Trust Registration Process under the Indian Trust Act 1882 – An Overview

Karan Singh | Updated: Feb 01, 2021 | Category: Trust

Trust Registration under the Indian Trust Act, 1882 starts with the drafting of a Trust Deed, and this deed is the main requirement in the process of Trust Registration in India. Trust Deed is formed on a non-judicial stamp paper, and every state in India has fixed its stamp duty rate. A Trust can be either public or private, where Private Trusts are governed according to the Indian Trust Act, 1882. As per the Indian Trust Act, 1882, the Trust is an organization where you or the Trustor can say the owner decides to transfer the right of his property to a trustee. The 3rd person or beneficiary can benefit out of it. Scroll down to check more information regarding the Trust Registration under the Indian Trust Act, 1882.

Table of Contents

Types of Trust

- Societies: It is primarily created for the advertising of arts, commerce, and science. Societies are controlled by the Societies Registration Act, 1860, and the society’s events are for only for non-profit purposes.

- Private Limited Trusts: Private limited Trusts are ruled under the Indian Trust Act, 1882. These trusts are formed for conducting various activities for the family, individuals, or close one relative.

- Public Limited Trusts: Public Limited Trusts are established for charity, education, and religious purposes. Charitable and Religious Trusts are the most common public trusts in India.

- Companies under Section 8 of the Companies Act, 2013: All the Private Limited Companies comes under Section 8 of the Companies Act, 2013. The primary objectives are for promoting arts, education, crafts, science, environmental activities, etc.

Types of Parties in a Trust

Below are the three type of parties in a Trust:

- Trustor: An individual who creates a trust is known as Trustor, which means a Trustor is the Trust’s Owner.

- Trustee: It is a person who holds the Trust’s property given by the Trustor.

- Beneficiary: It is a person for whom the Trust is formed. It is a 3rd party who may be recognized to the Trustee and Trustor.

What is a Trust Deed?

For the Trust Registration under the Indian Trust Act, 1882, a Trust Deed is required. It is like a tool of Trust by which Trust is declared. A trust deed has several clauses like the registered office clause, name clause, settler, trustee clause general body member clause and other rules & regulations.

Following are all the requirements for the Registration for Trust Deed:

- Trust Deed on stamp paper with mandatory stamp duty.

- Latest passport size photograph and identity proof of settlor.

- Latest passport size photograph and identity proof of settlor.

- Latest passport size photograph and identity proof of 2 trustees.

- Latest passport size photograph and identity proof of 2 witnesses.

- Signature of the settlor is required on each page of Trust Deed.

- Two witnesses on the Trust Deed.

Benefits of Trust Registration under the Indian Trust Act, 1882

Following are some benefits of Trust Registration under the Indian Trust Act, 1882:

- All the Trusts in India get land from the Government.

- The benefit of 80g Certificate.

- Tax Benefits.

- White money for the constriction of building.

- Benefits on Income Tax/Service.

- Registered Trust under the Trust Act uses Government Registered Name.

Eligibility Criteria for Trust Registration

Following is the eligibility criteria for Trust Registration under the Indian Trust Act, 1882:

- Minimum two or more individual are required for the Trust Registration under the Indian Trust Act.

- All the parties must not be qualified under the law in force in India.

- The goal of the Trust must not go against any law in India.

- All the practices are conducted by the Trustee must be reasonable.

- Ensure that any activities must not harm any individual.

- The aim of forming the Trust must be valid if any object is invalid then the Trust cannot be created.

- The formation of Trust should not go against any public interest or any other law in force in India.

Documents Required for Trust Registration under Indian Trust Act, 1882

Following are some vital documents required for trust registration under the India Trust Act, 1882:

- Submit a Trust Deed. A Trust Deed must contain the following information:

- Trust motive.

- Information of the settler and trustees like name, age, address, father’s name. Occupation, e-mail id, designation, and mobile number.

- Total number of Trustees.

- Address of registered office of the Trust.

- Rules & Regulations which must be followed by the Trust.

- Proposed name of the Trust.

- Submit a copy of Id proof of the settlor and Trustee.

- Submit the recent passport size photograph of the settlor and Trustee.

