Types of Company Takeover: A Guide on Different Takeovers

Shivani Jain | Updated: Feb 25, 2021 | Category: Company Takeover, SEBI Advisory

In today’s era, businesses are facing a lot of challenges in the form of competition, technologies, and dynamism. Therefore, to sustain their existence and strengthen their market position and financial performance, they undergo several structural modifications. The most preferable growth oriented strategy is Company Takeover. In this blog, we will talk about the concept and types of company takeover.

Table of Contents

Concept of Company Takeover

The term Company Takeover means a process in which one business entity acquires control over another business entity. Further, the term control means purchasing the majority stake in another business entity.

The company that acquires the Majority Stake is termed as the Acquirer or Bidder, and the company whose control or majority stake is acquired is termed as the Target Company.

Also, Read: 7 Steps to Takeover a Company In India

Benefits of Company Takeover

The key benefits of Company Takeover are as follows:

- Assists in Increasing the Business Size;

- Reduces Market Competition;

- Facilitates several Tax Benefits;

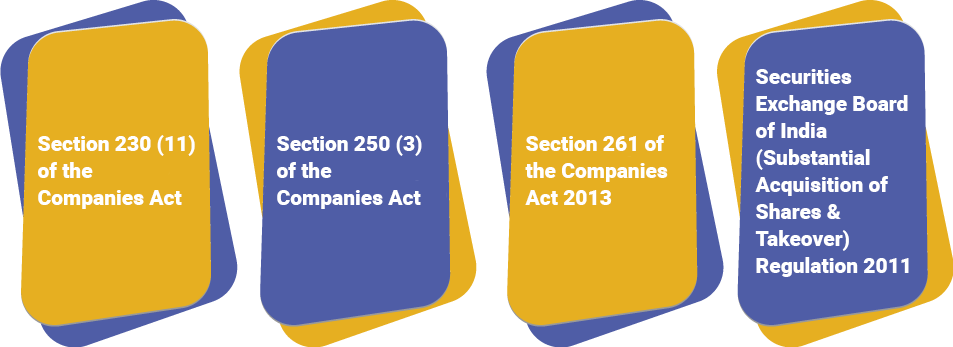

Governing Laws for Different Types of Company Takeover

The governing laws for different types of Company Takeover are as follows:

Section 230 (11) of the Companies Act 2013

Every form of Compromise and Arrangement is covered under this section.

Section 250 (3) of the Companies Act 2013

According to the provisions of this section, NCLT (National Company Law Tribunal) has the power to direct any company administrator to takeover the management and assets of that company.

Section 261 of the Companies Act 2013

According to the provisions of this section, NCLT authorises the appointed company administrator to prepare the scheme of Rehabilitation and Revival, comprising of the takeover of a sick entity by a solvent company.

Securities Exchange Board of India (Substantial Acquisition of Shares & Takeover) Regulation 2011

The provisions of the SEBI (Substantial Acquisition of Shares & Takeover) Regulation 2011 governs the process of Takeover of a listed company.

Reasons for Choosing Company Takeover

The reasons for choosing the process of Company Takeover are as follows:

- To achieve product development, market improvement, and advanced technologies of the target company;

- To expand the existing product line;

- To boost the productivity and profitability of the acquirer company;

- To increase the market size for the acquirer company;

