RBI Mandates Interoperability of PPIs (Pre-paid Cards, Wallets)

Karan Singh | Updated: Jun 16, 2021 | Category: Prepaid Wallet

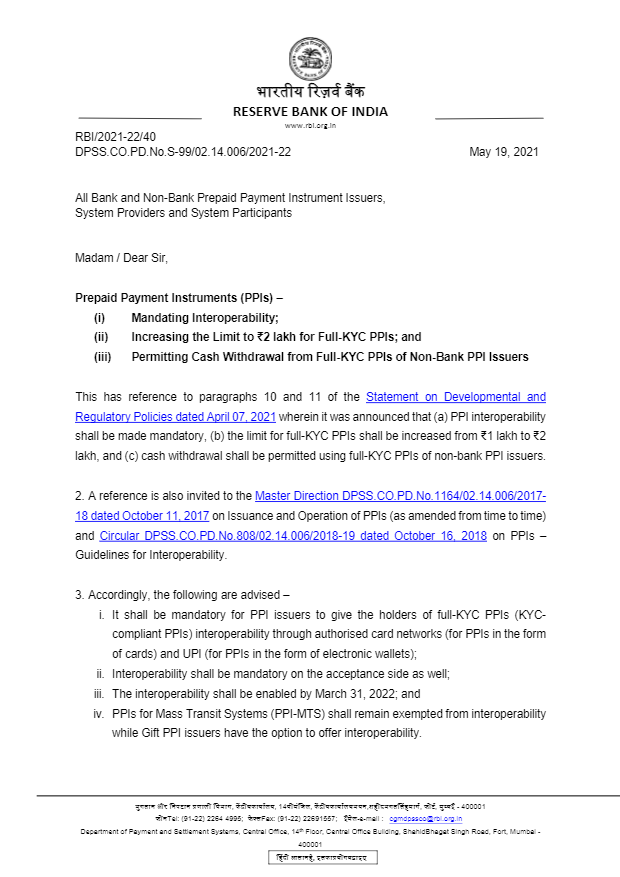

The Reserve Bank of India ordered all prepaid payment instruments or wallets that are KYC (Know Your Customer) compliant to be made interoperable by March 2022. The RBI issued a notification in this regard on 19th May 2021. In this blog, we are going to discuss the details of the notification concerning the interoperability of PPIs.

Table of Contents

Interoperability of PPIs: Details and Background of the Notification

The Reserve Bank of India tells in the notification that pre-paid instrument operators to permit full interoperability of PPIs card and e-wallets for clients who have met the full KYC criteria. Payment entities must enable PPI interoperability by 2022.

In April, the governor of the RBI, Shaktikanta Das, had announced that the limit for complete KYC PPI accounts would be raised from Rs. one lakhs to Rs. two lakhs. It means that a PPI e-wallet or PPI card user may double the amount they store on the payment instrument. In view of the fact that the migration towards interoperability has not been considerable, now interoperability has been made compulsory for complete KYC compliant PPIs for the entire payment acceptance infrastructure.

What is the Meaning of PPI?

PPI stands for Prepaid Payment Instruments are preloaded cards or digital wallets. For example, Mobikwik, Paytm, Phonepe, etc., are payment apps that allow clients to add funds into the app to spend the funds via the app itself. Such are PPI e-wallets. Conventionally payment apps possess PPI licenses; however, with the coming up of UPI (Unified Payment Interface), the ouccrences of loading the app with money have decreased significantly since the UPI is a flawless bank to bank payment system and based on which such apps deliver a great client experience.

What is the meaning of Interoperability of PPIs?

Interoperability means that despite who issues the PPI card or the e-wallet, clients can use their e-wallet or PPI card at any payment acceptance point. Hence, it means under interoperability, a PPI owner can swipe their card at any merchant channel having a card swiping instrument or machine. Similarly, while UPI is interoperability, a client would be able to transfer their Payment wallet funds to a Mobikwik or a Phonepe wallet if they want.

Why has Reserve Bank ordered for Interoperability of PPIs?

In order to encourage utilisation of payment instruments like cards & wallets and the given the restraint of insufficient payment acceptance infrastructure like ATMs, Point of Sale devices, QR codes etc., the Reserve Bank of India has been stressing for interoperability amongst the acquiring & issuing entities alike.

It should be remembered that the Reserve Bank of India[1], in its notification, has exempted Prepaid Payment Instruments for mass transit systems and gift Prepaid Payment Instruments from complying with their instruction. But, gift Prepaid Payment Instrument issuers may provide interoperability if they want.

What are the Advantages of the New RBI Order?

The new RBI order comes with the following benefits:

- Greater Online Payment Usage and Adoption: It may also direct to greater digital payment adoption and usage. It will additionally give the payment instrument great value and utility. It may add to India’s rising mobile payment users.

- Merchants would be Competent to Accept More Wallets: At present, mobile wallet providers are required to construct merchant networks to get clients to use their wallets, but with the new RBI order, providers do not have to worry about it as all UPI accepting merchants would be able to accept their wallets. This can increase acceptance and cover the way for improved revenue and volume.

Additional Details of the RBI Notification

The notification/circular of the Reserve Bank of India also laid down the rules of permitting cash withdrawal from completely KYC Prepaid Payment Instruments issued by non-banks. There would be a maximum limit of Rs. 2000/- per transaction within the general limit of Rs. 10,000 per month per PPI (Prepaid Payment Instrument). All cash withdrawal transactions using a wallet or a card will be certified by an extra aspect of authentication or PIN. Issuers delivering withdrawals would put a particular cooling-off period for cash withdrawals on opening the Prepaid Payment Instruments or loading/reloading funds into the Prepaid Payment Instrument to decrease the fraudulent use risk.

The cash withdrawal limit from the points of sale terminals with debit cards & open system prepaid cards issued from banks has also been streamlined to Rs. 2,000/- per transactions within an overall monthly limit of Rs. 10,000/- across all locations. Prior to this, withdrawals via this mode were capped at Rs. 1000/- for tier I and II centres and Rs. 2000/- in case of other centres.

Conclusion

Different industry players pervious lauded such moves telling that interoperability of PPIs may help wallets in getting back the space that they lost to banks and other players with the arrival of UPI and the new KYC necessities. There could also be an opportunity that non-banks would be able to compete for micro-savings from the underbanked segments efficiently.

Read our article:Types of Prepaid Wallet License: A Guide on Different PPIs