Overview of EPF Registration

Employee Provident Fund (EPF) is a scheme that offers retirement benefits to all the salaried employees irrespective of working in Government or Public or Private Sector organizations. The term, “employee” includes the range starting from experienced professionals to Security Guards, Housekeeping, etc. However, an apprentice, intern, and a migrating employee are excluded from the ambit of the EPF Scheme. EPF registration is regulated and administered by the EPFO (Employee Provident Fund Organization).

The companies or the entity having employee strength of twenty or more employees is required to get itself registered under the EPF scheme. However, the organizations having less than twenty employees can also voluntarily apply for the EPF Registration. Moreover, the Co-operative Societies are required to have employee strength of fifty or more for obtaining EPF Registration. It shall be noteworthy to note that the companies are required to obtain EPF registration with in one month from hiring twenty employees or it may result in a penalty.

The Employee Provident Fund and Miscellaneous Provisions Act, 1952, act as the governing law for the EPF Registration. As per this act, both the employer and employee are mandatorily required to contribute 12 percent of their basic wage to the respective EPF account. One of the most significant benefits of having an EPF account is that the EPF numbers remains the same even after changing jobs.

What is Employee Provident Fund?

Employees Provident Fund is a government-based scheme under the Employee Provident Funds and Miscellaneous Provisions Act, 1952. It acts as a retirement benefit to an employee which is provided the organization. Any company having more than twenty employee working is mandatory required to obtain EPF Registration under EPF Act.The objective behind the EPF Scheme is to mainly maintain a healthy relationship between the employer and employee. Employee-Employer bond.

What is the Employee Provident Fund Organization?

EPFO or the Employee Provident Fund Organization is the largest social security body with a huge volume of financial dealings taking place everyday. According to the Annual report of 2016-2017, it holds around 19.34 crore accounts concerning its members. Moreover, all the rules and regulations of the EPF Act are regulated and administered by the EPFO (Employee Provident Fund Organization).

