Alteration of MOA: Guide to Alter Memorandum of Association

Shivani Jain | Updated: Jul 13, 2020 | Category: Change in Registered office of company, Compliance

An MOA (Memorandum of Association) is a legal document required for the registration of a company. This document defines the relationship between the shareholders, directors, and company. Further, the mission, vision, and objective of a company are also covered in this document. In this blog, we will talk about the process for the alteration of MOA.

Table of Contents

Concept of Memorandum of Association

The Memorandum of Association is defined under section 2 (56) of the Companies Act, 2013. The definition says ‘an MOA can only be drafted or altered as per the provisions of the Act’. However, this definition neither specifies the meaning nor the functions that an MOA plays in a company.

A Memorandum of Association acts[1] as the Charter or principal document for a company. That means no company can get itself registered without an MOA. Moreover, this document provides the range of activities that a company is allowed to carry out.

Further, the provisions for the alteration of MOA are provided under section 13 of the Companies Act, 2013. A company needs to pass an SR (Special Resolution) to alter the Memorandum of Association. Lastly, the changes made must be included in every copy of the MOA.

Clauses of Memorandum of Association

As per section 4 of the Act, the clauses included in an MOA are as follows:

- Name Clause;

- Registered Office Clause;

- Objective Clause;

- Liability Clause;

- Capital Clause;

- Subscription Clause.

Concept of Name Clause

The name clause of an MOA deals with the name of the company. As per this clause, the name of a company must be unique, legal, and original. That means the proposed name of the company must not be similar to the name of an existing company.

Further, one can easily check the availability of a name on the MCA (Ministry of Corporate Affairs) website. Furthermore, any changes in the existing name require alteration of the Memorandum of Association.

Alteration of MOA: Name Clause

In case a company decides to change or modify its name, it needs to modify the Name Clause. Alteration of Name Clause will be governed by section 13 of the Companies Act, 2013[2. However, section 16 will act as governing law for a company that wants to rectify its existing name.

The company needs to inform the ROC about the change in name. The Registrar of Companies will register the new name and will a new Certificate of Incorporation.

Further, the two methods for changing the name of a company are as follows:

- By passing a special resolution;

- By acquiring prior approval from the central government.

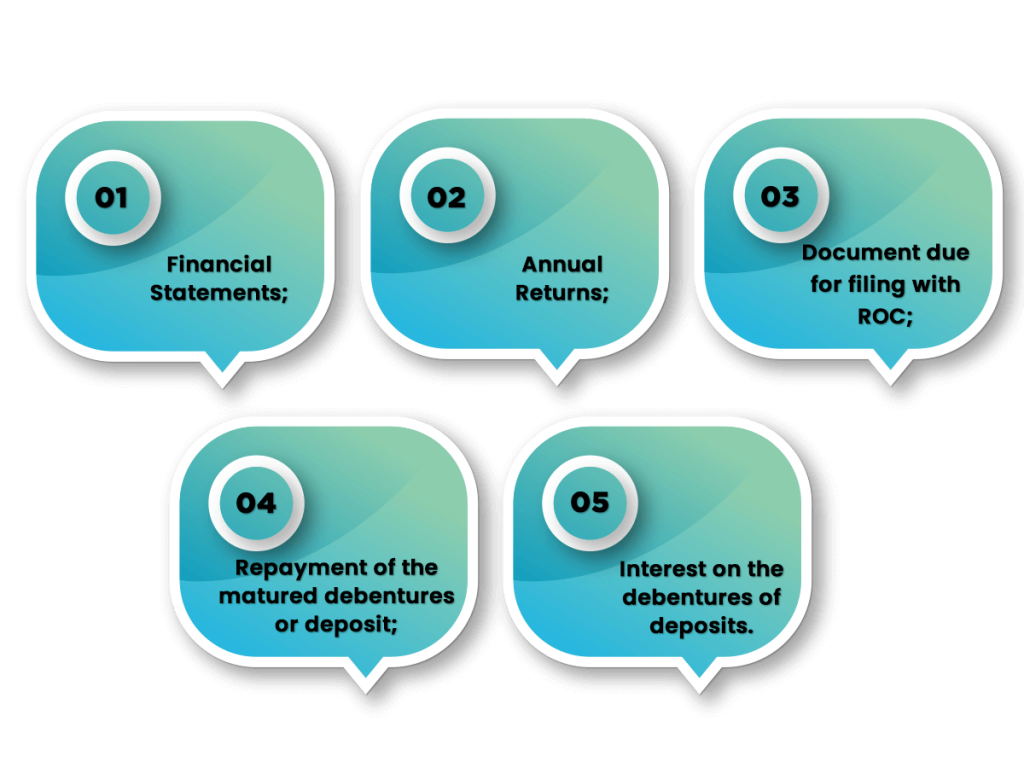

Furthermore, a company cannot alter its name if it has defaulted in either of the following:

- Financial Statements;

- Annual Returns;

- Document due for filing with ROC;

- Repayment of the matured debentures or deposit;

- Interest on the debentures of deposits.

