All You Need to Know about Formalities of Trust Registration – Overview

Karan Singh | Updated: Feb 06, 2021 | Category: Trust

All the private trusts in India are regulated and managed under the Indian Trust Act, 1882 whereas the public trusts direct the functioning of public trusts except in Gujarat and Maharashtra where public trusts are governed and ruled by Bombay Public Trusts Act, 1950. If anyone wants to establish a Trust in India, then he or she has to apply for Trust Registration under the Indian Trusts Act, 1882 but for the Trust Registration, the applicant must know about all the formalities of Trust Registration. A trust can be created by executing a trust deed, and there are two different types of Trust; Public Trust or Charitable is formed for the benefit of the general public whereas a Private Trust is established for the benefit of a specific group of individuals known as the Beneficiary. In this blog, we discuss the formalities of Trust Registration in India.

Table of Contents

What is a Trust, and Who can Create it?

Before we discuss the formalities of Trust Registration, we must discuss the definition of Trust. In the Indian Trust Act, 1882 (Section 3), a Trust is defined as a responsibility annexed to the property’s ownership and arising out of a confidence reposed in and accepted by the owner or declared by the owner for the profit of another or the owner. It simply means Trust is nothing but the transfer of property by the Settler to Trustee (another person) on whom the owner confidence for the benefit of a third person or you can also call Beneficiary. The Settler should legally transfer the property’s ownership to the Trustee.

A Trust can be created by:

- Any mentally better person and his or her age is above 18 years can create or establish a Trust. This includes a HUF (Hindu Undivided Family), an individual, AOP (Association of Persons, Company, etc.

- If a Trust is established by or on behalf of a minor, then the Principal Civil Court’s authorization of original jurisdiction is required.

Also, Read: Trust Registration Process under the Indian Trust Act 1882

What are the Formalities of Trust Registration You Must Know?

Following are some essential formalities of Trust Registration that you must know before applying for the registration:

- Public Trust vs Private Trust: In India, Private Trusts are regulated and controlled by Indian Trusts Act, 1882 whereas Public Trusts themselves control their functioning except in Maharashtra where Bombay Public Trusts Act, 1950 governs the working of Public Trusts.

- Number of Trustees: There is no limit on the maximum number of trustees, but a minimum of two trustees is required at the time of Trust Registration.

- Trust Deed: When anyone discusses the formalities of Trust Registration, the Trust Deed is an essential document without this document, the registration cannot be done. It also explains the main reason behind the existence of the Trust. This document also includes the list of its Beneficiary and tells the power of trustees and a minimum of two witnesses are required at the time of the deed signing process.

- Tax Benefit: Once the registration process is completed, Public Trusts can envoy the privileges which are offered by the Indian Government and Public trusts are also able to avail the tax exemption benefit.

Documents Required for Trust Registration in India – Formalities

Following is the list of all the vital documents required at the time of Trust Registration:

- First, you have to submit a Trust Deed because it is the vital document required at the time of registration. Following is the list of information that a Trust Deed must contain:

- The purpose of the Trust.

- Details of the Trustees and Settler such as Name, Father’s Name, Email ID, Designation, Mobile Number, Occupation, Age, Address.

- Number of Trustees.

- Address of the registered office.

- All the rules and regulations which is followed by the Trust

- Trust name.

- Copy of ID proof of the Settler and Trustee.

- Latest passport size photograph of the Settler and Trustee.

- Settler’s presence and their ID proof and two witnesses at the time of registration and some states in India have made Trustee’s presence mandatory.

- Following are some other vital documents:

- Submit a copy of ID proof of the Settler such as Voter’s ID, Passport, Driving License, Aadhar Card, etc.

- Submit a copy of ID proof of the Trustee such as Voter’s ID, Passport, Driving License, Aadhar Card, etc.

- PAN Card.

- Address proof of the TruTrust’sgistered office such as the latest Water Bill/Gas Bill/Electricity Bill/Phone Bill/Registration Certificate.

- Also, submit a NOC or No Objection Certificate signed by the owner of the land.