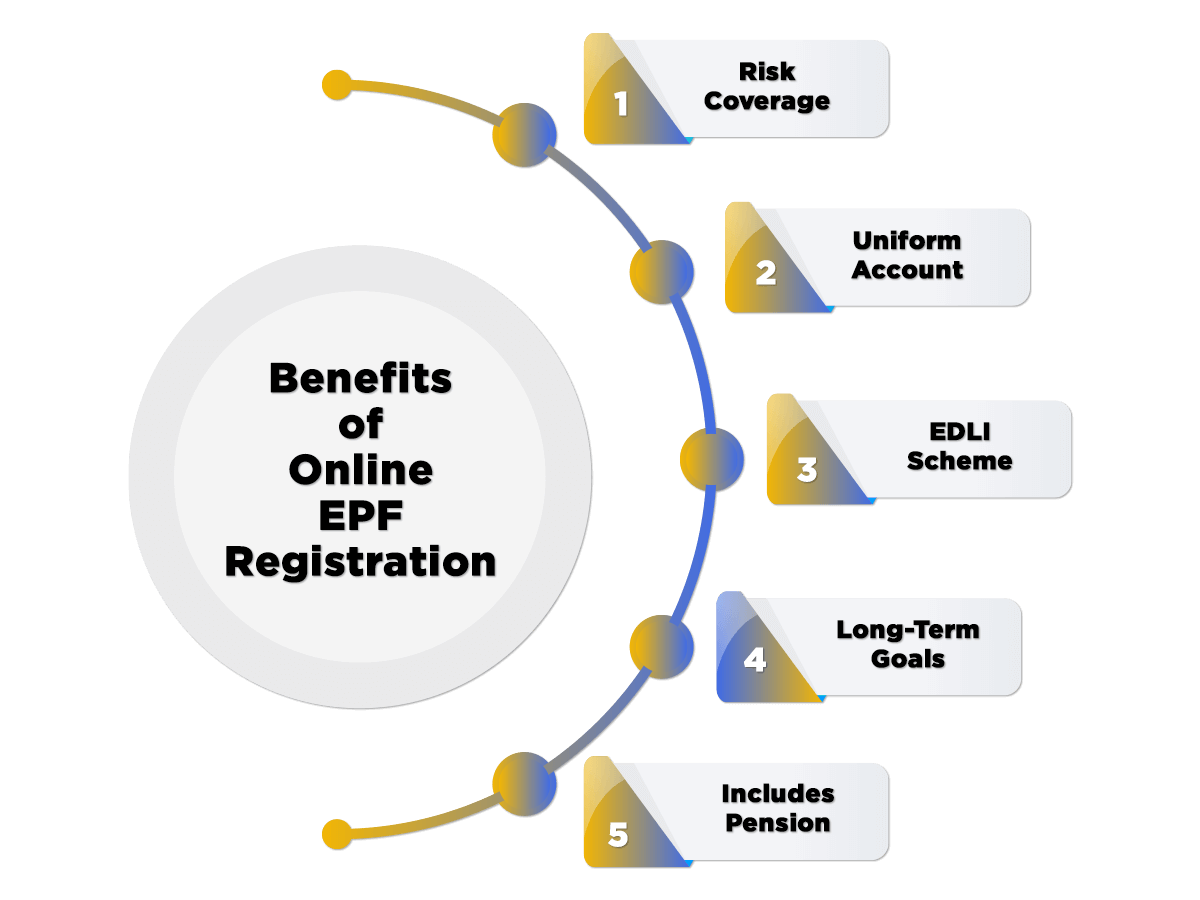

Benefits of EPF Registration

The following listed are the benefits of Online EPF Registration:

- Risk Coverage

The most significant benefit annexed with the Provident Fund Registration is that it covers the risk of both employees, and their dependents. The term risk means the situation concerning the employee’s retirement, illness, or death.

- Uniform Account

One of the major facets of a PF Account is that it is both continual and transferable. It means that the same account can easily be carried forward to any other place of employment.

- EDLI Scheme

EDLI is the acronym form for the Employee Deposit Linked Insurance Scheme. All the PF account holders are eligible under this scheme. This scheme requires a 0.5% deduction in salary.

- Long-Term Goals

The amount saved in the PF account helps the employee in fulfilling his or her long-term goals like marriage or higher education or any other situation that needs the urgent availability of funds, as the amount available in the PF account often comes handy during these situations.

- Includes Pension

The employer is required to contribute some proportion (specifically 12% of the employee’s monthly salary) to the EPF fund together with the employee. Moreover, out of the total contribution made by the employer, 8.33 percent is transferred to the EPS (Employee Pension Scheme). This will help the employee in saving the right amount of pension for his retirement.