Concept of Registered Office Clause

This clause includes the details and particulars of the registered office of a company. That means it contains the details of the state or UT in which the said office is located. Under section 12 of the Act, a company can change registered office by altering the Registered Office Clause.

An applicant company needs to inform the ROC about the exact office location within fifteen days from the registration. Also, it needs to verify the office address within thirty days from the registration of the Private Company.

A company needs to alter this Clause if it decides to shift its office from one state to another state.

Concept of Objective Clause

The Objective Clause of a company defines the objective and purpose of a company. A company needs to alter its object clause to change its objective and goals.

A company that wants to change its objective needs to alter the objective clause. The directors of a company need to publish the details of the change in two newspapers. One in the local language newspaper and another in the English newspaper.

Further, the company needs to publish the same on its official website as well.

Also, Read: A Complete Guide on Memorandum of Understanding Format

Concept of Liability Clause

The liability of the shareholders to pay off their debts is defined under the Liability Clause of the MOA. At the time of Winding-up, all the shareholders need to pay off the remaining amount on the shares.

This clause also contains a statement that a shareholder cannot be asked to pay more than the remaining amount.

Further, alteration of the liability clause can only be done by passing a special resolution. Such a resolution needs to be filed with Registrar within 30 days.

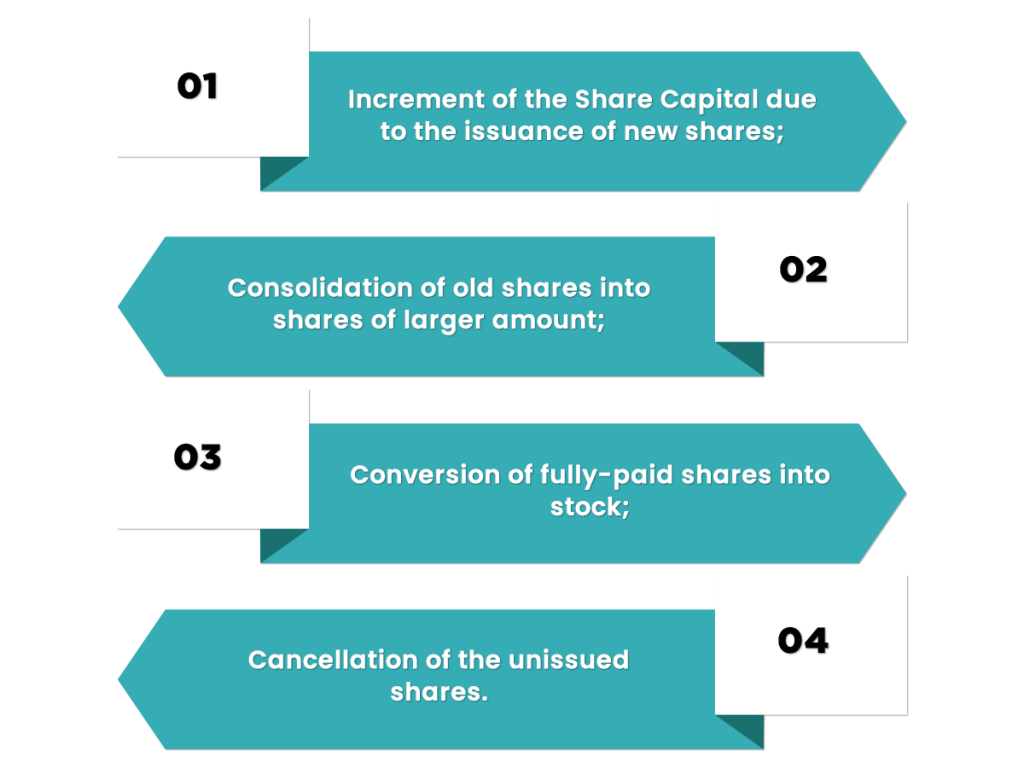

Concept of Capital Clause

This clause talks about the authorised share capital of a registered company. It also states the number of shares held by each shareholder and the face value of each share.

The situations in which a company needs to alter its capital clause are as follows:

- Increment of the Share Capital due to the issuance of new shares;

- Consolidation of old shares into shares of larger amount;

- Conversion of fully-paid shares into stock;

- Cancellation of the unissued shares.

