Implications of Union Budget 2021 on GST Act: A Complete Guide

Shivani Jain | Updated: Feb 10, 2021 | Category: GST, News, Other Services

Recently, the Union Budget 2021 was presented by our Union Finance Minister, Ms. Nirmala Sitharaman, on 01.02.2021. By way of the same, there were several minor changes made in the provisions of the Goods and Service Act 2016. In this blog, we will discuss about the Implications of Union Budget 2021 on GST Act.

Table of Contents

Concept of Goods and Service Tax

The term GST or Goods and Service Tax denotes an Indirect Tax regime, which has replaced several prevailing indirect tax laws, such as Excise Duty, VAT (Value Added Tax), Service Tax, etc. Further, the said act came into force on 01.07.2017.

The different laws compiled under GST Act are as follows:

- CGST Act (Central Goods and Service Tax);

- SGST Act (State Goods and Service Tax);

- IGST (Integrated Goods and Service Tax);

Also, it shall be significant to state that, any business entity or an individual, who is earning an annual business turnover of Rs 40 lakhs and Rs 20 lakhs in special states, need to apply for GST Registration on a mandatory basis.

Also, Read: Legal Entity Identifier: Implementation of LEI by RBI for Large Value Transactions

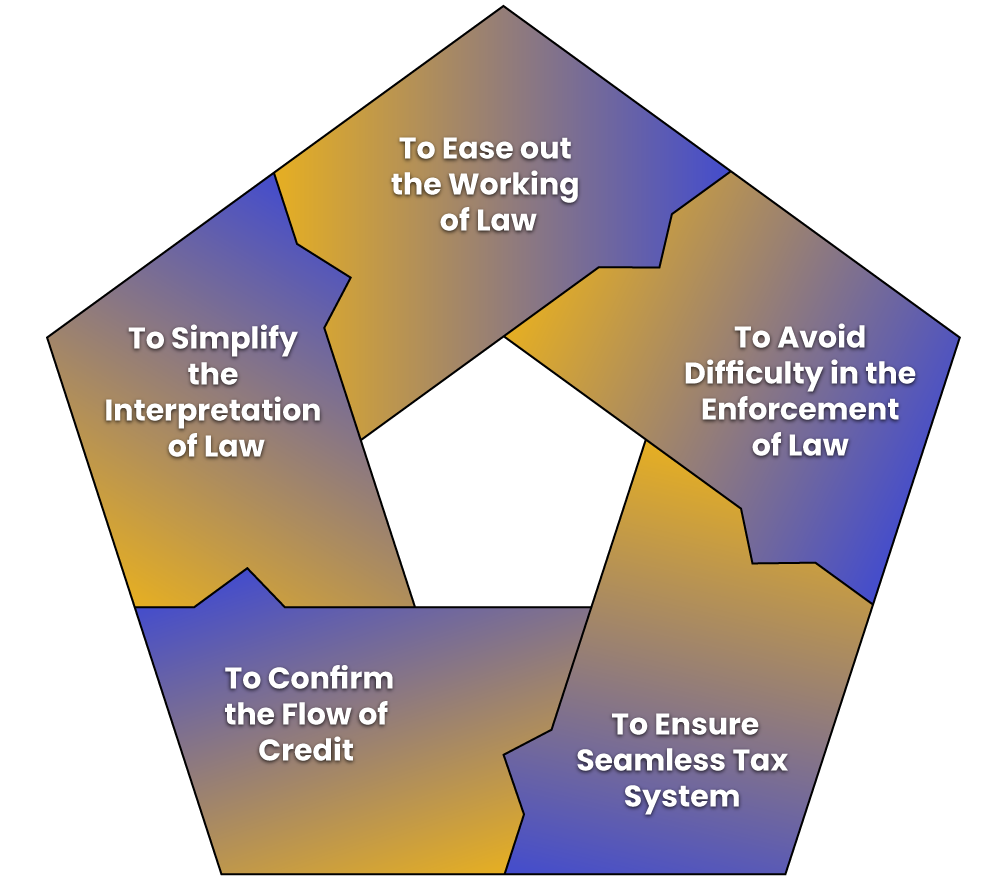

Reasons to Make Changes in GST Act

The main reasons behind the amendment and changes made in GST Act are as follows:

- To Simplify the Interpretation of Law;

- To Ease out the Working of Law;

- To Avoid Difficulty in the Enforcement of Law;

- To Ensure Seamless Tax System;

- To Confirm the Flow of Credit;

Key Implications of Union Budget 2021 on GST Act

The key implications of Union Budget 2021 on GST Act are as follows:

Widened Scope of term “Person”

The scope of the definition of the term “Person” has been increased by inserting clause (aa) in sub section (1) of section 7. The same is deemed to have a retrospective effect, i.e., the same is in force from 01.07.2017.

Based on the provisions of clause (aa), from now onwards a person and its constituents or members will be considered as two separate persons. Also, the transactions or supply of activities between the said person and its member will be deemed to have taken place from one person to another.

