Revised Regulatory Framework Proposed by RBI for NBFCs

Japsanjam Kaur Wadhera | Updated: Feb 13, 2021 | Category: NBFC, RBI Advisory

Over the years, NBFCs are turning systemically significant owing to their complexity, size and interconnectedness, the RBI has worked on to review the regulatory framework of NBFCs by adopting a scale based approach. Keeping in view with the recent difficulties faced in this sector, RBI stated that it has become imperative to re- examine the sustainability of the regulatory approach. Unconstrained growth with the help of less rigorous framework within an interconnected financial system would create systemic risk. The RBI introduced regulatory frameworks for NBFCs in order to keep pace with the changing realities. This article will discuss about the revised regulatory framework proposed by RBI for NBFCs.

Table of Contents

Need for Revised Regulatory Framework

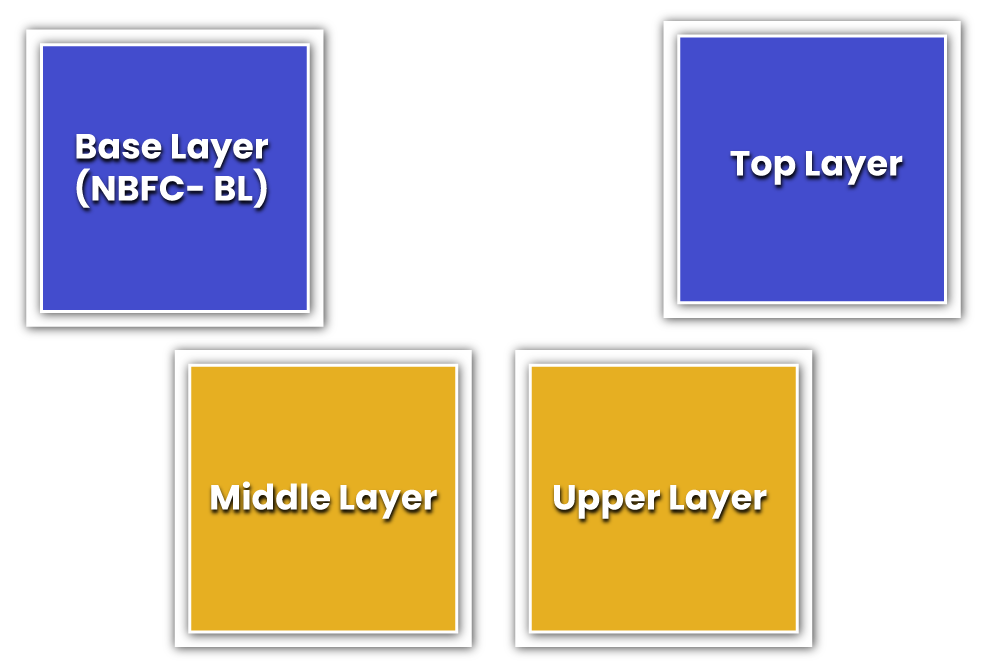

The RBI released a discussion paper on the revised regulatory framework in December 2020 policy, for NBFCs, which grouping NBFCs into 4 layers as it embarks on the path of scale- based regulation in the backdrop of the recent difficulties and stress in the sector. Such four layers are Base Layer (NBFC- BL), Middle Layer (NBFC- ML), Upper Layer (NBFC- UL), and a possible Top Layer (NBFC- TL). Regulations around concentration norms, capital requirement, governance and disclosure have been initiated for each layer:

Base Layer (NBFC- BL)

Around 9,209 NBFCs will be added in the Base Layer (BL) which may consist of NBFCs currently classified as non- systemically important NBFCs (NBFC- ND/ Non- Deposit taking), account aggregators, Non- Operative Financial Holding Company, Peer- to peer lending platforms and NBFCs up to Rs. 1,000 crore asset size. As low entry point norms raises the chances of failure resulting from poor governance of non- serious players, the Central Bank takes the initiate to plans to revise these norms for NBFC- BL from Rs. 2 crore to Rs. 20 crore. RBI comes up with harmonising the surviving NPA (non- performing asset) classification norm of 90 days to 180 days for NBFC- BL.