Concept of Subscription Clause

This clause describes the purpose behind the formation of the company and the number of shares subscribed by each shareholder. However, a company cannot alter its subscription clause. The subscriber sheet used at the time of formation has lifetime validity and cannot get altered.

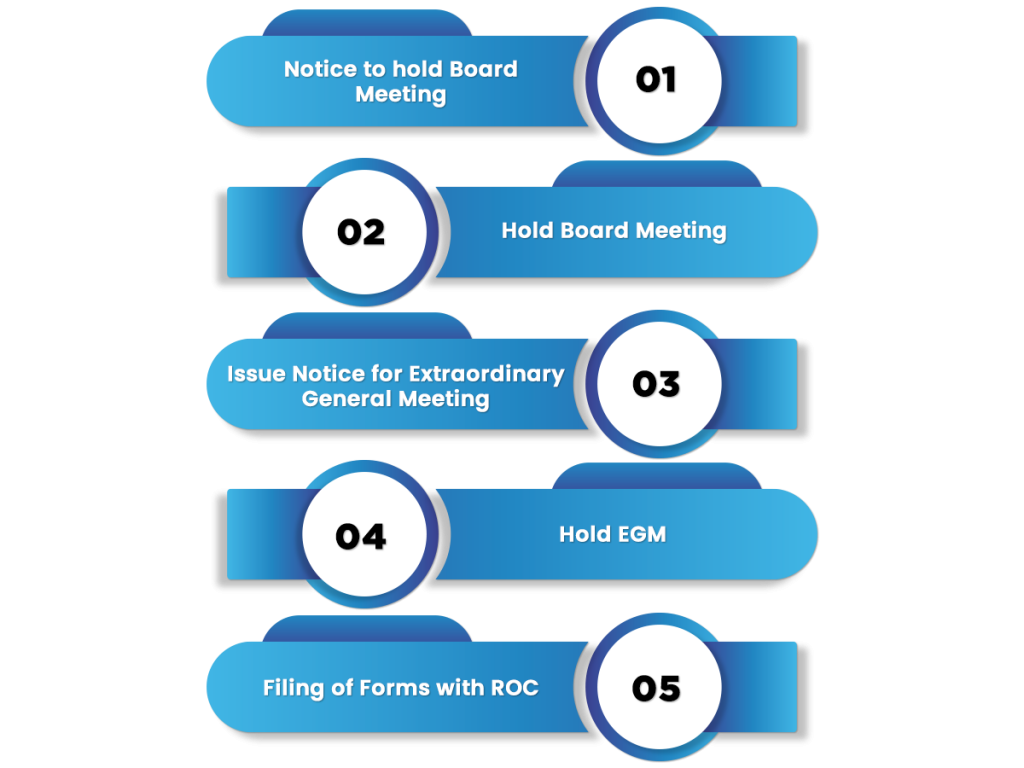

Procedure for Alteration of MOA

The procedure for the alteration of MOA is the same for both the private company and public company. Further, the steps included in the procedure are as follows:

- Notice to Hold Board Meeting: It is governed by section 173 and Secretarial Standards 1). The directors need to issue a notice for board meeting (BM) to pass a resolution. The notice must be issued at least seven days prior to the date of the meeting. The attachments of the notice include the following:

- Agenda of the Meeting;

- Draft Resolution;

- Notes to Agenda.

- Hold Board Meeting: It is governed by section 173 and Secretarial Standards 1). At the BM, the directors need to pass an ordinary resolution for allowing the process of alteration of MOA. They also need to fix the date, time, day, and venue of the Extraordinary General Meeting.

- Issue Notice for Extraordinary General Meeting: It is governed by section 101 of the Companies Act, 2013. The directors of the company need to send a notice for EGM to the shareholders at least twenty-one days prior to the date of the meeting. The notice must specify the place, day, date, and time of the meeting. It should also contain an explanatory statement on the business to be considered at the EGM.

- Hold EGM: It is governed by section 101 of the Companies Act, 2013. At EGM, the shareholders will pass a special resolution for the approval of Alteration of MOA;

- Filing of Forms with ROC: Lastly, the directors need to file MGT-14 with the ROC within 30 days of passing resolution. The attachments of the resolution are as follows:

- Certified Copy of the Resolution;

- Explanatory Statement;

- Copy of the Notice sent to members;

- A printed copy of the altered Memorandum of Association.

Conclusion

Alteration of MOA is not only tedious but a back breaking task. Therefore, it is always advised to consult professionals. At Swarit Advisor, our experts will give you end-to-end assistance in the process of alteration of MOA.

Also, Read: Change of Name of the Company