RBI Issues Guidelines For Implementation Of Indian Accounting Standards By NBFCs

Shivani Jain | Updated: Jan 08, 2021 | Category: NBFC, RBI Advisory

In order to promote and encourage high quality and constant implementation of the Indian Accounting Standards or AS, as well as to facilitate comparison and improved supervision, the RBI (Reserve Bank of India) had framed regulatory guidance concerning these standards, issued on 13 March 2020.

Further, these standards will apply to both NBFCs (Non Banking Finance Companies) and ARCs (Asset Reconstruction Companies) for the preparation of their financial statements and balance sheets from the financial year 2019- 2020 onwards.

In this blog, we will discuss the guidelines issued by the apex bank pertaining to the implementation of Indian Accounting Standards by NBFCs.

Table of Contents

Need For Implementation of Indian Accounting Standards

In view of the already existing chaos in the financial services sector aggravated by the unfortunate COVID -19 epidemic, there was an added stress in the economy and accordingly on the lending business. Therefore, the apex bank decided to implement this guidance, which had something in store for everyone, i.e., Audit Committees, Board of Directors, Management, Investors and Auditors.

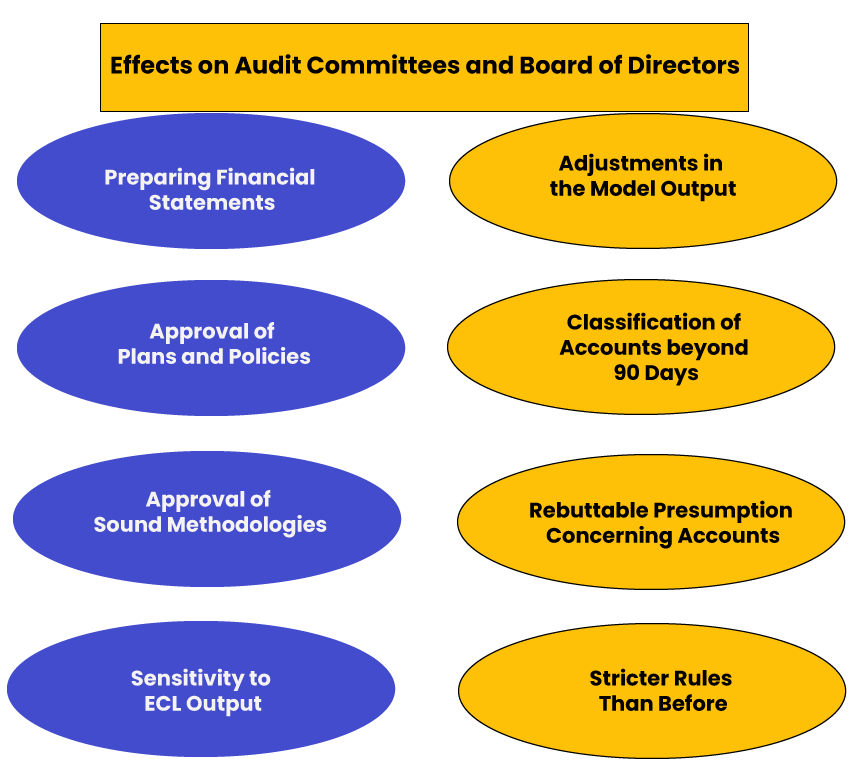

Effects on Audit Committees and Board of Directors

Audit Committees and Boards of Directors have a responsibility and accountability to contribute and manage high-quality Corporate Governance (CG) at their company. Therefore, in this respect, the Reserve Bank of India(RBI) has now provided the following specific responsibilities and duties of both audit committees and board of director of a registered NBFC or ARC in context of Indian Accounting Standards of financial reporting:

Preparing Financial Statements

The responsibility to prepare and guarantee fair and true presentation of the financial statements and records mainly vests with the board of directors of the respective company.

Approval of Plans and Policies

Approval of the policies and plans that clearly articulate and document the different business models for the portfolios of financial assets of a registered NBFC or ARC.

Further, it is significant because the subsequent measurement of such assets at an amortized cost or fair value because of other all-inclusive income or profit & loss depends on whether such a business model is to hold &accumulate cash flows of the underlying financial assets until maturity or to hold/ accumulate/ and sell or trade in those financial assets.

Moreover, such plans and policies shall also articulate the purposes for managing each portfolio and the restrictions imposed on subsequent reclassification.

Approval of Sound Methodologies

Approval of the sound methodologies for the calculation of Expected Credit Losses or ECL must be according to the size, complexity, and risk profile particular to the NBFClicense (Non Banking Financial Company) or ARC (Asset Reconstruction Company).

