Is it Necessary to Register a Partnership Firm?

Japsanjam Kaur Wadhera | Updated: Dec 15, 2020 | Category: Partnership Firm

Section 58 of the Indian Partnership Act, 1932 states that the registration of a firm can be done at any time( not necessarily at the time of formation but subsequently also) by filing an application with the registrar of the firm at the place of business or the firm situated or proposed to be situated. But the important question that arises is whether it is necessary to register a partnership firm in India or not? Part VII of the Partnership Act does not necessitate the compulsion to register a partnership firm. However, the registration of a partnership firm has many advantages.

This article will help you to understand the benefits of a partnership firm and the advantages that it can have if it is registered under the Partnership Act.

Table of Contents

What is Partnership?

The partnership is defined as a relationship between two or more persons who have agreed to share the profits and losses of a business managed by all of them or any one of them acting for all. The owners under a partnership firm are separately known as the “partners” and collectively a firm. The partnership firm is governed and controlled by the rules contained in the Indian Partnership Act, 1932.

Why Partnership Firm Registration is Important?

Under Part VII of the Indian Partnership Act, 1932[1] the registration of a partnership firm is not compulsory. However, it can be done in order to avail the benefits of Registration. It is on the decision of the partners to register the firm and there are no penalties for non – registration.

Advantages of Partnership Firm Registration

A partnership firm is one of the most preferred forms of starting a business in India because of its simplicity. There are many advantages that the partners can enjoy upon the registration of the partnership firm. Some of the advantages are as follows: –

Right to Sue the Firm or a Partner

A partner in a registered partnership firm has a right to file a suit against the said firm or any partner within the firm. Such a right is also specified under the Partnership Act which states that a partner whose name is entered into the Registers of the firm as a partner in the firm; has a right to file a suit.

Right to Sue Third Party

A registered partnership firm has a right to file a suit against a third party when the registration of the firm is done and the persons suing is entered into the registers of the firm as a partner in the firm.

Claim a Set-off

The partners or the firm can claim a set-off under a registered partnership firm. A set-off means a mutual adjustment of debts owed in a dispute with a third party.

Effects of Non-Registration

Section 69 of the Partnership Act deals with the effects of non-registration which refuses or denies certain rights to an unregistered firm such as: –

- A partner of an unregistered firm does not have right to file a suit against a firm or other partners in any court for the enforcement of any right arising from a contract or a right is granted by the Partnership Act unless the firm is registered under the act and the person suing is or has been shown in the Register of firms as a partner in the firm.

- A suit to enforce a right arising from a contract shall not begin in any court by or on behalf of a firm against any third party unless the registration of the firm is done and the person suing is or has been shown in the Register of partnership firms as a partner in the firm.

- A partnership firm which is not registered and any of its partners cannot claim a set-off. A set-off means a mutual adjustment of debts owed in a dispute with a third party.

Therefore, every partnership firm finds it advantageous to get itself registered under the Partnership Act sooner or later.

What does Non-Registration not effect?

Non – registration does not affect the following things: –

- Any set-off, claim or suit which does not exceed one hundred rupees in value.

- The right of the third party to sue the partners or the firm

- The firm or partners in the firm whose place of business in the said territory is situated in the areas to which the act does not apply or which have no place of business in the territories to which this Act extends.

- The enforcement of any right to sue for accounts of a dissolved firm or to sue for the dissolution of a firm or any power or right to realise the property of a dissolved firm.

- The powers of a receiver, official assignee or court under the Presidency- Provincial Insolvency Act, 1920 or Towns Insolvency Act, 1909, to realise the property of an insolvent partner.

