Compliances and Legal Requirements for a Fintech Startup in India

Karan Singh | Updated: Aug 13, 2021 | Category: Startup

In recent years the growth of startups in the Fintech sector has been increased, and the future of Fintech Startup in India looks to bring in India. Other aspects such as simplifying of financial processes, mobile users, and continuous build-up of digital networks in many industries have played an essential role in its expansion. Therefore, in this blog, we are going to discuss some of the compliances and legal requirements for a Fintech Startup in India.

Table of Contents

Meaning of Fintech Startup

Fintech stands for Financial Technology. It’s an organisation that, via the digital medium, deliver financial support, management, and planning services to other entities or organisations and individuals. Fintech leverages the utilisation of technology to promote or automate financial services & processes.

Following are some services furnished by different types of online finance companies:

- Lending resources from Peer to Peer;

- Personal Consulting Services for savings and finance;

- Payment services such as e-wallets & mobile payments;

- Retail banking services C2B (Customer to Business) and B2C (Business to Customer).

Compliances for Fintech Startup in India

There are compliances required for Fintech Startup in India. To categorise a startup in any one form would be a difficult task as most of them deliver an array of services. In this section, we will discuss the compliances for Fintech startup in India.

- Payments Aggregators and Gateways play an essential role in the payments sector due to the increase in digital transactions. All interactions are made via bank between Payment Gateway and the Reserve Bank of India. Payments gateways are required to maintain certain necessities to safeguard and protect digital payments;

- Providing insurance services online is still an inexperienced concept. These uses of IoT (Internet of Things) allowed services and track the individual necessities of the client. IRDAI makes the regulations and policies to be followed by brokers. Moreover, Insurance Web Aggregators is a platform where clients get to know concerning various insurance items. They are like a digital shopping interface for clients. They are governed by IRDA Insurance Web Aggregators Regulations, 2017. The Web Aggregators cannot promote a specific company;

- The payment market is the prime member of the Fintech industry. This sector has witnessed huge growth, inviting an enormous amount of investment. Close to 50% of startups in the payment industry include mobile wallets or digital wallets, PoS systems and Payment Gateways. It may be noted that for using e-wallets or mobile wallets, KYV compliance is essential;

- In the Fintech industry in India, online lending platforms have prospered. Banks earlier dominated the lending landscape in India; however, now it has been revolutionised by Peer to Peer Lending and SME lending startups. Lending platforms offer easy loans consent with minimal paperwork. MSME entities have profoundly benefited from this as they can get loans without difficulty. These platforms have leveraged the use of advanced technologies such as Machine Learning and Artificial Intelligence.

Compliances with the IT Act, 2000

Fintech entities run on the internet. Hence, they should obey the directions set out in the Information Technology (IT) Act, 2000[1]. Such companies rely on the personal data of individuals; hence, to avoid legal complications, they are required to obey specified data security necessities.

Corporate bodies should get approval from the information provider to reveal any confidential data. Moreover, they should maintain security control structures and follow information security formalities. Certifications like ISO, IS, and IEC 27001 are included.

Legal Requirements for Fintech Startup in India

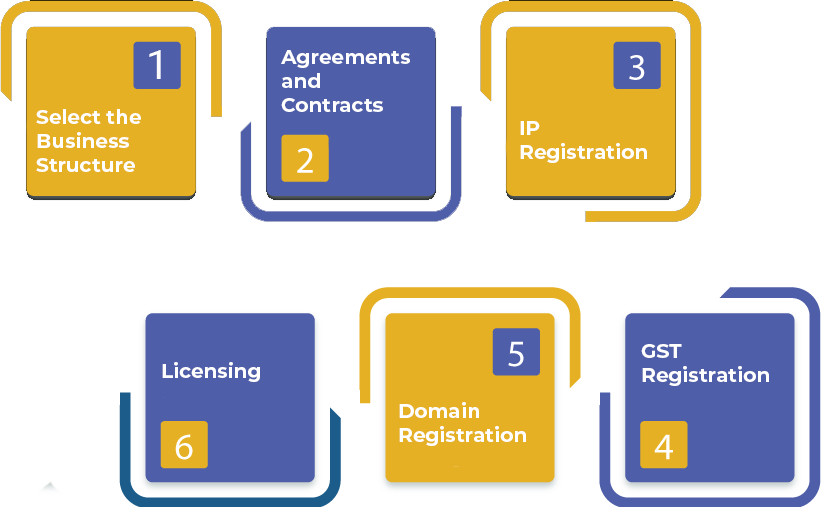

There are definite legal requirements that the Fintech Startup in India should fulfil. They have been listed below:

- Select the Business Structure: The first step for a Fintech Startup in India is to find out the business structure. As a Fintech Startup in India, you can choose for any of the following business structures:

- Private Limited Company: The shareholders and directors of the company don’t have any personal compulsion to the creditors of the company. Many choose this structure in the financial technology market.

- OPC (One Person Company): An OPC is where the company has one owner but operates as a business.

- LLP (Limited Liability Partnership): It is a combination of a company and a partnership. Here the limited liability of all partners is restricted or limited to their particular shares.

- Agreements and Contracts: One must obtain definite legal documents to commence a Fintech Startup in India. An advocate can aid you to draft customised legitimate documents as per your business necessity. Following are some contracts and agreements:

- IP Licensing Agreement;

- Privacy Policy;

- Co-Founders Agreement;

- Vendor Agreement;

- User Policy of a website;

- Employment Agreement;

- Terms of Use for Mobile Users;

- IP Registration: Intellectual Properties like Patent, Trademark, Copyright and Design should be attained. It will aid in safeguarding your website, applications, brand, etc. By Intellectual Property Registration, you will possess the right to seek remedy in the case of IP violation.

- GST Registration: An online finance business or a Fintech Startup in India should apply for GST Registration and get GSTN for their business.

- Domain Registration: A technology-based entity would desire to have their existence on the internet; hence, it’s a must to have a domain name and a completely developed website. If you are a small startup, then deem setting up a mobile application.

- Licensing: Licensing will be based upon the type of service furnished by the Fintech Startup in India.

- In the case of retail service providers, licensing is required for retaining Fintech to execute lending services & depositing services for MSMEs (Micro, Small, and Medium Enterprises);

- In the case of payment services, they require registering with the RBI;

- For investment and financial management, Fintech must be registered as Non-Banking Financial Companies (NBFCs) as suggested by the Reserve Bank of India (RBI).

Conclusion

With the beginning of Fintech, the conventional financial market has been disrupted hugely. As they use the latest and advanced technologies for furnishing financial services, their purpose of financial inclusion is targeted. But, substantial uncertainty concerning regulations, client mistrust and the need for a vast client base have caused complications to a certain extent.

There have been times when players of Fintech have been forced to get used to the regulations that were planned for traditional financial institutions or organisations. But, the outlook of regulators is anticipated to alter towards the Fintech industry. If you are preparing to commence a Fintech Startup in India, you must be aware of such information.

Read our article:Difference Between Small Finance and Payment Banks in India