All You Need to Know About Process and Benefits of Insurance Web Aggregator License

Karan Singh | Updated: Feb 20, 2021 | Category: Insurance Web Aggregator, IRDA Advisory

In India, a web aggregator is an insurance company that provides information on the insurance provided by different companies. Insurance web aggregators help buyers to compare various insurance products along with their prices and features. A web aggregator is registered under the Companies act approved by the Insurance Regulatory and Development Authority (IRDA). These web aggregators need to get Insurance Web Aggregator License before starting any aggregation activities through their website. The primary reason for introducing Insurance Web Aggregators in India was to educate people and make them know about the different insurance products.

In the past, people call insurance agents to learn about insurance policies against which insurance agents were taking high commission charges. That is why IRDAI introduced a digital, transparent, and highly regulated platform to minimize the misconducts of charging pointless commissions by agents. Insurance Web Aggregators also offers policy comparison facilities to get more information and decide on their insurance requirements. Scroll down to check more information regarding the process and benefits of Insurance Web Aggregator License.

Table of Contents

What is the Idea behind Insurance Web Aggregator? – Overview

Before we discuss the process and benefits of Insurance Web Aggregator License, let us first discuss the idea of Insurance Web Aggregator. Basically, it collects, maintains, and assembles the details of various insurance products provided by different insurance companies. All the details of various insurance products are collected by the web aggregator, which is available online for easy convenience by the buyers searching for insurance services. The idea of Insurance Web Aggregator is also controlled by the provisions of both the Insurance Act and the Companies Act. So, in India, if anyone wants to establish a company to operate as an Insurance Web Aggregator, it is mandatory to obtain Insurance Web Aggregator License from Insurance Regulatory and Development Authority (IRDA).

Also, Read: How to Start Insurance Web Aggregator Website?

Laws concerning Insurance Web Aggregator License

The legal provisions regulating the idea of Insurance Web Aggregator License are as follows:

- The Insurance Act, 1938.

- The Insurance Regulatory and Authority of India Rule, 2017.

What are the benefits of Insurance Web Aggregator License?

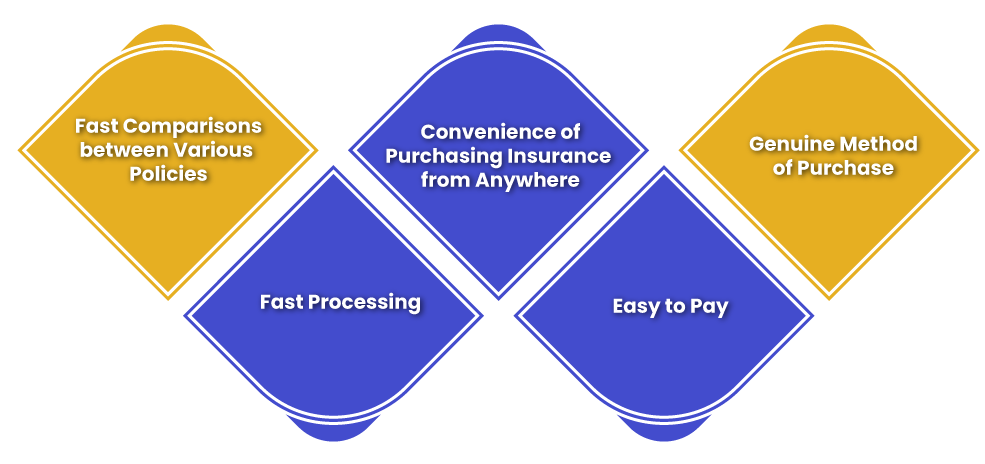

Following is the list of all the benefits of Insurance Web Aggregator License:

- Fast Comparisons between Various Policies: Web aggregators provide fast comparisons between multiple policies at the same time to the customers. Customers can compare various policies based on some major factors such as premiums, terms & conditions, benefits provided, coverage, etc.

- Fast Processing: Buying insurance online is easy and faster than taking insurance from an agent. The entire process from looking different plans up, comparing them and selecting the one you want and making the payment for it can be done in a portion of the time otherwise you take lots of time to buy a policy offline.

- Convenience of Purchasing Insurance from Anywhere: One of the significant benefits of Insurance Web Aggregator License is online aggregators provide is convenience. Customers can buy the insurance policy from anywhere in India. All you need is an internet connection or data and a clear thought of what you want. Once you choose the insurance policy you want, you only require to provide information about yourself and make the payment online, and you are done.

