Types of Companies Under Companies Act 2013: A Complete Guide

Shivani Jain | Updated: Jan 04, 2021 | Category: Business

In India, there are various types of companies existing in the market, right from the public and private companies to investment and limited liability companies. Further, these entities might look different from each other but are based upon certain distinguishable common features and can be grouped into below mentioned classes. In this blog, we will discuss the concept and types of companies under the Companies Act 2013.

Table of Contents

Concept of Company

According to section 2(20) of the Companies Act 2013, the term “company” denotes a company incorporated either under this Act or under any other previous company law.

Further, in a common manner, a company may be described as an incorporated association, which is an artificial person, having its own separate legal entity, with the features like perpetual succession, common seal, and a common capital made of transferable shares and limited liability.

Different Types of Companies under Companies Act 2013

The different types of companies under Companies Act 2013[1] are as follows:

Types of Companies Based on Incorporation

The different types of companies under Companies Act 2013, based on Incorporation, are as follows:

Statutory Companies

The term “Statutory Companies” denotes the companies that are constituted either by a special Act of Parliament or by State Legislature. Further, these companies are formed majorly with an intention to offer public services.

Also, it shall be relevant to note that although these type of companies are primarily governed under the provisions of that Special Act, still the provisions of the Companies Act 2013 will be applicable to them, except in the case where the said provisions are contradictory with the provisions of the relevant act.

For Example: Life Insurance Corporation of India and Reserve Bank of India

Registered Companies

The companies that are registered under the Companies Act 2013 or under any other previous Company Law are known as Registered Companies.

However, such companies come into existence only when they are registered under the provisions of the Companies Act and have acquired a Certificate of Incorporation granted by the Registrar.

Types of Companies Based on Liability

The different types of companies under Companies Act 2013, based on Liability, are as follows:

Companies Limited by Shares

A company in which the liability of the members is limited to the extent of the amount specified in the Memorandum of Association is termed as Company Limited by Shares.

Further, it shall be relevant to note that the concerned company can enforce liability both during the existence and winding up of the company. Also, if the shares held by a member are fully paid, then, in that case, no further liability rests on them.

For Example: a shareholder who has paid Rs 75 on a share of a face value of Rs 100 can be called upon to pay the remaining amount of Rs 25 only.

Moreover, the companies that are limited by shares are so far the most common form of business entity. Also, the same can either be public or private.

Companies Limited by Guarantees

The term “company limited by guarantee” means a company in which the liability of the members is limited to the extent of guarantee undertaken by them.

Therefore, the members of such a company are employed in the position of guarantors of the company’s debts up to the extent of the agreed amount.

For Example Clubs, Trade Associations, Societies, Research Associations, who are working for promoting several objects are the example of guarantee companies.

Unlimited Liability Companies

A company that is not having any limit on the liability of its shareholders or members is known as an unlimited company. Further, in this case, the members are liable for undertaking the company’s debts in proportion to their individual interests, and their liability is unlimited.

Also, such companies may or may not have share capital and can be either a private limited company or a public limited company.

Types of Companies Based on Number of Members of Company

The different types of companies under Companies Act 2013, based on the Number of Members, are as follows:

Public Limited Company

The term public limited company is defined under the provisions of section 2 (71) of the Companies Act 2013 as a company that is not a private company. Further, the main essence of a public limited company is that its shares and debentures are transferable in nature and are capable of being listed on the recognised stock exchange.

Also, a private limited company that is subsidiary to a public company will be termed as a public limited company only.

Moreover, as per the Companies (Amendment) Act 2015, now there is no need to have any minimum amount for obtaining Public Limited Company Registration.

Private Limited Company

The term Private limited company is defined under the provisions of section 2 (68) of the Companies Act 2013 as a company that is not able to transfer its shares and cannot have more than 200 members. Further, this business format prohibits the company from inviting the general public to subscribe to shares and securities.

Also, a private company needs a minimum of 2 directors and must add the suffix “Private Ltd” at the end of its name.

Moreover, as per the Companies (Amendment) Act 2015, now there is no need to have any minimum amount for obtaining Private Limited Company Registration.

