Vivad Se Vishwas Scheme 2020: Concept and Features Involved

Shivani Jain | Updated: Jan 05, 2021 | Category: News

Vivad se Vishwas Scheme 2020 was announced in the Budget 2020 as the “No Dispute but Trust Scheme: Vivad se Vishwas Scheme”. It aims to settle down all the pending disputes pertaining to direct taxes. Further, this scheme is a win-win dispute resolution package for both the government and the taxpayer. As it will not only offer certainty and immunity to the taxpayer regarding income tax return filing and prosecution but will ensure timely revenue generation and saving of time and resources to the government.

Further, this scheme got assent from the Hon’ble President on 17.03.2020 and become “Direct Tax Vivad Se Vishwas Act 2020.

Table of Contents

Aim of Vivad Se Vishwas Scheme 2020

The aim behind the implementation of Vivad se Vishwas Scheme 2020 are as follows:

- To Resolve Pending Income Tax Disputes and Litigation.

- To Save the Time and Resources for the Government.

- To Generate Timely Revenues for the Government.

- To Assist Taxpayers in Ending their Tax Disputes with the Tax Department by paying off the Disputed Tax and acquire a waiver from the payment of Interest and Penalty.

- To Get Immunity from Prosecution.

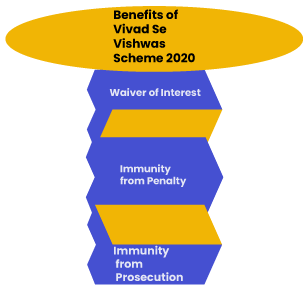

Benefits of Vivad Se Vishwas Scheme 2020

The key benefits of Vivad se Vishwas Scheme 2020 are as follows:

- Waiver of Interest.

- Immunity from Penalty.

- Immunity from Prosecution.

Key Dates of the Scheme

The last date for filing declaration under the Vivad se Vishwas scheme was 31.12.2020. Further, the taxpayer can make the payment without paying an additional amount by 31.03.2021.

Important Terms of Direct Tax Vivad Se Vishwas Act 2020

The important terms of the Vivad se Vishwas Scheme 2020 are as follows:

Appellant

The term appellant denotes a person who is able to fulfil the eligibility criteria and can furnish a valid application for the declaration under the Scheme.

Appellate Forum

The term appellate forum means either of the following:

- Supreme Court[1];

- High Court of a State;

- Income Tax Appellate Tribunal, or;

- The Commissioner (Appeals);

However, it shall be pertinent to mention that the proceedings pending before the Settlement Commission or the Authority for Advance Ruling will not become the part of this Scheme.

Disputed Tax

The determination of Disputed Tax will be made as per the table provided below:

|

S.no |

Criterion |

Disputed Tax |

|

1. |

A case where a Writ Petition, Appeal, or a Special Leave Petition (SLP) is pending before the Appellate Forum as on the prescribed date. |

The amount of tax payable in the Writ/ Appeal/ SLP was to be decided against the appellant. |

|

2. |

A Case where an order of a Writ Petition, Appeal, or a Special Leave Petition (SLP) has been passed by the Appellate Forum and time period for filing appeal or SLP against such order has not expired on the prescribed date. |

The amount of tax payable by the said appellant after giving effect to the order passed. |

|

3. |

A case where the Assessing Officer has passed the order and the time period for filing an appeal against such an order has not elapsed on the prescribed date |

The amount of tax payable by the said appellant must be in accordance with such an order. |

|

4. |

A case where the objection filed by the said appellant is pending before the DRP (Dispute Resolution Panel) under section 144C of the IT Act as on the prescribed date. |

The amount of tax payable by the said appellant must be in accordance with the adjustments in such a draft order. |

|

5. |

A case where the DRP (Dispute Resolution Panel) has issued directions or guidelines under section 144C (5) of the IT Act and no order has been passed by the Assessing Officer under sub section (13) on or before the prescribed date. |

