Important Features of Import Export Code

Japsanjam Kaur Wadhera | Updated: Dec 18, 2020 | Category: IEC

With the passage of time, the companies are contributing towards the development of the nation by expanding their business throughout the world. All the Indian companies carrying out import and export activities in India are required to obtain Import Export Code (IEC). IEC registration is compulsory, and no business can involve in the activities of import and export without the IEC License. Therefore, important features of import and export code shall be discussed in this article.

Once a business obtains IEC, it can be utilized by it throughout its existence and does not necessarily require any renewal.

Table of Contents

Why there is a need for Import Export Code?

The importers and exporters need Import Export Code in the following situations: –

- To clear the shipments from the customs required by the customs authorities, it is necessary for the importers to obtain Import Export Code.

- To send the funds via banks, the banks require the importers to provide Import Export Code.

- To clear the shipments the customs port require the exporters to provide Import Export Code.

- To receive funds in foreign currency transferred by exporters via bank, the bank requires the exporters to provide Import Export Code.

Import Export Code (IEC) Registration

In order to apply for the import export code, the following procedure must be followed: –

- The applicant is required to file an online IEC application form in the format Aayaat Niryaat Form no. 2A with the Director General of Foreign Trade (DGFT). Otherwise, it can also be done at the Regional office of DGFT offline.

- All documents are required to be submitted, including DSC and bank details.

- On the payment of the prescribed registration fee, the Import Export Code will be allotted and the application is going to be processed further.

- Upon the verification of the application and documents by the authorities, the applicant shall be granted with the Import Export License as a soft copy.

What are the documents that are required for the registration of Import Export Code?

The documents that are required for the IEC registration are: –

- PAN Card of the company or the individual

- Copy of Aadhar Card, Voter Id or passport of the individual or the company

- Passport size photograph

- Current bank account statement of the company or personal savings account

- Address Proof (requiring a copy of lease deed or rent deed, electricity or phone bill, sale deed)

- Incorporation Certificate or Partnership deed

- Copy of Cancelled cheque of the current bank account of the company or firm or proprietor.

- Copy of RBI[1] approval if the applicant has a non-resident interest in the firm or the company or he is a non-resident Indian (NRI)

- A net banking account or credit or debit card for online payment of government fees, that is, Rs. 500.

- Details of the proprietor if it is a company and details of partners if it is a firm or director

- DSC of the members of the firm for submission.