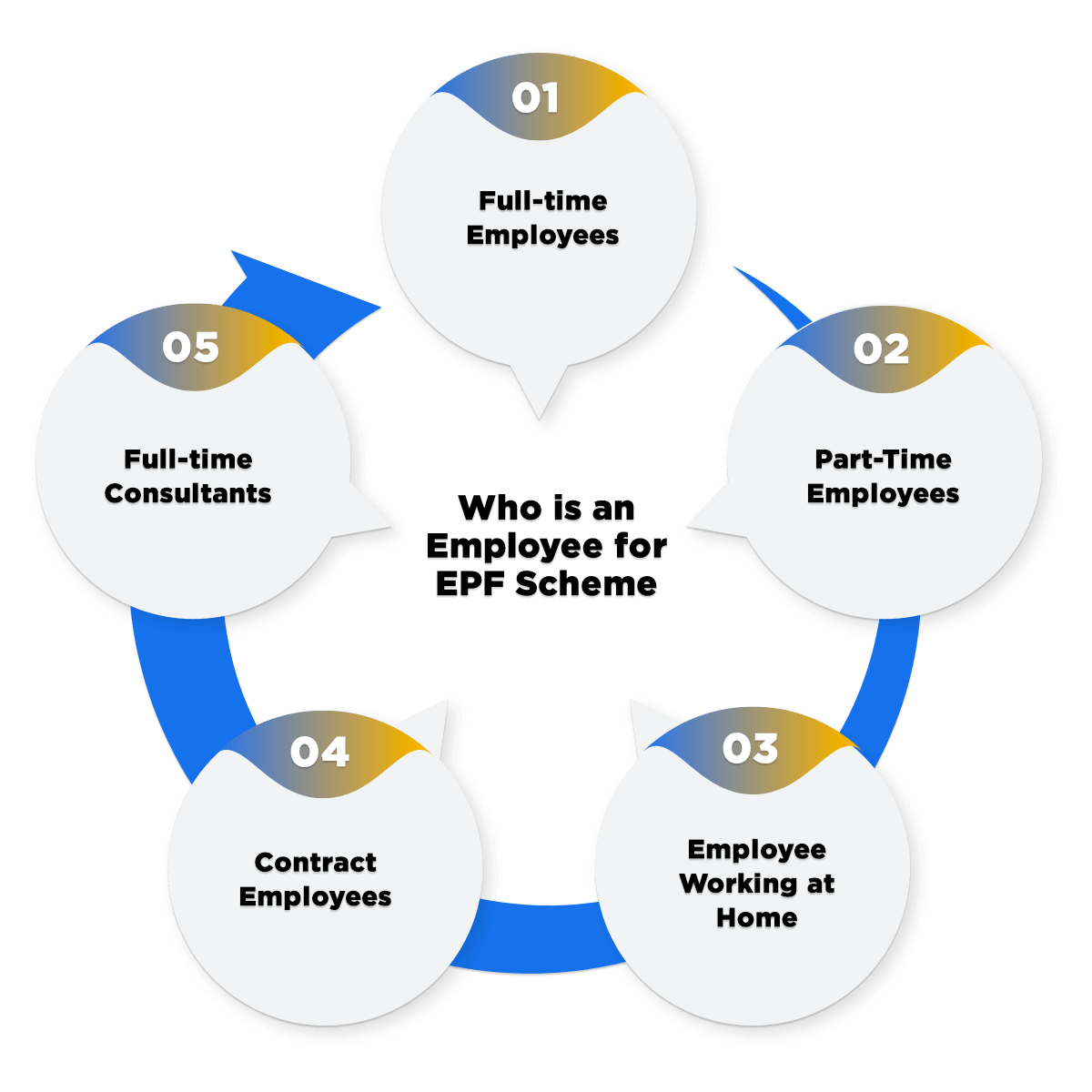

Who is an Employee for EPF Scheme?

The ones who are considered as an employee are listed below:

- Full-time Employees,

- Part-Time Employees,

- Employee Working at Home,

- Contract Employees,

- Full-time Consultants.

