Easy Steps to Start a Finance Company

Japsanjam Kaur Wadhera | Updated: Mar 10, 2021 | Category: Microfinance Company, Nidhi Company

The Finance company provides loans or credits to the commercial customers and individuals for various reasons depending upon their needs. The commercial customers may include small businesses, retail stores or large firms. To start a finance company not only a thorough understanding of target customers needs and comprehensive product line is required but also along with it a solid business plan is required to show how a successful company can be made. Further, it is important for any new finance company to comply with the strict state and federal regulation and gather initial funding requirements. This article will provide you with the easy steps to start a finance company and also discuss the types of businesses that can obtain license to start a finance company in India.

Table of Contents

Primary objective of Finance Company

The finance companies are the companies that lend to its customers, while some make loans to businesses or finance the sale of manufactured products to the customers. Finance companies are supplements of bank but are separate entities than banks as deposits from public are not taken by the finance companies and as well as the companies are not subjected to the strict banking regulations. The finance companies base the loans on the value of the assets that the borrowers provide as security. The funds are obtained for lending through the own borrowings of the company or parent corporations.

What are the steps to start a Finance Company?

- It is necessary to select the finance company specialty in the types of loans as well as customers to serve. The operational requirements and financial marketing differs from one specialty to another. It is necessary to focus on a single business model to successfully create and operate a new company. The decision to start a specific finance company specialty should be on the basis on experience, interest and the likelihood of success. Further determining the financial capacity is important in order to start a finance company.

- To start a finance company, it is necessary to confirm the business opportunity. A finance company should be able to attract clients and produce profits. Therefore it is necessary, to research the expected market space where the business can set up and compete.

- Another thing is to identify the business requirements for example, what are the fixed costs in order to operate the business or what are the business processes that are important for day to day operations? Is there a need for financial partner such as bank or mortgage lender? How much capital is required to start the business? What will be the expected revenue per transaction or client? And various other concerned requirements.

- Once all the above planning has been made, the next step is to set up the business plan. The business plan serves many functions. It is a draft or framework for building a company in the future and to ensure that all the requirements are met by formulating detailed description of the company for the potential investor and lenders. It is necessary to define the goals of the business. It must define the need for a new financial company in the target location, to identify the target market and the planning how to reach their, providing the description of the products and services and the manner in which the company shall be organized.

- The next thing is to describe the organization and management of the company. It is necessary to clarify who owns the company, to specify the qualification of the management team, to create an organizational chart. A well developed and comprehensive organizational structure can help to start a finance company more successfully.

- It is important to explain the product line, that is, the type of financial products and loans that will be provided. There one needs to emphasize the benefits of the products that are going to be offered to the target customers.

- Further, explain how the business is financed by determining how much money is required to start the finance company. Specify the equity that is owned and the percent of investment done by investors in the company. One must indicate how the company is planning to finance with leverages, where such loans are taken from and how it is going to be used in the business. any funding request must state how much is required and what is the intention of using it and the terms of the loan and investment.

- The next thing is to document the sales and marketing management strategies. The marketing strategies must explain the manner in which the finance company is going to attract and communicate with the customers and depositors/ lenders. The sale strategy helps defining the way in which the products will be sold.

- It is also important to include the financial statements in the business plan and review it. A ratio analysis must be included to the document so as to understand the financial trends time to time and predict any future financial performance. The ratio and trend analysis data helps to analyze whether the finance company will be able to serve the customers over the time, and how to analyze the assets and manage liabilities and whether there is enough consideration to meet the obligations.

- Once the type of the finance company to start is decided, the next thing is to choose a name that represents the brand and is unique enough to obtain a URL or a website address.

- It is necessary to obtain intellectual property rights such as patenting or trademark or copyrighting the business and the ideas involved and all other symbols related to trademark. Obtaining such rights help to protect the business idea by registering it in the name of the company.

- Further, finance companies are required to acquire operational licenses and permits to operate. It is necessary to specify what type of finance company it is and submit the requisite documents along with the prescribed fees.

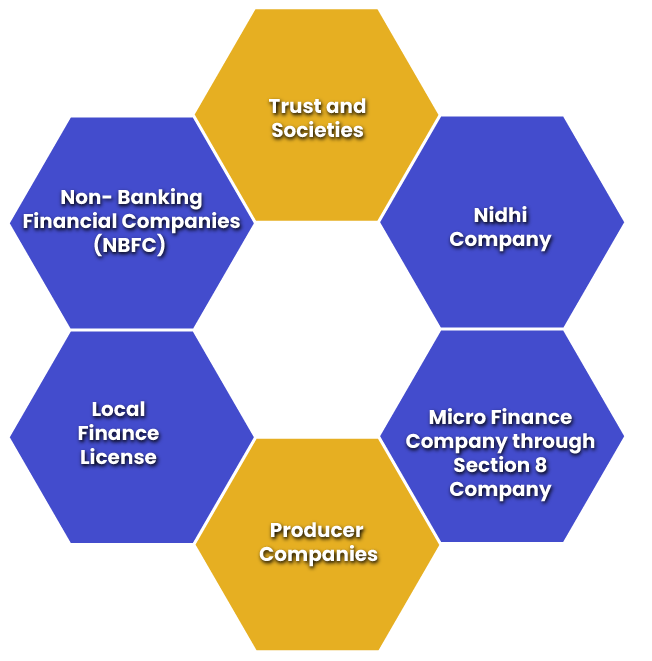

Types of Finance companies in India

The companies that are engaged in the finance business are called Non- Banking Financial Companies (NBFC). The finance company can be started under following types of businesses:

