Operational and Credit Policy Norms for NBFCs: A Complete Guide

Shivani Jain | Updated: Jan 19, 2021 | Category: NBFC

In India, the concept of NBFC has made its presence six decades back, i.e., around 1960, and since then this lending structure is playing a significant role in serving the lower income and backward sections of the society. Further, as compared to conventional banks, these entities are much easier to access and offers financial assistance to the needy ones. In this blog, we will discuss in detail regarding the concept and types of NBFC, together with the Operational and Credit Policy Norms for NBFCs.

Table of Contents

Concept of NBFC Registration

Every company or a business entity that wants to operate as an NBFC in India needs to first obtain registration under the provisions of the Companies Act 2013. After that, it requires to apply under the RBI Act 1934 for NBFC Registration.

Also, it shall be significant to record that RBI acts as the regulatory force for the NBFCs registered in India.

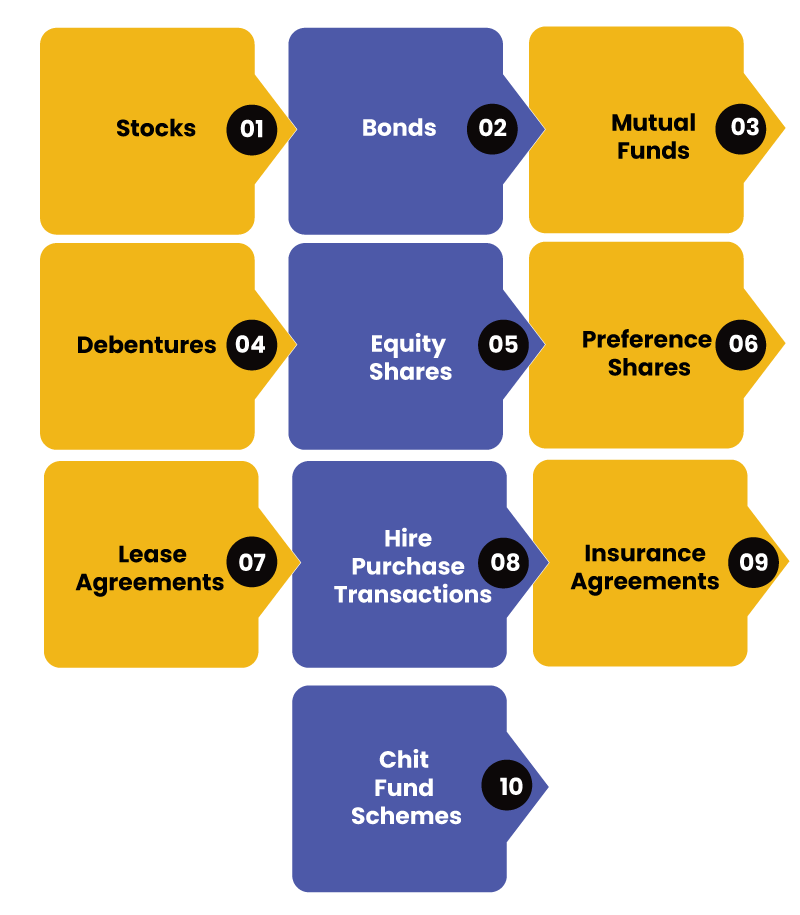

Operational Areas of NBFCs in India

In India, the Operational Areas of an NBFC are as follows:

- Stocks;

- Bonds;

- Mutual Funds;

- Debentures;

- Equity Shares;

- Preference Shares;

- Lease Agreements;

- Hire Purchase Transactions;

- Insurance Agreements;

- Chit Fund Schemes;

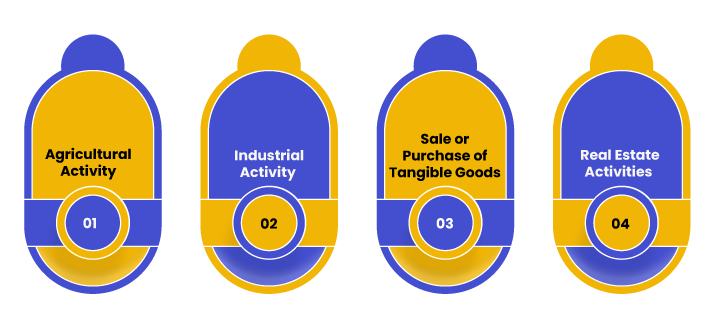

Non Operational Areas of NBFCs in India

In India, the Non Operational Areas of an NBFC are as follows:

- Agricultural Activity;

- Industrial Activity;

- Sale or Purchase of Tangible Goods;

- Real Estate Activities;

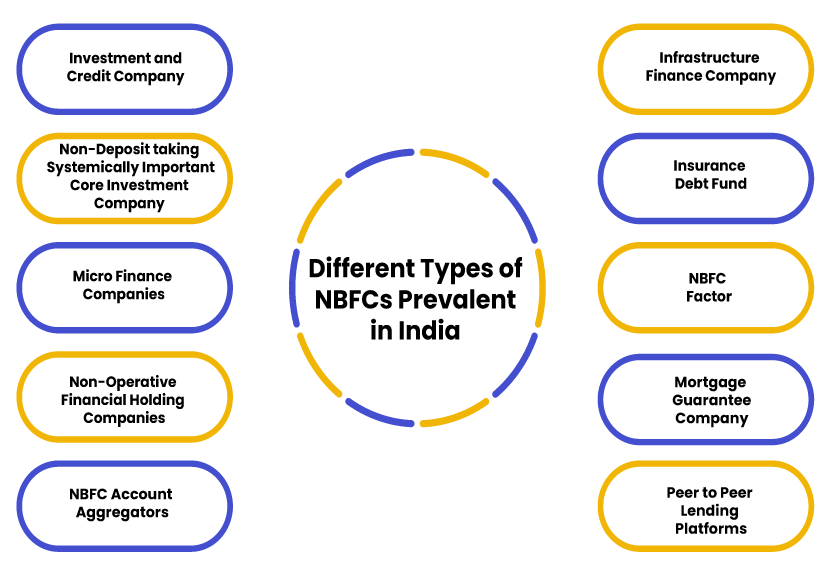

Different Types of NBFCs Prevalent in India

The different types of NBFCs prevalent in India are as follows:

Investment and Credit Company

The term Investment Credit Company or ICC denotes a combination of the three different NBFCs as follows:

- Asset Finance Company;

- Loan Company;

- Investment Company;

Further, the different lending and investment activities provided by an Investment Credit Company are as follows:

- Asset Financing;

- Provides Loan;

- Offers Investment Solutions;

Infrastructure Finance Company

An Infrastructure Finance Company mainly provides Loans and Advances to Infrastructure Companies, such as Construction and Real Estate Companies.

Non-Deposit taking Systemically Important Core Investment Company

In India, the activities with which a Non Deposit taking NBFC deals with are as follows:

- Equity Shares;

- Preference Shares;

- Debentures;

- Stocks;

Further, this NBFC provides a loan to only those entities or companies, which as per the latest Audited Balance Sheet have the total assets over Rs 500 crores.

Insurance Debt Fund

The NBFCs that provide long term debts to the Infrastructural Projects are known as Insurance Debt Fund.

Micro Finance Companies

The term Micro Finance Company denotes a business structure that offers loans and financial assistance to only the Marginalized and Weaker Sections of the society.

NBFC Factor

These type of financial lenders are mainly engaged in acquiring AOR (Accounts of Receivables) of an Assignor. Further, the main reason behind such activities is to offer discounted loans against the security interest over such receivables,

Non-Operative Financial Holding Companies

A Non-Operative Financial Holding Company offers financial credit to only those business entities who are aiming to establish either a new bank or financial institutions.

Mortgage Guarantee Company

A Mortgage Guarantee Company mainly deals with those individuals who are facing repayment issues against the home loan taken. That means these entities assist the individuals in the risk of default against the taken home loans.

NBFC Account Aggregators

In India, an NBFC Account Aggregator signifies an entity that is engaged in collecting, providing, or retrieving information of a client concerning the financial assets under a contract.

Peer to Peer Lending Platforms

The term Peer to Peer Lending Platform or P2P denotes a newly evolved concept that provides a common platform for both the Lenders and Borrowers. The main aim behind such a platform is to facilitate Mobilization of Funds.

Also, Read: RBI Issues Guidelines For Implementation Of Indian Accounting Standards By NBFCs

Concept of Operational and Credit Policy Norms for NBFCs

As stated above, all the NBFCs that are registered in India are regulated and governed by the Apex Bank. Therefore, to carry out operations in a hassle-free manner, it is mandatory for all the entities to comply with Operational and Credit Policy Norms for NBFCs. Further, these norms are provided by the Reserve Bank of India.