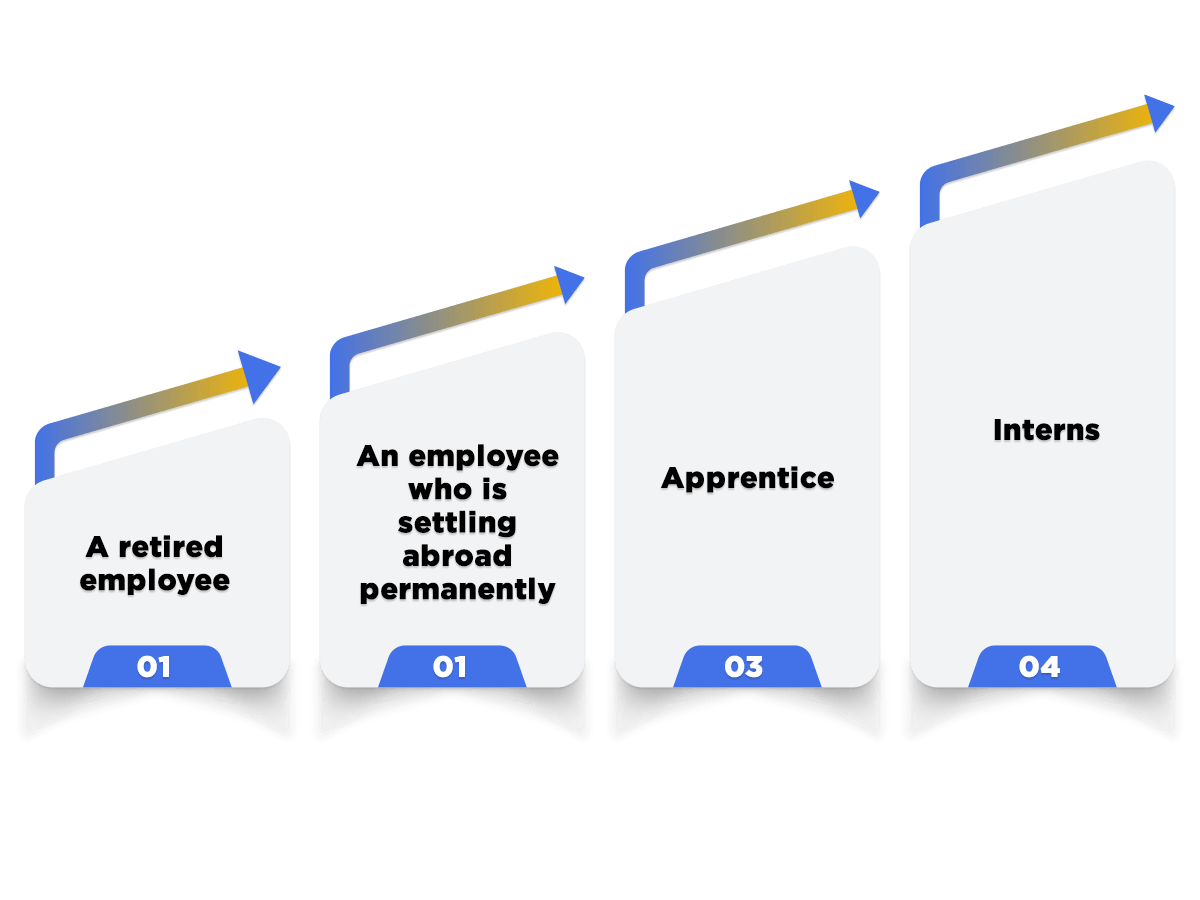

However, the following listed are ones outside the ambit of an employee:

- A retired employee,

- An employee who is settling abroad permanently,

- Apprentice,

- Interns.

Who are all eligible to obtain EPF Registration?

The listed below are the entities eligible to obtain Online EPF Registration:

- Any Establishment which is employing more than twenty employees during any time in the previous financial year.

- Any Factory irrespective of the industry, having more than twenty employees during the previous financial year.

- c) The Central Government at any time can ask an establishment to obtain compulsory EPF Registration irrespective of the employee count. The same is possible only after providing two months’ notice to that concerned establishment. Such an establishment or company is then required to get themselves registered under the EPF scheme on an immediate basis.

Who are all Exempted from the Registration under EPF Scheme?

Any company or establishment having less than twenty employees is exempted from the necessity of getting them registered under the EPF Act. Such companies, if want can still acquire registration under the EPF scheme. However, the same will then be termed as Voluntary EPF Registration.

What is the Contribution Rate prescribed for EPF Scheme?

The listed below are the Rate of Contribution for an Establishment Employing more than 20 Employees:

- Employer’s Contribution Rate

The concerned Employer is required to share his part of contribution at the rate of 12 percent of the Employee’s basic salary plus DA(Dearness Allowance).

