How Can MSME Registration Guarantees Business Growth In India?

Shivani Jain | Updated: Dec 19, 2020 | Category: MSME

‘MSMEs’, the backbone and growth drivers of our economy, contribute around 30% of the total GDP (Gross Domestic Product) and 40% of the total exports. Also, this sector plays a crucial role in generating employment opportunities and provides around 110 million people employment every year. Therefore, it can rightly be stated that MSME Registration Guarantees Business Growth in India.

In this blog, we will discuss the concept of MSME and how MSME Registration Guarantees Business Growth in India.

Table of Contents

Concept of Micro Small and Medium Enterprises

The term MSME or Micro Small and Medium Enterprise mean the enterprises or the business entities registered under the provision of the MSMED Act. Further, these enterprises are usually labour intensive in nature and offer significant employment opportunities at minimal capital cost.

Moreover, it shall be considerate to state that due to growth driven capability of the MSME sector, the government tries to provide it various incentives, subsidies, and schemes as well. One such recent example is the “Atma Nirbhar Bharat Scheme”, i.e., the Self-reliant India Initiative.

As per the initiative, the criterion for classifying MSMEs have been revised, and as a result, the factors, such as “Investment in Plant and Machinery” and “Turnover”, have been combined into one.

However, earlier, the categorization of an MSME or Micro Small and Medium unit was based only on its investment in plant and machinery, together with the type of sector, i.e., Manufacturing or Service Sector.

Categorizations of Micro Small and Medium Enterprises

The categorization of MSMEs under the MSME sector are as follows:

Micro Enterprises

|

Type of Industries |

Type of Investment |

Amount of Investment |

Amount of Turnover |

|

Manufacturing and Service Sector |

In-Plant and Machinery |

Less than Rs. 1 Crore |

Less than Rs. 5 Crores |

Small Enterprises

|

Type of Industries |

Type of Investment |

Amount of Investment |

Amount of Turnover |

|

Manufacturing and Service Sector |

In Plant and Machinery |

Rs. 1 Crore to Rs. 10 Crores |

Rs. 5 Crore to Rs. 50 Crores |

Medium Enterprises

|

Types of Industries |

Type of Investment |

Amount of Investment |

Amount of Turnover |

|

Manufacturing and Service Sector |

In Plant and Machinery |

Rs. 10 Crores to Rs. 20 Crores |

Rs. 50 Crores to Rs. 100 Crore |

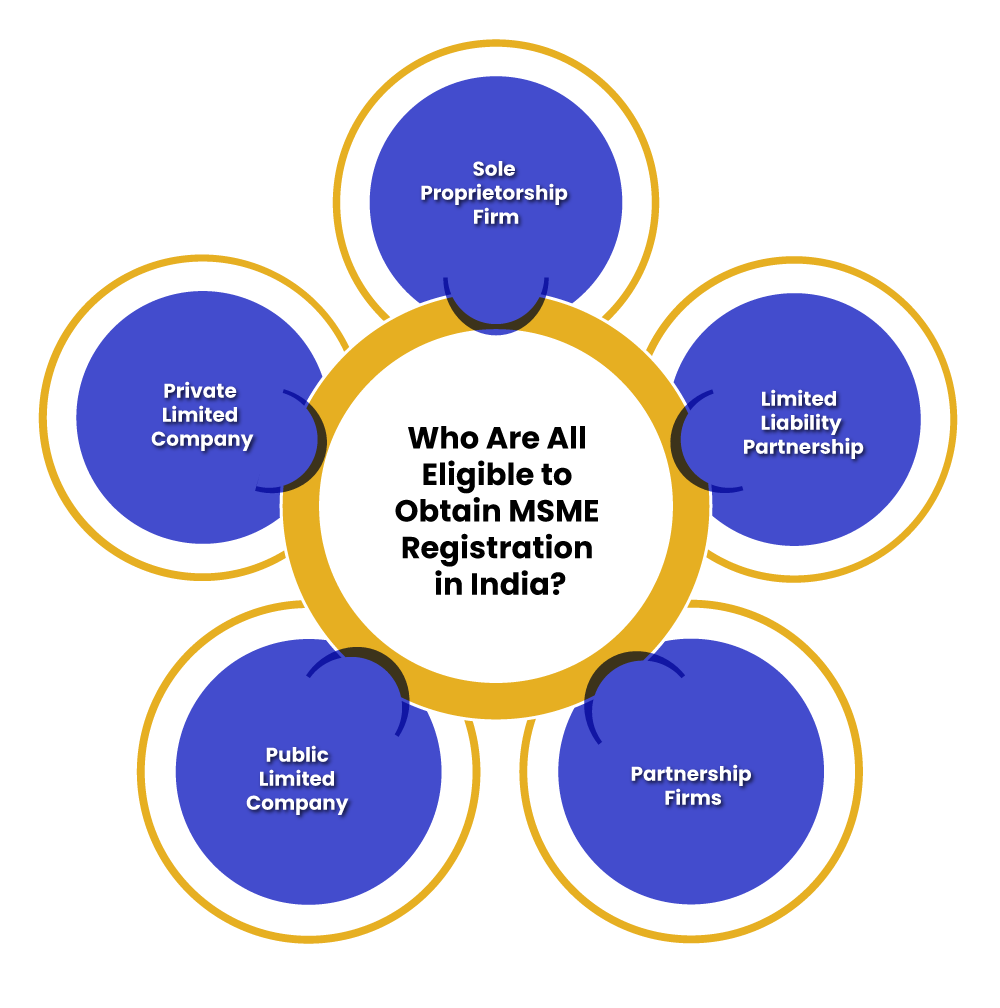

Who Are All Eligible to Obtain MSME Registration in India?

The entities eligible to obtain MSME Registration in India are as follows:

- Sole Proprietorship Firm;

- Limited Liability Partnership;

- Partnership Firms;

- Public Limited Company;

- Private Limited Company;

How the MSME Registration Guarantees Business Growth?

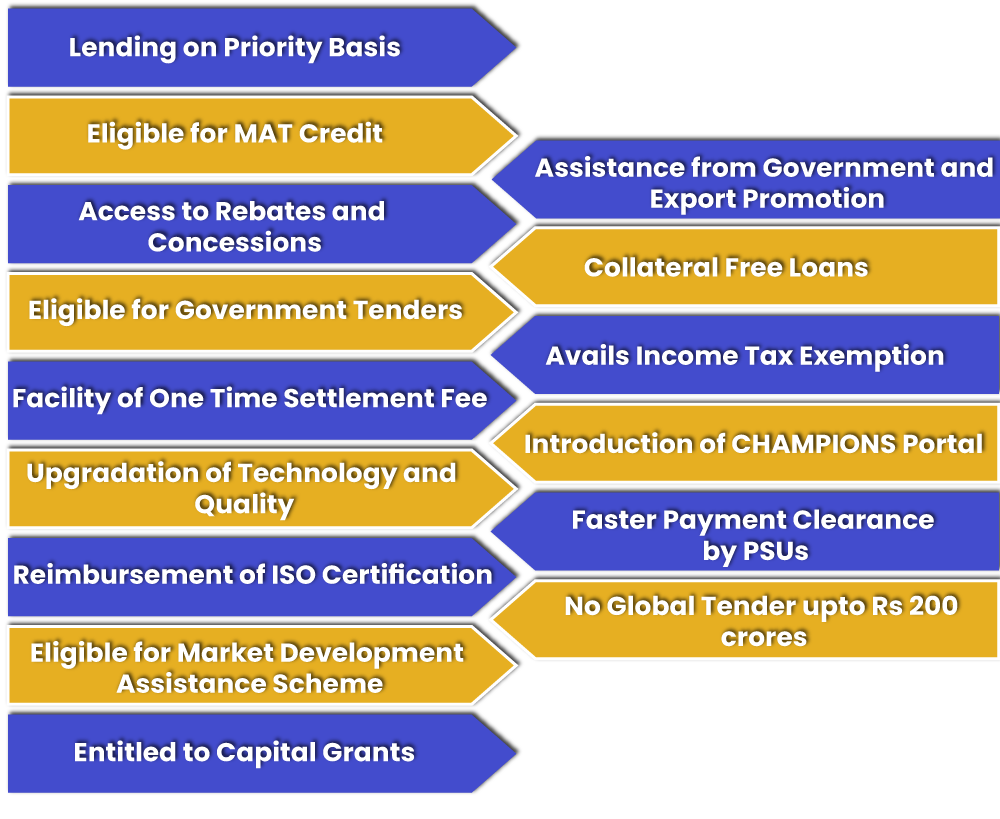

The factors and benefits that prove MSME Registration Guarantees Business Growth in India are as follows:

Lending on a Priority Basis

The first benefit of an MSME Registration Online is that the entities are eligible to avail of cheaper loans and credit from the financial institutions. At present, the interest rate charges from MSMEs range from 1 to 1.5%.