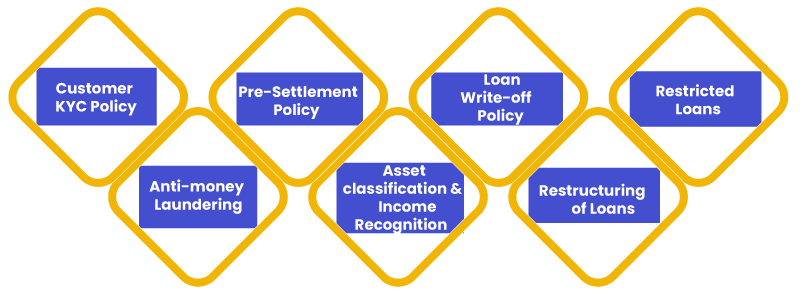

The key elements of the Operational and Credit Policy Norms for NBFCs are as follows:

- Customer KYC Policy;

- Anti-money Laundering;

- Pre-Settlement Policy;

- Asset classification & Income Recognition;

- Loan Write-off Policy;

- Restructuring of Loans;

- Restricted Loans;

Customer KYC Policy

The first and the foremost Operational and Credit Policy Norms for NBFCs is Customer KYC Policy. In India, the Reserve Bank has directed all the financial lenders to carry out their operations based on the provisions prescribed under the KYC Policy “Know Your Customer”. Further, the main aim behind the implementation of KYC Policy is to examine and report all the vague and unclear transactions to the relevant authority.

Moreover, these guidelines work to protect and safeguard the financial institutions from the fraud and dishonest borrowers who engage themselves in the Money Laundering Activities. Also, these guidelines assist the banks and financial institutions to get familiar with their clients or borrowers in a better way. That means these guidelines purposes to address the disparities in a better and authentic way.

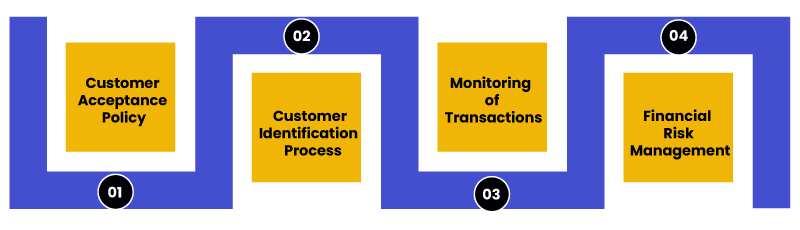

The essential elements of the KYC Policy are as follows:

Customer Acceptance Policy

All the NBFCs need to frame clear guidelines concerning Customer Acceptance Policy, which must obtain the aspects as follows:

- One cannot open an account in a Benami or Bogus name;

- A customer will be categorized as low, medium, or high based on the factors as follows:

- Nature of the Business Activity;

- Location of the Customer;

- Mode of Making Payment;

- Annual Turnover;

- All the documents and information submitted must be in accordance with the provisions of the PMLA 2002 or Prevention of Money Laundering Act 2002[1] and the guidelines and directions issued by RBI;

- In the case of Non-cooperation from the customer side, he/ she can neither open nor close an existing account;

- The financial institution must duly check the particulars provided prior to opening an account;

- If in case a person has been authorised to act on behalf of some other person, then, in that case, the same must be clearly spelt out in the documents;

Customer Identification Process

The term customer identification means the mode of tracing a person and ascertaining his/her credibility based on the documents and particulars submitted by him/her. Therefore, it is always advised for an NBFC to collect all the relevant information to establish the legitimacy of a new client. The same can be done by the steps as follows:

- Track the legal status of the concerned individual or entity through the relevant documents submitted;

- Track about individuals who are asserting to act on behalf of a particular legal person or entity;

- Determine about the Entitlement and Ownership Structure of a new customer, and for that the said NBFC needs to verify about the individuals who are intending to act or are acting on behalf of the legal person;

Monitoring of Transactions

Monitoring of Transactions plays a crucial part in the effective working of KYC Policy, as it efficiently and effectively assists the company in mitigating the risk factor. Further, the same can be done by the ways as follows:

- An NBFC must establish a mechanism for the periodical assessment of the risk categorization of accounts. The same can be done by bifurcating on the basis of high, medium, and low;