- Employee’s Contribution Rate

The respective employeeis required to share his part of contribution at the rate of 12 percenthis monthly basic salary.

Rate of Contribution for establishment hiring less than 20 employees:

As per the EPFO (Employee Provident Fund Organization) rules, the listed below establishments are required to contribute at the rate of 10 percent of the employee’s basic salary plus DA (Dearness Allowance):

- Any establishment which is having an employee strength of less than twenty employees.

- Any Sick Industrial Company as acknowledged by the BIFR (Board for Industrial and Financial Reconstruction).

- Any establishment which is having accumulated losses equivalent to its total net worth at the end of any financial year.

- Any establishment dealing either in the following listed industries:

- Jute

- Beedi

- Brick

- Coir and

- Guar gum Factories

Documents Required for EPF Registration

The documents required for obtaining EPF Registration are listed below:

- Name of the Employer.

- PAN Card details of the Employer.

- Employer’s ID Proof in the form of Passport/ Driving License/ Voter ID.

- Address proof of the Registered Office in the form of Sale Deed (in case it is a self-owned premise) or Rent Agreement/ Lease Deed (in case of the Rented Premises).

- Utility Bills like electricity bill, Water Tax Receipt, etc., but not older than two months.

- A copy of the Certificate of Registration is needed in the case where the establishment is Trust Registration/Society/LLP (Limited Liability Partnership) or Company.

- A copy of the Partnership Deed, Address Proof, and ID Proof of each partner is needed in the case where the establishment is a Partnership Firm.

- A cancelled cheque (bearing the pre-printed Account Holder’s Name and Account No).

- Balance Sheet Details

- A copy of First Sale Bill

- A copy of MOA (Memorandum of Association) and AOA (Articles of Association), if the applicant is either a Public or a Private Limited Company.

- Details regarding the total wages dispersed in a month.

- Details of the Employees needed for the allotment of UAN (Unique Account Number):

