Is it Possible to Make Members in Nidhi Company: Step by Step Guide

Japsanjam Kaur Wadhera | Updated: Jan 19, 2021 | Category: Nidhi Company

A Nidhi Company is an NBFC (which does not required RBI approval) that works for its members by accepting deposits and lending funds. One of the most important criteria of Nidhi Company is that it works for its members only. It cannot accept deposits nor can it lend funds to any other person other than its members. To make any person a member of Nidhi Company, one share must be given to him. However, in cases where the member wants to have fixed or recurring deposit, the number of shares shall be 10. This article will talk about whether is it possible to make members in Nidhi Company or not.

Table of Contents

How to make members in Nidhi Company?

In order to make members in Nidhi Company, a Nidhi Company shall: –

- Not allow a Trust or a corporate body or a minor to be a member and ensure that its members are not decreases to less than 200 at any time.

- Allot minimum shares to each deposit holder a minimum 10 shares of 10 each which are equal to Rs. 100 and at least 1 share of Rs 10 to saving account holder.

By way of Allotment of New Shares

A Nidhi Company can allot new shares to its new members. According to the provisions of the companies Act[1], there is a present exemption through which section of right issue and private placement is not applicable to Nidhi Company, therefore the allotment of shares can directly be done by Board of Directors of the Company through passing a resolution. It is important to note, that the number of shares should not exceed authorized share capital of the company.

By way of Transfer of share of existing members

Nidhi Company being a Public Limited Company, the existing shareholder of Nidhi Company may transfer his shares to another person as the shares of the public limited company are freely transferrable. In this case, a person will also become a member of the Nidhi Company once his name is entered in the register of members.

Out of the above two ways, the second method is the cheapest, quickest and the best way to make members in Nidhi Company because the allotment happens hand to hand with no separate filing to the Ministry of Corporate Affairs (MCA) each month. Every member is given 1 share (10 shares in case of fixed deposit) of Nidhi Company to complete membership procedure.

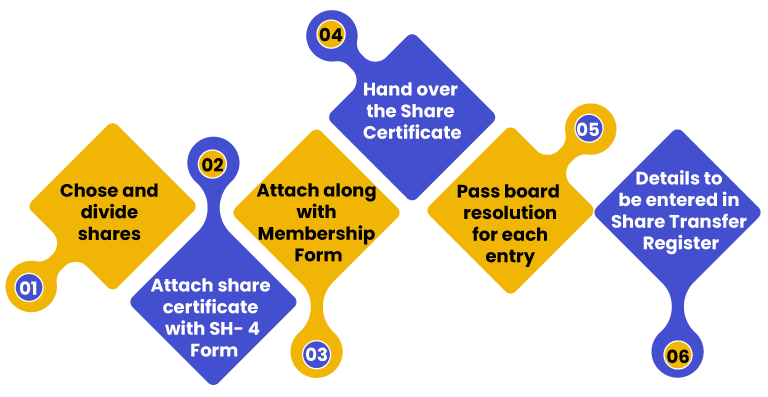

What is the Procedure to make members in Nidhi Company?

Chose and divide shares

Choose any one person’s shares and divide them into small share certificates equal to either 1 share or 10 shares depending upon the requirement.

Attach share certificate with SH- 4 Form

Form SH- 4 is used to give effect to share transfer. Form SH- 4 has to be attached with the share certificates.

Attach along with Membership Form

Form SH- 4 and share certificates are to be attached along with the membership form. The transfer procedure is to be conducted and all the necessary details are required to be furnished with the share certificate and Form SH- 4.

Hand over the Share Certificate

Once the shares are transfers and proper due diligence has been conducted in respect to share transfer, the proper set of documents should be handed over to the applicant and one copy of the document will be kept in the company as a record.

Pass board resolution for each entry

The board resolution shall be passed at the end of the month validating the transfer of shares that took place during the month. The board resolution shall be passed at the end of every month.

Details to be entered in Share Transfer Register

It is mandatory for Nidhi Company to maintain a share transfer register and every detail regarding the transfer of shares shall be entered in the share transfer register.

Nidhi Company Registration Procedure

Nidhi Company Registration Process takes up around 45 days. The procedure to obtain Nidhi Company Registration is as follows: –

- To start the registration of Nidhi Company, minimum 3 directors and 7 members are required.

- The applicant is required to apply for Digital Signature Certificate (DSC) and Director Identification Number (DIN).

- After getting the DSC and DIN, file an application in INC- 1 to Ministry of Corporate Affairs for the reservation of name of the Nidhi Company.

- Upon the Approval of the name, prepare a Memorandum of Association (MOA) and Articles of Association (AOA) according to the objectives of the company and all the required documents carefully.

- Apply for Incorporation.

- Apply for PAN and TAN

The Ministry of Corporate Affairs (MCA) has issued an integrated incorporation form INC- 32. Now the companies can apply for incorporation online by filing a SPICe+ Form in Form INC- 32 using DSC of the director along with the e- MOA in Form INC – 33 and e- AOA in Form INC – 34.

Documents required for Nidhi Company Registration

- Copy of ID proof of shareholders and Directors (Aadhar card, voter id, drivind license, passport)

- Copy of PAN card of shareholders and Directors.

- Copy of Address Proof of Shareholders and Directors ( electricity bill, telephone bill, bank statement)

- Passport size photograph

- Property ownership documents of registered office

- If property owned then electricity bill, ownership documents and NOC if required.

- If property rented then electricity bill, rent agreement and NOC

Conclusion

The core business of Nidhi Company is borrowing and lending money between their members. It can accept, lend funds only from and to its members and is regulated by the Ministry of Corporate Affairs and Companies Act 2013. The main objective of Nidhi Company incorporation is to grow the habit of savings of the members. The procedure to make members in Nidhi Company can be done by two ways which is discussed above in the article. For a person to become a member in Nidhi Company, it is required to follow the complete procedure of membership to issue shares of the company.

Also, Read: Operational and Credit Policy Norms for NBFCs: A Complete Guide