- After that, implement suitable preventive measures to rule out suspicion;

- Must ensure that all the books of accounts and records are made in accordance to section 12 of the Prevention of Money Laundering Act 2002;

- Also, must report the case of suspicion to the competent authorities;

Financial Risk Management

For implementing an effective KYC Programme, the company must follow suitable procedures. Further, the key elements of a KYC Programme are as follows:

- It must include all the details as follows:

- Proper Management Faults;

- Delegation of Tasks;

- Training and Other Related Issues;

- All the NBFCs need to create Risk Profiles of both their current and new customers;

- Must implement required Anti Money Laundering measures, in order to rule out the chances of financial risk;

- It should implement effective Employees Training Programme to train the personnel as per the KYC procedures;

- It must ensure that separate training programs are held for both back-end and front-end staff;

Anti-money Laundering

As we all know that transparent transactions and dealings play an imperative and significant role in the growth of the industry. Therefore, the DBOD (Department of Banking Operations and Development), together with RBI, has laid down certain directions for both NBFCs and Banks. The same will be under the supervision and direction of the FATF (Financial Action Task Force).

Also, over the time, these recommendations have now turned out to be a benchmark for the concerned regulatory authorities and assist them in framing the policies concerning Ani Money Laundering and Terror Funding.

Further, it is mandatory for all the financial institutions to duly comply with the said guidelines, to build healthy and global financial relationships.

The directions issued by RBI concerning the framing of Anti-money Laundering and KYC Measures are as follows:

- The information and details submitted by a customer must not be available to anyone other than NBFCs;

- The information and particulars provided by any customer must not give rise to perceived risk;

- Banks are not allowed to use any client information without the permission of the said person;

- All the operational directions are issued by RBI under section 45K and 45L of the Reserve Bank Act 1934. That means in case of any default, the defaulter will be liable not only for penal actions but with hefty penalties as well;

Pre-Settlement Policy

Another significant Operational and Credit Policy Norms for NBFCs is Pre-settlement Policy. The term Pre-settlement Policy means the early repayment of a loan. As per this policy, borrowers can clear and satisfy all their dues concerning the loan taken prior to the actual date of completion. Therefore, it is mandatory for both NBFCs and Banks to lay out a policy for the same.

Further, the terms and conditions used in the Pre-settlement Policy are based on the conditions as follows:

- Must clarify whether part prepayment is allowed or not;

- It should clearly specify about the provisions of penalty in case of any default;

- All the provisions concerning Rebate and Reward must be clearly specified in the Pre-payment Policy;

- Must specify that whether the facility of pre-payment of loan allows the next loan cycle o not;