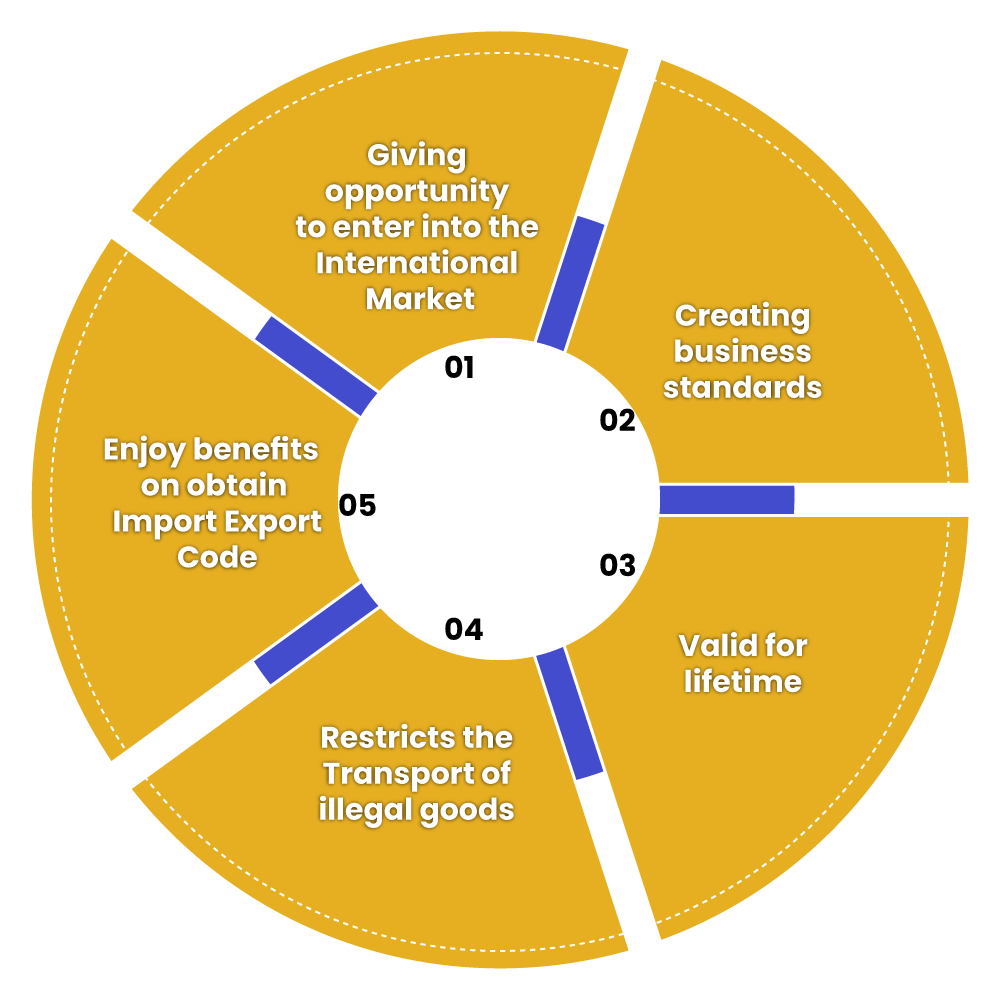

What are the Features of Import Export Code

Import and export code provides many opportunities to the businesses who wish to expand their business globally. Not only the expansion provides growth and development to your business, but it also brings out a certain level of standard and reputation to that business. Therefore, the important features of Import Export Code are: –

1- Giving Opportunity to enter into the International Market

The import export code is required for the import and export of business. It gives the opportunity to the people to reach out and unlock the international markets. It helps the businesses to enhance and upgrade their business quality and take it to a new level.

2- Creating business standards

One of the key features of import export code is that it helps to establish business standards as the business is reached out globally. It helps to maintain a healthy business relationship between the clients.

3- Valid for lifetime

The import-export code has a validity of a lifetime and thus it comes under the key features of import and export code. A business once obtains an IEC can enjoy its validity and utilize it till the time it exists. The unique 10 digit code does not need any renewal.

4- Restricts the Transport of illegal goods

According to the instructions and requirements to obtain import-export code, it is necessary to provide authentic information to the concerned authorities. A person cannot obtain an IEC unless he does not provide authentic information. Therefore, it helps to reduce or restrict the transport of illegal goods by the people.

5- Enjoy benefits on Obtain Import Export Code

Another aspect that comes under the key features of the Import Export Code is that a company or an individual can enjoy many benefits once it obtains import-export code for its business. It can get benefits on Import-Export from Export Promotion Counsel or Director General of Foreign Trade (DGFT) etc. One can also claim a refund of taxes paid at the time of exporting the goods.

Eligibility to obtain Import Export Code

Any time of business, whether Partnership firm, Sole Proprietorship, Charitable Organization and Private Limited Company can register for Import Export Code while dealing with import and export of goods.

However, import-export code is not required if the goods are for personal use and not connected with trade, agriculture or manufacture.

Conclusion

Import Export Code is mandatory for those businesses that are willing to expand their business throughout the world. With the growth and development of the new industries, import-export code helps the business to grow and form new changes with the requirements of the people. Because of the important features of the import export code, this 10 digit code can be used by the businesses to carry out their trade without any renewal of it, as it is valid for a lifetime. Once the business obtains IEC, it can involve in import and export of goods and services with no issues.

Also, Read: GST Department Cannot Block Import Export Code: Bombay HC