How Is Nidhi Company Different From NBFC: A Complete Guide

Shivani Jain | Updated: Dec 12, 2020 | Category: Nidhi Company

In India, the process of incorporation of a Nidhi Company requires less capital in comparison to the incorporation of an NBFC. Further, it shall be relevant to mention that a Nidhi Company enjoys undeniably greater advantages than an NBFC. However, at the same time, there are some restrictions wherein a Nidhi Company cannot perform activities that of an NBFC. In this blog, we will discuss the concept How is a Nidhi Company different from an NBFC?

Table of Contents

Concept of Nidhi Company

The term “Nidhi Company” denotes a business format that is governed and regulated by section 406 of the Companies Act 2013[1]. It is a business structure that is incorporated with the aim to encourage the habit of saving and thrift among its members. Also, a Nidhi Company receives deposits and lends money to its members only.

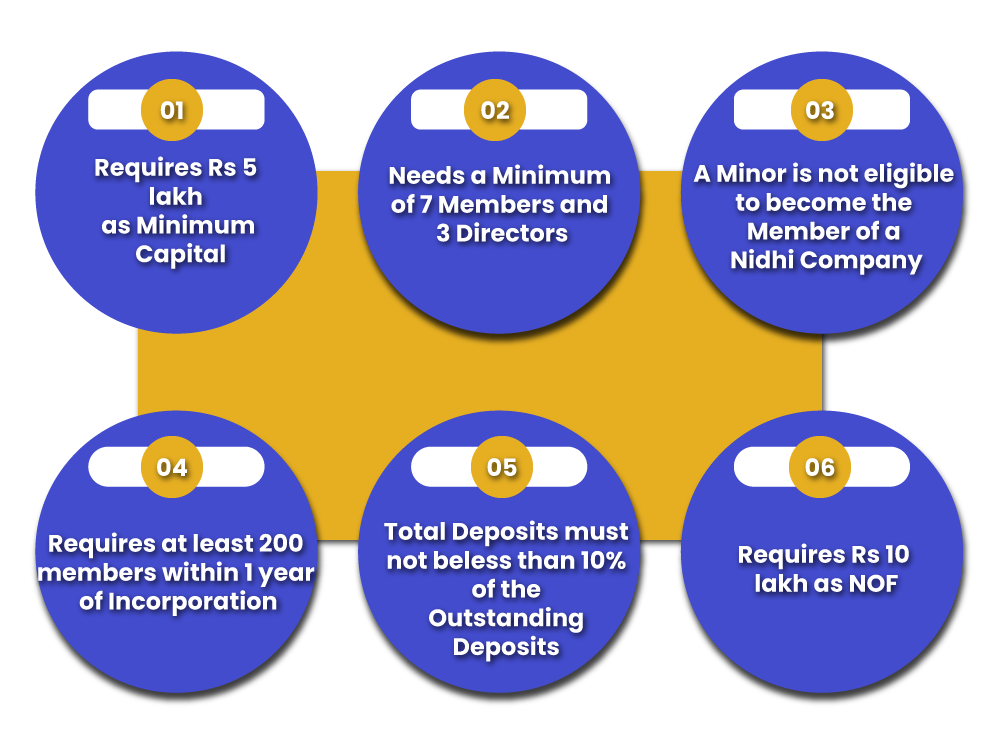

Key Requirements of Nidhi Company

The key requirements of a Nidhi Company are as follows:

- Requires Rs 5 lakh as Minimum Capital;

- Needs a Minimum of 7 Members and 3 Directors;

- A Minor is not eligible to become the Member of a Nidhi Company;

- Requires at least 200 members within 1 year of Incorporation ;

- Total Deposits must not be less than 10% of the Outstanding Deposits;

- Requires Rs 10 lakh as NOF (Net Owned Fund);

Concept of Non Banking Financial Company

The term NBFC or Non-Banking Financial Company or NBFC denotes a company that is incorporated under the provisions of the Companies Act 2013. The main aim of this business format is to offer long term and specialized credit services to the customers. Further, it shall be relevant to state that a Nidhi Company works for the benefit of its members. In contrast, an NBFC registration works to fulfil the financial needs of the weaker section of the society.

Key Requirements of NBFC Company

The key requirements of an NBFC Company are as follows:

- Needs to be Incorporated under the provisions of the Companies Act 2013;

- Requires Rs 2 crore as Minimum Net Owned Fund;

- Business Activity must be defined under section 45I (a) of the RBI Act 1934;

How is Nidhi Company Different From NBFC?: Difference

The key factors on which a Nidhi Company is different from NBFC are as follows:

Objective behind Incorporation

Nidhi Company

Nidhi Companies are incorporated with an aim to inculcate the habit of thrift and savings among its members and to satisfy their financial needs.