One Person Company

With the enforcement of the Companies Act 2013, various new concepts, such as One Person Company as a business format, were introduced, which were not there earlier in the Companies Act 1956. Further, theses kind of amendments has completely transformed the Indian Corporate Laws.

Further, the main aim behind the implementation of the concept of One Person Company or OPC was to provide an avenue for commencing a business with ease, flexibility, and limited liability, that partnership firms and sole proprietorship firms do not offer.

Some of the unique features of One Person Company are as follows:

- It requires only one person as its member;

- It needs only one person as its director;

- One of the unique features of an OPC as a business format that separates it from other types of companies under the Companies Act 2013 is that the sole member of the company needs to mention a nominee while incorporating the company. The reason behind the same is that since there is only one shareholder or member in an OPC, so after his/ her death, the person nominated will become the next sole member. However, it shall be pertinent to note that thesame does not happen in other business formats as they follow the notion of perpetual succession.

Also, one of the main advantages of the One Person Company Registration is that it includes fewer compliances but provides greater credibility.

Types of Companies Based on Domicile

The different types of companies under Companies Act 2013, based on Domicile are as follows:

Foreign Company

The term Foreign Company is defined under section 2 (42) of the Companies Act 2013 as the company or body corporate that is incorporated or formed outside India. Further, in a laymen’s sense, a foreign company is a business format that has a place of business outside India.

Also, section 379 to section 393 of the Companies Act 2013 deals with the provisions applicable to a Foreign Company.

Indian Company

The term Indian Company is defined under section 2 (20) of the Companies Act 2013 as any company incorporated under the provisions of the Companies Act 2013 or under any other previous corporate law.

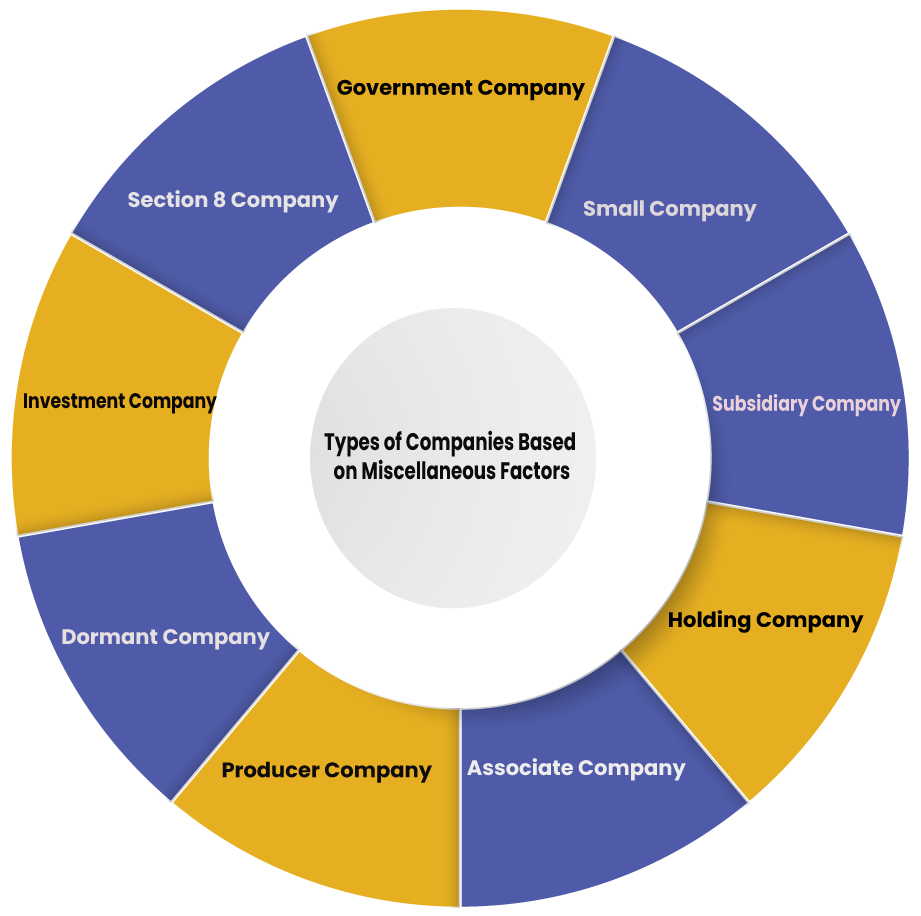

Types of Companies Based on Miscellaneous Factors

The different types of companies under Companies Act 2013, based on Miscellaneous Factors, are as follows:

Section 8 Company

The term Section 8 Company denotes a company or a business entity that is incorporated under the provisions of section 8 of the Companies Act 2013. Also, such a company holds a valid license from the Central Government and works on the objectives as follows:

- To promote commerce, art, sports, science, social welfare, education, research, religion, protection of the environment, charity, or any such other object;

- To apply its profits, if in case any, or any other income generated for promoting its objects; and

- To restrict the payment of dividend to its members;

Further, the main benefit of section 8 company registration is that it provides various tax benefits and exemptions offered by the government.

Government Company

The term Government Company is defined under the provisions of section 2 (45) of the Companies Act 2013, as the company or entity in which the shareholding of not less than 51% is held either by the Central Government, any State Government, or partly by one or more State Government and partly by the Central Government.

Further, these companies enjoy several exemptions and privileges offered under the provisions of the Companies Act 2013.

Small Company

The term Small Company is defined under section 2 (85) of the Companies Act 2013. It means a company other than a public limited company. Further, the paid-up capital and an annual turnover of the company must not be more than Rs 50 Lakhs and Rs 2 Crores, respectively.

However, it shall be relevant to note that no clause of a small company shall apply to the entities as follows:

- Holding Company;

- Subsidiary Company;

- A company incorporated under section 8 of the Companies Act 2013;

- A company or a body corporate governed or administered by any special act;

Also, it shall be considerate to note that a small company enjoys all the benefits and exemptions provided under the provisions of the Companies Act.

Subsidiary Company

The term subsidiary company denotes a business format that is incorporated under the provisions of section 2 (87) of the Companies Act 2013, as the company that is subsidiary to a holding company.

Holding Company

The term holding company means a company that is incorporated under the provisions of section 2 (46) of the Companies Act 2013. Further, in a laymen’s sense, the term holding company means a company to which other companies are subsidiary companies.

Moreover, the term holding includes the following:

- The company or entity that controls the composition of BOD (Board of Directors);

- The company that controls or exercises controls on more than one half of the total voting power either on its own or in association with more than one of its subsidiary companies:

Associate Company

The term Associate Company is defined under section 2 (6) of the Companies Act 2013 as a company in which some other company has a substantial influence, however, the same is not termed as a subsidiary company. Further, the concept of Associate Company includes Joint Venture Company as well.

Producer Company

The term Producer Company means a legally recognised body of agriculturists and farmers that aim to provide the following:

- Ensure Good Status to Members;

- Provide Support, Income, and Profitability to Members;

- Improve the Standard of Living for Members;

Moreover, for obtaining the Producer Company Registration, one needs to apply under section 465(1) of the Companies Act 2013. Also, all the members of a producer company must compulsorily be a primary producer in nature.

Dormant Company

The term Dormant Company means a company that is formed and incorporated under the provisions of section 455 of the Companies Act 2013 for some future project or to hold some property and asset, and the same has no significant accounting transaction. Therefore, the members of such an inactive or dormant company will furnish an application to the Registrar for declaring that company as dormant.

After being satisfied with the application filed, the registrar will allow the status of dormant and will issue a certificate regarding the same.

Also, in the case where the company has not furnished its annual return for a period of two years, then, in that case, the same will be declared as dormant by the registrar.

Investment Company

The term Investment Company is defined under section 186 of the Companies Act 2013 as the company that has a fundamental transaction or business pertaining to securities offered by such an entity. Further, the term securities mean the shares, debentures, or any other security offered by such a company.

Conclusion

In a nutshell, the different types of companies under the Companies Act 2013 are based on several factors, such as Independence, Financial Conduct, Liability, Domicile, etc. Further, there are chances that the companies might have two or more of the features mentioned above.

Furthermore, in case of any other doubt or dilemma, reach out to Swarit Advisors, our corporate experts are always there to provide a solution to your doubt and confusion.

Also, Read: Start a Retail Shop in India: Factors & Licenses to Consider