What to do if Your IEC Application is Rejected?

Japsanjam Kaur Wadhera | Updated: Dec 30, 2020 | Category: IEC

The Import Export Code (IEC) is issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries. For the individuals and companies to expand their business globally, it is mandatory to obtain IEC code for trading goods and services. The Import Export Code is a 10 digit code issued by DGFT and the purpose of issuing import export license is to monitor and regulate the foreign trade activities in India. But sometimes during the registration of IEC code, the application gets rejected on various grounds. Therefore, this article will discuss about what to do if your IEC application is rejected in the course of the registration procedure.

The trade of goods across international borders has to be done by acquiring the mandatory IEC License.

Table of Contents

Procedure for IEC Registration

- The first step for the registration of the IEC code is to visit the DGFT website[1] and click on the service tab.

- The applicant is required to fill the details regarding his PAN Card number.

- Once the PAN Card details are submitted, further details are to be filed such as date of birth, name, and incorporation details etc.

- Once the PAN card is verified, phone number and email id has to be provided to receive OTP.

- A 20 digit e-com reference number is provided as a unique identifier for the application, to the applicant.

- Further, information regarding import export business entity is required to be given by the applicant.

- Payment through debit or credit card or net banking has to be made by the applicant after uploading all the documents supporting the application.

- The information provided by the applicant shall appear on a window in ANF-2A Form.

- E-certificate on the registration of IEC code shall be received by the applicant with 15 days from the date of the submission of the application.

Documents required for IEC Registration

- Aadhar Card, Voter Id or Passport of the applicant

- Photograph of the applicant

- PAN Card of the individual or the company

- Certificate of Incorporation, Partnership Deed, Sale deed, Bank Certificate

- Copy of cancelled cheque

- Articles of Association (AOA), Memorandum of Association (MOA)

Why is IEC Registration needed?

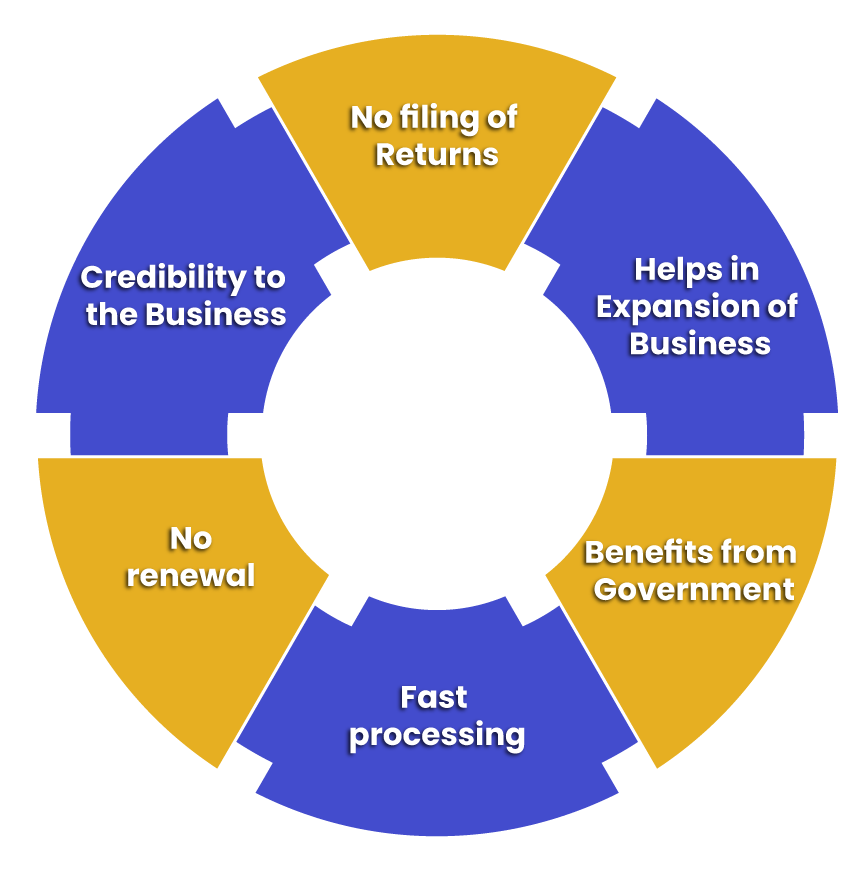

Once the IEC code is obtained, it provides many benefits to the individual or a company. The following as some of the benefits that would explain why IEC registration needed:

No filing of Returns

Once the IEC registration is done, it frees the individual or a company from a lot of paperwork and saves time as well. There is no need to file returns with DGFT.

Helps in Expansion of Business

Once the IEC registration is done, the individual or a company can easily expand its business globally without any hindrance.

Benefits from Government

Upon the IEC registration, the individual or a company gets the benefits from the DGFT, customs, export promotion council etc.

Fast processing

Since the registration for IEC code can be done online now, it is much easier to process the application. It takes around 10 to 15 days to process the application and get the IEC Code.

No renewal

Once the IEC code is obtained, there is no need to renew it. The IED Code remains valid for a lifetime once obtained.

Credibility to the Business

The IEC code registration provides credibility and authenticity to the business. it adds guarantee that the business is authentic and helps it to expand and grow.

Why is IEC Application Rejected?

Even though all the documents are submitted, there can still be reasons for which IEC application is rejected. The IEC application is rejected if the application form is submitted in an incomplete manner. The following errors or discrepancies may result into the rejection of IEC Application:

- Mismatch of the company name with the PAN Card.

- Name wrongly entered.

- Bank details provided are not correct.

- Any changes in the business not updated yet.

In either of these cases, the IEC application is rejected. Therefore, it is necessary to file the application form correctly along with the submission of all necessary documents.

What happens when IEC application is Rejected/ in case of no IEC?

If the IEC application is rejected, the business cannot run seamlessly. It would become more difficult to engage in import and export of goods and services. And more importantly, a hefty penalty has to be faced for the same by the individuals or the companies engaged in import export business. It is always advisable to register for IEC code for the business who wishes to engage in import export trade. Since the IEC application is rejected on the grounds discussed above, it is the responsibility of the individual or the company to scrutinize the application well, before its submission. This also leads to save time.

In the situations where for example a business location is changed or if in a partnership firm, the partnership firm has dissolved or modifications are required in the registered mobile number and email id, then in such cases there is a need to apply for the IEC code. IEC code helps to prevent a situation where IEC application is rejected. The individuals and companies must apply for the IEC code to minimize chances of hindrances or any situation where IEC application is rejected.

Conclusion

It is quite obvious that in any situation that anyone expects to maintain the business comprehensively, it is advisable to obtain IEC code from the Directorate General of Foreign Trade (DGFT). Without the IEC license, it shall be illegal to carry the business of Import Export in any condition. Also where it is equally important to prevent any situation where IEC application is rejected, it is the much responsibility of the individual or the company to scrutinize and submit a complete and correct application form for the registration of the IEC code.

Since obtaining the IEC certificate is not that typical. However, the procedure is quite simple and many advantages are provided upon its registration.

Also, Read: GST Department Cannot Block Import Export Code: Bombay HC