Web Aggregator License in India: Its Concept & Process To Register

Shivani Jain | Updated: Dec 11, 2020 | Category: Insurance Web Aggregator

In this unexpected world, security and safety are hard to come by. As a result, nowadays, people are more in buying insurance policies for their families and native ones to secure the future. However, with so many policies available in the online market, people have a tough time in selecting the right one. Therefore, it is always advisable to consult an Insurance Web Aggregator to get the best solution. And to start the business of Insurance Web Aggregator, one needs to obtain Web Aggregator License in India from IRDA.

In this blog, we will discuss the concept and process to obtain Web Aggregation License in India.

Table of Contents

Concept of Insurance Web Aggregator

A Web Aggregator or Insurance Web Aggregator is an insurance company or intermediary that offers information and details pertaining to the insurances provided by different companies. That means it acts as the comparison model for the prices and features of different insurance products.

Regulatory Framework for Web Aggregator License in India

In India, the Web Aggregator Companies is registered under the provisions of the Companies Act 2013 and is regulated and governed by the provisions of the Insurance Act 1938[1] and Insurance Regulatory and Authority of India (Insurance Web Aggregator) Rules 2017

Role of Web Aggregator in India

In India, the role of Web Aggregator can be summarised as:

- Expands and Boosts the Online Market for Insurance Products;

- Improves and Enhances Customers Experience;

- Assists the Customers in the process of Sale;

- Aims to make the Insurance Sector Approachable and Transparent;

Guidelines for Web Insurance Aggregators

The guidelines for Web Insurance Aggregators are as follows:

- Cannot promote specific insurance product or service;

- Can sell products based on the Analysis Report;

- Needs to properly display the pricing of each insurance product;

- Restricted from showcasing Rankings, Ratings, Features, and highlights of the best-selling Insurance Product;

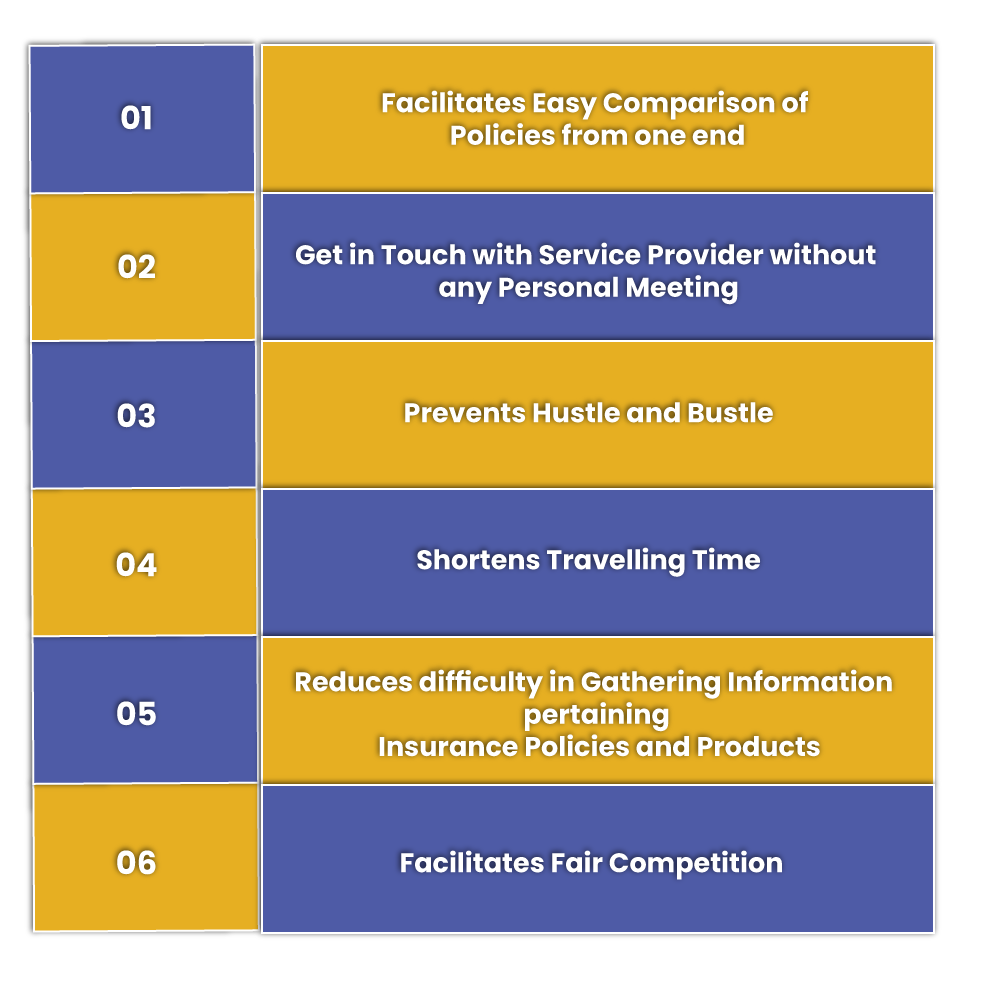

Benefits of Web Aggregator License in India

The benefits of Web Aggregator License in India are as follows:

- Facilitates Easy Comparison of Policies from one end;

- Get in Touch with Service Provider without any Personal Meeting;

- Prevents Hustle and Bustle;

- Shortens Travelling Time;

- Reduces difficulty in Gathering Information pertaining Insurance Policies and Products;

- Facilitates Fair Competition;

Eligibility Criteria for Web Aggregator License in India

The Eligibility Criteria for obtaining Web Aggregator License in India are as follows:

- One needs to apply either as a Limited Liability Partnership under LLP Act 2008 or a Private Company under Companies Act 2013;

- A copy of MOA and AOA or LLP Agreement, specifying the object of commencing Web Aggregation Business;

- The business should be involved in anything other than selling insurance policies online;

- The Entity must have signed Referral Agreement with the Insurer;

- Must have a website to display a comparison between different Insurance Products;

- The Qualification of the Principal Officer must be as per Form C of Schedule I;

- The Principal Officer must possess necessary training, which needs to be certified by a competent authority;

- Members must adhere to Fit and Proper Criteria prescribed for Insurance Aggregators as per Form D Schedule I;

- The company must not violate any responsibility and obligation specified under Form W and Form V;

- The entity must not be disqualified under the eyes of the law;

Who are all Not Eligible to Obtain Web Aggregator License in India?

The ones who are not eligible to obtain Web Aggregator License in India are as follows:

- An Insurance Agent;

- A Corporate Agent;

- A Microfinance Agent;

- A Surveyor;

- A Loss Assessor;

- An Insurance Marketing Firm;

- TPA;

- A Micro Insurance Agent;

Capital Requirements for Insurance Web Aggregator Business

Any individual or business entity that wants to operate as an IWA in India needs to have at least Rs 25 lakhs as the minimum capital requirement. Further, it can raise the same by issuing shares based on the provisions of Companies Act 2013.

However, in the case of a Limited Liability Partnership (LLP), the contribution must be made by the partners only in the form of cash.

Moreover, in the case Foreign Investors, the aggregate shareholdings must not cross the threshold limit of 49% of the total paid-up capital.

Documents Required for obtaining Web Aggregator License in India

The documents required for obtaining Web Aggregator License in India are as follows:

- A copy of Certificate of Registration of the company;

- A copy of MOA and AOA or LLP Agreement;

- A copy of PAN (Permanent Account Number) Card;

- Bio-data of all the proposed Designated Partners or Directors, together with the copies of their Qualification and Experience Certificates;

- Bio-data of the Principal Officer, together with the copies of his/ her Qualification and Experience Certificates;

- Declaration of Competency from all the proposed Directors or Designated Partners;

- Snippets of the Online Portal, together with proof of Domain Name Registration;

- Address Proof of the Premise from where the website has been hosted;

- A complete list of all the individuals who have the authority to regulate, administer, and post details on the portal regarding the insurance products;

- Certificate issued by a Practising Chartered Accountant regarding the Net Worth and Shareholding Pattern of the Company;

- Copies of all the Audited Balance Sheets, Annual Report, and Accounts for the previous three financial years;

- Company’s Business Plan for the next three years;

- Infrastructure details comprising of the proposed IT Infrastructure available with the applicant;

- Human Resource Chart showcasing the details of the functions and responsibilities of each individual;

- Login Credentials of the Web Aggregation portal;

- LMS by IRDAI IT department;