Procedure for Trust Registration in India – Formalities

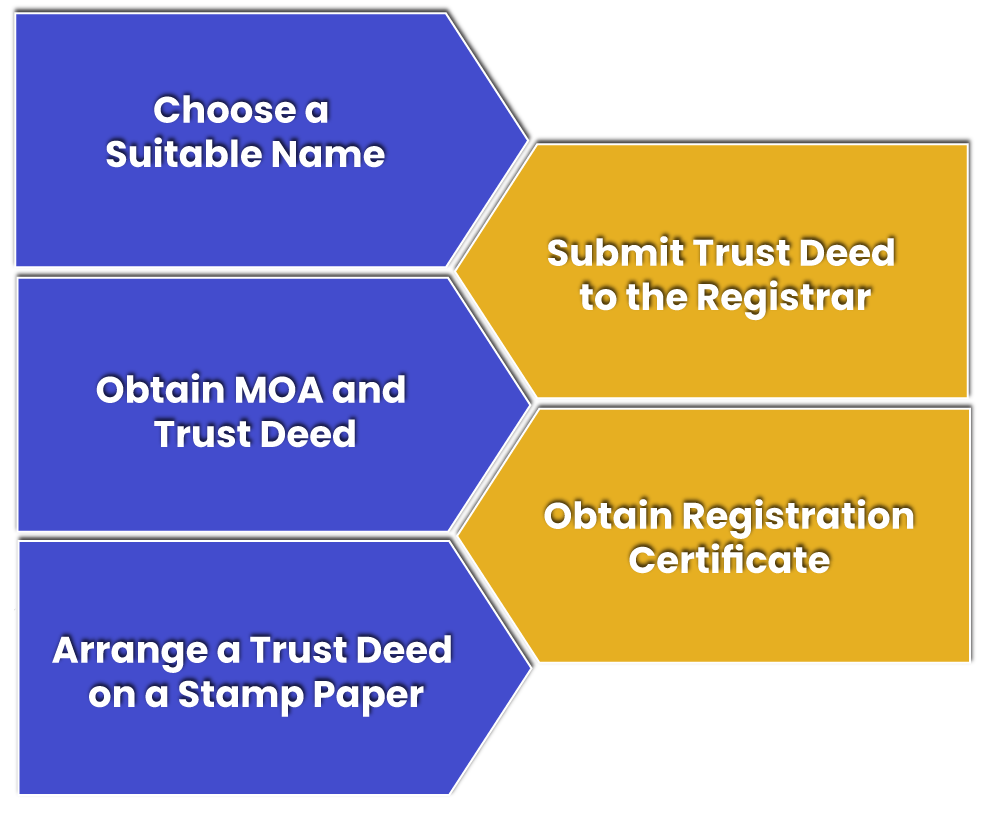

Following is the process of Trust Registration in India:

- Choose a Suitable Name: The first step is to choose an appropriate or suitable name, and the suggested name by the applicant should not come under the controlled list of the names according to the provisions of the Emblems and Names Act, 1950.

- Obtain MOA and Trust Deed: A Trust Deed is a legal document of the Trust’s existence, and it includes the rules and regulations of the Trust. This document also includes the laws regarding the changes, removal, or addition of the Trustees. Whereas, MOA or Memorandum of Association signifies the Trust’s charter and defines the relationship between the Trustor and the Trustees. It also specifies the objective for which the Trust is formed. Such document of a Trust must contain the names, addresses, occupations of all the members along with their signatures.

- Arrange a Trust Deed on a Stamp Paper: The applicant must require to prepare the Trust Deed on a Stamp Paper, and the value of the stamp paper is of a certain percentage of the value of the property of the Trust. Moreover, this percentage varies from state to state. Once the applicant submits all the mandatory papers, they can collect a certified copy of the Trust Deed. A copy can be collected within one week from the Registrar Office.

- Submit Trust Deed to the Registrar: After receiving the Trust Deed receipt copy, submit the same with photocopies of all the essential documents with the local Registrar’s office. The Settler must sign on every page of the Trust Deed photocopy. It is also compulsory for all the Settlers and two witnesses to be physically available along with the ID proofs at the time of trust registration in India. But, the physical presence of Trustees is arguable.

- Obtain Registration Certificate: After submitting the Trust Deed, the Registrar will keep the Trust Deed photocopy and return the original one. Once all the formalities of Trust Registration are completed, a Certificate of Registration will be issued to the applicant, and it will be issued within seven working days.

Conclusion

If you wish to run a Trust in India, it is essential to know about all the formalities of Trust Registration in India. Moreover, the registration process of a Trust in India is simple, and it requires fewer documents. The primary and most essential documents needed for the registration is a Trust Deed. Our professional team at Swarit Advisors shall draft the Trust Deed for you and help you complete the registration process.

Also, Read: Checklist and Documents Required for Trust Registration in India