Recently, the World Bank has allocated around the US $750 million (Rs 5600 crores) as emergency response funding for the MSME sector. The main purpose behind such funding was to offer the much required support and liquidity to the MSME sector. Further, through this funding, NBFCs and banks will now be able to offer credit to MSMEs.

Eligible for MAT Credit

A registered MSME is capable of availing MAT (Minimum Alternate Tax) credit, which can be carried forward up to a period of 15 years.

Access to Rebates and Concessions

After obtaining MSME Registration, a business entity is eligible to acquire several rebates and concessions, which will, in return, reduce the cost of applying patent registration for new technology.

Eligible for Government Tenders

After the integration of the Government e-marketplace with the Udyam Registration Portal, all the registered MSMEs are now eligible to get access to government e-tenders.

The facility of One Time Settlement Fee

In the case of repayment of defaults against the loans, the registered MSMEs can now choose the option of one-time settlement fee.

Upgradation of Technology and Quality

To improve the cost-effectiveness and encourage the use of clean energy in the process of manufacturing, the central government has decided to reimburse the project cost incurred towards the fulfilment of the goals for MSME sector units. Also, it has decided to compensate for the expenses incurred for the preparation of audit reports, implementation of clean technology, subsidies for licensing products as per the national and international standards.

Reimbursement of ISO Certification

To encourage the certifications and standards acquired by MSMEs in a bid to improve their performance in all the sectors, MSMEs can now avail exemption and concession on all the expenses incurred for acquiring ISO 9000, HACCP, and ISO 14001 Certification.

Eligible for Market Development Assistance Scheme

All the businesses registered under the MSMED Act are eligible for Market Development Assistance Scheme. As per this scheme, the Central Government follows the policy of Price and Purchase Preference, wherein it purchases more than 358 listed items and products exclusively from registered MSMEs.

Entitled to Capital Grants

In India, the MSME sector is known for generating employment and providing entrepreneurial ventures a start, as a result, the government has decided to offer support for entrepreneurial development and capital grant for infrastructure improvisation.

Assistance from Government and Export Promotion

The Government of India organises various craft fairs, exchange programmes, exhibitions, and international trade events. Further, the reason behind such programmes is to provide MSMEs international platforms for trade-related aspects, together with new business connections. Also, the government offers incentives, subsidies, technical support, and tax exemptions for the export of goods and services by MSMEs.

Collateral Free Loans

The MSME Ministry[1], together with SIDBI (Small Industries Development Bank of India), has created a trust named CGTMSE (Credit Guarantee Fund Trust for Micro Small Enterprises), particularly to introduce Credit Guarantee Fund Scheme for providing collateral-free loans up to Rs 50 lakhs to MSMEs.

Avails Income Tax Exemption

As per the Presumptive Basis of Taxation Scheme, an entity registered is exempt from maintaining unnecessarily detailed books of accounts and undertaking audit procedures.

Introduction of CHAMPIONS Portal

It shall be significant to mention that the introduction of CHAMPIONS Portal is another positive reason as to why MSME Registration Guarantees Business Growth. The main objective of this portal is to assist MSMEs in terms of raw material, permissions, finance, and labour, etc.

Also, this portal seeks to help registered MSMEs in reaching new opportunities and heights, inclusive of production of medical products, together with the accessories combined.

Faster Payment Clearance by PSUs

To improve the liquidity status of MSMEs, the Central Government has directed that the amount outstanding by PSUs (Public Sector Units) or Government Departments need to be cleared within 45 days of acceptance of goods or service.

No Global Tender up to Rs 200 crores

Recently, the government has amended the provisions of the General Financial Rules 2017 to disallow the global tenders in government procurement up Rs 200 crores. Further, the same was announced in the Atma Nirbhar Bharat Stimulus Package. The reason behind the implementation of such decision was to create more opportunities and prospects for domestic players. Moreover, the local industry will benefit as well from this initiative.

Conclusion

In a nutshell, we can rightly state that MSME Registration Guarantees Business Growth as it aims to uplift and elevate small entities from the growth and financial viewpoint. Since MSME Registration is a bundle of productive benefits, as a result, one can choose to go for registration to set off the development of his/her business.

Besides this, the Ministry of MSME takes care of the financial health of the small entities by offering them easy credit, that, too at nominal rates.

Lastly, in case of any other doubt or confusion, reach out to Swarit Advisors, our MSME experts are there to cater to all your needs and provide end to end assistance.