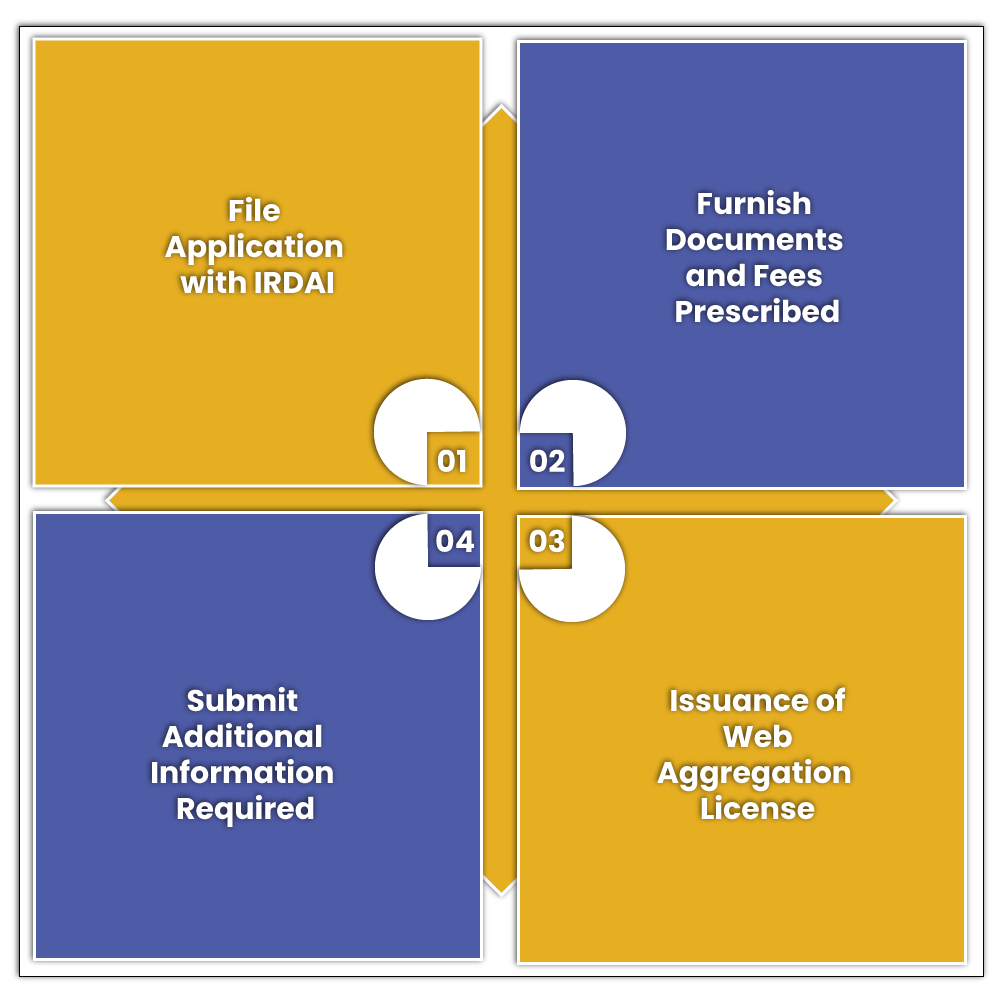

Process for Obtaining Web Aggregation License in India

The steps involved in the process for obtaining Insurance Web Aggregator License in India are as follows:

File Application with IRDAI

In the first step, the applicant requires to apply with IRDAI for obtaining web aggregator license in form A of Schedule I.

Furnish Documents and Fees Prescribed

Now, in the next step, the applicant requires to submit all the documents required, together with the fees of Rs 10000 as specified under the laws. Moreover, the proposed business entity needs to submit its five years business plan as well.

Submit Additional Information Required

In case the authority granting registration requires some additional information or clarification, then, in that case, the applicant company requires to file replies to all the queries raised by the IRDAI (Insurance Regulatory Development Authority of India). Further, it shall be pertinent to mention that the applicant needs to file the reply within 30 days, starting from the date of the communication.

However, in case the authority rejects the application of registration, then the company needs to file the same all over again.

Issuance of Web Aggregation License in India

Lastly, if the authority is satisfied with the application and documents furnished, it will issue a Certificate of Registration (COR) to the applicant company.

The validity of Web Aggregation License in India

The Certificate of Insurance Web Aggregator or IWA License remains valid for a period of 3 years, starting from the date of issuance of the license.

Renewal of Web Aggregator License in India

In India, the holder of the Web Aggregator License needs to apply for the renewal at least 30 days before the date of expiry by filing an application, together with the fees of Rs 25000.

Conclusion

In a nutshell, an Insurance Web Aggregator acts as the comparison model for the prices and features of different insurance products. Further, this model not only boosts the Online Market for Insurance Products but aims to make the Insurance Sector Approachable and Transparent as well.

However, an Insurance Web Aggregator License holder is not allowed to promote specific insurance product or service but can sell products based on Analysis Report. Also, it needs to properly display the pricing of each insurance product;

Lastly, for any other doubt and confusion, reach out to Swarit Advisors, our skilled and proficient IRDA experts will assist you in acquiring Insurance Web Aggregator Registration in a hassle-free manner.

Also, Read: Is It Possible To Get a Loan Under Nidhi Scheme?