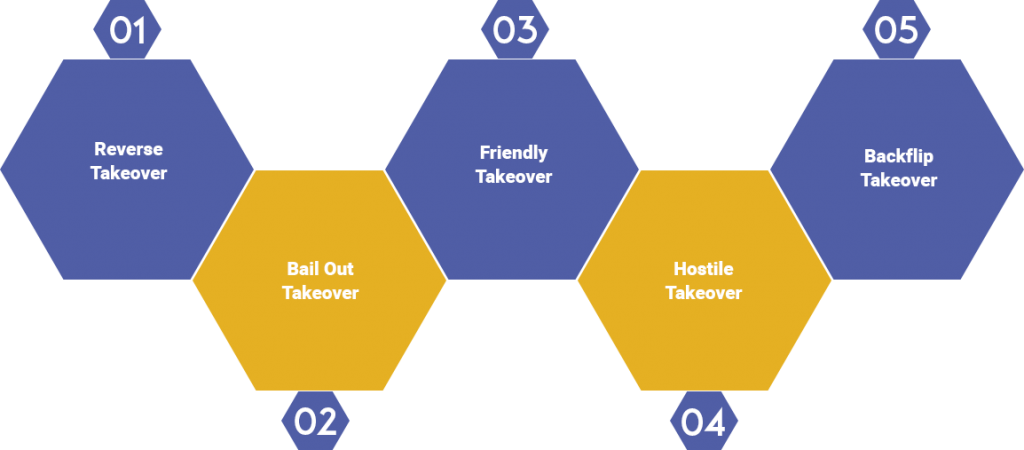

Different Types of Company Takeover

The different types of Company Takeover are as follows:

Reverse Takeover

Whenever a private limited company decides to lists its equity shares on a recognised stock exchange, but do not wish to undergo the process of Initial Public Offer, it undertakes the process of Reverse Takeover. Under this type of company takeover, a private limited company acquires shares of a public listed company.

Bail Out Takeover

In a Bail out Takeover, a profit making company acquires a sick entity to bail it out from the procedure of liquidation.

Friendly Takeover

When the acquirer or bidder company obtains the consent of the target company prior to undergoing the course of Takeover, the same is known as the Friendly Takeover. Thus, it is a process wherein both the parties mutually agree to the stipulations and conditions of a takeover.

Hostile Takeover

Hostile Takeover is completely opposite from a Friendly Takeover. Under this concept, the acquirer company does not take prior permission from the target company and forcefully practises the process of takeover.

Backflip Takeover

In the case of Backflip Takeover, an acquirer company chooses to become the subsidiary of the Bidder or Target Company.

Consideration for Different Types of Company Takeover

The consideration for different types of Company Takeover are as follows:

In the form of Cash

When the acquirer or bidder company pays the consideration in form of cash, for the shares acquired of the target company.

In the form of Shares

When the acquirer company decides to pay the consideration by allotting its equity shares to shareholders or members of the target company. The same will be done in proportion to their previous shareholding.

By Forming a New Company

A bidder company can form a new company by acquiring equity shares of the target company. Thereafter, the shareholders of both the entities are allotted equity shares of the newly structured company.

Procedure for Different Types of Company Takeover

The steps involved in the procedure for different types of Company Takeover are as follows:

Pass Board Resolution

The directors of a bidder company need to pass a Board Resolution (BR) to approve the process of bidding for the shares of the Target Company.

File Application to Commission

In the next step, the company needs to file an application with the commission for the approval of Takeover Bid. Further, the said application must be filed with the attachments as follows:

- Takeover Bid;

- No Objection Certificate (NOC) from the relevant government authority;

- Information Memorandum;

Registration of the Proposed Takeover Bid

Once the company has received approval from the authorities, the bidder company requires to file an application to get the proposed takeover bid registered with the commission.

Send the Takeover Bid

After obtaining registration, in the next step, the bidder company will send the takeover bid to the target company.

Convene a Board Meeting

Further, the target company will hold a board meeting to accept that 90% of its shareholding is subject to acquisition.

File Takeover Report

Once the process of Company Takeover is complete, the bidder company needs to file a takeover report with the commission within seven days from the conclusion of Takeover.

Conclusion

In a nutshell, Company Takeover is the most preferable growth oriented strategy, in which one corporate entity purchases the majority stake in another corporate entity. Further, the parties involved in a takeover are Acquirer and Target Company. Also, there are five different types of company takeover, and for each of them one needs to follow the process mentioned above.

Also, Read: An Ultimate Company Takeover Checklist – for a Successful Acquisition