Incorporate Section 8 Company: Concept & Process to Register

Shivani Jain | Updated: Jan 16, 2021 | Category: Section 8 Company

In India, any person or an individual who wants to promote art, science, commerce, education, sports, social welfare, research, charity, environmental protection, religion, etc., needs to incorporate section 8 company. Although this business format is somehow similar to Trust and Societies, however, to obtain section 8 company registration, one requires to apply with the MCA (Ministry of Corporate Affairs).

In this blog, we will discuss the concept and procedure to incorporate section 8 company in India.

Table of Contents

Eligibility Criteria to Incorporate Section 8 Company

The eligibility criteria to incorporate section 8 company in India can be summarised as:

- In case a company intends to promote art, science, commerce, education, sports, social welfare, research, charity, environmental protection, religion, etc.;

- If in case a company wants to invest all of its profits and other income in the promotion of the above mentioned objectives;

- Whenever a company does not want to pay out a dividend to its member;

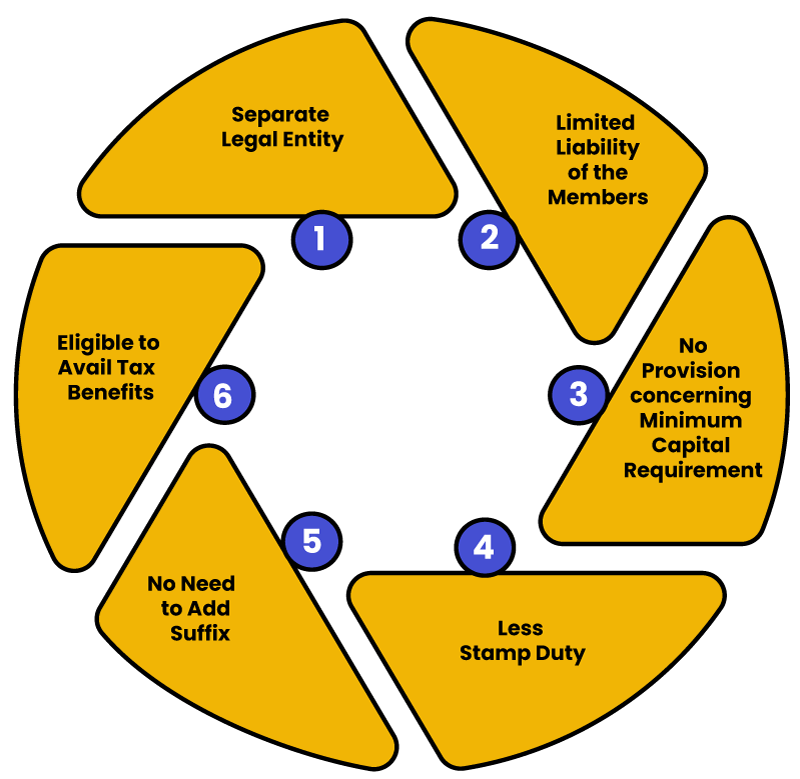

Benefits to Incorporate Section 8 Company

The benefits to incorporate section 8 company in India are as follows:

Separate Legal Entity

The term separate legal entity means that the company incorporated is distinct and separate from its members. That means the members are not liable to pay off debts of the company and needs to pay only till the amount remaining unpaid on the shares.

Limited Liability of the Members

In the case of a section 8 company, the members need to pay only till the extent of amount remaining unpaid on the shares held by them. That means there is no need for them to pay the debts of the company.

No Provision concerning Minimum Capital Requirement

It shall be significant to note that to incorporate section 8 company in India, there is no need to have any amount as the minimum capital requirement.

Less Stamp Duty

In India, the stamp duty charged to incorporate section 8 company is very reasonable as compared to other business formats. The reason behind the same is that this business format invests all of its profits and other income in the promotion of its objectives.

No Need to Add Suffix

There is no need to use “Private Limited Company”, “Pvt Ltd Company”, or “Limited Company” as the suffix for the company’s name.

Eligible to Avail Tax Benefits

After obtaining section 8 company registration, the said company gets various benefits if it acquires section 80G registration and section 12AA registration as well.

Documents Required to Incorporate Section 8 Company

The documents required to incorporate section 8 company in India are as follows:

- PAN Card Details of all the Members;

- Aadhaar Card Details of all the Members;

- Latest Bank Statements for both the company and its members;

- Telephone Bill, Electricity Bill, or any other Utility Bill;

- Voter Identity Card of all the members;

- Passport of all the members;

- Driving License of all the members;

- Latest Passport size Photograph for all the Directors;

- Copy of the Rental Agreement or Sale Deed;

- A copy of company’s MOA (Memorandum of Association);

- A copy of company’s AOA (Articles of Association);

Forms Required to Incorporate Section 8 Company

The different forms required to incorporate section 8 company in India are as follows:

Form INC 13

A company needs to draft its MOA (Memorandum of Association) and AOA (Articles of Association) in Form INC 13, together with the affixation of the latest photographs of the subscribers.