The amount of tax payable by the said appellant must be in accordance with the assessment order passed by the Assessing Officer under sub section (13). |

|

6. |

A case where an application for the revision filed under section 264 of the IT Act is pending on the prescribed date |

The amount of tax payable by the said appellant if the application for revision was not accepted. |

|

7. |

A case where the Commissioner (Appeals) has issued a notice of enhancement under section 251 of the Income Tax Act on or prior to specified date. |

The amount of tax payable by the said appellant will be according to clause (1) plus the amount of additional tax relating to matters for which the notice of enhancement was issued, |

Specified Date

The term specified date means the 31.01.2020;

Disputed Interest

The term disputed interest means the amount of interest calculated in any case under the provisions of the IT Act 1961, where:

- Such an interest is not charged on the dispute; or

- Where the appellant has filed an appeal regarding such interest;

Disputed Penalty

The term disputed penalty means calculated under the provisions of the IT Act 1961, where:

- Such a penalty is not levied with regard to disputed tax or disputed income;

- Where the appellant has filed an appeal regarding such penalty;

Tax Arrear

The term Tax Arrear means either of the following:

- The Aggregate Amount of the Disputed Tax, Interest Chargeable, or Charged on such a Disputed Tax, and Penalty Levied or Leviableon such a Disputed Tax;

- Disputed Interest;

- Disputed Penalty;

- Disputed Fee;

- Disputed TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) as calculated under the provisions of the Income Tax Act;

Situation Under Which A Taxpayer Becomes Eligible For Scheme

The situations under which a taxpayer becomes eligible for being covered under the Vivad se Vishwas Scheme 2020 for an assessment year are as follows:

- Appeals or Writ petitions have been filed on or prior to 31.01.2020;

- Orders for which the time period for filing appeal has not finished on 31.01.2020;

- Cases pending prior to the DRP (Dispute Resolution Panel) on 31.01.2020;

- Cases where DRP (Dispute Resolution Panel)has issued direction on or prior to 31.012020, but no such order has been passed;

- Cases where assesses, have filed a revision under section 264 of the IT Act on or prior to 31.01.2020 and are pending;

- Any search case if the disputed tax demand is less than Rs 5 crores in a year;

- The appeals or writ petitions filed either by the tax department or taxpayers;

- Disputes wherein the taxpayers have already made the payment and are eligible as well;

- Cases of Arbitration in India or Abroad;

