RBI Proposes Overseas Direct Investment Rules

Karan Singh | Updated: Sep 15, 2021 | Category: RBI Advisory

Recently, the Reserve Bank of India proposed Overseas Direct Investment Rules and financial commitments by businesses in India, and the regulator has proposed to liberalise regulatory structure for ODI-FDI structures.

In current times, Overseas Direct Investment (ODI) has become popular. ODI refers to direct investment outside India, which means investments through the Automatic Route or the Approval Route via contribution to the Capital Subscription to Foreign Company’s Memorandum or through purchase of present shares of an overseas company by either market purchase or stock exchange or through private placement, presenting a long-term interest in the overseas company. Scroll down to check RBI’s Overseas Direct Investment Rules.

Table of Contents

What do you mean by Authorised Dealer Banks and Indian Party?

Before moving to the RBI’s Overseas Direct Investment Rules, it is essential to know the meaning of Authorised Dealer Banks and Indian Party.

- Authorised Dealer Banks: Overseas Direct Investment (ODI) can be made only through registered Authorised Dealers with the Reserve Bank of India. The Resident Individual or Indian Party is required to route all transactions concerning particular foreign JV/WOS only via one branch of an Authorised Dealer. This branch would be the designated Authorised Dealer concerning JV/WOS, and all communications & transactions relating to the investment in that specific JV/WOS are to be reported only via this designated branch of an Authorised Dealer.

In case the JV/WOS is being established overseas by two or more Indian promoters, then all Indian promoters jointly called the Indian Party and the Resident Individual would be required to route all transactions concerning JV/WOS only through a single designated Authorised Dealer. In case the Resident Individual or Indian Party desires to switch over to another Authorised Dealer, an application by a method of a letter may be made to the RBI after getting a No Objection Certificate (NOC) from the present Authorised Dealer.

- Indian Party: It is a company registered in India, or it’s a body created under Parliament Act or a Partnership Firm incorporated under the Indian Partnership Act, 1932 or an LLP (Limited Liability Partnership) incorporated in the LLP Act, 2008 and other company in India as may be informed by the Reserve Bank of India. When more than one such entity, body, or company makes an investment in the overseas JV/WOS, such fusion will also form an Indian Party.

What is ODI-FDI Framework?

ODI-FDI framework refers to an Indian company that invests in an overseas entity which investors or has investment already in India; it is also known as Round Tripping. The FEMA Regulations does not classify round-tripping evidently. It’s a market practice to approach the RBI when Indian Companies or entities acquire/invest in overseas companies which have holdings in India.

The RBI has proposed that if an Indian company invests in an overseas company that invests in India, there shouldn’t be tax evasion or avoidance.

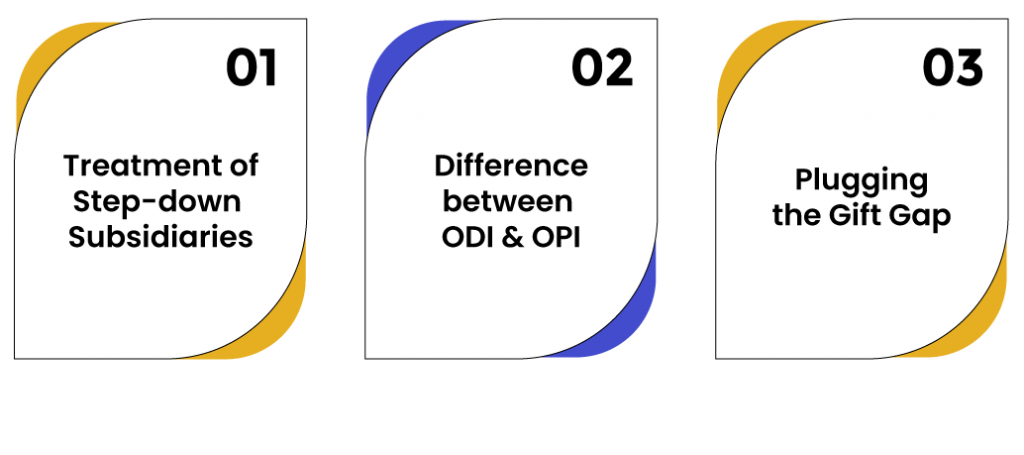

Proposed Overseas Direct Investment Rules

Besides ODI-FDI Framework, there are three important changes standout in the Overseas Direct Investment Rules by the regulator, and you can check the same below:

- Treatment of Step-down Subsidiaries;

- Difference between ODI & OPI;

- Plugging the Gift Gap.

- Difference between ODI & OPI: The current definition for ODI defines it as:

- Investment via contribution to the capital subscription to the MOA (Memorandum of Association) for overseas company;

- Through purchase of current shares of an overseas company by market purchase/private placement or via a stock exchange, not including Portfolio Investment.

Now the RBI has proposed a threshold for ODI. The new definition, as suggested by the regulator, is mentioned below:

- Equity capital acquisition of the unlisted overseas company, subscription to the MOA of the overseas company;

- Investment in 10% more of the Paid-up capital of a listed overseas company;

- Acquisition of indirect or direct control/power in the overseas company.

- Regulating Financial Commitments: At present, an Indian Party is permitted to give loans or guarantee in favour of the overseas company where it has equity participation. The regulation proposes to strengthen the present regime.

Remember this objective; the rules proposed by the regulator define an overseas company and step-down subsidiary for the 1st time. Financial commitments that an Indian company can offer on their behalf are also added.

Foreign Company will be defined as:

- A company which is registered & incorporated outside India;

- An incorporated company that is involved in a strategic sector.

In the case where such an overseas company having ODI and authorise by the Indian company having ODI and control by an Indian company establishes a subsidiary, then it will become a step-down subsidiary. Moreover, a subsidiary of a step-down subsidiary will be a step-down subsidiary. The Indian company and its promoters can offer personal, bank guarantee, corporate, performance on behalf of both overseas company and step-down subsidiary within the limit of the financial commitment as per the FEMA. Here the primary objective is to make sure that any loan, guarantee, or pledge that an Indian Company offers for either an overseas company or a step-down subsidiary should abide under the Overseas Direct Investment Rules.

- Plugging the Gift Gap: According to the existing FEMA Rules, people can get overseas securities as a gift from an individual. Different ingenuous foreign structures have been implemented earlier through third parties.

With the gift route, the Indian founders have avoided round-tripping concerns, transferring money outside & resulting in severe Overseas Direct Investment compliances. To prevent Indian founders from the transfer of value of domestic assets in this way, the regulator has proposed a limitation on the gift receipt of overseas securities from relatives only. As the regulator is concerned over such structures, the draft Overseas Direct Investment Rules propose limiting this permission by allowing receiving gifts from relatives only as provided under the Company Law and not from any third party or individual.

Conclusion

If we conclude the overall purpose of the Overseas Direct Investment Rules proposed by the RBI[1], it seems to match the essential directional objective that we see across our economic laws that value transfers happen at fair prices and is not effectively done by either exaggerating or understating values.

Read our article:What are the Implications of the New Outsourcing Framework for Non-Bank PSOs?