Form INC 14

The directors of the company need file a declaration in form INC 14, stating that the draft of AOA and MOA are based on the provisions and norms prescribed for section 8 company. Also, they need to specify that all the requirements to incorporate section 8 company are duly taken care of.

However, it shall be considerate to record that the said declaration has to be made on a judicial stamp paper and must be notarized by either of the following:

- An Advocate;

- A Company Secretary;

- A Chartered Accountant, or;

- A Cost Accountant;

Form INC 15

Every person who is subscribing as a member of the company needs to file a declaration in Form INC 15. The same must be made on stamp paper and duly notarized by each member of the company.

Form INC 9

The company needs to form a list in Form INC 9, comprising of both the first directors and subscribers. Also, the same must be made on a stamp paper and should be appropriately authorised.

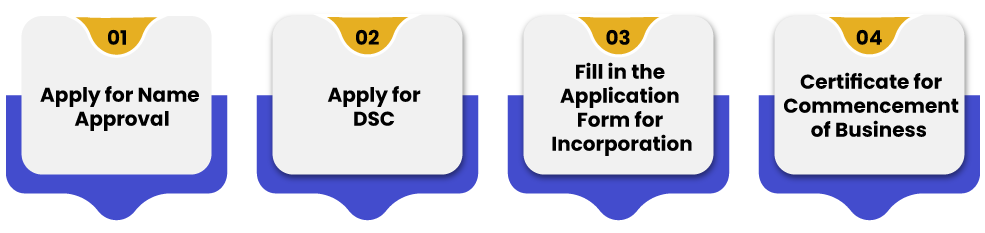

Process to Incorporate Section 8 Company in India

The steps involved in the process to incorporate section 8 company in India are as follows:

Apply for Name Approval

In the first step, the directors of the company need to file Part a of SPICe form, together with SPICe+ form to reserve the name of the proposed company. Further, a company has the authority to reserve 2 names for the proposed section 8 company.

Apply for DSC

Now, in the next step, the proposed country requires to apply for DSC (Digital Signature Certificate) for at least 1 of its directors to sign documents digitally.

Fill in the Application Form for Incorporation

Once, the name proposed gets reserved, the directors of the said company need to file an application form to incorporate section 8 company, within a period of 20 days. The said application form must be uploaded online together with all the requisite documents and attachments.

Nowadays, SPICe+ acts as an advance version and a combination of 8 forms as follows:

- Name Reservation;

- ESIC Registration;

- Incorporation;

- Apply for DIN;

- GST Registration;

- TAN Application;

- PAN Application;

- EPF Registration;

That means the company just needs to file SPICe+ form instead of 8 separate forms and applications.

Further, the part B of the said form includes details as follows:

- Total Number of Directors;

- Total Number of Members;

- Authorised Share Capital;

- Paid-up Capital;

- Total Number of Shares held by Members;

- Address of the proposed Company;

Also, it shall be considerate to note that to incorporate section 8 company, the applicants need to attach some additional documents as well with SPICe+ form in part –B, which are as follows:

- The physical copy of the MOA drafted and duly signed by members and witnesses;

- The physical copy of the AOA drafted and duly signed by members and witnesses;

- A Declaration in form INC 14 duly attested by a practising professional;

Certificate for Commencement of Business

Once the application to incorporate section 8 company is duly approved by ROC (Registrar of Companies), it will issue a certificate of incorporation (COI). After that, the company needs to file an application for seeking approval to commence business activities within a period of 180 days, starting from the date of incorporation of the said company.

Post Incorporation Compliance for Section 8 Company

The post registration compliance for a section 8 company are as follows:

- Appointment of Auditor within a period of 30 days;

- Convene Board Meeting within a period of 30 days;

- Convene Annual General Meeting within 9 months of the first financial year;

Annual Compliances of Section 8 Company

The annual compliances for section 8 company are as follows:

- Appointment of Auditor under section 139 of the Companies Act 2013;

- Maintenance of Statutory Registers as per section 8 of the Companies Act 2013;

- Conduct Annual General Meetings;

- Filing of Director’s Report in the Board Meeting;

- Filing of the Financial Statements of the Company;

- Filing of Annual Return in form MGT 7 with the Registrar of Companies;

Conclusion

In a nutshell, the organizations that have the objective to promote the fields, such as art, science, commerce, education, sports, social welfare, research, charity, environmental protection, religion, etc., or any other similar nature objective, then, in that case, it needs to incorporate section 8 company.

At Swarit Advisors, our experts will guide you with the best advice and process to obtain section 8 company registration in India.

Also, Read: Know the Features of Section 8 Company?