NBFCs

The main behind the incorporation of an NBFC is to provide financial assistance to the small businesses and weaker sections of the society. Therefore, NBFC, as a business structure, plays a crucial role in the growth of the economy.

Eligibility to Conduct any Other Business

Nidhi Company

A Nidhi Company is not allowed to undertake any other business transaction, such as Chit Fund, Lending Business, and Hire Purchase, etc., It is allowed to undertake only those activities and transactions that are covered under Nidhi Scheme.

NBFCs

An NBFC can carry out the activities of Hire Purchase, Chit Fund, and Lending Business, etc.

Right to Acquire Securities

Nidhi Company

In India, a Nidhi Company cannot acquire or buy securities in the form of stocks or shares that has been issued by the company.

NBFCs

In contrast, a Non-Banking Financial Company or NBFC can acquire securities in the form of stocks and shares.

Need for RBI Approval

Nidhi Company

There is no need for a Nidhi Company to obtain prior approval from RBI regarding the commencement of Business Activities.

NBFCs

In contrast, an NBFC does require prior approval from RBI regarding the commencement of Business Activities.

Issuance of Debentures

Nidhi Company

A Nidhi Company is not eligible to issue debentures to third parties.

NBFCs

An NBFC can issue debentures to the third parties.

Issuance of Preference Share Capital

Nidhi Company

A Nidhi Company is not eligible to issue preference share capitalto its members.

NBFCs

An NBFC can issue preference share capital to its members.

Open a Current Bank Account

Nidhi Company

A Nidhi Company is not allowed to open a current bank account in its name by the government.

NBFCs

An NBFC can open a current bank account in its name.

Compulsory Conditions

Nidhi Company

In India, a Nidhi Company is permitted to have branch offices only till the time it earns profit continuously for a period of 3 years.

NBFCs

There is no such condition or restriction applicable to an NBFC.

Brokerage and Incentives

Nidhi Company

A Nidhi Company is eligible to pay Incentives and Brokerage while receiving deposits and granting loans to its members. However, it shall be pertinent to note that only on the basis of a fixed salary, a Nidhi Company can employ people.

NBFCs

There is no such condition or restriction applicable to an NBFC.

Process of Registration

Nidhi Company

The process of Nidhi Company Registration involves comparatively fewer compliance requirements than an NBFC.

NBFCs

The process of NBFC Registration is not only lengthy in nature but involves a lot of compliance and intricacies as well.

Operations outside the Registered State

Nidhi Company

A Nidhi Company acts as a brand within a state and is not allowed to carry out operations anywhere other than the registered state.

NBFCs

An NBFC is eligible to operate PAN India.

Eligible to Enter into Partnership

Nidhi Company

In India, for the purpose of lending and borrowing, a Nidhi Company is not eligible to enter into a partnership with any other business format.

NBFCs

There is no such condition or restriction applicable to an NBFC.

Net Owned Fund Requirements

Nidhi Company

A Nidhi Company requires a minimum of Rs 10 lakhs as NOF (Net Owned Fund).

NBFCs

An NBFC requires a minimum of Rs 2 crores as the Minimum NOF (Net Owned Fund).

Capital Investment Requirement

Nidhi Company

A Nidhi Company requires comparatively less capital investment than an NBFC.

NBFCs

A Non Banking Financial Company requires a lot of amount as capital investment for its incorporation.

Requirement of Advertisement

Nidhi Company

In India, a Nidhi Company is not eligible to advertise itself for accepting deposits.

NBFCs

An NBFC is permitted to advertise its services and operations to accept or issue loans, deposits, etc.

Conclusion

In a nutshell, the concept of Nidhi Company is slowly emerging in India on a big scale due to its undeniable benefits and advantages. However, at the same time, it shall be relevant to state that there are certain restrictions as well that significantly affect its growth level.

Also, this business format deals only with the financial needs and deposits of its member. In contrast, NBFCs are incorporated to satisfy financial needs on a larger platform.

Therefore, it can rightly be stated that a Nidhi Company works on the concept of Mutual Benefit, whereas an NBFC operates on the concept of communal benefit.

Lastly, in case of any other doubt or perplexity, reach out to Swarit Advisors, our proficient and skilled experts will cater to all your needs regarding Nidhi Company Registration and NBFC Registration.

Read our article:Is it Possible to Make Members in Nidhi Company: Step by Step Guide