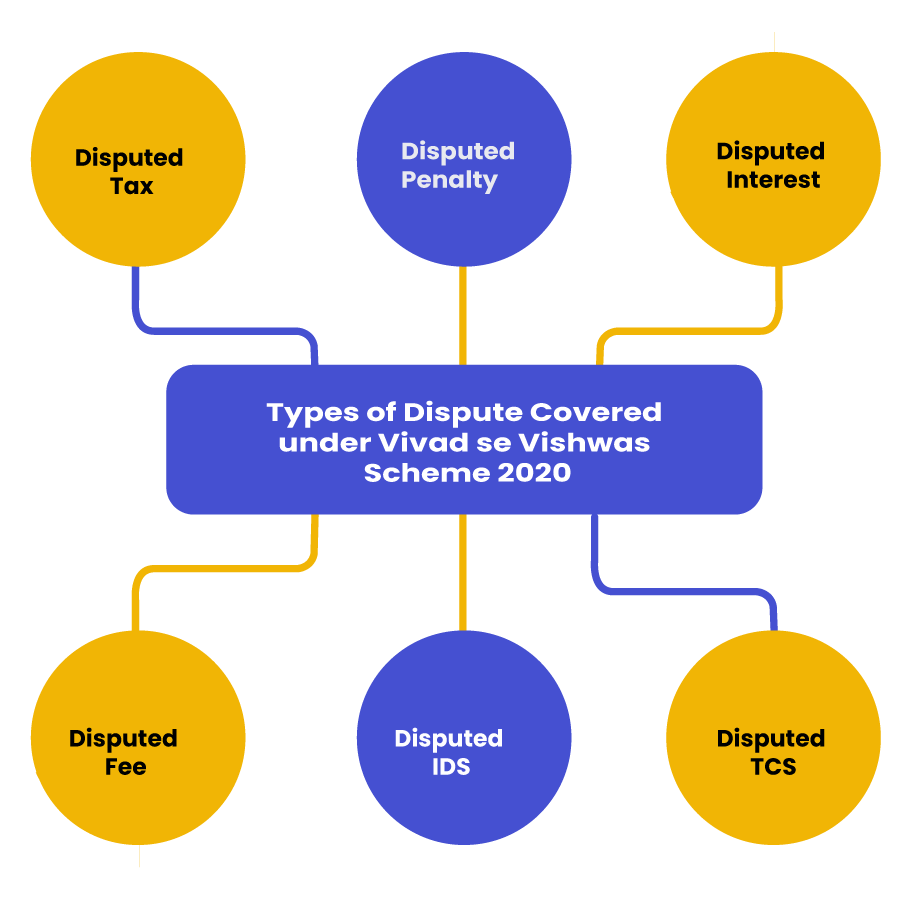

Types of Dispute Covered under Vivad se Vishwas Scheme 2020

The different types of dispute covered under Direct Tax Vivad se Vishwas Scheme 2020 are as follows:

- Disputed Tax;

- Disputed Penalty;

- Disputed Interest;

- Disputed Fee;

- Disputed IDS;

- Disputed TCS;

Payment Schedule under Direct Tax Vivad Se Vishwas Act 2020

|

Payment Made |

Appeal relates to Disputed Tax |

Appeal relates to Disputed Penalty, Interest or Fee |

|

On or prior to 31.03.2021 |

100% of the disputed tax (125% in search cases) |

25% of the disputed penalty, interest, or fee |

|

01.04.2021, but on or prior to the last notified date |

110% of the disputed tax (135% in search cases), in such a manner, that it does not increase the total demand. |

30% of the disputed penalty, interest, or fee |

However, if in case, an issue in the appeal filed by the taxpayer is already decided in his/ her favour, then, in that case, the amount payable is 50 percent of the aforesaid amount. Further, the term decided means the appeal decided by the Tax Department or Appellate Forum.

Also, Read: Companies Fifth Amendment Rules 2020: A Detailed Summary

Amount Payable under this Scheme

The amount payable under the Vivad se Vishwas Scheme 2020 are as follows:

If in case the Appeal is filed by Assessee

|

Nature of the Tax Arrear |

If paid up to 31.03.2021 |

If paid after 01.04.2021 |

|

Tax Arrears = Income Tax + Interest (Chargeable or Charged) + Penalty (Chargeable orCharged) on |

100% of the Disputed Tax |

110% of the Disputed Tax, if such 10% of the disputed tax exceeds the interest charged and penalty levied, then such excess will be ignored. |

|

Disputed Interest, Disputed Penalty, or Disputed Fee |

25% |

30% |

|

Search Cases |

125% of the Disputed Tax |

135% of the Disputed Tax |

If in case the Appeal is filed by Tax Department

|

Nature of the Tax Arrear |

If paid up to 31.03.2021 |

If paid after 01.04.2021 |

|

Disputed Tax |

50% of the Disputed Tax |

55% of the Disputed Tax, if such 10% of the disputed tax exceeds the interest charged and penalty levied, then such excess will be ignored. |

|

Disputed Interest, Disputed Penalty, or Disputed Fee |

12.50% of the disputed interest |

15% |

|

Search Cases |

62.50% of the Disputed Tax |

67.50 percent of the Disputed Tax |

Situation Under Which A Taxpayer Is Excluded From Scheme

The cases or situations under which a taxpayer is excluded from the Vivad se Vishwas Scheme 2020 are as follows:

- Search case, where the Disputed Tax is more than Rs 5 crores in a year.

- Prosecution case filed by the Income Tax Department under the provisions of the Income Tax Act.

- Cases pertaining to the Undisclosed Foreign Income and Assets;

- Cases completed based on the Information received from Foreign Countries.