- Non-Banking Financial Companies (NBFC)

- Micro Finance Company through section 8 company

- Trust and Societies

- Nidhi Companies

- Local Finance License

- Producer Companies

Finance Company Registration through various types of businesses

Non- Banking Financial Companies (NBFC)

In order to register the finance company as a Non- Banking Financial Company (NBFC) a minimum capital of Rs. 2 Crore is required to start the business. The NBFC is governed by the Reserve Bank of India (RBI). Further it is a huge task to get the RBI license and it takes almost around 5 to 6 months to get the registration procedure completed. One must also take into consideration, that there is no guarantee whether the RBI will grant the finance license or not.

Advantages of NBFC registration

- It is the most authentic option to start a finance company.

- A proper license is obtained from the Reserve Bank of India (RBI).

- It is easy to operate the finance company as a NBFC in any part of the world.

- Foreign investments can be accepted up to certain limits.

Disadvantages of NBFC registration

- The finance company registration as an NBFC involves a very high compliance cost.

- The capital requirement is quite high.

- As stated above, it is not easy to obtain the license from the RBI.

Trust and Societies

The Trust and Societies are one of the most popular forms of starting a finance company in India. It is the suitable option for those who wish to start a finance company at a shorter level that is, at the district level. However, since due to many frauds that are happening, getting a Trust and Society license is becoming difficult day by day and the society license is not easily issued from the Registrar of the Society.

Advantages of Trust and Societies

- Trust and societies can accept deposits.

- The registration can be done involving less cost.

- It involves less compliance.

Disadvantages of Trust and Societies

- The finance company as a Trust of Society can be started and work up to only district level.

- There can be change in ownership with elections.

- The finance can be provided only to the members.

Nidhi Company

The registration of finance company as a Nidhi Company is one of the best and the easiest form to start the finance business in India. The Nidhi Company can be started with a very minimal capital of Rs. 5 lakh and can be registered with the 15 to 20 days. One can easily accept deposits and grant loan under the Nidhi Company.

The basic requirements for the registration of Nidhi Company are:

- A Nidhi Company can be started with a minimum capital of Rs. 5 lakh and in a year it must be raised to Rs. 10 lakhs.

- A minimum of 7 persons are required to start a Nidhi Company in India, out of which 3 people are elected as the director of the company.

Some of the documents required for the Nidhi Company registration are PAN Card, identity proof, photograph, address proof, electricity bill as a proof for registered office, No Objection Certificate from the owner (NOC) and Rent agreement in case the premises are registered.

In order to register the finance company as a Nidhi Company the below mentioned procedure is required to be followed:

- The first step to register a Nidhi Company is to apply for digital signature certificate (DSC) for all the 7 directors.

- Once the digital signature is made, the applicant is required to apply for 3 DINs. DIN is the Director Identification Number that every director must have in accordance with the law.

- The next step is to get the name approved from the Ministry of Corporate Affairs (MCA). Once the approval is granted, the next step is to apply for the incorporation.

- Lastly, the applicant is required to prepare and file all the necessary documents with the MCA. Upon the satisfaction of the MCA, a registration certificated shall be grant to the applicant.

Micro Finance Company through Section 8 Company

Even though no RBI approval is required under this type of company, it is yet difficult to start a finance company as a micro finance company in India since the MCA does not easily approve the company.

Producer Companies

The Producer companies are the type of companies which are suited best for the producers or farmers. At least 10 people are required to start a finance company as a producer company. This option is similar to Nidhi Company however the latter is more flexible than the former company.

Local Finance License

Some states offer local finance license in order to start a finance company in the state rather than the district. States such as Kerala and Maharashtra generally offer for the state finance license.

Conclusion

Starting a finance company involves a thorough planning and research. The purpose of finance company is to provide loans to the commercial customers and individuals for various reasons. It fulfils the financial needs of the people. The easy steps to start a finance company have been discussed thoroughly in the above article and it is important to register the finance company so as to avail the benefits upon registration. Whether it is starting off a new business venture or about taking loans, a financial help from a recognized institution is the best option to avail finances at the time of need of funds. The finance companies serve and extend their hand to help those who cannot access mainstream banking and financial services. Hence, finance company is the new road that many entrepreneurs are engaging into. The Indian economy has been witnessing a remarkable growth and evolution in the financial services industry with the establishment of several finance companies.

Also, Read: How to Start a Micro Finance Institution in India?