New FAQs Issued By CBDT On Vivad Se Vishwas Scheme 2020: Key Highlights

Shivani Jain | Updated: Jan 06, 2021 | Category: News

Recently, the apex body CBDT (Central Board of Direct Taxes) has issued a Circular No 21/ 2020, dated 04.12.2020, regarding the FAQs and Clarifications on some vital and crucial issues in the New FAQs Issued By CBDT On Vivad Se Vishwas Scheme 2020

Further, it shall be relevant to state that the said FAQs are in continuance to the earlier Circular No 9/ 2020, issued on 22.04.2020, containing questions 1 to 55. Furthermore, this circular contains question from 56 to 89.

Also, it needs to be taken into consideration that the due date prescribed by CBDT for filing of income tax returns or tax disputes under the Vivad se Vishwas Scheme 2020 as 31.12.2020 and the declarants can pay the amount of disputed tax without any penalty or the additional amount by 31.03.2021.

In this blog, we will deal with the key highlights of the New FAQs issued by CBDT on Vivad se Vishwas Scheme 2020.

Table of Contents

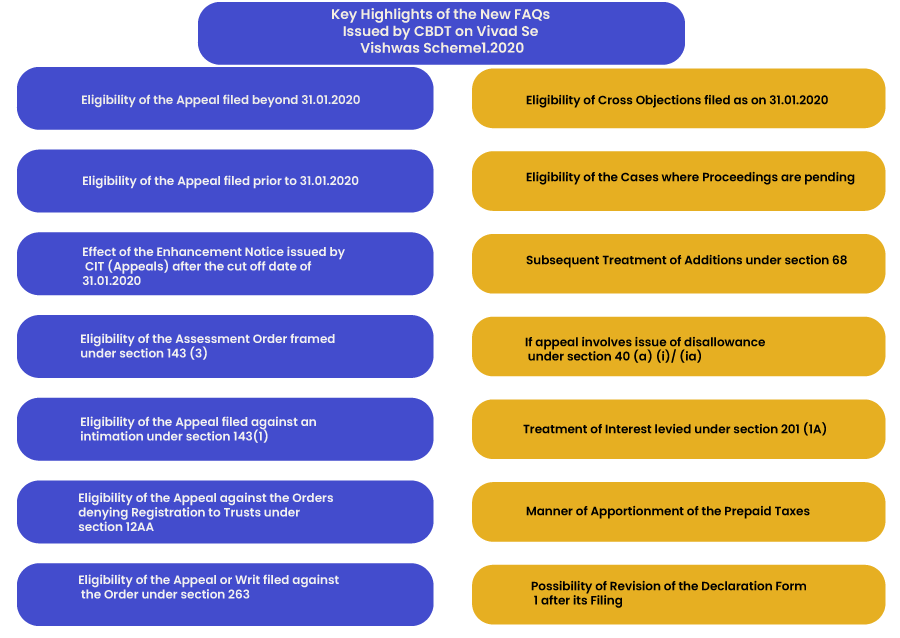

Key Highlights of the New FAQs Issued by CBDT on Vivad Se Vishwas Scheme

The key highlights of the new FAQs issued by CBDT on Vivad se Vishwas Scheme 2020 are as follows:

Eligibility of the Appeal filed beyond the cut off date of 31.01.2020

It has been clarified by CBDT in its Circular that if the time period for filing an appeal has expired during the tenure of 01.04.2019 to 31.01.2020, (including both the dates), and the application for the condonation of delay is furnished before 04.12.2020, starting from the date of issuing of CBDT Circular, and the appeal is admitted by the respective appellate authority prior to the date of filing of declaration (the last date for declaration form 1 is 31.12.2020), then, in that case, such an appeal will be considered to be pending as on 31.01.2020, and the same will be eligible under the provisions of the Vivad se Vishwas Scheme 2020.

However, in the case, where the appeal filed is beyond the cut off date of 31.01.2020, with the condonation of delay application, but the same has not been admitted or rejected by the concerned appellate authority, then, in that case, the same will not be eligible under the provisions of the Vivad se Vishwas Scheme 2020. Further, the same will apply in the case where such condonation application has been duly approved by the appellate authority after 31.12.2020.

Eligibility of the Appeal filed prior to the cut off date of 31.01.2020

It has been explained by the CBDT[1] (Central Board of Direct Taxes) in the circular that where an appeal has been furnished before the cut off date, i.e., 31.01.2020, but the same has been disposed of by the respective appellate authority, against the assessee after 31.01.2020, then, in that case, the same will be eligible as well under the Scheme. Further, the disputed tax payable under the said scheme will be calculated with reference to the position of the appeal on 31.01.2020

Effect of the Enhancement Notice issued by CIT(Appeals) after the cut off date of 31.01.2020

In case the CIT (Appeals) issues the Enhancement Notice after the cut off date of 31.1.2020, but prior to the date of issuance of the CBDT Circular, i.e.,04.12.2020, then, in that case, the same shall be required for determining the disputed tax payable under the provisions of the CBDT on Vivad se Vishwas Scheme 2020.

However, to ensure fair play and justice to all the assessees, CBDT has further provided that if the Enhancement Notice is issued on or after the date of issuance of Circular, i.e.,04.12.2020, then, in that case, the same will not be taken into account for calculating the disputed tax payable under the provisions of the Scheme.

Eligibility of the Assessment Orderframed under section 143 (3)

CBDT has clarified in its circular that such a case will be considered as “Search Case” and consequently the set threshold limit of Rs 5 crores of the disputed tax payable will apply.

Eligibility of the Appeal filed against an intimation under section 143(1)

CBDT has clarified in its circular that if an appeal has been filed against intimation under section 143(1) of the Income Tax Act, then, in that case, the same will be eligible under the Scheme only if the adjustment has been made under sub clauses (iii) to (vi) of the clause (a) of section 143(1) of the Act.

