RBI Overhauls Regulatory Restrictions on Loans and Advances

Karan Singh | Updated: Aug 04, 2021 | Category: RBI Advisory

Recently, the RBI or the Reserve Bank of India restored the regulatory restrictions on loans and advances by traditional banks to directors of other banks & related companies. The Notification regarding regulatory restrictions on loans and advances was announced by the Reserve Bank of India on July 23, 2021, which delivers for increased limits in loans and advances to be provided by banks. Scroll down to check the Notification in detail.

Table of Contents

To whom this Notification was issued?

The Reserve Bank of India to address all scheduled traditional banks excluding RRBs, all small finance banks & all local area banks.

Legal Restrictions

According to Section 20 of the Banking Regulation Act, 1949[1], there is an absolute prohibition on banks to enter into any promise for allowing the loan to or on behalf or any of its directors and stated other parties wherein the director is interested. The master circular on loans and advances statutory & other restrictions lays down the prohibitions and limits.

Revised Notification: Regulatory Restrictions on Loans and Advances

The master notification on regulatory restrictions on loans and advances specifies companies or persons to whom advances and loans can be extended up to a particular limit with prior consent from the board. Now the revised Notification released by the Reserve Bank of India vide Notification has changed or amended the limits for some classes of individuals. In the table mentioned below, we have explained the present limitations and the revised, improved limits.

| Type | Present Limits (RBI Master Circular) | Revised Limit (RBI Notification dated 23rd July 2021) |

| Other Directors of banks | Up to Rs. 25 lakh | Up to Rs. 5 crore for personal loans (this amendment shall apply in the case of personal loans only) |

| Companies where directors of other banks are interested as guarantor or partner | Up to Rs. 25 lakh | No revision |

| Entities wherein other directors of banks hold considerable interest or is a guarantor or director. | Up to Rs. 25 lakh | No revision |

| Relative (other than spouse) & minor or dependent children of MD/Directors/Chairman | Up to Rs. 25 lakh | Up to Rs. 5 crore |

| Relative (other than spouse) & minor or dependent children of MD/Directors/Chairman of other banks | Up to Rs. 25 lakh | Up to Rs. 5 crore |

| Companies wherein relative as mentioned above are guarantors or partners | Up to Rs. 25 lakh | Up to Rs. 5 crore |

| Entities where relatives are interested as director/guarantor if he or she is a significant shareholder. | Up to Rs. 25 lakh | Up to Rs. 5 crore |

The Central Bank also informed that the suggestions for credit facilities of an amount less than Rs. 25 lakh or Rs. 5 crore (according to the case) to these borrowers could be sanctioned by the relevant authority in financing banks under the controls covered in such authority, but the matter should be informed to the banks.

Also, Read:RBI extends timeline for Payment Aggregators

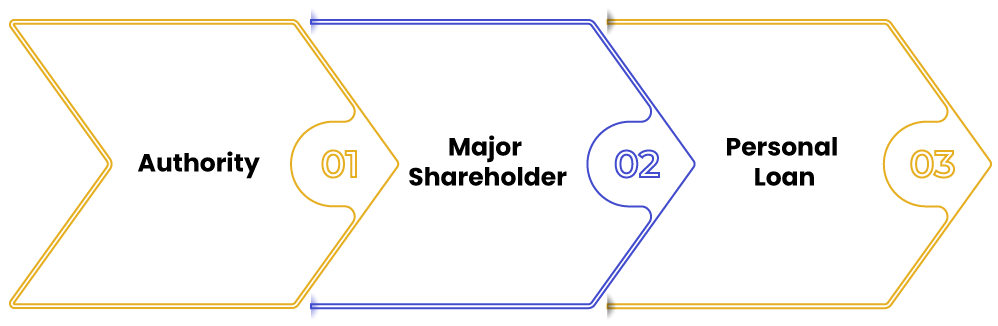

Clarification of Definite Terms

The Reserve Bank of India, in its Notification, also tells definite terms, which can be helpful for good understanding. These terms are given below:

- Authority: It shall consist of the right to assign a majority of directors or to control the policy decisions or management practicable by an individual or persons acting individually or in performance, directly or indirectly comprising by virtue of their shareholding or shareholding agreements or management rights or voting agreements or in a different way.

- Major Shareholder: According to the Notification, major shareholder refers to an individual’s holding 10% or more of paid-up share capital of Rs. 5 crores in paid-up shares, whichever is less.

- Personal Loan: This term is taken from the circular of the RBI (Reserve Bank of India) on coordination of banking statistics. According to this Notification or circular, the meaning of personal loans is loans delivered to persons and include client credit, education loan, loans offered for enhancement of immovable assets & loans prolonged for investment in financial assets.

Requirement for Amendment in Regulatory Restrictions on Loans and Advances

The master circular on loans and advances; legal and other restrictions was released more than five years ago. Owing to the rising inflation, these limits became indistinct & unclear and thus required revision. Moreover, because of the Covid-19 pandemic impact in the country, such relaxation was predicted.

Conclusion

Thus, with the amendment notifications of the Reserve Bank of India to the regulatory restrictions on loans and advances, the limits have been increased in the advances & loans to be provided by banks. You can also check the official Notification of the Reserve Bank of India below for a good understanding.

NOT72DE11B78FC7714B5E872265606C29F75B