- Cases under the acts as follows.

- Narcotic Drugs and Psychotropic Substances Act 1985.

- Special Courts Act.

- Unlawful Activities (Prevention) Act 1967.

- Prevention of Corruption Act 1988.

- Conservation of Foreign Exchange & Prevention of Smuggling Activities Act 1974.

- Prevention of Money Laundering Act 2002.

- Prohibition of Benami Property Transactions Act 2016.

How Can A Taxpayer Withdraw Appeal?

- The declarant needs to file the declaration before the designated authority in the prescribed format;

- After filing the declaration, the appeal filed by the declarant will be considered as withdrawn from the date of filing, and the designated authority will issue the certificate for the same;

- The declarant can withdraw such an appeal or the writ petition filed with leave of the court;

- The declarant can withdraw any proceeding or conciliation or arbitration, and can furnish its proof together with the declaration;

- The declarant needs to furnish an undertaking for waiving his right to seek or follow any remedy or claim in regard to the tax arrears covered under the Vivad se Vishwas Scheme 2020;

When Can A Taxpayer Withdraw Appeal?

The situations under which a taxpayer can withdraw an appeal or proceeding under the vivad se vishwas scheme 2020 are as follows:

- Consequent to such a declaration and fulfilment of terms and conditions, appeals/ writ petitions/ objections of taxpayers and tax department in regard of the disputed Income, disputed Penalty, disputed Fee, or disputed Interest pending before either of the following can be withdrawn:

- Commissioner (Appeals);

- DRP;

- ITAT;

- High Court, or;

- Supreme Court of India

- In the case of taxpayer’s appeals, a certificate to the effect needs to be filed by the taxpayer as well;

Role and Responsibilities of Designated Officer

The role and responsibilities of the designated officer under the Vivad se Vishwas Scheme 2020 are as follows:

- As per the act, any person who is below the rank of Commissioner of the Income Tax, as notified by the Principal Chief Commissioner, will not be eligible to become a designated officer;

- Within 15 days from the receipt of the declaration, the designated authority needs to calculate the amount payable by the declarant;

- Further, the designated officer will grant a certificate of declaration regarding the tax arrears and amount payable to the declarant;

- Once the declarant has paid the amount due, the designated authority will then pass an order affirming that the amount due has been paid;

- The order passed by the designated authority will act as conclusive proof for the matter stated therein;

Payment by Declarant

- The declarant needs to pay the amount determined by the designated authority within a period of 15 days, starting from the date of the receipt of the certificate;

- He shall afterwards intimate the details of respective payment to the designated authority;

Refund of Excess to Declarant

- If the amount paid by the taxpayer prior to the filing declaration exceeds the actual amount payable under the Vivad se Vishwas Scheme 2020, then, in that case, the taxpayer will be granted the refund for such excess amount;

- However, it shall be relevant to state that no such interest shall be payable to the respective taxpayer on such refund;

Conclusion

In a nutshell, the beauty of the Vivad se Vishwas Scheme 2020 is that a taxpayer needs to pay only the disputed tax and can get relief from penalty, prosecution, and interest.

Usually, penalty and interest exceed tax, and consequently, it becomes very problematic for a taxpayer to pay the full outstanding amount. Therefore, theVivad se Vishwas Scheme 2020 is beneficial for all those taxpayers who do not want to litigate or where the amount of outstanding tax involved is very less than the tax interest and penalty.

However, if in the case a high amount of tax is involved and the taxpayer faces a liquidity crunch, then, in that case, it may not be possible for him/her to opt for the said Vivad se VishwasScheme 2020. Also, the Scheme is not favourable if there are high probabilities to win an appeal or case.

Lastly, in case of any other doubt or dilemma, reach out to Swarit Advisors, our proficient and experienced tax experts are there to cater to your needs and assist you with the process of filing Income Tax Return.

Also, Read: 17 Provisions Of The Companies (Amendment) Act 2020 Amended By MCA