Further, the term sound methodologies include addressing procedures, policies, and controls for assessing and calculating credit risk on all the lending entities.

Sensitivity to ECL Output

All the parameters and assumptions considered, together with their sensitivity to the ECL (Expected Credit Losses) output, are to be properly documented and articulated. Further, the rationale and justification behind any change in the ECL model also need to be documented and sanctioned by the board of directors.

Adjustments in the Model Output

Any adjustments or modifications made to the model output, i.e., a management overlay, needs to be approved and sanctioned by the audit committee. Moreover, there is a need to clearly and specifically document the rationale or the basis behind adjustments.

Classification of Accounts beyond 90 Days

The classification of accounts that are presented after 90 days, still are not treated as impaired, needs to be approved by the audit committee, together with a clearly documented rationale.

Rebuttable Presumption Concerning Accounts

As per the Indian Accounting Standard 109, there is a “Rebuttable Presumption” that whenever the books of accounts are past more than 30 days, it means a significant rise in the credit risk for that particular financial asset.

Further, this would typically consequence in a “Higher Impairment Loss Provision” from “12 months ECL (Expected Credit Losses)” to “Lifetime ECL (Expected Credit Losses)”.

Moreover, the said presumption can be rebutted only if the registered NBFC (Non-Banking Financial Company) and ARC (Asset Reconstruction Company) has reasonable and acceptable information.

However, as per the guidance issued by RBI for the Implementation of Indian Accounting Standards, such a presumption is rebuttable only if there is clear documentation regarding the justification for doing so, together with the approval by the audit committee.

Stricter Rules Than Before

Now, the RBI or Reserve Bank of India has specified comparatively stricter rules than Indian Accounting Standards, as now these regulations prohibit NBFCs and ARCs from deferring the recognition of the substantial rise in the credit risk for any exposure that is past 60 days.

Therefore, the board of directors and the audit committee may now require to spend some more time with the management to comprehend and understand these detailed necessities prior approving, moreover, the same comprisingof interactions with the auditors as well.