- Settler presence with their original id proof and two witnesses at the time of Trust Registration in India.

- Submit a self-attested copy of the id proof of the settler like Voter’s ID, Aadhar Card, Passport, Driving License or any photo ID.

- Submit a self-attested copy of the ID proof of each Trustee like Voter’s ID, Aadhar Card, Passport, Driving License or any photo ID.

- PAN Card.

- Submit NOC or No Objection Certificate signed by the owner of the land.

- Submit any address proof of the Trust’s registered office such as water bill, gas bill, phone, electricity bill, and make sure all the bill must be latest.

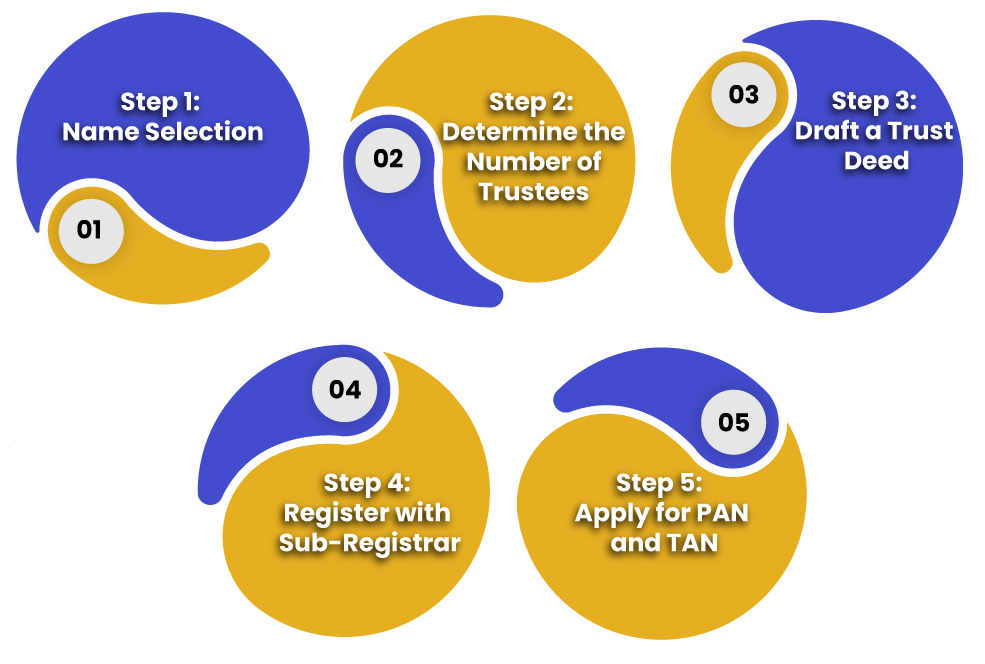

What is the process of Trust Registration under the Indian Trust Act, 1882?

Following is the procedure of Trust Registration under the Indian Trust Act:

- Step 1: Name Selection: The first step is to select a distinctive name for your Trust and such name must be new and must not lead to any violations.

- Step 2: Determine the number of Trustees: Once you choose the name of Trust, then the parties should choose the settlers of the Trust, and a minimum of two trustees are required for creating Trust, and the Trustees must be an Indian Resident.

- Step 3: Draft a Trust Deed: After that, you have to draft a Trust Deed. You can check all the requirement of drafting a Trust Deed from above.

- Step 4: Register with sub-registrar: For the Registration of Trust Deed, trustees and Trust’s Author should be present with the sub-registrar office along with two witnesses. There must be properly attested copy of Trust Deed and registration fee must be paid.

- Step 5: Apply for PAN and TAN: On the Registration of Trust Deed, apply for PAN and TAN of the company afterwards apply for a bank account.

Conclusion

It could be a good idea to establish a trust in India for someone who wants to carry out charitable activities with some tax benefits, but for that, you need to obtain Trust Registration under the Indian Trust Act. The limitations for creating such a firm are considerably low compared to other registrations, but the things start becoming complicated for the Trust for regulations. If you want to establish a legally oriented trust in India, then you can contact Swarit Advisors.

Also, Read: Process of NGO Registration in India