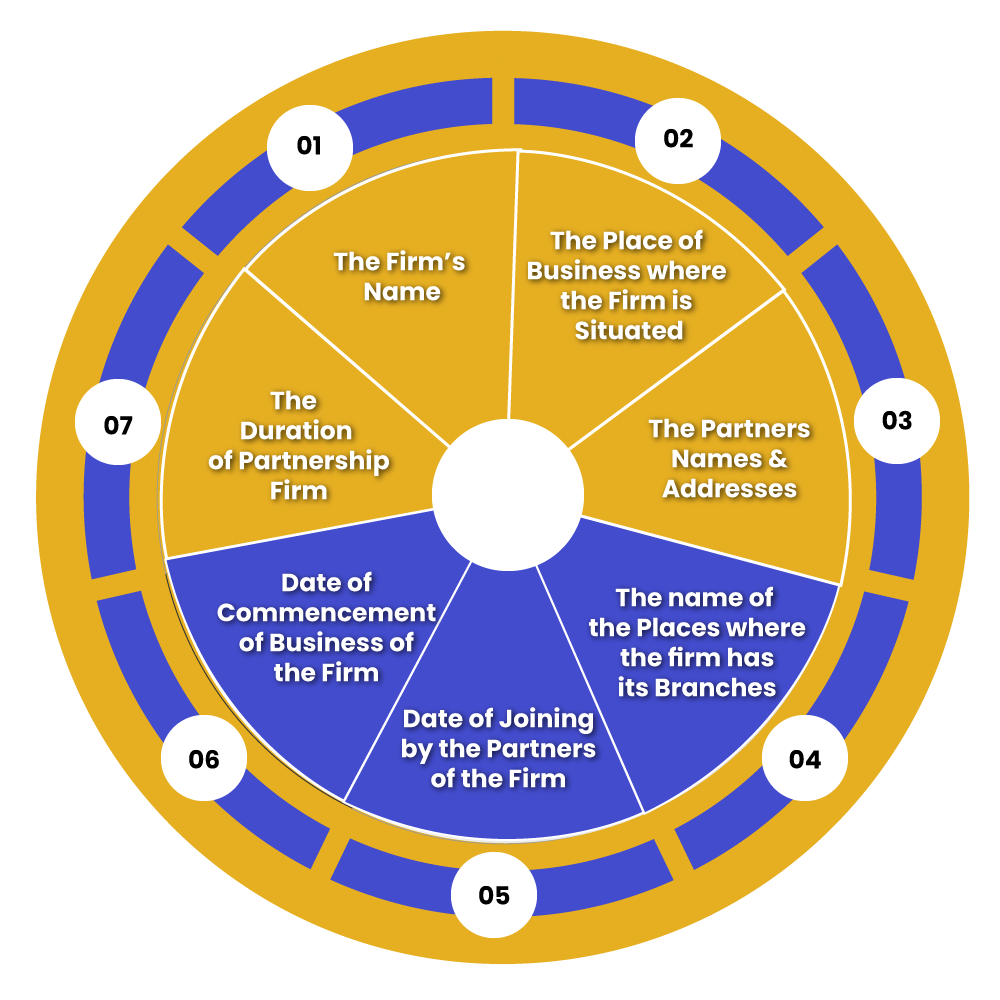

Procedure to Register a Partnership Firm

The registration of a partnership firm can be done by providing the following details and information to the Registrar of the firms: –

- The Firm’s Name

- The Place of Business where the Firm is Situated

- The Partners Names & Addresses

- The name of the Places where the firm has its Branches

- Date of Joining by the Partners of the Firm

- Date of Commencement of Business of the Firm

- The Duration of Partnership Firm

The statement of all the information stated above must be submitted by the partners, signed by them and along with the prescribed fees. The Registrar shall, upon the satisfaction of the statement shall make an entry of it in the register and shall file the statement.

Conclusion

The Indian Partnership Act, 1932 ensures the registration of a partnership firm without making it compulsory. It is not obligatory to register a partnership firm but a firm can enjoy many advantages that the Partnership Act provides upon its registration. Therefore, registration of a partnership firm protects the firm and its partners from the effects that it would have if it is not registered.

Also, Read: How Is Nidhi Company Different From NBFC: A Complete Guide