Now, on the basis of the amended provisions, a club will be considered separate from its members. Therefore, the Principal of Mutuality, given by the Apex Court in the case State of West Bengal v. Calcutta Club Limited, 2019 (29) G.S.T.L. 545 (SC), will not be applicable on GST Act.

Also, it shall be considerate to take into consideration that, due to the amendment in the provisions of section 7, Para 7 of Schedule II stands omitted from 01.07.2017.

Stringent Conditions Concerning ITC Claim

One of the main implications of Union Budget 2021 on GST Act is stringent conditions concerning ITC claim. So, to eradicate the issue of illegal ITC Claim and discrepancies in the data entered by recipient and supplier for ITC Claim, it has now become compulsory for the suppliers to enter the details of the debit note or invoice in the statement of Outward Supply, i.e., in GSTR 1, and only after that, he/ she will become eligible to claim ITC under section 16 of the GST Act.

It shall be considerate to note that such a clause was already recognised under the provisions of section 37 (1) of the CGST Act. However, the same has now been inserted by way of section 16 (2) (aa) as well.

Omission of GST Audit & Reconciliation Statement

Based on the provisions of section 35 (5) and 44 (2) of the CGST Act, the requirement to furnish the GST Audit and Reconciliation Statement, after getting the books of accounts audited by a certified Chartered Accountant has now been omitted.

Also, it shall be considerate to note that the provisions of section 44 of the CGST Act has been substituted with a new one, and as per new provisions, there is a need for the taxpayer to submit a self certified reconciliation statement, together with the audited annual financial statement. That means, once such amendments come into force, form GSTR 9C can be filed easily without any certification.

Levy of Interest on Net Cash Liability

Based on the speech given by our Union Finance Minister on the Union Budget 2021, a proviso has been inserted in the Finance Act 2019, which states that an interest will be charged on the Net Cash Liability only, and the same has retrospective effect, i.e., applicable from 01.07.2017.

Separate Proceeding for Transporter and Supplier

From now onwards, the confiscation, seizure of goods, and conveyance used in transit will have a separate proceeding for the tax recovery. That means if in case the supplier of such goods wants to conclude the proceeding by paying of the tax levied together with the penalty imposed for such confiscation and seizure, then, in that case, proceedings started against the transport will continue to exist till the time the said issue is resolved.

Definition of Self Assessed Tax

As per section 75 (12) of the CGST Act, the term self-assessed will now comprise of tax payable in the outward supply, i.e., amount declared in form GSTR 1. However, it shall be considerate to take into consideration that amount declared in Form GSTR 3B will not be considered for the same.

Provisional Attachment under Section 83 (1)

After the amendments made in the provisions of the GST Act, the concept of Provisional Attachment of Property will now be valid all through the proceedings, commencing from the initiation of assessment proceeding under chapter XII or XIV or XV till one year of the expiry of the order.

Deposit 25% of Penalty for Appeal

It shall be considerate to take into consideration that a new provision has been inserted under section 107 (6), which state that it is compulsory for the appellant to deposit 25% of the penalty levied for filing an appeal against the order of seizure or detention.

Deposit of Funds under section 129

For releasing the goods detained in transit or for contravening the provisions of this Act, the concerned person will now be held liable to pay a penalty equal to 200% of the amount payable as tax. Earlier, the said limit was fixed at 100%.

Also, it shall be significant to state that prior to the proposed changes, there was a need for the taxpayer to pay tax on the release of goods as well. Moreover, in the case, where the owner does come forward, then, in that case, 200% of the tax payable or 50% of the total value of the goods, whichever is higher.

Further, it is the duty of the proper officer to issue a notice of 7 days. The same must specify the amount of penalty levied. However, if in case, the owner or the transporter fails to pay the penalty levied, then, in that case, the proper officer will seize the goods in question and will sell the same to recover the imposed penalty. But, in the case of perishable goods, the officer appointed may reduce the period of 15 days.

Further, the conveyance used for the transportation of goods seized will be released as well on the payment of Rs 1 lakh.

Changes Made in Section 16 of the IGST Act

In the case of Zero rated supply, the provisions of the GST Act provides for the Non Payment of GST or Refund of GST. However, now based on the amendments made, if in case the export or sale proceeds is not received with the prescribed time under FEMA, then, in that case, GST shall be payable, together with the interest.

Further, it shall be significant to take into the note that parallel provisions have been inserted in the Customs Act as well, wherein it has been planned that any goods, which are entered for exportation by making a wrongful claim of remission or refund will be liable for confiscation. To give effect the same a sub-section (ja) has been added to section 113 of the Customs Act.

Furthermore, a new provision named section 114 AC has been inserted in the Customs Act, to prescribe a penalty in particular cases, wherein any person who claims refund of tax or duty discharged, by using fraudulent invoices, on the exports of goods.

Conclusion

In a nutshell, the main agenda behind the implications of Union Budget 2021 on GST Act was to make the interpretation and working of law simplified, together with the seamless tax system. Further, in case of any doubt or dilemma, contact our proficient experts at Swarit Advisors, who are always ready to cater to all your queries and doubts.

Also, Read: Everything You Must Know About Patent Law in India