Ideal NBFC Software: Authorising NBFCs to Simplify Workflow

Karan Singh | Updated: Jun 11, 2021 | Category: NBFC

The Non-Banking Financial Company sector is flourishing at a quick speed. NBFCs are the financial path that facilitates financial services and banking services without having a banking license. Non-Banking Financial Companies delivers services like credit facilities, acquisition of shares, Peer 2 Peer Lending, credit facilities, etc. Non-Banking Financial Companies are playing a crucial role in the development of India. To fasten the growth of the Indian economy, these companies require adapting advanced technologies and programs comprising ideal NBFC Software.

Table of Contents

What are the Features of Ideal NBFC Software?

An Ideal NBFC Software authorises Non-Banking Financial Companies in building robust operational infrastructure & service portfolio. This software also makes sure the flawless management of their database. Following are the significant features of an ideal NBFC Software:

- Simplify the management system;

- Preparing disbursement of loan text file according to the bank format;

- Versatile, Precise, and user-friendly;

- Automates the management system of the loan;

- Make sure the top level of security or protection;

- Supervises PDD or Pending Document Tracking;

- Conveys data-driven information on due payment & interest on loan amounts;

- Real-time tracking on client’s questions and existing service, comprising insurance;

- Provide subtle estimation of penalties or late fees.

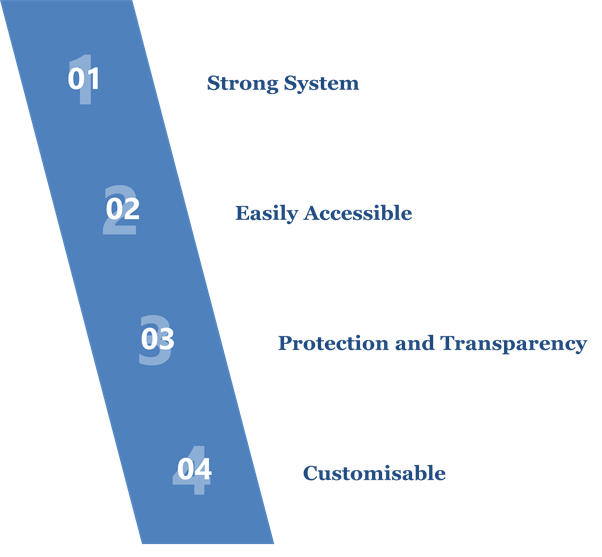

Benefits of Leveraging Ideal NBFC Software

Automation is the next huge thing for financial entities that seek improved experience of the customer. After executing ideal NBFC software, the private lenders can get the following benefits:

- Strong System: NBFC Software makes sure flawless management of complex database with its strong aspects. Reports arranged in the software can be easily transferred to the MS Office files for upcoming references. Estimation of loan EMI also becomes more delicate with the NBFC Software.

- Easily Accessible: This software also delivers remote accessibility aspect to the customer all around the country. It aids in ensuring rapid turnaround time and increase client’s satisfaction rate. Also, it offers timely intimation to customers concerning the due payment through SMS and Email. This software’s multi-user system provides prompt access to customers & confirms transparency with the operations of the NBFC.

- Protection and Transparency: Protection & transparency always remains a primary subject of concern for Non-Banking Financial Companies. An NBFC Software grips a high level of encryption, thereby confirming unparallel security for the database of Non-Banking Financial Companies. This software permits the admin to sets the accessibility of data for each user group. It also lets customers open their private accounts by creating login credentials. The software is easy to impart & install transparency in operations.

- Customisable: This software can be adjusted as per the requirements of the user. Apart from this, the software permits you to add new functionalities to the system as the entity spreads portfolio. Exposure to the modified mobile apps is also helping customers to get services with a minimum of inconveniences.

Importance of Ideal NBFC Software in Current Scenario

Non-Banking Financial Company software is strong, easy to use, user-friendly and intelligent equipment that runs on the latest technology and seeks minimal human intervention. Non-Banking Financial Company avails of the following benefits from the software:

- E-KYC: The overhead price linking to the clients KYC[1] can be reduced after installing this software. The use of E-KYC increases the verification process and improves full efficacy.

- Loan Management: This software rapidly overcomes the possible errors that are accountable for delayed loan processing. It helps experts & professionals twist the loan services as per the requirements of the customer. It also gives a correct loan figure amount after processing the given input and auto-generates receipts for repayments.

- Minimum Documentation: This software helps Non-Banking Financial Companies overcome needless paperwork and increase the loan process and sanctions. The inclusion of the software authorises Non-Banking Financial Companies to provide hassle-free credit to the clients.

- Track Defaulters: The NBFC software regularly keeps the tracking of defaulters accountable for non-payment or delay. The software enables firms to check the details of the customer more efficiently and identify the defaulters.

- Arranged Management: The firm’s data merged on cloud storage reduces illegal access to sensitive information.

In What Logic NBFC Software Develop the Loan Management?

The NBFC Software enables the entity to control the loan services effectively through data-driven information. Following are the various facts of a loan management system that can be efficiently controlled by the software:

- Credit Analysis;

- Automation collection of EMI;

- Approval System;

- The management system of the document;

- EMI Calculation;

- Client dashboard to check the loan status, EMI schedule, etc.;

- End to end disbursement management;

- Online application for loan eligibility.

Hence, we can end by saying that the NBFC Software delivers the error-free and seamless processing of loan applications.

Conclusion

The non-adoption of the current technology can put any entity in a stressful condition, considering the existing market trends & client choice. With so many clients at the doorsteps, entities always find it difficult to consider them with seamless facilities. Automation keeps them ahead of possible delays & authorises them to facilitate quality services to the clients.

Execution of Non-Banking Financial software can provide a win-win suggestion for the private lenders of this nation. Apart from reorganising the workflow, this software is very good at regulating a varied portfolio of financial products. Also, it provides data-driven information to the expert for finding the pain point within the system.

Read our article:Buying and Selling of NBFCs in India – An Overview