- Easy to Pay: Making online payment of insurance policy is far better and easier than an offline payment. With the various payment gateways available online, insurance policy payment can be made in seconds; otherwise, you have to pay for insurance in cash or through a cheque.

- Genuine Method of Purchase: Many customers are afraid of buying an insurance policy online, that the policy will not be genuine or authentic. But they fail to know that insurance policies available online are absolutely 100% genuine and authentic. The banks or insurance companies are only using web aggregator as a platform to sell their insurance policies. The policy’s application will go directly to the banker or the insurer who will approve or reject the application. The bank or insurer themselves will issue the policy.

Essential Documents Required for Insurance Web Aggregator License Registration

Before starting the process of Insurance Web Aggregator License Registration, you need to arrange all the essential documents as mentioned below:

- Submit a copy of Certificate of Registration (COR).

- In case of a company, submit a copy of AOA (Articles of Association) and MOA (Memorandum of Association)

- Submit a copy of LLP Agreement which is authorized by CA (Chartered Accountant).

- PAN Card copy.

- Submit the copies of experience certificates and qualification certificates of all the proposed directors/partners.

- Submit the copies of experience certificates and qualification certificates of the Principal Officers.

- Submit a declaration which is duly signed by two partners or directors stating the capability of the promoters, partners, directors, principal officer or shareholders:

- They are not mentally imperfect.

- The net revenue of the company is at least more than Rs. 25 lakhs.

- The directors, Key Managerial Personnel (KMP), shareholders, and the principal officer are major.

- In the past 5 years, they have not been involved in any economic violations.

- They have no criminal records in the previous five years.

- The company’s director does not hold any position in an insurance company.

- The principal officers or directors of a company are not registered as the:

- Company Agents.

- TPAs.

- Insurance Brokers.

- Insurance Agents.

- Micro-insurance Agents.

- Surveyors or Loss Assessors.

- Any other insurance intermediaries stated by the regulations of IRDAI.

- Submit pictures of the designated portal and a proof that the company has attained the registration of domain name.

- Submit an address proof of the specific area where a website is hosted. Such an area can be registered office or any other office for actions.

- Detailed list of all the individual who have authority to regulate and post details on the official portal regarding insurance guides, products, etc.

- Next three yare of business plan of the company.

- Details of infrastructure.

- HR chart displaying all the responsibilities of each individual.

- Certificates of training and qualification of the certified verifiers and principal officers.

- Login details for the aggregation website verification by IRDAI.

Process of Insurance Web Aggregator License Registration

Below is the step by step process of Insurance Web Aggregator License Registration:

- Step 1: File an Application: The first and foremost step is to apply with the IRDA in Form-A of Schedule I of the regulations of IRDAI.

- Step 2: Submit Documents and Required Fees: The Company’s director should file an application along with the essential documents. They need to pay a specific fee of INR 10,000 plus applicable taxes. The application fee must be paid through a Demand Draft to the IRDAI. If an applicant failed to submit the fee and the application, it would not continue further.

- Step 3: Eligibility Criteria: Before filing an application for the registration, an applicant must know the eligibility criteria. If the company wants to perform outsourcing and telemarketing functions, it must specify the same in the application.

- Step 4: Refusal of Application: The authority can also reject the application if it does not comply with IRDAI conditions. In case of any failure, the authority will give the applicant thirty days to fix all the errors and mistakes before it gets refused.

- Step 5: Additional Information: The authority may also ask for extra information to submit. Further, filing replies to the questions asked by IRDAI is a multi-stage process. A company required to file multiple replies for one question. Suppose an applicant cannot file a reply before thirty days from the communication date. In that case, the authority rejects the application, and the applicant requires to a file a new application for the registration.

- Step 6: Issuance of License: Once the authority satisfied with all the documents and information submitted by the applicant, IRDAI will issue a Registration Certificate to the applicant.

Conclusion

An Insurance Web Aggregator works as an online platform for providing information related to financial and insurance products. The license for the same can be obtained by the above-mentioned requirements, process and benefits of Insurance Web Aggregator License. Therefore apply for the Insurance Web Aggregator license today.

Also, Read: Web Aggregator License in India: Its Concept and Process To Register