Challenges Faced by the MSME in India – An Overview

Karan Singh | Updated: Aug 16, 2021 | Category: MSME

The assistance made by the informal sector to the economy of India is substantial. The fact is that India’s growth relies considerably on MSMEs that contribute substantially to the GDP by making mass employment in every side of India. In an outlook of its importance, the Government of India is expected to deliver sufficient support to makes sure the growth of MSMEs does not get restricted at any point, especially during the pandemic that has majorly impact the global economies to a standstill. However, despite being so effective, the MSMEs have their issues and challenges that act as obstructions to their growth. Scroll down to check some common challenges faced by the MSME in India.

Table of Contents

Role of MSME in Contributing to the GDP of India

MSME is regarded as a significant contributor to the GDP of our nation. It has imparted flexibility to the economic infrastructure by raising the production value and the employment rate to fulfil national and international demands. The MSME sector is dominated by micro-enterprises. Currently, India has approximately 6.33 crore MSMEs, out of which 6.30 crores are working as micro-enterprises.

In Financial Year 2020, the number of registered MSMEs has risen by approximately 18.5% as compared to the preceding year. However, the growth rate declined from 40% in the preceding Financial Year, increasing from 15 lakhs MSMEs registered in the year 2018. In general, the number of Micro, Small, and Medium Enterprises in India in the last five years stood at Rs. 90 lakhs.

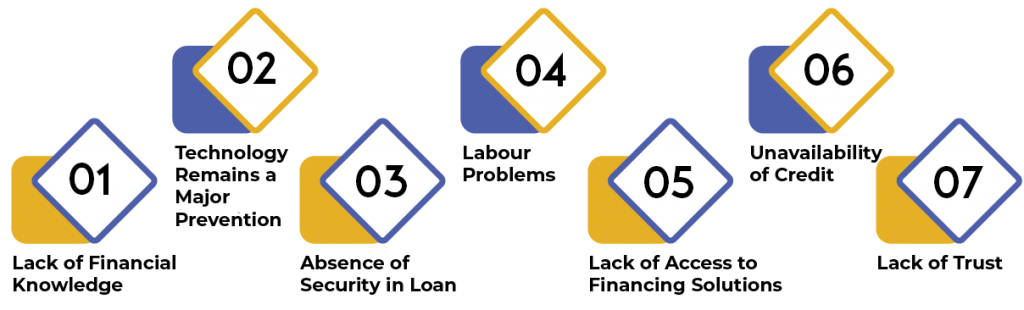

What are the Ordinary Challenges Faced by the MSME?

Following are some common challenges faced by the MSME:

- Lack of Financial Knowledge: It is one of the most common challenges faced by the MSME in India. Even as entrepreneurs keep making new plans & strategies for the expansion of their present business, there is still an enormous number of entrepreneurs who lack the financial expertise to guide the business in the correct direction. Those who do not have enough financial knowledge may not be able to make vital business decisions concerning MSME loans. In the absence of financial expertise, you may finish by taking incorrect decisions that may harm the business unless you are looking for any external help. Also, finance knowledge is essential because you have to depend on an MSME loan to survive the crisis that may knock at the door anytime. Therefore, it is vital to know everything regarding MSME loans, determine the interest rate of MSME loans and compare the same in the market before getting a loan.

- Technology Remains a Major Prevention: Most businesses in India fail to collect the advantages of the advanced technology developments in their sector due to the requirement of awareness and knowledge. Thus, MSMEs need to be informed of the technological advancements that are vital for their business growth. It is essential for scientific research bodies to remain involved with the local MSME clusters and take notice of their technology-related issues. But, there have been united efforts to provide solutions to MSMEs in such matters as the Government is working towards the launch of an e-commerce portal known as “Bharat Craft” that will act as a direct interface between buyers & sellers.

- Absence of Security in Loan: Some businesses in India may find it hard to get MSME loans as an outcome of a severe collateral or security protocol. Since small entities may not have the property to validate the criteria to get a loan, business owners may choose for unsecured business loans from lenders & not fret over providing security or assets to obtain the MSME loan consent.

- Labour Problems: Most Small, Medium Enterprises (SMEs) face common labour problems and especially in the new normal times, the ongoing migrant crisis has demonstrated itself as one of the most complicated areas for industries to run in such times of Covid-19 pandemic. Despite labour problems, businesses also need to highlight skill development, training and ensuring market linkages to provide both rural & urban micro-entrepreneurs. The highlighting on skill development can benefit the sector considerably & more so at the crisis time.

- Lack of Access to Financing Solutions: Most businesses in India face recurrent problems of accessing financing or obtaining an MSME loan even as the Government has executed measures to make credit for businesses readily available to promote entrepreneurship. The regulatory excuses that cause a delay in getting certifications, licenses, and insurance also hinder the forecasts of MSMEs. Most businesses face problems concerning manufacturing, timely purchase of raw materials, or even access to advanced technologies or obtain new skills due to the lack of funding.

- Unavailability of Credit: Another obstruction that limits the possibility of this sector is its inability to get timely credit at a nominal interest rate. According to some experts, MSMEs working in PAN India lack the expediency of getting easy credit from financial institutions. Now, this mitigates their urge for development and long-term growth. The Covid-19 pandemic has impacted MSMEs to a great deal. The outburst has left them distributed by eroding their present resources. As an outcome, the majority of entities are now out of human resources adequate resources. At current, the liquidity crisis is one of the pressing challenges faced by the MSME.

- Lack of Trust: It has been observed that banks desist from extending MSME loans since the amount remains small, and also banks think MSMEs lack the required repayment capacity. In such a condition, they finish up by executing stringent regulations on these start-ups. Some businesses in India fail to observe their credit rating that obstructs the outlook of getting loans. Further, traditional lending options make it hard for business owners to meet criteria besides the extended procedure of MSME loan consent further dampens their spirits.

Despite these challenges faced by the MSME, success in business is not indefinable if you are strong-minded, and these issues can be easily solved if you get the proper support from the lender.

Viewpoint in India to Encourage the Development of MSMEs in India

The Government of India needs to take some necessary measures to encourage the development and growth of MSMEs. The Government of India is thinking to create national manufacturing capabilities by leveraging the proposed public projects and procurements. The projects like Bharatmala[1], Sagarmala are already in effect and intend to connect the rural and urban divide, thereby ensuring the development of the industrial sector. Currently, the economy urgently requires a robust connection between Government industry-academia to track down the evolving necessity in manufacturing to encourage the industrial supply chains in India.

To overcome the above-mentioned challenges faced by the MSME, adopting advanced technology is one of the possible solutions in the future. The Government has taken several steps to make sure the technological development of MSMEs in India on account of the competition level in the global market.

Conclusion

Above mentioned challenges faced by the MSME are practically severe and require prompt resolution. The Government of India is trying to make a roadmap for this sector. Currently, the Government of India has introduced an incentive package of Rs. 3 lakh crores under which MSMEs in India can get collateral-free loans from the proposed banks. But, the proposed schemes suffer from pressing challenges that seek quick resolution from the Indian Government.

Read our article:RBI Loan Restructuring for MSME up to Rs 50 crores