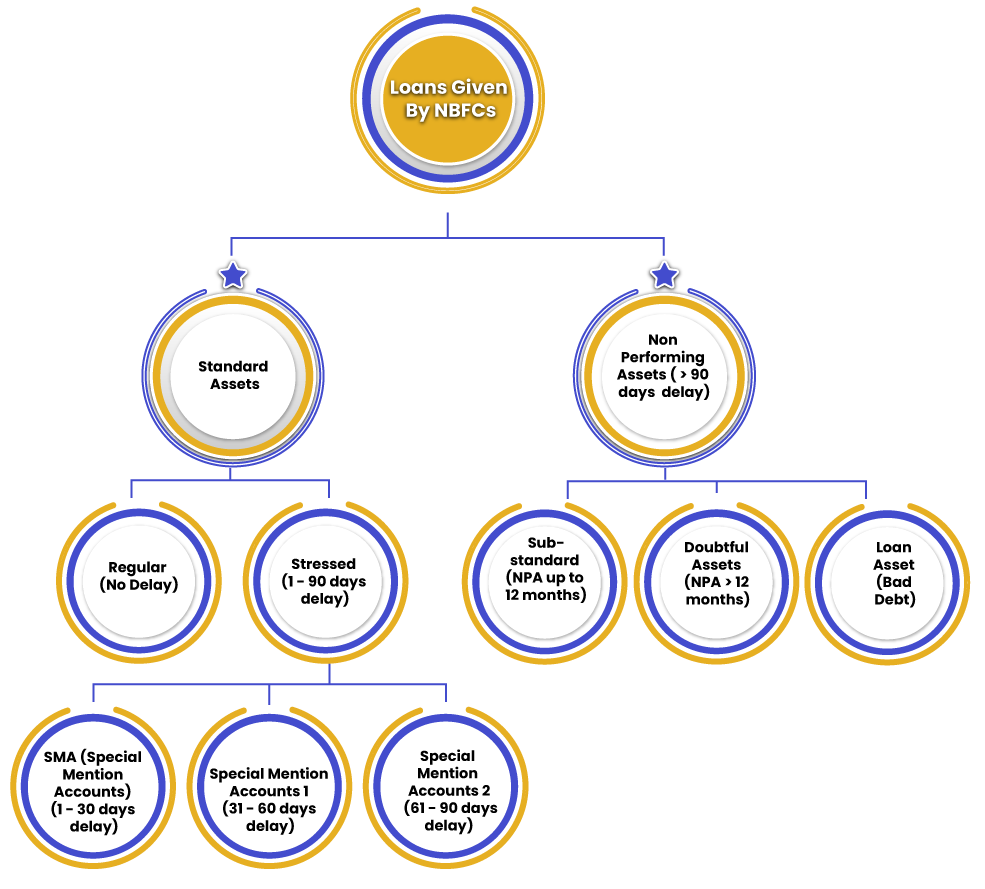

Asset classification and Income Recognition

It needs to be taken into due consideration that loans act as a valuable source for the financial institutions. Therefore, it is mandatory for every bank to classify its borrowers and customers based on Standards and NPA (Non-performing Assets).

Flow Chart for Asset Classification:

Further, it is mandatory for every Non Banking Financial Company to undergo the process of Income Recognition based on the standard prescribed ICAI (Institute of Chartered Accountants) as follows:

- All the Income that comprises of either interest or other charges must be acknowledged only when realized;

- In the same manner, Income from all the Non Performing Assets must be recorded on Cash basis;

- If in case, the company recognises any of such income as mentioned above, then, in that case, remaining unrealized income will be reversed and derecognized;

Loan Write-off Policy

One of the most significant Operational and Credit Policy Norms for NBFCs is Loan Write-off Policy. Whenever an NPA or Non Performing Assets loan attains arrears in a certain period of time, then, in that case, it can be written off by the NBFC. Further, the guidelines for writing off such loans by NBFC are as follows:

|

Types of Loan Assets |

Guidelines Issued by RBI |

|

1. Standard Assets |

1% of the total outstanding amount |

|

2. Sub-standard Assets |

50% of the total outstanding amount |

|

3. Loan Assets |

100% of the total outstanding amount |

Therefore, it is always advisable to NBFCs to choose the suitable accounting policy for the writing of Loans. However, it shall be taken into consideration that a policy that removes or write off NPA Loans on a speedy basis, might underrate the real value of the portfolio as well, or might overstate the quantity of the same. As a result, it is always suggested that an analyst while reviewing the quality of the portfolio must keep a track of the debts writer- off as well;

Restructuring of Loans

It shall be pertinent to take into the record that an NBFC reserves the right to alter or modify the terms and conditions of a loan agreement. However, the same is done based on the policies drafted by BOD (Board of Directors).

Also, such an event entice the situations as follows:

- Prior Commencement of the Business;

- In case when the said asset is termed as sub-standard;

- Post Commencement of the Business when the asset has been termed as sub-standard;

- When the restructuring of principal and interest can be done with or without sacrifice;

Restricted Loans

One of the most significant Operational and Credit Policy Norms for NBFCs is the policy of Restricted Loans. Based on the laws, regulations, and guidelines issued by RBI, it is mandatory for all the financial institutions including NBFCs and Micro Finance Companies to not to approve the loans of the candidates as follows:

- Loans to Bailout or Replace the lenders who want to withdraw;

- Loans to Political parties, candidates, or any other political organizations;

- Loans to Gambling Enterprises;

- Loans for the activities concerning Drugs and Alcohol;

- Loans for Weapon or Armament activities;

Conclusion

In a nutshell, Operational and Credit Policy Norms for NBFCs plays a crucial role in managing and stabilizing the existing turbulence in the economic infrastructure of the company.

In case of any other doubt or perplexity concerning the Operational and Credit Policy Norms for NBFCs, reach out to Swarit Advisors, our proficient and skilled RBI experts are there to cater to all your queries.

Also, Read: Cancellation or Surrender of NBFC Registration: A Complete Guide