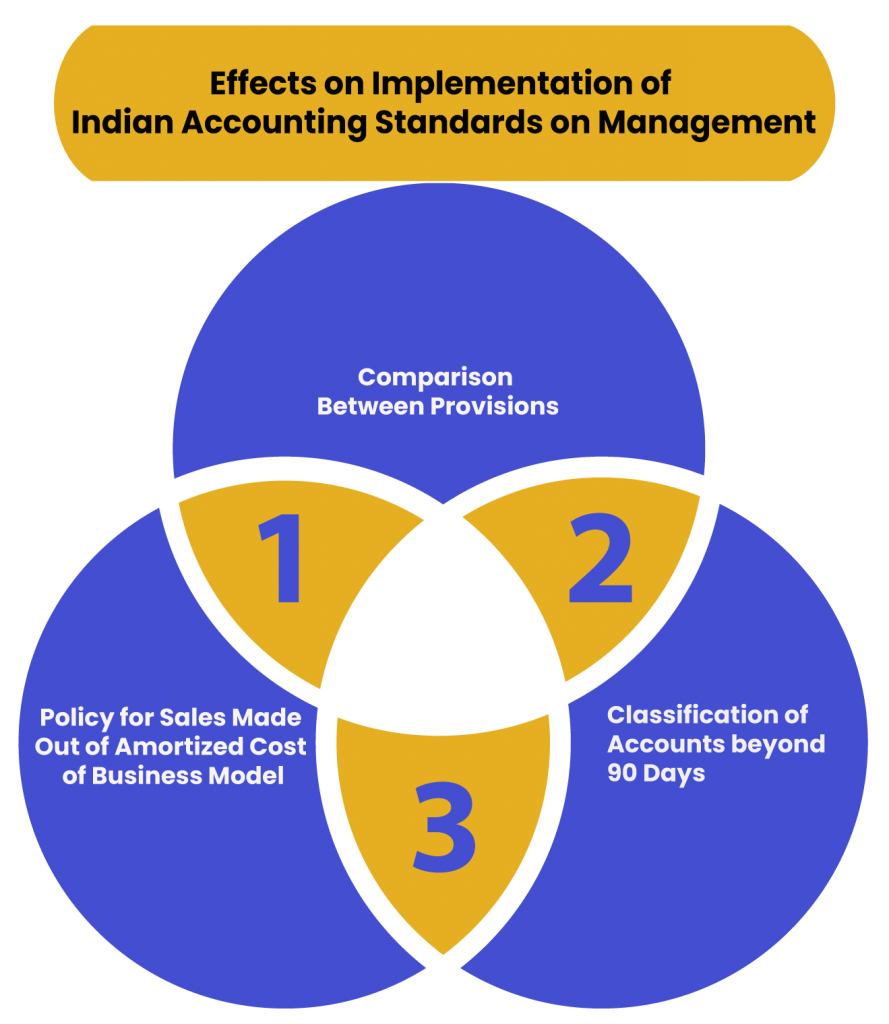

Effects of Implementation of Indian Accounting Standards on Management

As stated above, from now onwards it shall be mandatory for the BOD (Board of Directors) and Audit Committee to efficiently discharge these responsibilities, in the same manner, the management of NBFCs (Non-Banking Financial Companies) and ARCs (Asset Reconstruction Companies) will need to guarantee the timely implementation of these various policies, processes, models, controls, assumptions and other related documentation.

Also, all the prepared documents are then provided to the Audit Committee and Board for their review and approval.

Further, the RBI has recommended NBFCs and ARCs to not to make any change in the assumptions, parameters, and other aspects of their ECL (Expected Credit Losses) model for profit smoothening.

Also, the definition of the default used for accounting purposes is to be directed by the definition adopted for the regulatory purposes. RBI has provided guidance on determining “Net Owned Funds”,“Owned Funds”, and “Regulatory Capital” as well.

Furthermore, it shall be noteworthy to note that, the management of an NBFC registration or ARC will now have to comprise the following additional disclosures as follows in their financial statements:

Policy for Sales Made Out of Amortized Cost of Business Model

As per Indian Accounting Standards 109, the sales that are made frequent or of high value or without any specific reason are not consistent with the amortized cost business model.

Classification of Accounts beyond 90 Days

The classification of accounts that are presented after 90 days, still are not treated as impaired, then, in that case, the management will have to disclose information concerning the total amount of outstanding and overdue amounts.

Comparison Between Provisions

Now, the management needs to compare the prescribed template of provisions needed under extant prudential norms for asset classification, income recognition, with the provisions concerning impairment allowances made under Indian Accounting Standard 109[1].

Effects on Prudential Floor for Expected Credit Losses

As per the guidelines issued by RBI, all the NBFCs and ARCs will keep on to record the impairment allowances as needed by Indian Accounting Standards 109, using the three-stage ECL (expected credit losses) model.

However, in parallel, they will continue to maintain the asset classification and determine provisions in accordance with the asset classification, income recognition, and provisioning, but the same shall comprise of borrower/beneficiary wise classification, restructured assets, and NPA ageing as well.

If the Impairment Allowance Lower than the Provisioning Needed

If in case the impairment allowance provided under Indian Accounting Standard 109 is lower than the provisioning needed under asset classification, income recognition, and provisioning (comprising of standard asset provisioning), then, in that case, all the NBFCs and ARCs shall use the difference from their net profits or losses after tax to a separate and distinct reserve, known as “Impairment Reserve”. The main objective of this condition is to set a benchmark to the BOD (Board of Directors), RBI, and all the other stakeholders, on the suitability of provisioning for credit losses.

Need of New Requirement

This is a significant new requirement, serving the dual aim of ensuring that the PAT (Net Profit After Tax)continues to be calculated as per the Indian Accounting Standards, and at the same time, all the registered NBFCs or ARCs will set aside or appropriate the amounts from profits generated into a separate reserve if in case the Indian AS 109 concerning ECL provision is less than the asset classification, income recognition, and provisioning.

Further, it is a balanced and conventional approach recommended by the RBI, as under this approach, the amount in such impairment reserve will not be counted for any regulatory capital. The reason behind the same is that the amount is prohibited to be withdrawn without obtaining the prior approval from RBI. Also, the same will be reviewed by the apex bank going forward as well.

Effects of Implementation on Auditors and Investors

From now onwards, the auditors need to consider the guidelines concerning the implementation of accounting standards in the audit procedure of NBFCs and ARCs financial statements.

Further, in the same manner, the investors and the users of the financial statements will need to access all the additional financial information or disclosures to satisfy that there is an effective implementation of the above processes and the same will result in improved Financial Reporting and CG (Corporate Governance).

Conclusion

In a nutshell, the implementation of Indian Accounting Standards by RBI is a welcome move, and now it is up to all the registered ARCs (Asset Reconstruction Companies) and NBFCs (Non-Banking Financial Companies) to embrace and efficiently implement these measures and guidelines both in letter and spirit.

Further, in case of any other doubt in Implementation Of Indian Accounting Standards and complexity in understanding the provisions suggested, reach out to Swarit Advisors, out proficient experts are there to cater to all your doubts and queries and will assist you in the process of NBFC registration as well.

Also, Read: NBFC Supervision to Cover Auditors- RBI measures to strengthen Financial Sector