- Aadhar card

- PAN card

- Bank account details like the Account Number, and IFSC Code

- Contact Number and Email-ID

- Date of birth (DOB) as per the Aadhar Card

- Designation of the concerned employee

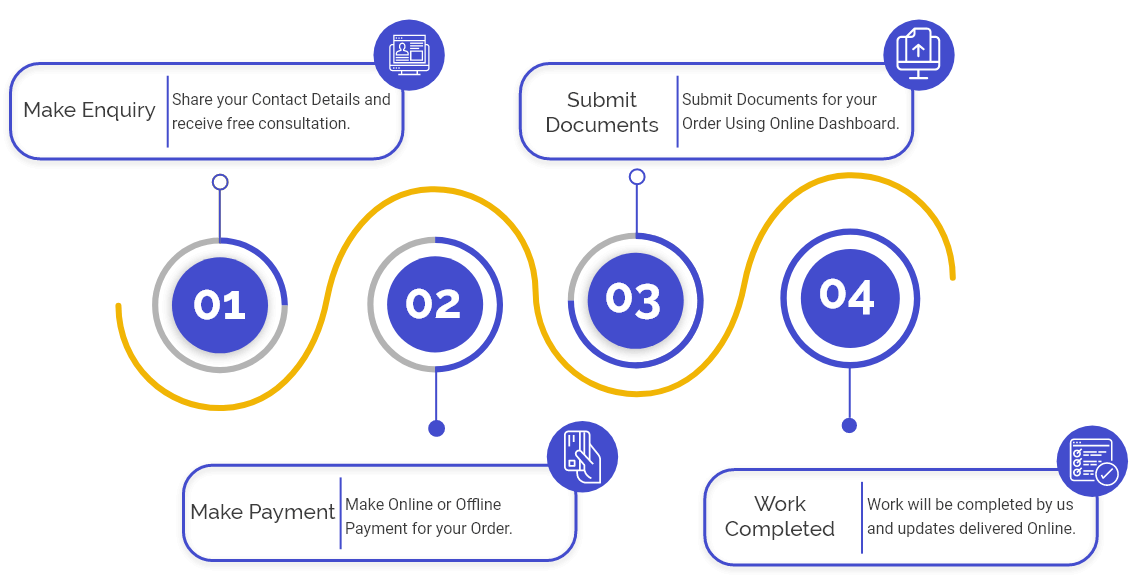

Procedure for EPF Registration

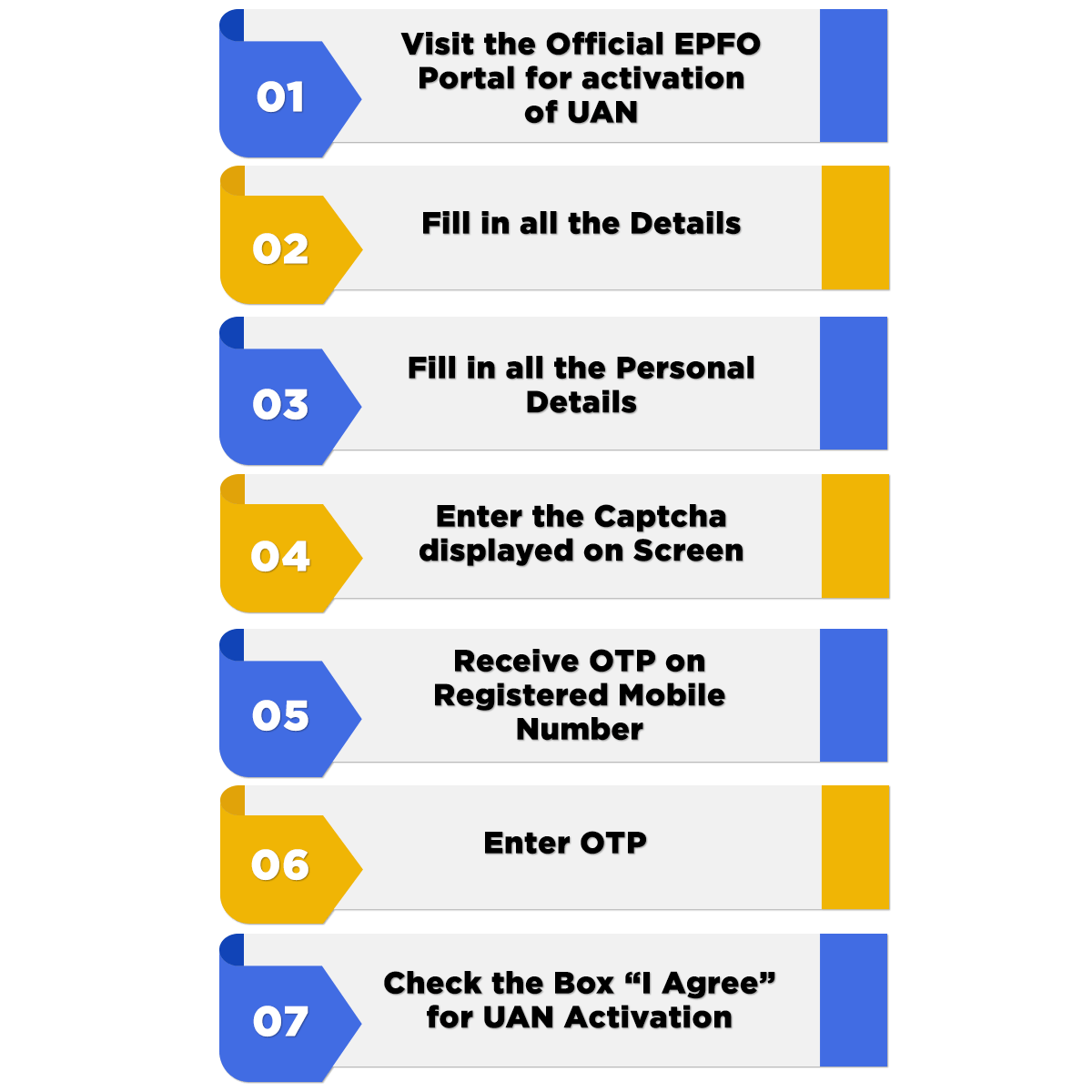

The below-listed are the steps included in the Procedure to obtain Online EPF Registration:

- An employee is required to visit online on the official EPFO portal, for the activation of UAN (Universal Account Number).

- Now, the said employee is required to fill all the details like the UAN (Universal Account Number), Member Id, PAN Card, Aadhar Number, etc.

- After that, in the next step the employee is required to provide his or her asked details like theName, Contact Number, Address, etc.

- For completing the form, the employee is required to correctly fill theCAPTCHAshown on the screen.

- After completing the application form, the said employee will then receive an OTP (One Time Password) on his registered mobile number with UAN.

- In the last step, the employee is asked to check the box saying “I Agree” and authenticate the OTP for the UAN activation.

What is the Rate of Interest charged on the EPF Deposits?

As per the declaration made by the EPFO on 05.03.2020, the rate of interest charged on the EPF Deposits has been reduced to 8.50% from 8.65% for the financial year 2019-2020. Earlier, 8.65% was charged as the Rate of Interest on the EPF Deposits.

What is a Universal Account Number?

UAN is the abbreviated form for the Universal Account Number. It is a 12-digit number issued to every employee at the time of registration by the EPFO. Allotment of this number requires details like Name, PAN Card, Father’s Name, Aadhaar number, Date of Birth (DOB), etc. Moreover, one of the most significant benefits of UAN is that it provides autonomy regarding the EPF account in the hands of employees and automatically reduces the role of the employer. Same UAN can be used by the employee throughout his service period, irrespective of job change.

How much Penalty is prescribed for the Employer’s Delay?

The table listed below describes the rate of interest charged as penalty on an employer in case there is a delay in making PF payment:

|

S.No |

Period of Delay |

Rate of PenaltyImposed (p.a.) |

|

1. |

Upto 2 months |

5 percent |

|

2. |

2 to 4 months |

10 percent |

|

3. |

4 to 6 months |

15 percent |

|

4. |

Beyond 6 months |

25 percent |

FAQs of EPF Registration

Both employer and employee will contribute 12% each in the Provident Fund.

Yes, an employer is eligible to contribute more than 12% in EPF. However, the same will be known as Voluntary Contribution.

An individual can log in to his/her PF account by using the allotted UAN (Universal Account Number).

A minimum of 20 members are required to obtain EPF Registration in India.

The term Basic Wage includes all the remunerations that are earned by an employee as per his/her employment contract.

The term “Basic Wage” does not include the cash value of any Food Allowance; DA (Dearness Allowance); HRA (House R¬ent Allowance); Overtime allowance; Bonus; and the gifts made by the employer.

Yes, an EPF holder is eligible to withdraw his/her full PF amount. However, the same is possible only after attaining the age of retirement or on termination of service.

If in case a person has not resigned, then he/she is eligible to withdraw only a part of the amount available in the PF account.

Normally, it takes around 25 to 30 days for a bank to transfer the PF amount in the respective bank account.

Usually, authorities take around 3 to 5 business days to verify the documents and approve KYC (Know Your Customer).

Although an employee has the power to update his/her KYC details at the official EPF UAN Portal. However, the concerned employee needs to get his/her details verified by the employer through EPFO (Employee Provident Fund Organization) employers’ portal.

Firstly, the employer needs to approve the request for the name change. After that, the employee requires to submit the same at the PF Office. The process for the name change will take around 15 days to 2 months time for approval.