Middle Layer

Entities currently classified as NBFC- ND/ Non- Deposit taking- Systemically Important, housing finance companies, infrastructure debt funds, infrastructure finance companies, core investment companies, standalone primary dealers and deposit taking NBFCs are considered for NBFCs in the Middle Layer (ML). Where no changes are proposed in minimum capital requirement for NBFC- ML, RBI stated that the linkages of their exposure limits are proposed to be changed to Tier 1 capital from Owned Funds as currently applicable for banks.

Also, Read: Pros and Cons of Non Convertible Debentures (NCD) Issued by NBFC

The existing credit concentration limits prescribed for NBFC- ML for their investment and lending can be merged into a single exposure limit of 25% for the single borrower and 40% for a group of borrowers anchored to the NBFCs Tier 1 capital. This is not as stringent as for banks which currently have single and group exposure limits of 20% and 25% respectively. Provided that systemically important NBFCs already follow a 90 days NPA classification norm, so there will not be an impact on the middle layer NBFCs. The standard asset provisioning of 0.4% remains unchanged.

IPO Financing

While emphasizing that Initial Public Offer (IPO) financing by individual NBFCs more for their abuse of system has come under scrutiny, the paper proposed to fix a ceiling of Rs. 1 crore per individual for any NBFC. NBFCs are at liberty to select more conservative limits. Also, a sub- limit within the commercial real estate exposure ceiling must be fixed internally in order to finance the land acquisition.

According to the regulatory framework, a few restrictions are extended to NBFC- ML, including not allowing then to provide loans to the companies for buy back of securities and shares. The guidelines on sale of stressed assets y NBFCs will be modified on similar bases as that for banks. The paper suggested that NBFCs having ten and more branches are mandatorily required to adopt Core Banking Solution. Further it recommended a uniform tenure of 3 consecutive years applicable for statutory auditors of NBFC. It suggested the appointment of functionally independent Chief Compliance Officer.

To address issues arising out of excessive risk- taking caused by misaligned compensation packages, the compensation guidelines for NBFCs along the lines of banks can be considered. Also making some disclosures prescribed for banks applicable to NBFCs will bring great transparency and at the same time shall provide better understanding to the stakeholders regarding the entity.

Upper Layer

NBFCs which are identified as systemically important among them inviting new regulatory superstructure is considered under Upper Layer. This layer consists of NBFCs having large potential of systemic reach of risks and may impact financial stability. There is no parallel for this layer currently and this will be a new layer for the revised regulatory framework.

The regulatory framework proposed by RBI for NBFCs falling in this layer will be bank- like, though with appropriate and suitable modifications. It is expected that total of not more than 25 to 30 NBFCs will occupy this layer. It is felt that Common Equity Tier (CET) 1 capital can be introduced for NBFC0 UL to enhance the quality of regulatory capital. It is initiated that CET 1 may be directed at 9% within the Tier 1 capital. The paper also suggested that NBFC- UL must be prescribed with differential standard asset provisioning on bank lines. Given the higher systemic risk posed by NBFC- UL, the Large Exposure Framework (LEF) as applied to bank may be extended with suitable adaptation.

The NBFC- UL are needed to be subjected to the mandatory listing requirement and should follow the consequent listing obligations and disclosure requirements.

Top Layer

Considered supervisory judgment might push some NBFCs out from the upper layer of the systemically significant NBFCs for higher supervision or regulation. Such NBFCs will occupy the top of the upper layer as a distinctive set. Basically, this top layer of the pyramid will remain empty unless supervisors view specific NBFCs. That is, if some NBFCs being in the upper layer are seen having extreme risks as per the supervisory judgement, they can be added to significantly higher supervisory or regulatory requirements.

Conclusion

The RBI has taken initiative to set strong and well governed NBFCs that can promote resilience in the financial system by providing much required backup within the system. And thus, revised regulatory framework proposed by RBI for NBFCs for its tremendous growth and working.

Also, Read: Know the Factors which led to the growth of Indian NBFCs