans;

- Any financial transactions such as lease, receivables purchases, or other credit resources.

Why is it Necessary to Enact the Companies (Amendment) Act, 2017 for NBFC and Housing Finance Company?

Due to the inconsistencies in the earlier Companies Act, the Government changed the Act by registering the essential provisions. The Ministry of Corporate Affairs (MCA) represents the rectification job of the Companies Act, 2013 to a Companies Law Committee (CLC). Hence, the Companies (Amendment) Act, 2017 came into existence after taking the consideration made by the Companies Law Committee. Section 186 went through major changes amongst all alters made in the Companies Act.

Amendment Examination of Section 186

Section 186 was incorporated with some relaxations, and you can check the same below:

Section 186 (2) tells that no company can directly or indirectly provide any:

- Loan to any person or body corporate;

- Protection and guarantee in association with a loan to any individual or body corporate;

- Obtain by way of purchase, subscription or otherwise, the safety of any other body corporate.

More than 60% of its paid-up capital (share) along with reserves and the safety premium account, or 100% of its safety and reserve premium account, whichever is more.

The permission of the Board is compulsory for the expenditure of the security, advance, guarantee, or loan under Section 186(2). A similar necessity applies to investment activities. Please remember that a Board Resolution shows the member’s approval is obligatory for serving such purposes.

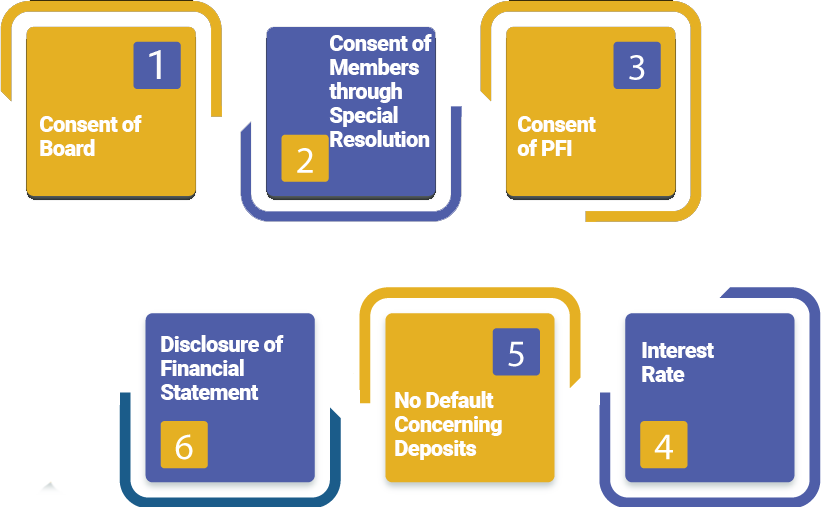

Highlighting Requirements Under Section 186

- Consent of Board

- The consent of the Board is required regardless of the amount of investment, loan, security, or guarantee.

- The consent of the Board should be united at the meeting of the Board.

- Simple resolution by the spreading or of the directors’ committee is not sufficient.

- Consent of Members through Special Resolution

1. Prior consent by such resolution is essential when the aggregator of the loan, security, investment, or guarantee is more than the prescribed limit under Section 186(2).

2. The limit should be higher from:

- 60% of the paid-up share capital and free reserves and premium securities account;

- 100% of free reserve and premium account for securities.

3. The special resolution should include the total amount up to which Board can allow the proposed investment, loan, guarantee, or security.

4. Exceptions:

- The company or an entity provides a loan to its WOS (Wholly Subsidiary Company or JV (Joint Venture);

- The company give security or guarantee to its WOS (Wholly Subsidiary Company or JV (Joint Venture);

- The holding company obtain the securities of its WOS (Wholly Subsidiary Company through subscription or otherwise.

- Consent of PFI

- Prior consent should be taken from the Public Financial Institution (PFI) from which it has taken a loan.

- Exceptions:

- The aggregate of loans, security, investments, or guarantee doesn’t surpass the prescribed limit.

- There is no defaulting in the repayment of loan instalments.

- Interest Rate

The interest rate must be more than the prevailing revenue of Government Security nearby to the loan period.

- No Default Concerning Deposits

The expenditure of loans, security, investment, or guarantee is not possible in the effect of earlier repayment defaults. Entities with a track record of repayment are capable of undertaking such activities.

- Disclosure of Financial Statement

The company should disclose all the details of investment made; a loan is provided, security or guarantee is given and the aim to be utilized by the recipient in their financial statement.

Section 186(11): Non-applicability of Section 186: According to Section 186(11), it is the only possible, where a loan or the guarantee or any investment or security is made by:

- Banking Company;

- Housing Finance Company;

- Insurance Company;

- A company concerned with the business of offering infrastructural companies or Financing of Companies.

Section 186(1) will not come into effect if the investment made by the given entities:

- An entity whose primary business is the acquisition of share, stock, debenture, or other securities;

- An NBFC;

- It is compulsory to take former investment into account while making an investment in Right Share u/s 62(1)(a) of the Companies Act, 2013[1].

Investment Company mentions to a company that is concerned with a business of procuring shares, debentures, and securities. If the company’s assets exist in the form of debentures, shares, or other securities identical to 50% of its assets, earning is from the investment business includes 50% of its total income. In the next segment, we are going to talk about the inference of Chapter IIIB of the RBI Act, 1934 on the NBFC and Housing Finance Company.

Exemptions are given out by RBI to NBFC and Housing Finance Company

The RBI has got rid of prescribed exemptions for Housing Finance Companies and routed them to an equal level to NBFCs (Non-Banking Financial Companies). It looks that new improvement in Finance Act, 2019 has inspired them to undertake such measures. It is worth nothing that the said Act governs the Housing Finance Companies in India.

Also, RBI has confirmed that the Chapter IIIB of the RBI Act, 1934 would no longer applicable to the NBFC and Housing Finance Company. In August 2019, this peak institution conferred HFCs (Housing Finance Companies) with the status of non-banks.

Conclusion

The Amendment Act, 2017 combined all the essential provisions that were not comprised in the former Act. In discussion with CLC, MCA has made this Act more practical for the NBFC and Housing Finance Company. Apart from that, the Reserve Bank of India (RBI) has also affirmed the withdrawal of definite exemption concerning Housing Finance Companies and included it in the classification of non-banks.

Read our article:NBFCs request RBI for Restructuring Loans and Fresh Liquidity Support during Covid-19