Yes, an employer is eligible to hold an employee’s PF Account, but only for deposit. However, the employer is cannot use the account for arbitrary purposes, as he/she holds it on a fiduciary basis.

Yes, it is necessary to obtain KYC (Know Your Customer) for PF withdrawal.

Yes, out of 12% contribution made by the employer, 8.33% belongs only for retirement purposes and is deposited in the EPS (Employee Pension Scheme). The concerned employee can withdraw the same on his/her retirement.

A company can register up to 3 signatories with PF. It needs to update the DSC of the signatories on the EPFO (Employee Provident Fund Organization) portal. Further, the purpose of DSC is online verification of KYC documentation and for completing the PF claim.

Out of the total contribution made by an employer, i.e., 12%, around 8.33% is further deposited into the Employees' Pension Scheme (EPS), whereas the remaining amount of 3.67% is transferred to the EDLI account.

The EPFO (The Employees’ Fund Organization) has the authority to allot UAN to its contributory members.

Yes, employers can easily search UAN (Universal Account Number) of other establishments. He/she just needs to select the option saying “Search UAN”, and then use the registered Member ID or the UAN.

All the companies that are employing 20 or more employees are eligible to apply for the EPF scheme.

The employees who are not covered under the EPF scheme are retired employees; employees who have settled abroad permanently; apprentice; interns.

An employer is solely responsible for depositing the entire amount in the EPF scheme.

Yes, the EPFO (Employee Provident Fund Organization), being a Governmental Organization, comes under the ambit of the RTI Act.

At present, any PF withdrawals made by an individual are credited directly into his/her (beneficiary’s) bank account.

No, as per section 12 of the EPF Act, an employer does not have the right to reduce the salary of an employee against the payment of EPF.

No, an employer is not eligible to join PF (Provident Fund).

In case of the death of the pension member, the nominee appointed will become eligible to receive the pension.

The applicant can visit the unified portal, i.e., https://dcmsme.gov.in/howtosetup/grgxx01x.html, for checking the status of his or her UAN (Universal Account Number).

Yes, Swarit Advisors is a 100% online platform rendering services all over the nation no matters wherever the individual is conducting his or her business. The only thing required is an internet connection on the mobile or laptop, and we are all set to get your registration done

The benefits or advantages of EPF Registration are Risk Coverage; Uniform Account; Employee Deposit Linked Insurance Scheme; Emergency Needs; Pension Coverage.

No, the contribution made by the employer and employee in the Provident fund is exempted from the Income Tax. That means the same is not taxable.

The types of Provident Fund available in India are Statutory Provident Fund; Recognized Provident Fund; Unrecognized Provident Fund; and Public Provident Fund.

No, there is no for anyone to be present at our office as the entire procedure of EPF registration is 100% online. However, the applicant needs to provide a scanned copy of all the documents by way of mail.

A period of 4 to 5 working days is required for the EPF Registration.

The steps involved in the Process for obtaining EPF registration are Employer’s Registration; Verification through OTP (One Time Password); Establishment Login; Registration Certificate; KYC Update for every employee; and Common Registration.

No, there is no need to make any extra payment. We at Swarit Advisors will send an all-inclusive invoice to our clients, with no hidden charges.

In this case, the contribution will be calculated based on the wages paid to the employee in a calendar month.

UAN or Universal Account Number is a 12-digit unique number allotted to every member. This distinctive number is permanent and remains applicable throughout the life of the member. Further, a UAN does not change with the change of employment. Lastly, this number helps in the automatic transfer of Funds and PF withdrawals.

EDLI benefits are payable to those individuals who are eligible to receive EPF dues.

Earlier, an employer needs to contribute 12% of the employee’s salary in the EPF account. However, due to the COVID-19 pandemic, the contribution rates have been reduced to 10% from May 2020. Moreover, 8.33% of the contribution is still deposited into the Employees' Pension Scheme (EPS). However, the amount for the EDLI account is reduced to 1.67% from 3.67%.