Further, the adjustments made under these subclauses are as follows:

(iii) Disallowance of the loss claimed if in case the return of the previous year for which the set off of loss is demanded was furnished beyond the date specified under 139 (1);

(iv) Disallowance of the expenditure specified in the audit report, but the same has not been taken into account for computing the total income;

(v) Disallowance of the deduction claimed under various sections, such as 10AA, 80 IA, 80 IAB, 80 IB, 80 IC, 80 ID or section 80 IE, if the said return is furnished beyond the date specified under section 139 (1); or

(vi) Addition of the income shown in Form 16 A or Form 26 AS or Form 16, if the same has not been included while calculating the total income in the return;

However, the adjustments made under sub clauses (i) and (ii) of the clause (a) of section 143 (1) of the Act, are not qualified to be settled under the provisions of the Scheme.

The adjustments made under these sub clauses are as follows:

(i) Any arithmetical error in the Income Tax Return;

(ii) An incorrect claim, if the same is apparent from any information or detail furnished in the return.

Eligibility of the Appeal against the Orders denying Registration to Trusts under section 12AA

CBDT has clarified in its circular that if an appeal filed against the order denying the Registration to Trusts under section 12AA is not qualified to be settled under the provisions of the Vivad se Vishwas Scheme 2020.

Further, the most appropriate reason for the said ineligibility will be the lack of probability of quantification of the disputed tax payable under these cases.

Eligibility of the Appeal or Writ filed against the Order under section 263

CBDT has clarified in its circular that if an order passed under section 263 of the Income Tax Act 1961 contains only the general directions and the income is not quantifiable, then, in that case, the appeal filed against such order will not be eligible under the provisions of the Vivad se Vishwas Scheme 2020.

Further, in such cases, the assessee needs to settle all the issues mentioned in the order, as well as the issues pending in the appeal as on 31.01.2020, with regard to the said order.

On the other hand, if the order passed under section 263 contains specific directions and the income is quantifiable as well, then, in that case, the appeal filed against such order will be eligible under the Scheme.

Eligibility of Cross Objections filed as on 31.01.2020

CBDT has clarified in its circular that all the Cross Objections filed as on 31.01.2020 are eligible as well to be settled under the FAQs issued by CBDT on Vivad se Vishwas Scheme 2020. However, it shall be pertinent to note that the main appeal also needs to be settled, together with the cross objections.

Eligibility of the Cases where Proceedings are pending

CBDT has clarified in its circular that cases where the proceeding is pending before the IT settlement commission or a writ petition have been filed against the order passed by the settlement commission are not qualified to be settled under the Scheme.

Subsequent Treatment of Additions under section 68

CBDT has clarified in its circular that the Scheme is not a “Tax Amnesty Scheme”.Therefore, the assessees cannot pass entries in their Books of Accounts by crediting the unsecured loans/share capital/share premium in the Capital Reserve Account.

Also, the assessees need to credit such unsecured loans/share premiums/share capital as income in their “Revenue Account”.

If the appeal involves an issue of disallowance under section 40(a)(i)/(ia) of the Income Tax Act

CBDT has clarified in its circular that no consequential relief will be available in case the proceedings are pending under section 201 of the Income Tax Act.

However, Question No 31 of the earlier CBDT Circular No 9/2020, issued on 22.04.2020, clearly provided that where an assessee settles his/her TDS (Tax Deducted at Source) liability as a deductor of TDS under the Scheme, then, in that case, he/she will acquire consequential relief regarding the expenditure disallowance under section 40(a)(i)/ (ia).

Treatment of Interest levied under section 201(1A) of the Income Tax Act

CBDT has clarified in its circular that once an appeal against the order passed under section 201(1) is settled under the Vivad se Vishwas scheme, then, in that case, there will be 100% waiver of the corresponding interest levied under section 201(1A) of the Income Tax Act.

Manner of Apportionment of the Prepaid Taxes

CBDT has clarified in its circular that if the prepaid taxes, such as TDS (Tax Deducted at Source)/TCS (Tax Collected at Source)/ Advance Tax are clearly recognizable with the respective source of income, then, these taxed will be adjusted against the tax liability with reference to such income.

Further, the remaining prepaid taxes, which cannot be clearly determined with the source of income, then, in that case, the same will be apportioned against the leftover tax liability, i.e., the undisputed tax liability and the disputed tax liability.

Possibility of Revision of the Declaration Form 1 after its Filing

CBDT has clarified in its circular that the Declaration filed in Form 1 can be revised and modified at any number of times by the taxpayer, prior to the issuance of the certificate of final tax by the Designated Authority, i.e., the PCCIT. Further, the certificate issued provides the final amount of tax payable under the Vivad se Vishwas scheme 2020.

Conclusion

In a nutshell, the beauty of the Vivad se Vishwas Scheme is that the taxpayer needs to pay the only disputed tax and can obtain relief from the penalty, prosecution, and interest.

Usually, penalty and interest exceed the tax payable, and therefore, it becomes tough and multifaceted for the taxpayer to pay the full amount. This Scheme is thus beneficial for all those tax payers who do not wish to litigate or where the amount of tax in question is very less than the tax interest and penalty imposed.

However, if in case a high amount of tax is involved and the tax payer faces liquidity crisis, then, in that case, it may not be possible for him/her to opt the VsV Scheme. Moreover, the said scheme is not beneficial if in case there are high chances for the taxpayer to win particular tax litigation.

Lastly, in case of any other doubt and perplexity, reach out to SwaritAdvisors, our tax experts will cater to all your needs and concerns.

Also, Read: Vivad Se Vishwas Scheme 2020: Concept and Features Involved