Factoring Regulation (Amendment) Bill 2021: To draw 9000 NBFCs, boost MSME Cash Flow

Karan Singh | Updated: Aug 03, 2021 | Category: MSME

On 29th July 2021, the Rajya Sabha introduced a Factoring Regulation (Amendment) Bill 2021. This bill will expand the credit facilities for small businesses and aid them in accessing funds from 9000 NBFCs (Non-Banking Financial Companies). The amendments will provide a movement to the economy by giving an effective working capital cycle for MSMEs.

Table of Contents

What is Factoring Business or Firm?

Factoring is a monetary transaction in which a company or a firm sells its accounts receivable invoices to a 3rd party called a factoring firm at a discount so that it gets immediate money to continue its business. The factoring company or firm pays a percentage of the invoices quickly. Firms often factor in receivables to improve their cash flow. Factoring is different from bank loans. In factoring, the importance is on the receivables of the firm selling its receivables. A factoring transaction involves three parties.

Provisions of the Factoring Regulation (Amendment) Bill 2021

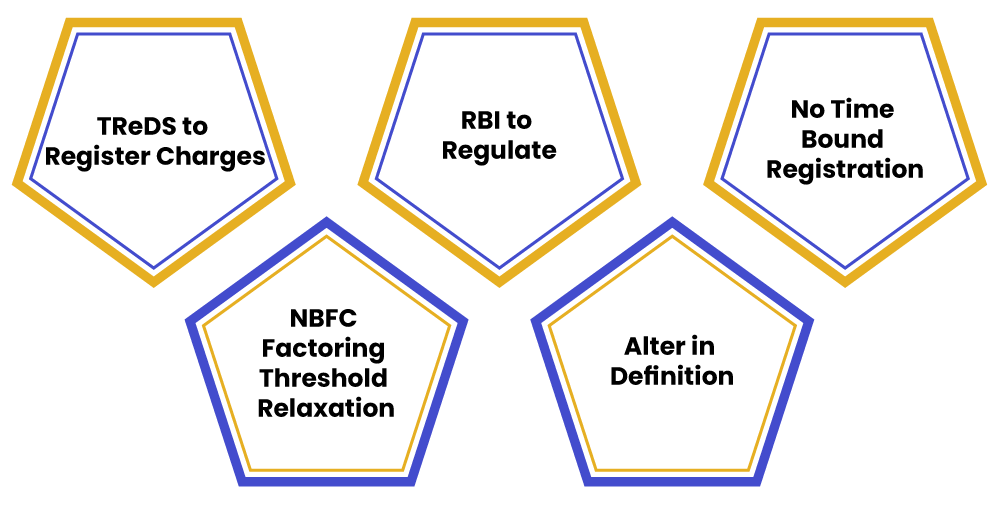

Following are some provisions of the Factoring Regulation (Amendment) Bill 2021:

- TReDS (Trade Receivables Discounting System) to Register Charges: TReDS is a digital stage that provides financing of trade receivables of MSMEs (Micro, Small, and Medium Enterprises). The Factoring Regulation (Amendment) Bill 2021 defines that trade receivables are financed via the (TReDS) Trade Receivables Discounting System; the details regarding transactions has to be filed with the Central Registry by the TReDS on behalf of the factor.

- NBFC Factoring Threshold Relaxation: Factoring Regulation (Amendment) Bill 2021 amends the Factoring Regulation Act, 2011 with an outlook of broadening the scope of the companies which can engage in factoring business. The current law which provides the Reserve Bank of India the authority to allow NBFCs to remain in factoring business only if it were their primary business that is more than half of assets to be deployed & incomes gained from the factoring business. The Factoring Regulation (Amendment) Bill 2021 has removed this threshold and gives the opportunity in this business to more non-bank lenders at a time when small businesses are facing financial tension.

- RBI to Regulate: It has authorised the (RBI) Reserve Bank of India to make regulations to permit Certificate of Registration to a factor, filing of transactional details with the Central Registry and all other matters.

- Alter in Definition: The bill amends the definition of the assignment, factoring, and receivables business to get them at par with the global definitions.

- No Time Bound Registration: It also removed thirty-day time duration for the factors to register details of every transaction entered by them. The registering authority for the transactions is the Central Registry that is established under the SARFAESI Act, 2002[1].

Importance of the Factoring Regulation (Amendment) Bill 2021

- Allowing Non-NBFC Factors and other companies to undertake to factor may raise funds’ supply available to small businesses or entities. It can cause to decrease the funds’ cost and enable greater access to the credit lacking small businesses & also aid them with timely payments against receivables.

- It is anticipated to relax the Act’s restrictive provisions and make sure that a robust regulatory oversight mechanism is placed via the Reserve Bank of India.

- MSMEs faces challenges concerning the delay in receivables, and this bill would help smoother working capital cycle & healthy cash flow. MSMEs would get more accessible liquidity which will aid in their operation.

The Standing Committee on Finance has advised that best international practices be adopted to bring domestic factoring entities on a par with international peers & make credit finance more accessible to MSMEs. Amending the Factoring Act and altering the definition of assignment “receivables” and “factoring” will get them in consonance with global purposes.

The Factoring Act, 2011 was enacted for controlling the receivables to factors, making provisions for registration for doing factoring business and the parties’ right in a factoring contract. There is a lot of delay in MSMEs getting payment against their bills for supplying to various buyers. This leads to locking of working capital & hampering productive activities of MSMEs, the Parliamentary Committee had said in their report. The amendments suggested by the Government seek to resolve problems & allow more classification of NBFCs to assume factoring business. Factoring credit constitutes only 2.6% of the total official MSME Credit in India. It is estimated that only 10% of the receivable market is currently covered under the official bill discounting method, while the rest comes under conventional cash credit overdraft arrangements with banks.

Regardless of considerable growth in the past few years, the factoring market only accounts for 0.2% of the GDP of India, which is awfully low as compared to some emerging economies like China Brazil. The universal factoring market is expected to reach 9.2 trillion dollars by 2025.

The house panel worried about the necessity for the RBI (Reserve Bank of India) to build enough regulatory resources to make sure efficient regulation of factoring activities as an enormous number of players might take part in the businesses with the execution of the new norms.

Conclusion

The Factoring Regulation (Amendment) Bill included many pieces of advice or recommendations from the UK Sinha Committee, and later on, the bill was initiated in September 2020 and then mentioned to the standing committee of the house.

Read our article:A Complete Guide on SFURTI Scheme